Answered step by step

Verified Expert Solution

Question

1 Approved Answer

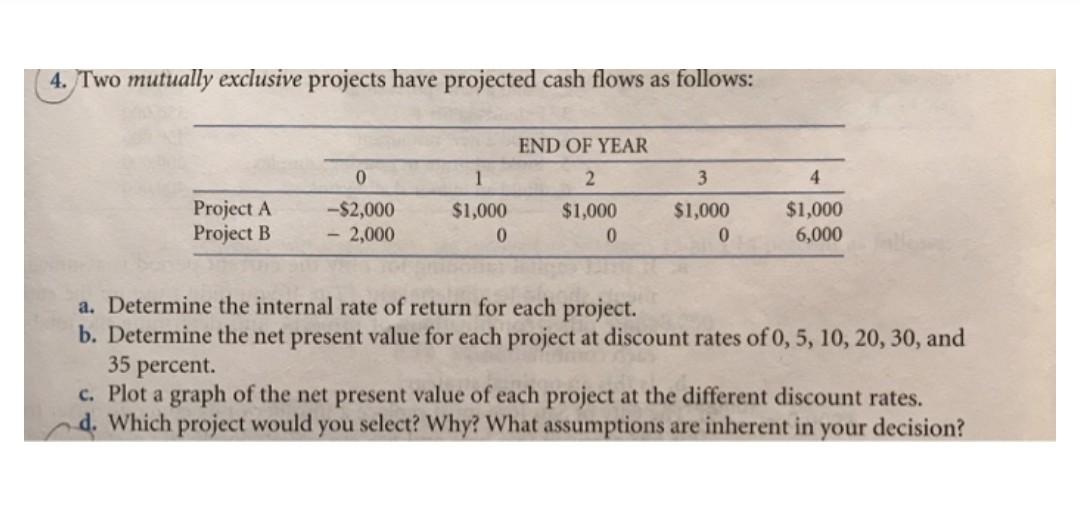

I just want to know how we calculated IRR for project A and B 4. Two mutually exclusive projects have projected cash flows as follows:

I just want to know how we calculated IRR for project A and B

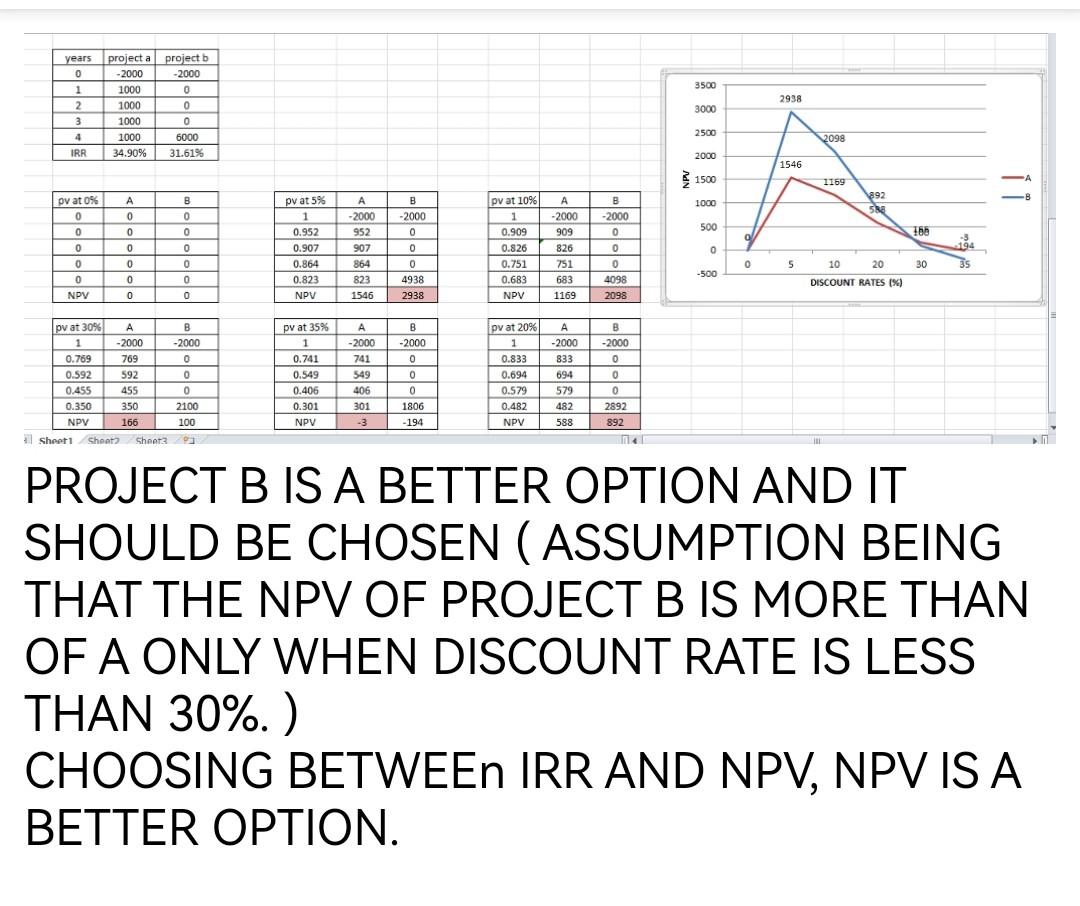

4. Two mutually exclusive projects have projected cash flows as follows: a. Determine the internal rate of return for each project. b. Determine the net present value for each project at discount rates of 0,5,10,20,30, and 35 percent. c. Plot a graph of the net present value of each project at the different discount rates. d. Which project would you select? Why? What assumptions are inherent in your decision? PROJECT B IS A BETTER OPTION AND IT SHOULD BE CHOSEN ( ASSUMPTION BEING THAT THE NPV OF PROJECT B IS MORE THAN OF A ONLY WHEN DISCOUNT RATE IS LESS THAN 30\%. ) CHOOSING BETWEEn IRR AND NPV, NPV IS A BETTER OPTIONStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started