I know I didnt do this right so if you can correct my work and show how you did the problems I will give thumbs up.

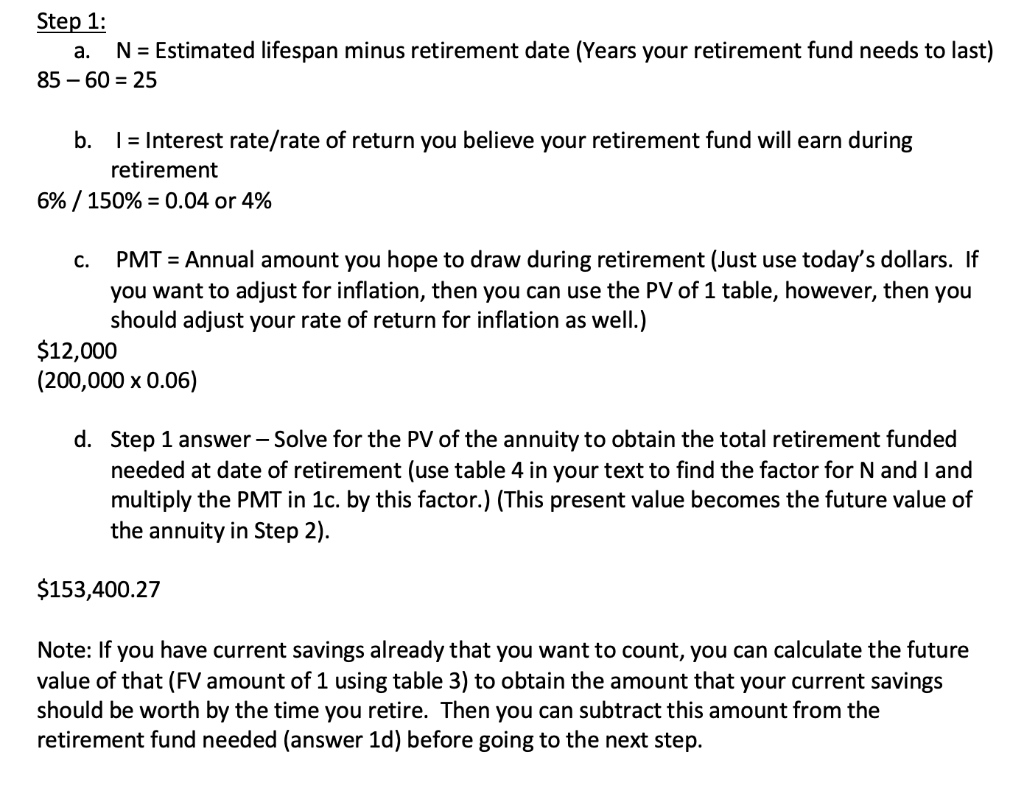

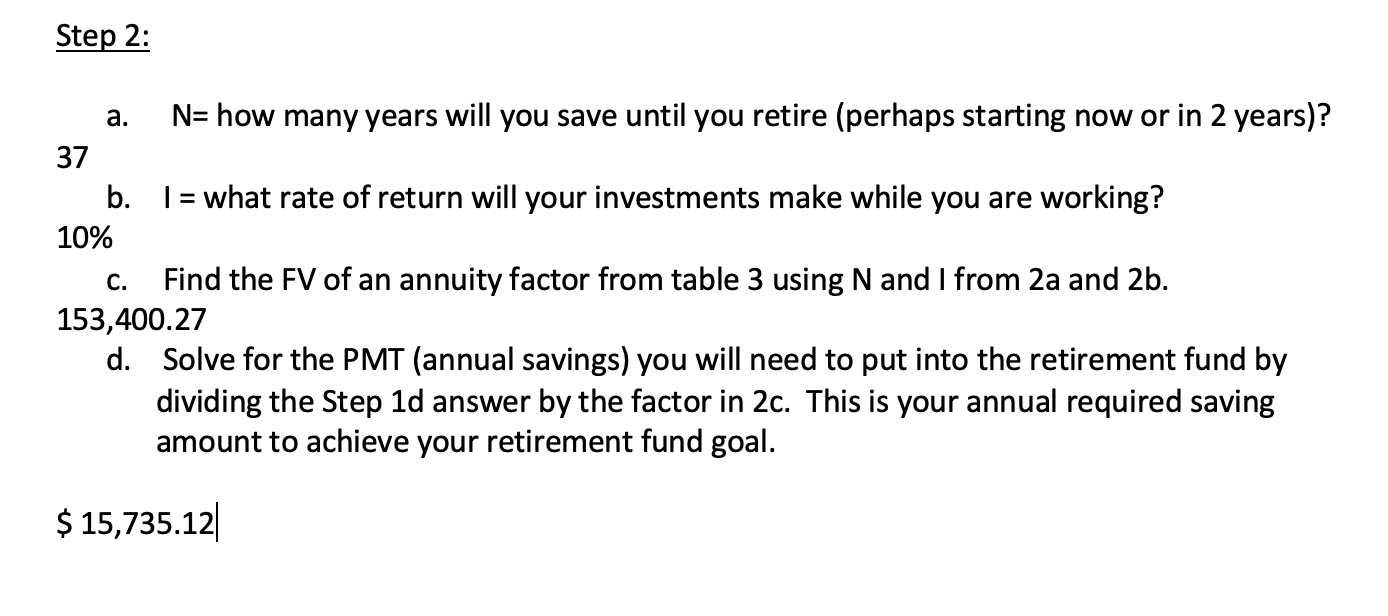

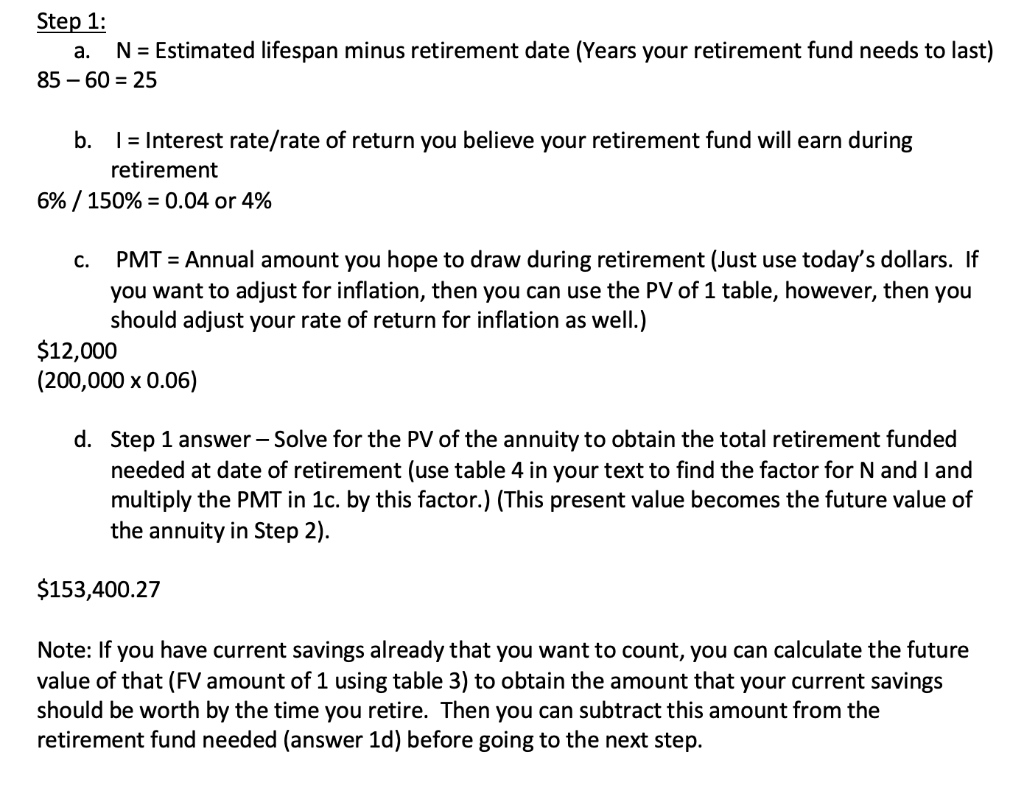

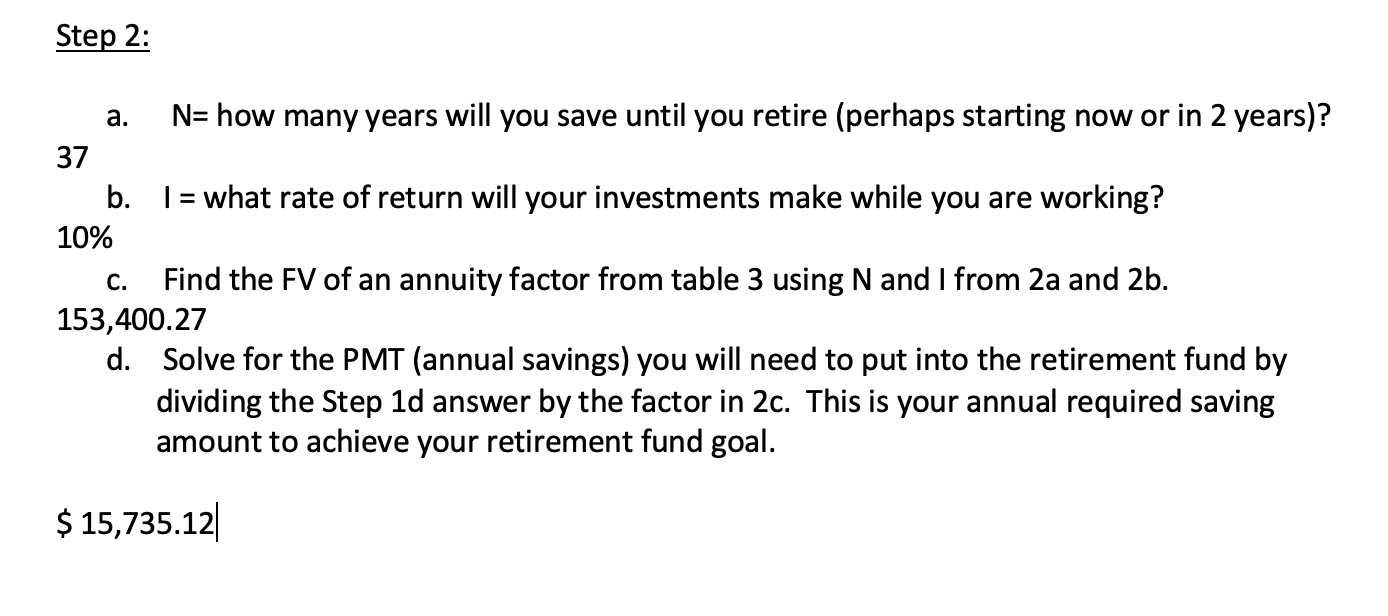

Step 1: a. N = Estimated lifespan minus retirement date (Years your retirement fund needs to last) 85 - 60 = 25 b. 1 = Interest rate/rate of return you believe your retirement fund will earn during retirement 6% / 150% = 0.04 or 4% C. PMT = Annual amount you hope to draw during retirement (Just use today's dollars. If you want to adjust for inflation, then you can use the PV of 1 table, however, then you should adjust your rate of return for inflation as well.) $12,000 (200,000 x 0.06) d. Step 1 answer - Solve for the PV of the annuity to obtain the total retirement funded needed at date of retirement (use table 4 in your text to find the factor for N and I and multiply the PMT in 1c. by this factor.) (This present value becomes the future value of the annuity in Step 2). $153,400.27 Note: If you have current savings already that you want to count, you can calculate the future value of