Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i know it is lomg but i really need help! thank you please hkep me i need it for today :( Requirement 5. Prepare Cooke's

i know it is lomg but i really need help! thank you

please hkep me i need it for today :(

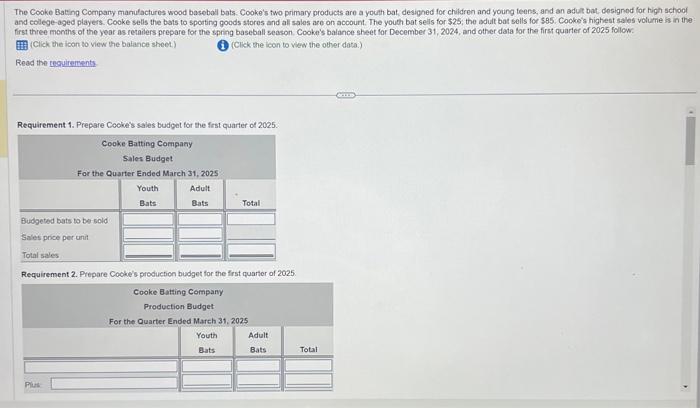

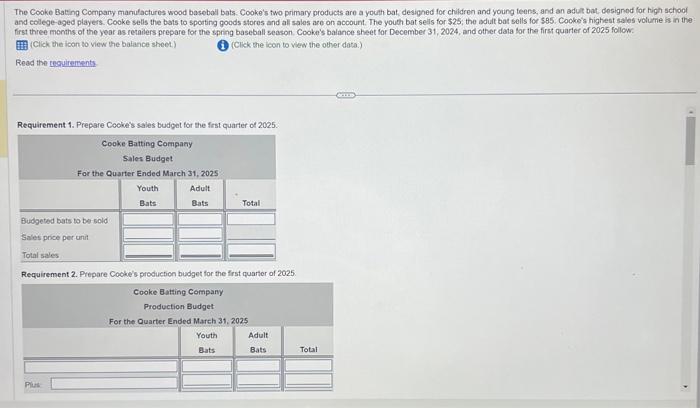

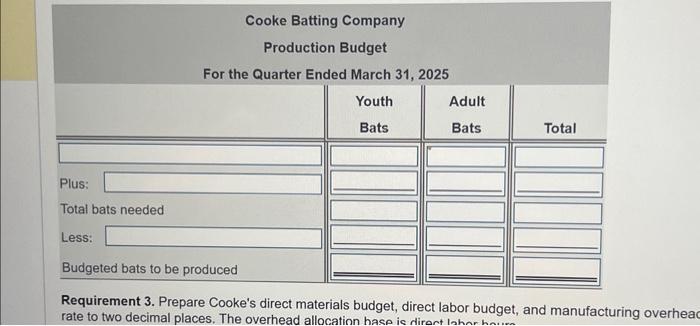

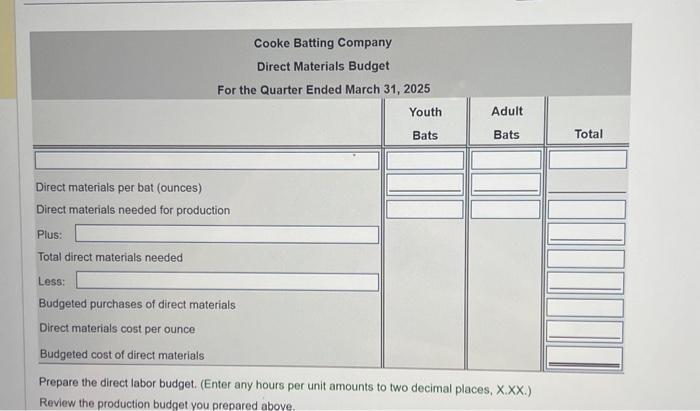

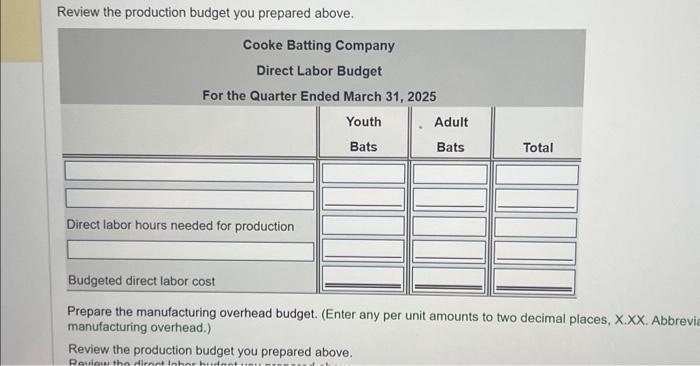

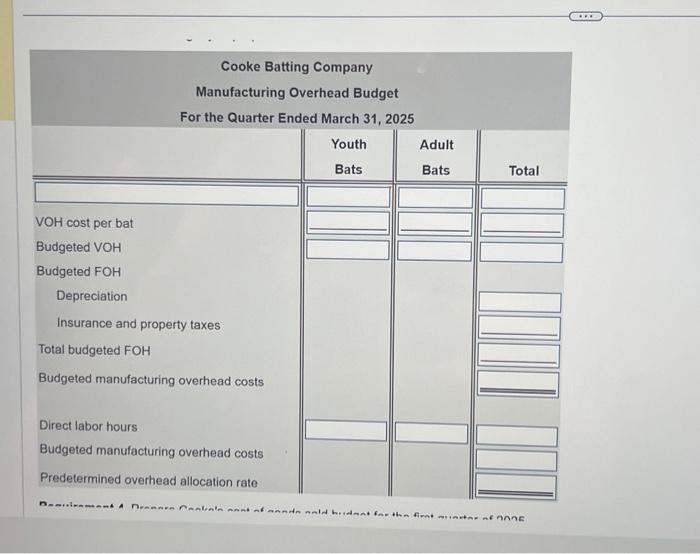

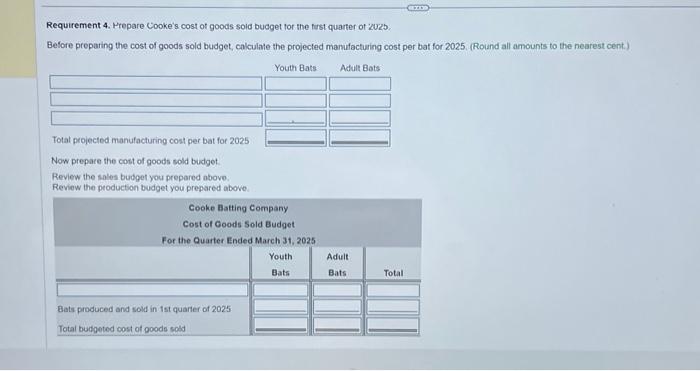

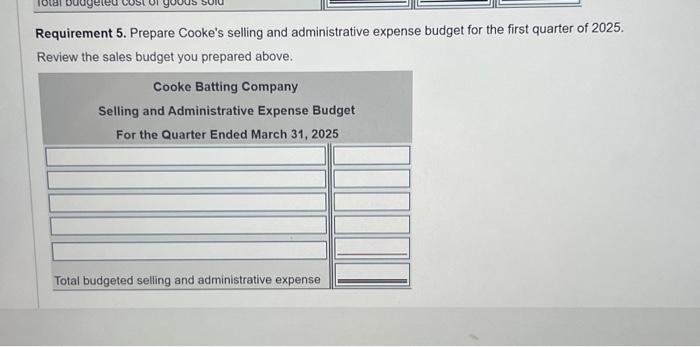

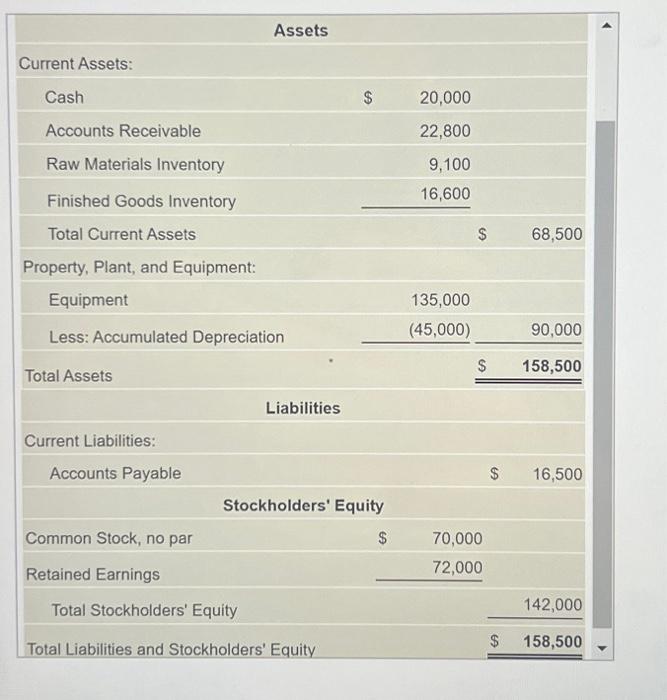

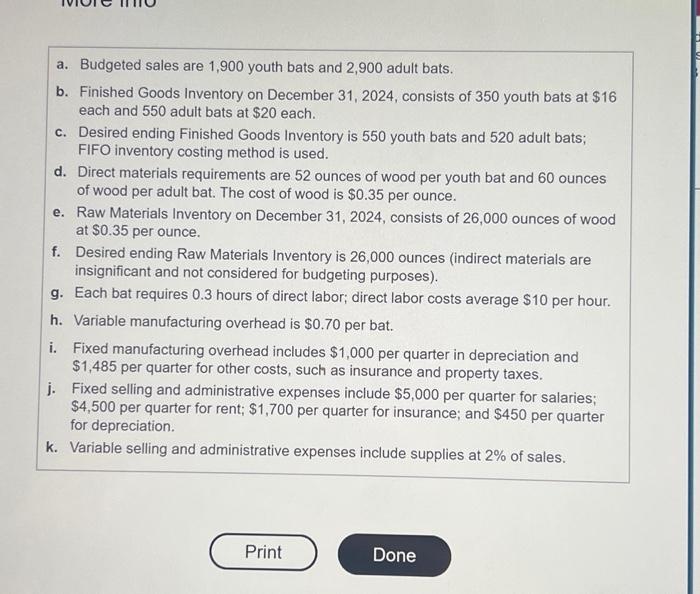

Requirement 5. Prepare Cooke's selling and administrative expense budget for the first quarter of 2025. Review the sales budget you prepared above. Review the production budget you prepared above. Prepare the manufacturing overhead budget. (Enter any per unit amounts to two decimal places, X.XX. Abbrevie manufacturing overhead.) Review the production budget you prepared above. The Cooke Bating Company manufactures wood basebal bats. Cooke's two primary products are a youth bat, designed for children and young teens, and an adut bat. designed for tigh schoof. and college-aged players. Cooke sells the bats to sporting poods stores and all sales are on account. The youth bat sells for $25; the oduit bat sells for $8.5. Cocke's highest sales volume is in the first three months of the year as retailers prepare for the spring baseball season. Cookn's balance sheet for December 31, 2024, and other data for the first quarter of 2025 follow. (Click the icon to view the balance sheet) (1) (Click the icon to vew