Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know it slopy but I really need help with this homework!!!!! The first 5 pictures were blurry, here is clear pictures on the questions

I know it slopy but I really need help with this homework!!!!!

The first 5 pictures were blurry, here is clear pictures on the questions

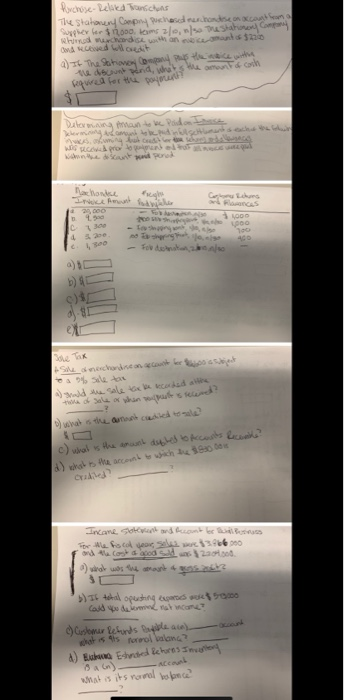

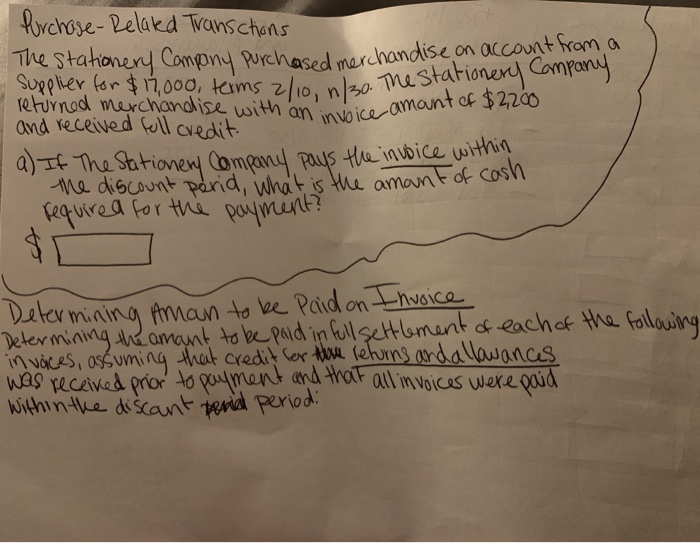

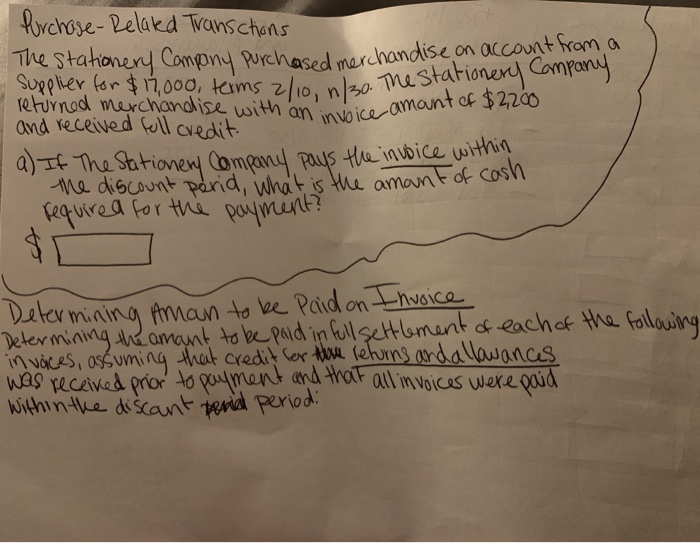

Purchase- Related Transaction

The Stationery Company purchased merchandise on account from a supplier for $17,000 terms 2/10 n/30. The Stationery Company returned merchandise with invoice amount of $2, 200 and received full credit.

a) If The Stationery Company pays invoice within the discount period, what is the amount of cash required for the payment? $____________.