that (FV amount of 1 using table 3) to obtain the amount that your current savings should be worth by the time you retire. Then you can subtract this amount from the retirement fund needed (answer 1d) before going to the next step. Step 2: a. N= how many years will you save until you retire (perhaps starting now or in 2 years)? 37 b. l = what rate of return will your investments make while you are working? 10% Find the FV of an annuity factor from table 3 using N and I from 2a and 2b. 153,400.27 d. Solve for the PMT (annual savings) you will need to put into the retirement fund by dividing the Step 1d answer by the factor in 2c. This is your annual required saving amount to achieve your retirement fund goal. C. $ 15,735.12 Step 1: a. N = Estimated lifespan minus retirement date (Years your retirement fund needs to last) 85 - 60 = 25 b. 1 = Interest rate/rate of return you believe your retirement fund will earn during retirement 6% / 150% = 0.04 or 4% C. PMT = Annual amount you hope to draw during retirement (Just use today's dollars. If you want to adjust for inflation, then you can use the PV of 1 table, however, then you should adjust your rate of return for inflation as well.) $12,000 (200,000 x 0.06) d. Step 1 answer - Solve for the PV of the annuity to obtain the total retirement funded needed at date of retirement (use table 4 in your text to find the factor for N and I and multiply the PMT in 1c. by this factor.) (This present value becomes the future value of the annuity in Step 2). $153,400.27 Note: If you have current savings already that you want to count, you can calculate the future value of that (FV amount of 1 using table 3) to obtain the amount that your current savings should be worth by the time you retire. Then you can subtract this amount from the retirement fund needed (answer 1d) before going to the next step. Step 2: a. N= how many years will you save until you retire (perhaps starting now or in 2 years)? 37 b. l = what rate of return will your investments make while you are working? 10% Find the FV of an annuity factor from table 3 using N and I from 2a and 2b. 153,400.27 d. Solve for the PMT (annual savings) you will need to put into the retirement fund by dividing the Step 1d answer by the factor in 2c. This is your annual required saving amount to achieve your retirement fund goal. C. $ 15,735.12