the other data.) Read the teoulrements Requirement 1. Prepare Cocke's sales budget for the frst quarter of 2025. Requirement 2. Prepare Cooke's production budget for the first quarter of 2025 . \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Assets } & \\ \hline \multicolumn{5}{|l|}{ Current Assets: } \\ \hline Cash & $ & 20,000 & & \\ \hline Accounts Receivable & & 22,800 & & \\ \hline Raw Materials Inventory & & 9,100 & & \\ \hline Finished Goods Inventory & & 16,600 & & \\ \hline Total Current Assets & & $ & 68,500 & \\ \hline \multicolumn{4}{|l|}{ Property, Plant, and Equipment: } & \\ \hline Equipment & & 135,000 & & \\ \hline Less: Accumulated Depreciation & & (45,000) & 90,000 & \\ \hline Total Assets & & S & 158,500 & \\ \hline \multicolumn{4}{|c|}{ Liabilities } & \\ \hline \multicolumn{4}{|l|}{ Current Liabilities: } & \\ \hline Accounts Payable & & & 16,500 & \\ \hline \multicolumn{4}{|c|}{ Stockholders' Equity } & \\ \hline Common Stock, no par & $ & 70,000 & & \\ \hline Retained Earnings & & 72,000 & & \\ \hline Total Stockholders' Equity & & & 142,000 & \\ \hline Total Liabilities and Stockholders' E & & & 158,500 & \\ \hline \end{tabular} Requirement 4. Prepare Cooke's cost of goods sold budget for the first quarter of 2025 . Before proparing the cost of goods sold budget, calculate the projected manufacturing cost per bat for 2025 . (Round all amounts to the nearest cent.) a. Budgeted sales are 1,900 youth bats and 2,900 adult bats. b. Finished Goods Inventory on December 31,2024 , consists of 350 youth bats at $16 each and 550 adult bats at $20 each. c. Desired ending Finished Goods Inventory is 550 youth bats and 520 adult bats; FIFO inventory costing