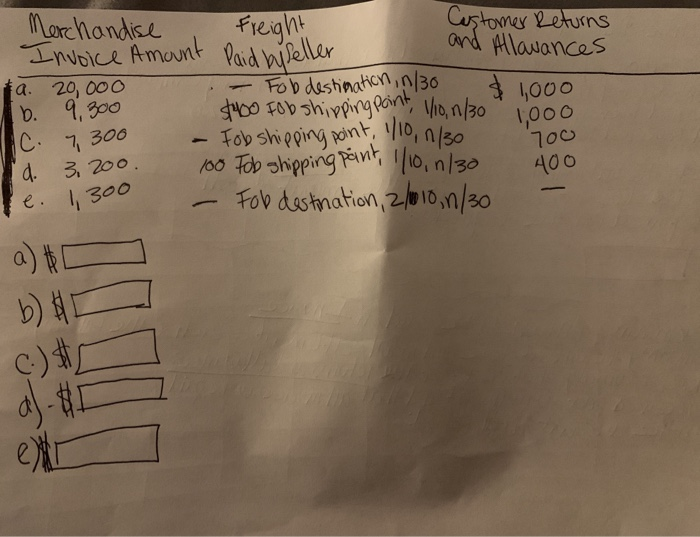

Determining Amounts to be Paid on Invoices

Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period:

Merchandise

Invoice Amount Freight

Paid by Seller Customer Returns

and Allowances

a. $20,000 FOB destination, n/30 $1,000

b. 9,300 $400 FOB shipping point, 1/10, n/30 1,100

c. 7,300 FOB shipping point, 1/10, n/30 700

d. 3,200 100 FOB shipping point, 1/10, n/30 400

e. 1,300 FOB destination, 2/10, n/30

a. $________

b. $________

c. $________

d. $________

e. $________

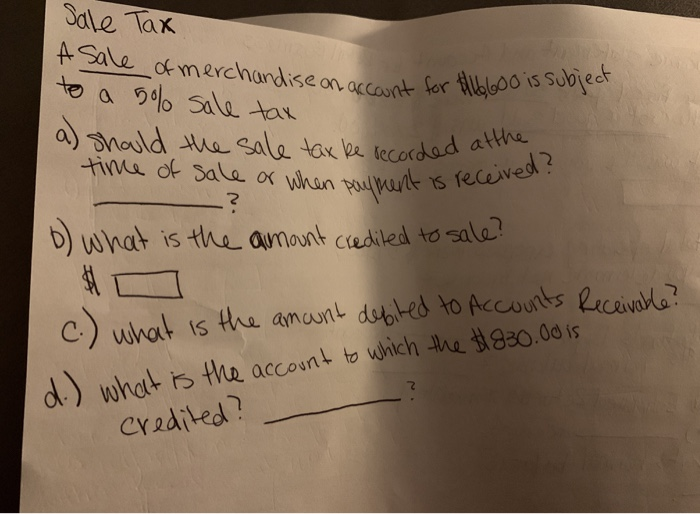

Sales Tax

A sale of merchandise on account for $16,600 is subject to a 5% sales tax.

(a) Should the sales tax be recorded at the time of sale or when payment is received?

___________

(b) What is the amount credited to sales?

$__________.

(c) What is the amount debited to Accounts Receivable?

$__________.

(d) What is the account to which the $830.00 is credited?

__________.

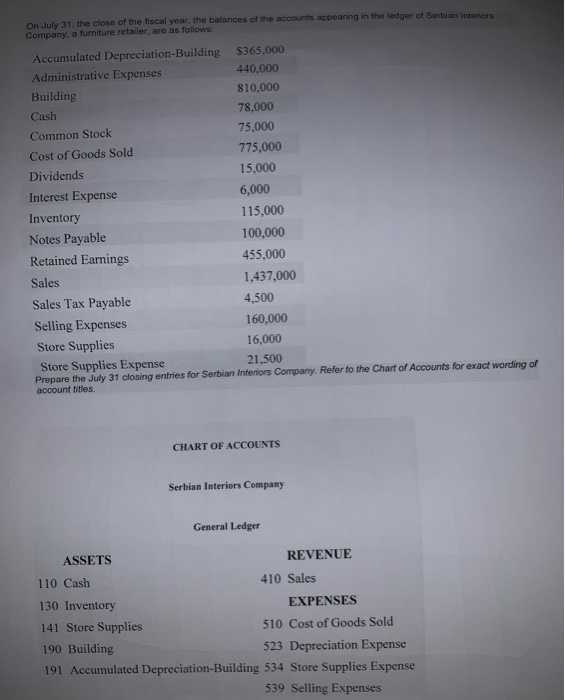

Income Statement and Accounts for Retail Business

For the fiscal year, sales were $3,866,000 and the cost of goods sold was $2,204,000.

a. What was the amount of gross profit?

$__________.

b. If total operating expenses were $573,000, could you determine net income?

___________.

c. Customer Refunds Payable is a(n) ________account.

What is its normal balance?

d. Estimated Returns Inventory is a(n)________account.

