I know it is a refund, but I cannot get the correct number for the amount. This was my first attempt -- can you tell me where I went wrong? Pictures of actual question and supplemental documents are included.

| Salary (153,900 + 30,900) | $184,800 |

| Self Employment Revenue | $5,900 |

| Dividends | $1,180 |

| State Income Tax Refund | $200 |

| Gross Income | $192,080 |

| Self Employment Expenses | ($1,700) |

| Employer Portion Self Employment Taxes (5,900-1,700) * .9235 * (.029/2) | ($56) |

| Alimony | ($10,950) |

| AGI | $179,374 |

| Taxes (limit is $10,000) | ($10,000) |

| Home Mortgage Interest | ($15,900) |

| Cash Charitable Contributions | ($15,950) |

| Non-Cash Charitable Contributions (fair value) | ($590) |

| QBI Deduction (5900-1700-56) * .20 | ($829) |

| Taxable Income | $132,820 |

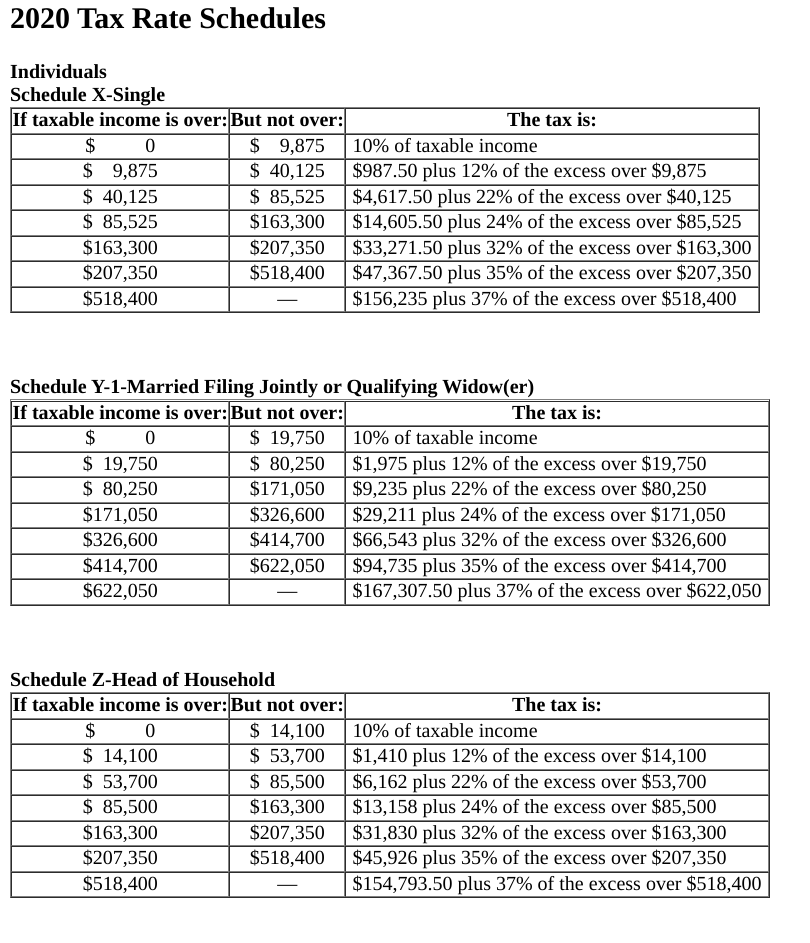

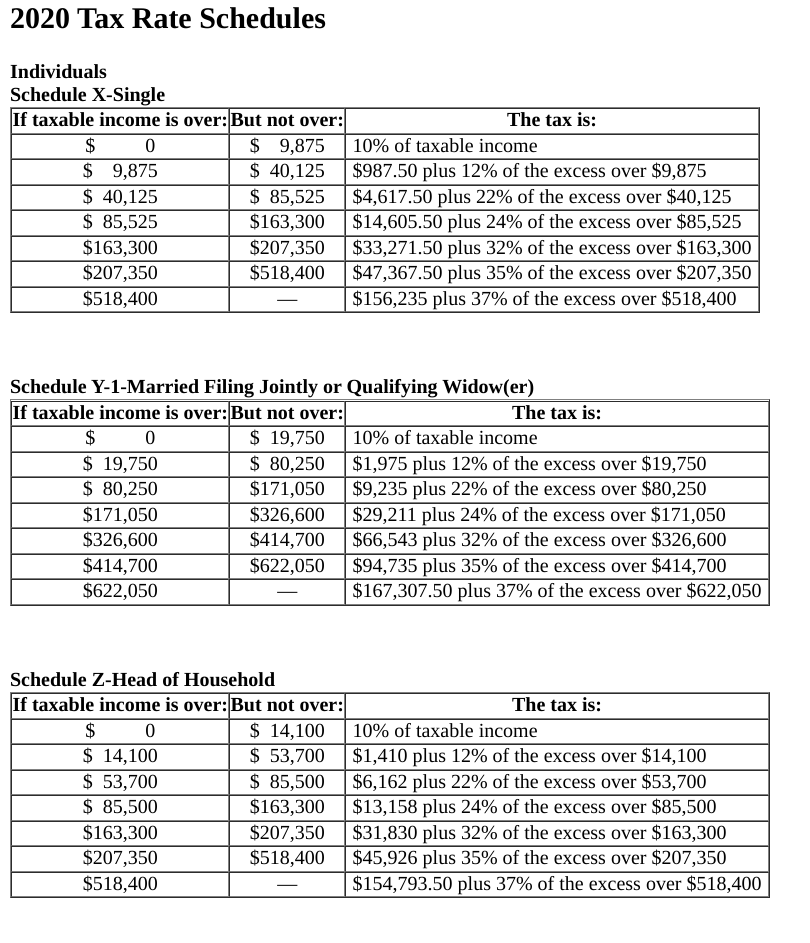

| Tax on Income without dividends (132820-1180) * info on tax schedule | $20,541 |