method is used. d. Direct materials requirements are 52 ounces of wood per youth bat and 60 ounces of wood per adult bat. The cost of wood is $0.35 per ounce. e. Raw Materials Inventory on December 31,2024 , consists of 26,000 ounces of wood at $0.35 per ounce. f. Desired ending Raw Materials Inventory is 26,000 ounces (indirect materials are insignificant and not considered for budgeting purposes). g. Each bat requires 0.3 hours of direct labor; direct labor costs average $10 per hour. h. Variable manufacturing overhead is $0.70 per bat. i. Fixed manufacturing overhead includes $1,000 per quarter in depreciation and $1,485 per quarter for other costs, such as insurance and property taxes. j. Fixed selling and administrative expenses include $5,000 per quarter for salaries; $4,500 per quarter for rent; $1,700 per quarter for insurance; and $450 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 2% of sales. Cooke Batting Company Direct Materials Budget For the Quarter Ended March 31, 2025 Direct materials per bat (ounces) Direct materials needed for production Plus: Total direct materials needed Less: Budgeted purchases of direct materials Direct materials cost per ounce Budgeted cost of direct materials Prepare the direct labor budget. (Enter any hours per unit amounts to two decimal places, X.XX.) Review the production budget you prepared above. Requirement 3. Prepare Cooke's direct materials budget, direct labor budget, and manufacturing overhea rate to two decimal places. The overhead allocation hase is direct tahordget, Cooke Batting Company Manufacturing Overhead Budget For the Quarter Ended March 31, 2025 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started