Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know it's a long one, but I really need the answers. You don't have to break your work down! I always thumbs up, thanks!

I know it's a long one, but I really need the answers. You don't have to break your work down!

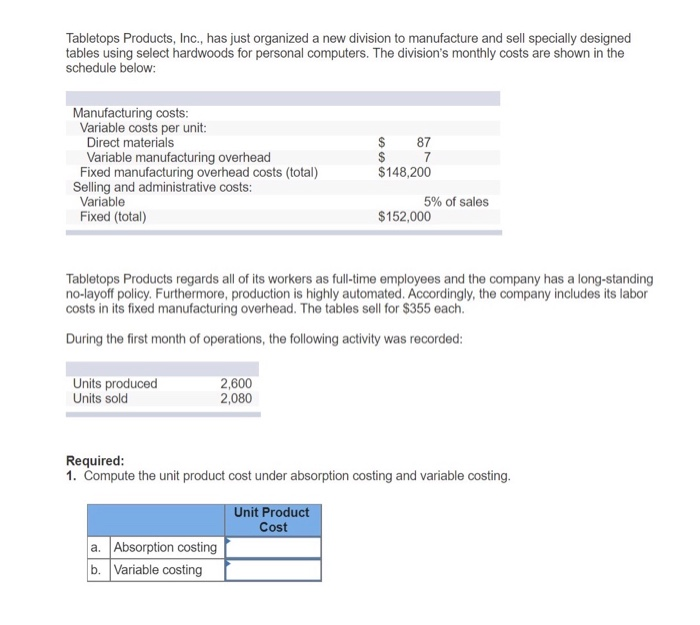

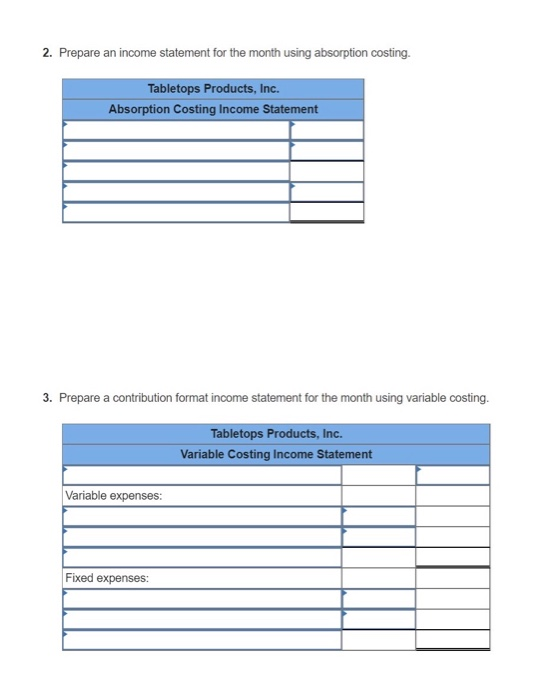

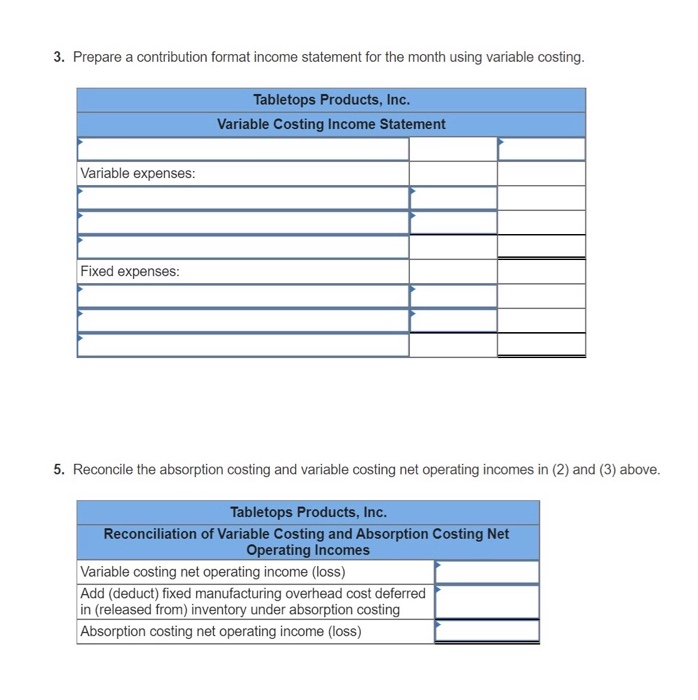

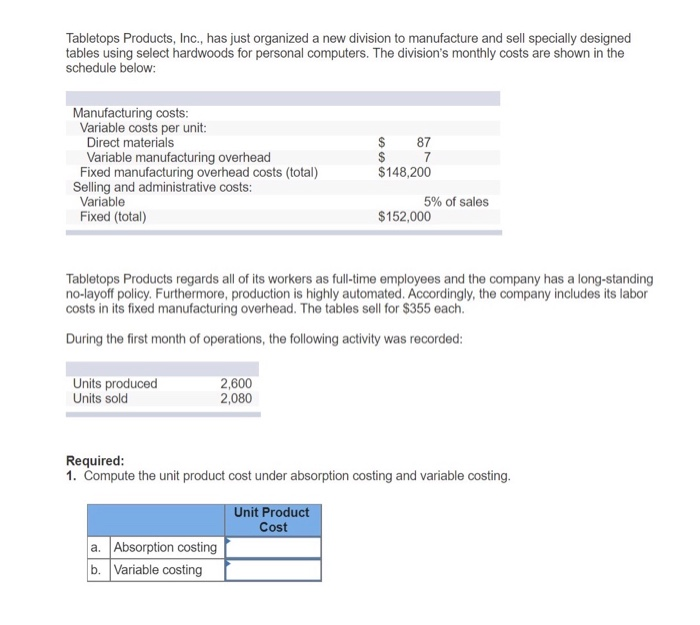

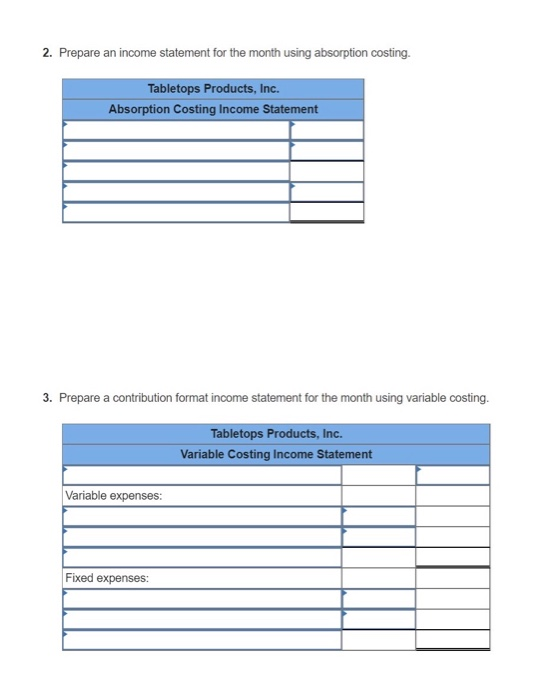

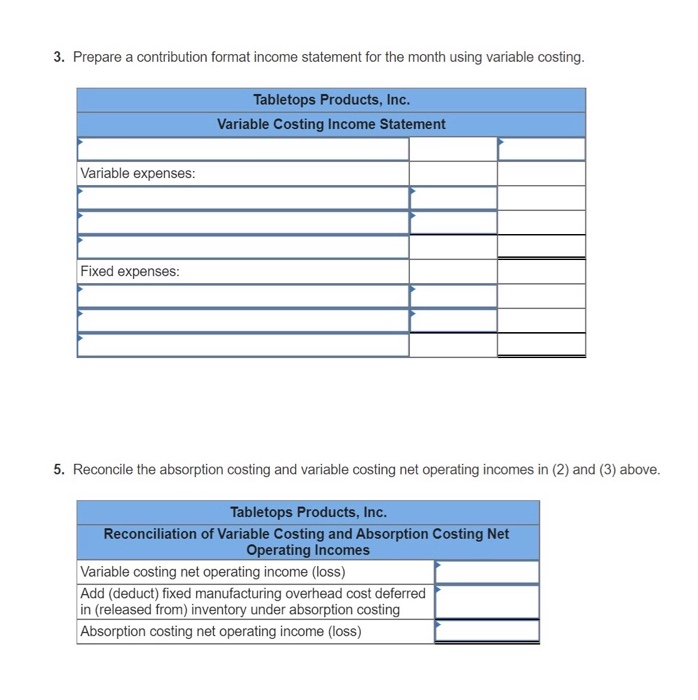

Tabletops Products, Inc., has just organized a new division to manufacture and sell specially designed tables using select hardwoods for personal computers. The division's monthly costs are shown in the schedule below: $ 87 Manufacturing costs: Variable costs per unit: Direct materials Variable manufacturing overhead Fixed manufacturing overhead costs (total) Selling and administrative costs: Variable Fixed (total) $148,200 5% of sales $152,000 Tabletops Products regards all of its workers as full-time employees and the company has a long-standing no-layoff policy. Furthermore, production is highly automated. Accordingly, the company includes its labor costs in its fixed manufacturing overhead. The tables sell for $355 each. During the first month of operations, the following activity was recorded: Units produced Units sold 2,600 2,080 Required: 1. Compute the unit product cost under absorption costing and variable costing. Unit Product Cost a. Absorption costing b. Variable costing 2. Prepare an income statement for the month using absorption costing. Tabletops Products, Inc. Absorption Costing Income Statement 3. Prepare a contribution format income statement for the month using variable costing. Tabletops Products, Inc. Variable Costing Income Statement Variable expenses: Fixed expenses: 3. Prepare a contribution format income statement for the month using variable costing. Tabletops Products, Inc. Variable Costing Income Statement Variable expenses: Fixed expenses: 5. Reconcile the absorption costing and variable costing net operating incomes in (2) and (3) above. Tabletops Products, Inc. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead cost deferred in (released from) inventory under absorption costing Absorption costing net operating income (loss) I always thumbs up, thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started