What is its normal balance?

__________.

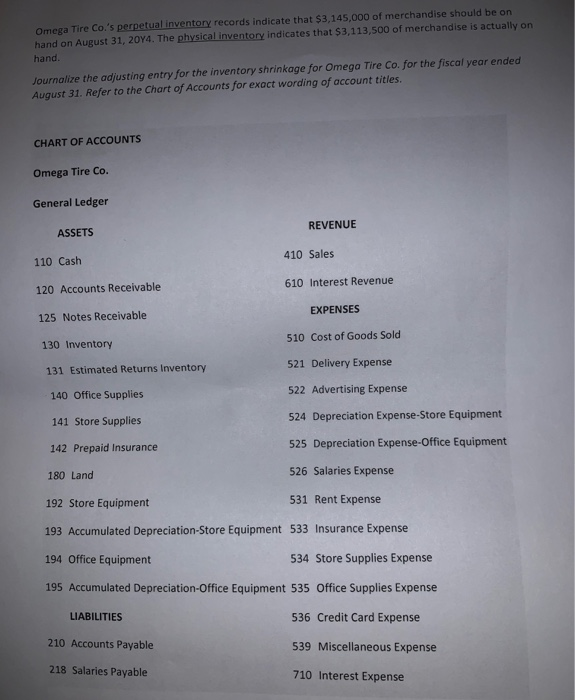

Omega Tire Co.s perpetual inventory records indicate that $3,145,000 of merchandise should be on hand on August 31, 20Y4. The physical inventory indicates that $3,113,500 of merchandise is actually on hand.

Journalize the adjusting entry for the inventory shrinkage for Omega Tire Co. for the fiscal year ended August 31. Refer to the Chart of Accounts for exact wording of account titles.

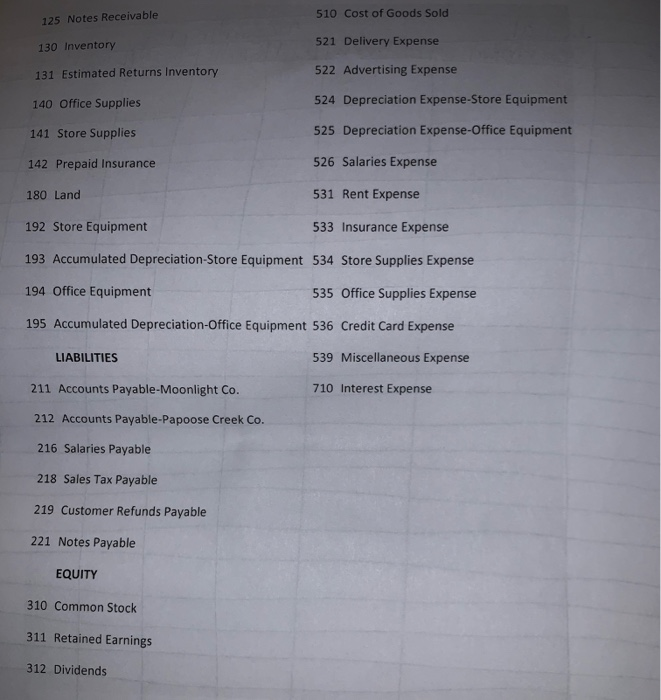

CHART OF ACCOUNTS

Omega Tire Co.