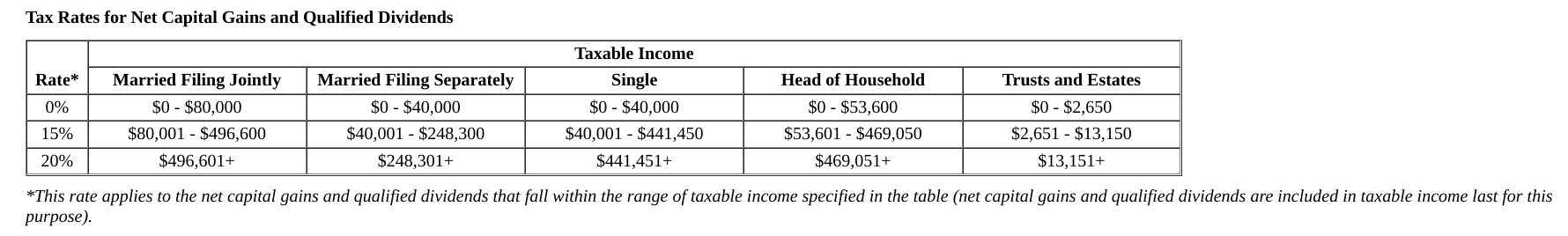

| Tax on Dividends (1180 * .15) | $177 |

| Self Employment Tax (5900-1700) * .9235 * .029 | $113 |

| Total Taxes | $20,831 |

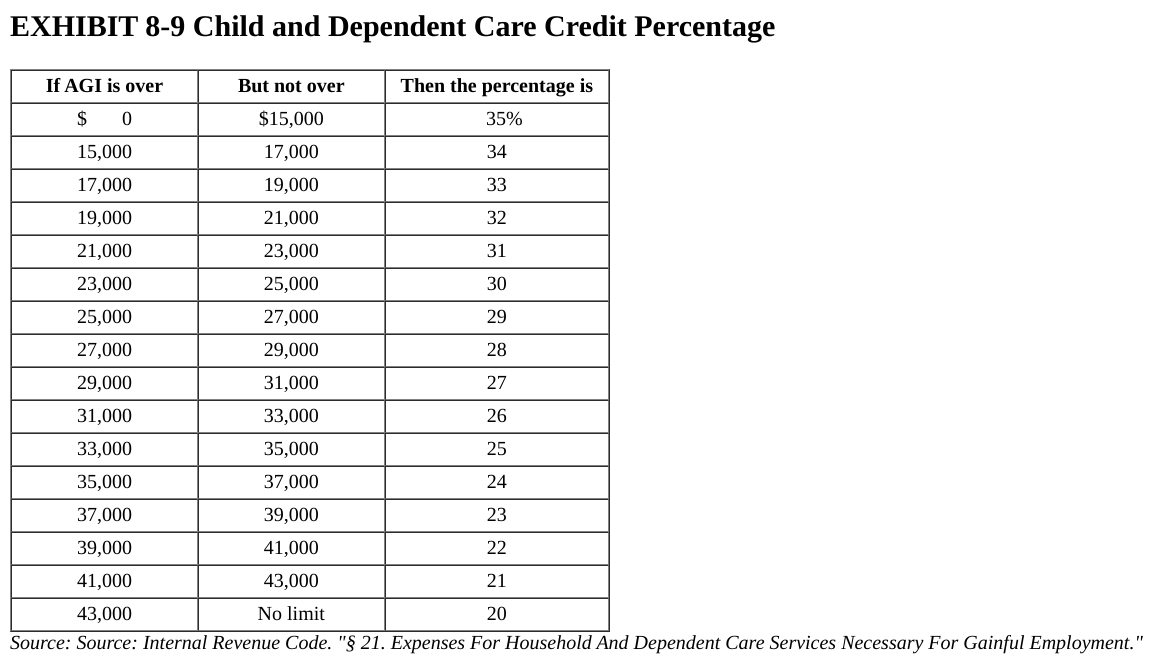

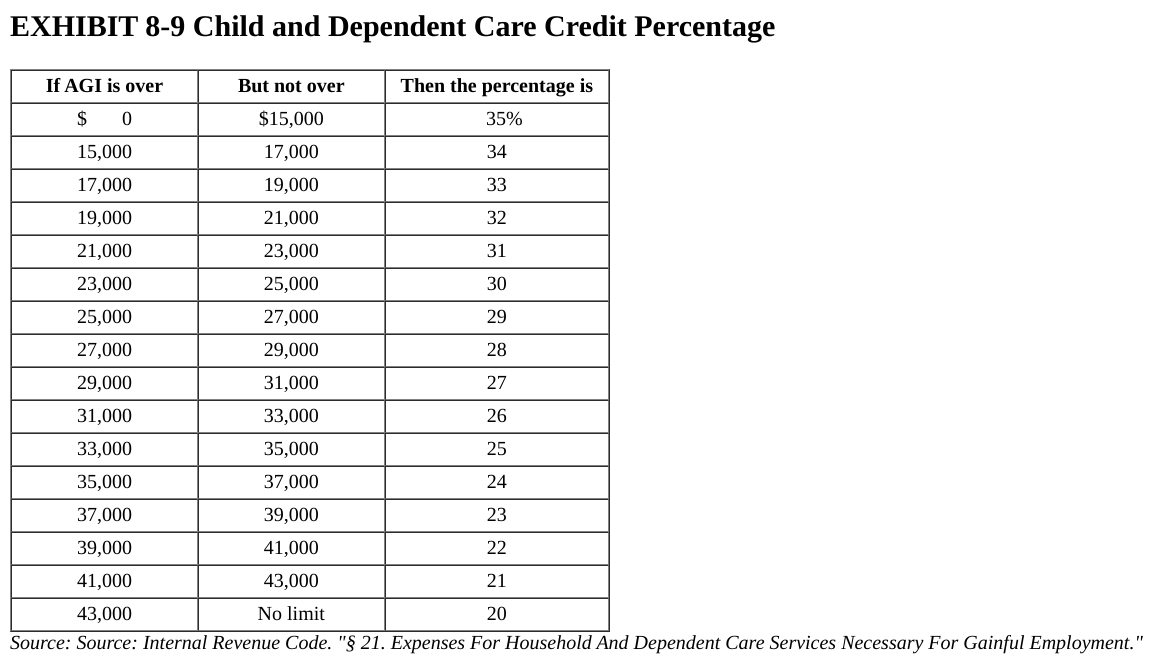

| Child Care Credit (3000 * .20) | ($600) |

| Child Tax Credit (IRS guideline) | ($2,000) |

| Federal Tax Withholding | ($21,000) |

| Tax Refund | $2,769 |

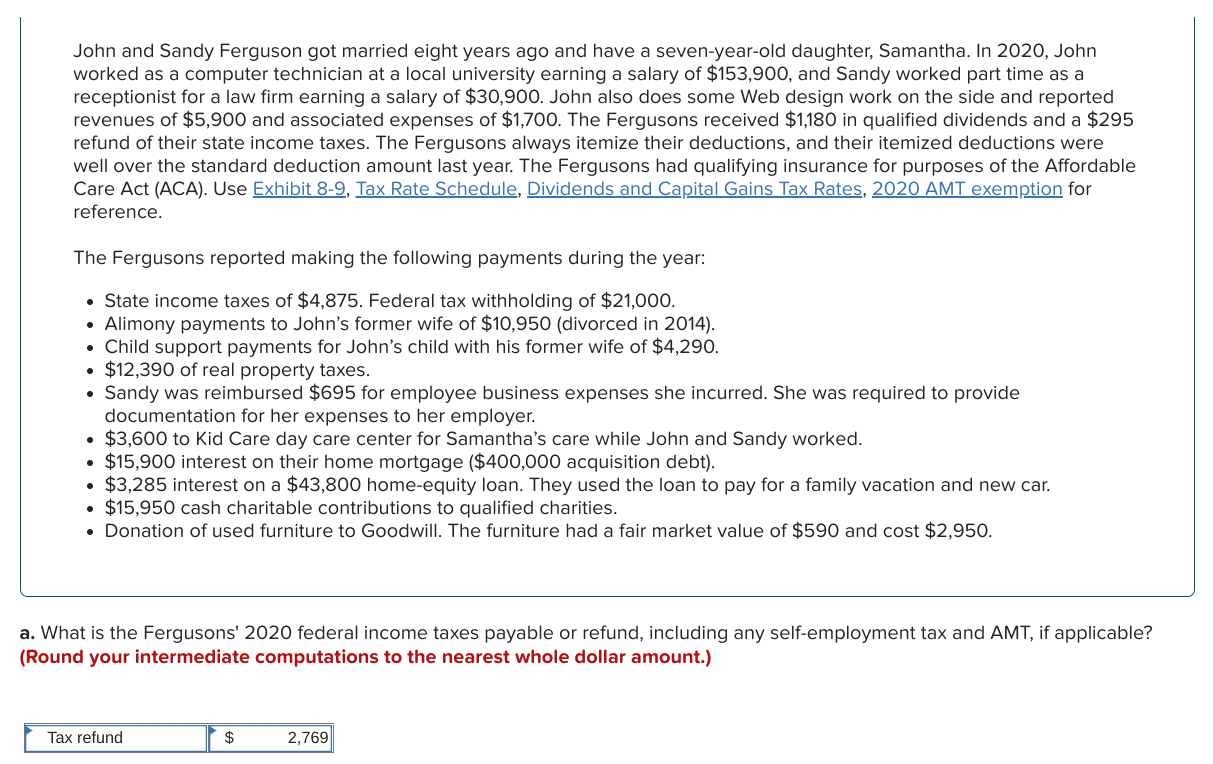

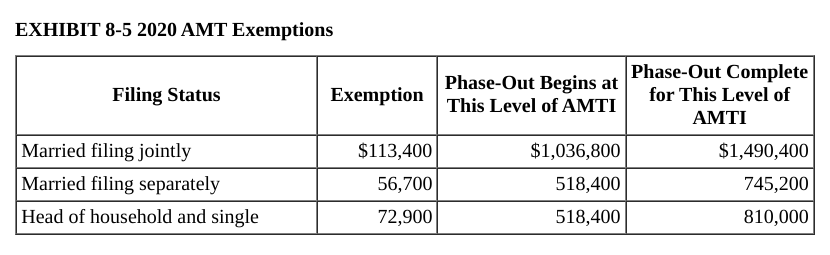

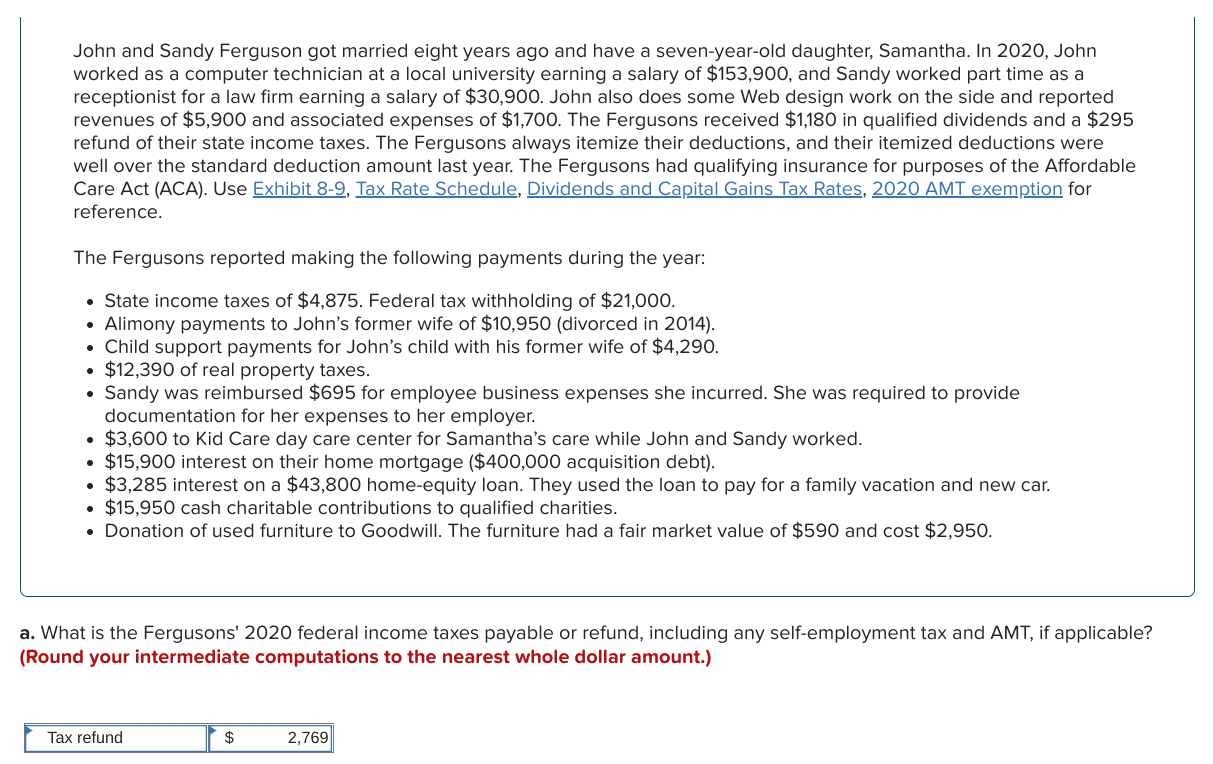

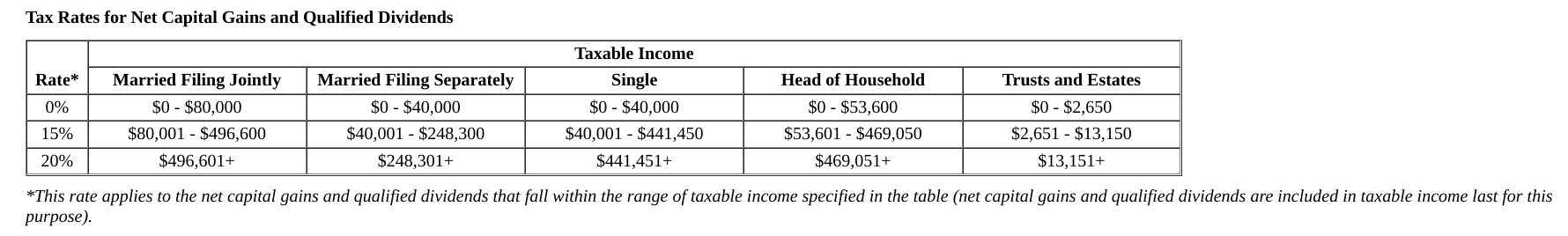

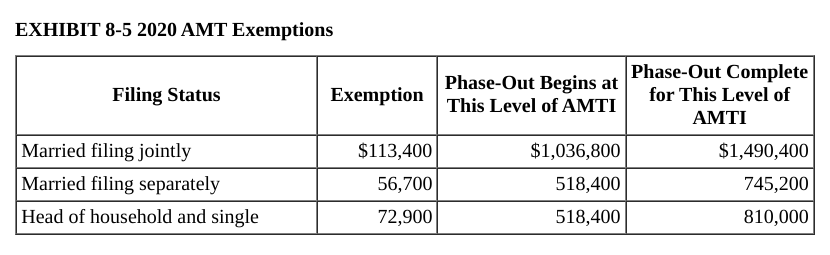

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2020, John worked as a computer technician at a local university earning a salary of $153,900, and Sandy worked part time as a receptionist for a law firm earning a salary of $30,900. John also does some Web design work on the side and reported revenues of $5,900 and associated expenses of $1,700. The Fergusons received $1,180 in qualified dividends and a $295 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA). Use Exhibit 8-9, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2020 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,875. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,950 (divorced in 2014). Child support payments for John's child with his former wife of $4,290. $12,390 of real property taxes. Sandy was reimbursed $695 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $15,900 interest on their home mortgage ($400,000 acquisition debt). $3,285 interest on a $43,800 home-equity loan. They used the loan to pay for a family vacation and new car. $15,950 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $590 and cost $2,950. . a. What is the Fergusons' 2020 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable? (Round your intermediate computations to the nearest whole dollar amount.) Tax refund $ 2,769 EXHIBIT 8-9 Child and Dependent Care Credit Percentage If AGI is over But not over Then the percentage is $ 0 $15,000 35% 15,000 17,000 34 17,000 19,000 33 19,000 21,000 32 21,000 23,000 31 23,000 25,000 30 25,000 27,000 29 27,000 29,000 28 29,000 31,000 27 31,000 33,000 26 33,000 35,000 25 35,000 37,000 24 37,000 39,000 23 39,000 41,000 22 41,000 43,000 21 43,000 No limit 20 Source: Source: Internal Revenue Code. "S 21. Expenses For Household And Dependent Care Services Necessary For Gainful Employment." 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: $ 0 $ 9,875 $ 9,875 $ 40,125 $ 40,125 $ 85,525 $ 85,525 $163,300 $163,300 $207,350 $207,350 $518,400 $518,400 The tax is: 10% of taxable income $987.50 plus 12% of the excess over $9,875 $4,617.50 plus 22% of the excess over $40,125 $14,605.50 plus 24% of the excess over $85,525 $33,271.50 plus 32% of the excess over $163,300 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Tax Rates for Net Capital Gains and Qualified Dividends Rate* Head of Household 0% Married Filing Jointly $0 - $80,000 $80,001 - $496,600 $496,601+ Married Filing Separately $0 - $40,000 $40,001 - $248,300 $248,301+ Taxable Income Single $0 - $40,000 $40,001 - $441,450 $441,451+ Trusts and Estates $0-$2,650 $2,651 - $13,150 $13,151+ $0 - $53,600 $53,601 - $469,050 $469,051+ 15% 20% *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). EXHIBIT 8-5 2020 AMT Exemptions Filing Status Exemption Phase-Out Complete Phase-Out Begins at for This Level of This Level of AMTI AMTI $1,036,800 Married filing jointly Married filing separately Head of household and single $113,400 56,700 72,900 518,400 $1,490,400 745,200 810,000 518,400 John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2020, John worked as a computer technician at a local university earning a salary of $153,900, and Sandy worked part time as a receptionist for a law firm earning a salary of $30,900. John also does some Web design work on the side and reported revenues of $5,900 and associated expenses of $1,700. The Fergusons received $1,180 in qualified dividends and a $295 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA). Use Exhibit 8-9, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2020 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,875. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,950 (divorced in 2014). Child support payments for John's child with his former wife of $4,290. $12,390 of real property taxes. Sandy was reimbursed $695 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $15,900 interest on their home mortgage ($400,000 acquisition debt). $3,285 interest on a $43,800 home-equity loan. They used the loan to pay for a family vacation and new car. $15,950 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $590 and cost $2,950. . a. What is the Fergusons' 2020 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable? (Round your intermediate computations to the nearest whole dollar amount.) Tax refund $ 2,769 EXHIBIT 8-9 Child and Dependent Care Credit Percentage If AGI is over But not over Then the percentage is $ 0 $15,000 35% 15,000 17,000 34 17,000 19,000 33 19,000 21,000 32 21,000 23,000 31 23,000 25,000 30 25,000 27,000 29 27,000 29,000 28 29,000 31,000 27 31,000 33,000 26 33,000 35,000 25 35,000 37,000 24 37,000 39,000 23 39,000 41,000 22 41,000 43,000 21 43,000 No limit 20 Source: Source: Internal Revenue Code. "S 21. Expenses For Household And Dependent Care Services Necessary For Gainful Employment." 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: $ 0 $ 9,875 $ 9,875 $ 40,125 $ 40,125 $ 85,525 $ 85,525 $163,300 $163,300 $207,350 $207,350 $518,400 $518,400 The tax is: 10% of taxable income $987.50 plus 12% of the excess over $9,875 $4,617.50 plus 22% of the excess over $40,125 $14,605.50 plus 24% of the excess over $85,525 $33,271.50 plus 32% of the excess over $163,300 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Tax Rates for Net Capital Gains and Qualified Dividends Rate* Head of Household 0% Married Filing Jointly $0 - $80,000 $80,001 - $496,600 $496,601+ Married Filing Separately $0 - $40,000 $40,001 - $248,300 $248,301+ Taxable Income Single $0 - $40,000 $40,001 - $441,450 $441,451+ Trusts and Estates $0-$2,650 $2,651 - $13,150 $13,151+ $0 - $53,600 $53,601 - $469,050 $469,051+ 15% 20% *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). EXHIBIT 8-5 2020 AMT Exemptions Filing Status Exemption Phase-Out Complete Phase-Out Begins at for This Level of This Level of AMTI AMTI $1,036,800 Married filing jointly Married filing separately Head of household and single $113,400 56,700 72,900 518,400 $1,490,400 745,200 810,000 518,400