General Ledger

ASSETS

110 Cash

120 Accounts Receivable

125 Notes Receivable

130 Inventory

131 Estimated Returns Inventory

140 Office Supplies

141 Store Supplies

142 Prepaid Insurance

180 Land

192 Store Equipment

193 Accumulated Depreciation-Store Equipment

194 Office Equipment

195 Accumulated Depreciation-Office Equipment

LIABILITIES

210 Accounts Payable

218 Salaries Payable

219 Customer Refunds Payable

221 Notes Payable

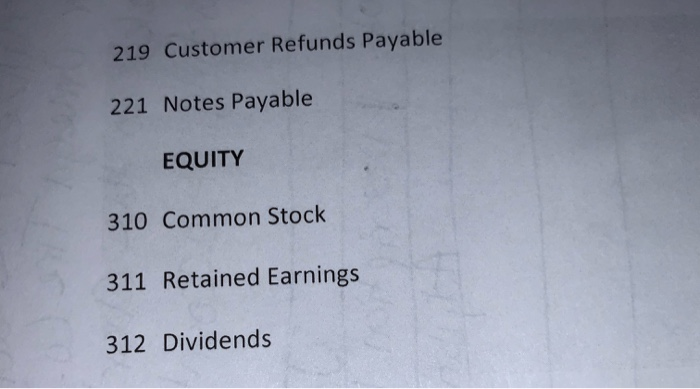

EQUITY

310 Common Stock

311 Retained Earnings

312 Dividends

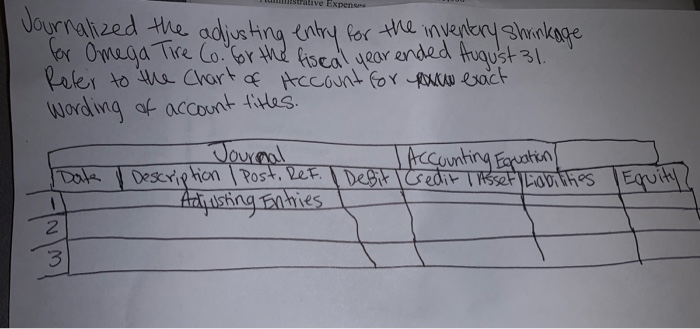

Journalize the adjusting entry for the inventory shrinkage for Omega Tire Co. for the fiscal year ended August 31. Refer to the Chart of Accounts for exact wording of account titles.

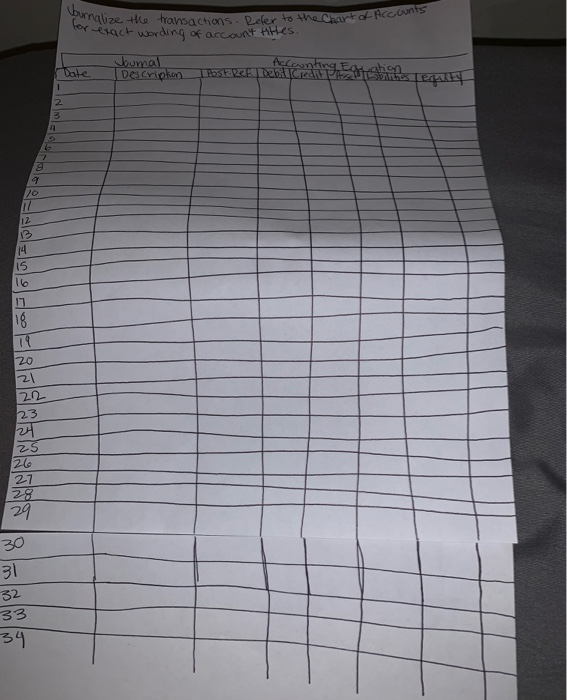

PAGE 10

JOURNAL

ACCOUNTING EQUATION

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

1 Adjusting Entries

2

3

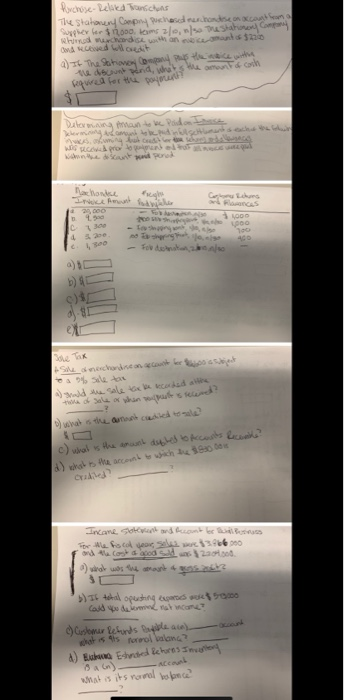

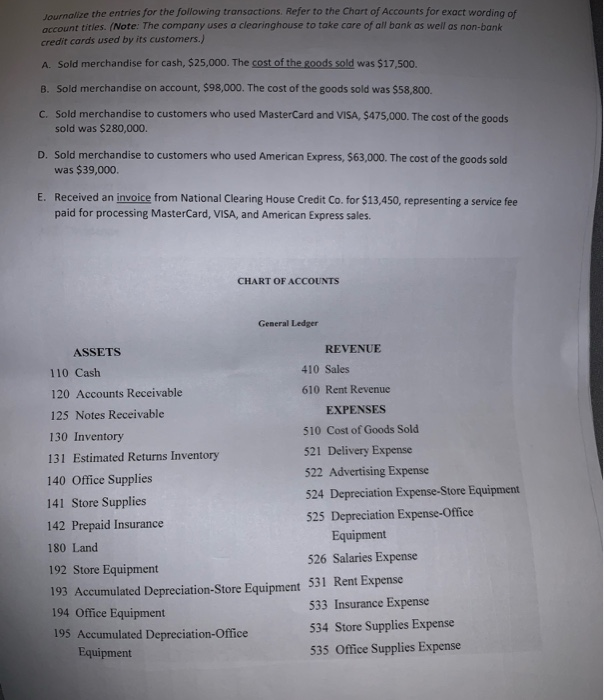

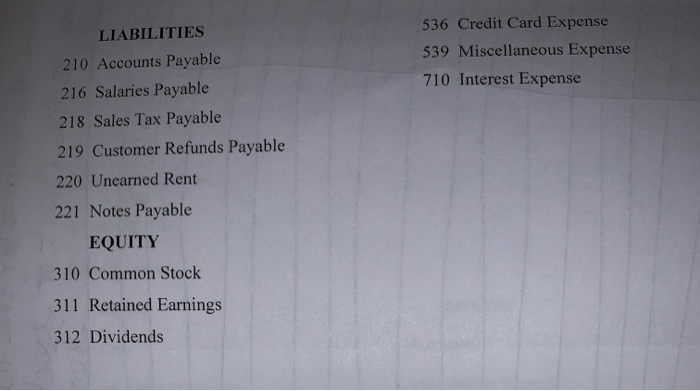

Journalize the entries for the following transactions. Refer to the Chart of Accounts for exact wording of account titles. (Note: The company uses a clearinghouse to take care of all bank as well as non-bank credit cards used by its customers.)

A. Sold merchandise for cash, $25,000. The cost of the goods sold was $17,500.

B. Sold merchandise on account, $98,000. The cost of the goods sold was $58,800.

C. Sold merchandise to customers who used MasterCard and VISA, $475,000. The cost of the goods sold was $280,000.

D. Sold merchandise to customers who used American Express, $63,000. The cost of the goods sold was $39,000.

E. Received an invoice from National Clearing House Credit Co. for $13,450, representing a service fee paid for processing MasterCard, VISA, and American Express sales

ASSETS

110 Cash

120 Accounts Receivable

125 Notes Receivable

130 Inventory

131 Estimated Returns Inventory

140 Office Supplies

141 Store Supplies

142 Prepaid Insurance

180 Land

192 Store Equipment

193 Accumulated Depreciation-Store Equipment

194 Office Equipment

195 Accumulated Depreciation-Office Equipment

LIABILITIES

210 Accounts Payable

216 Salaries Payable

218 Sales Tax Payable

219 Customer Refunds Payable

220 Unearned Rent

221 Notes Payable

EQUITY

310 Common Stock

311 Retained Earnings

312 Dividends

REVENUE

410 Sales

610 Rent Revenue

EXPENSES

510 Cost of Goods Sold

521 Delivery Expense

522 Advertising Expense

524 Depreciation Expense-Store Equipment

525 Depreciation Expense-Office Equipment

526 Salaries Expense

531 Rent Expense

533 Insurance Expense

534 Store Supplies Expense

535 Office Supplies Expense

536 Credit Card Expense

539 Miscellaneous Expense

710 Interest Expense

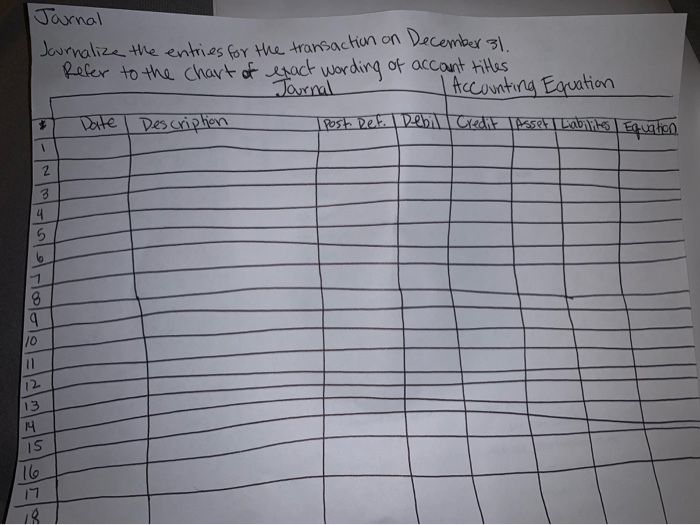

Journalize the entries for the transactions on December 31. Refer to the Chart of Accounts for exact wording of account titles.

PAGE 10

JOURNAL

ACCOUNTING EQUATION

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started