I know its a long question but any answers would be greatly appreciated! thank you so much in advance!

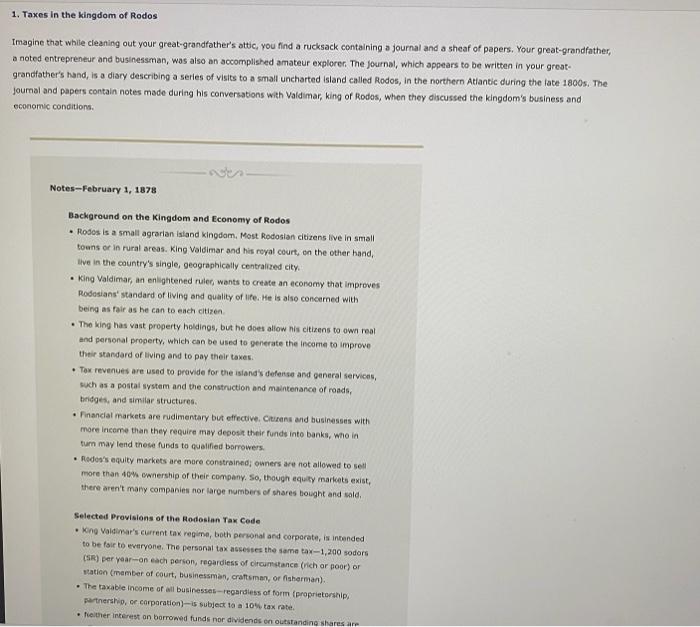

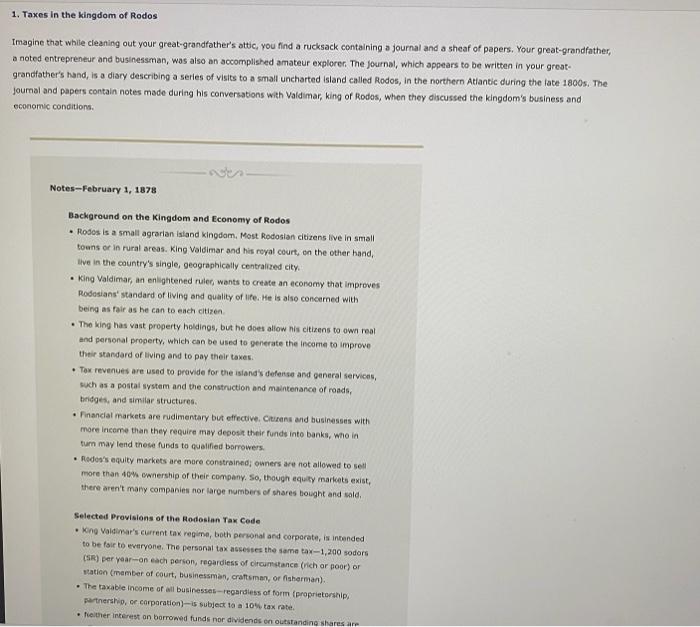

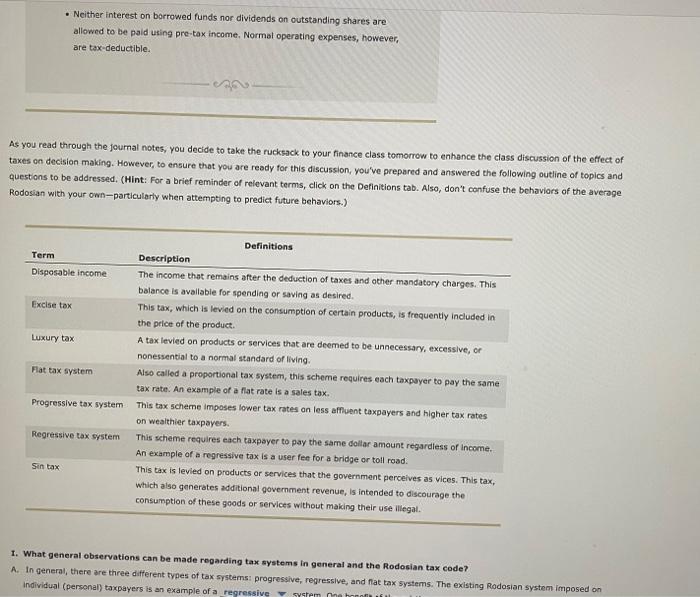

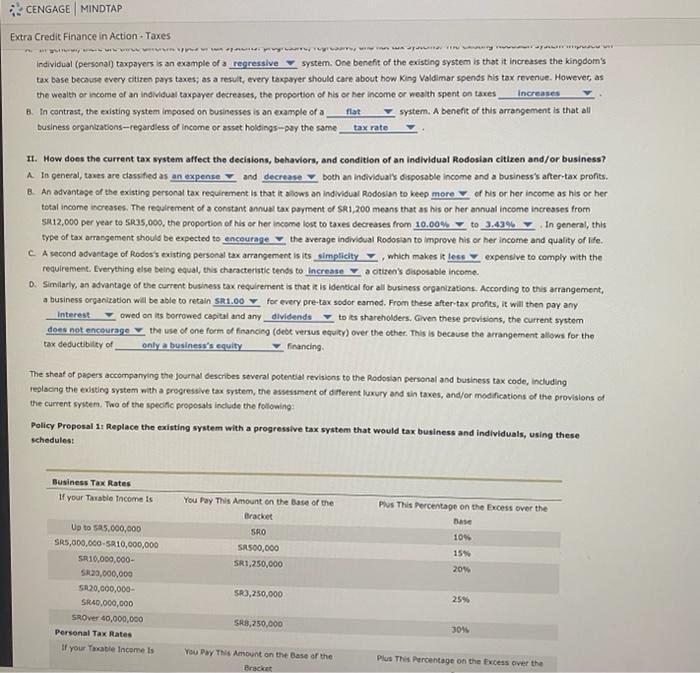

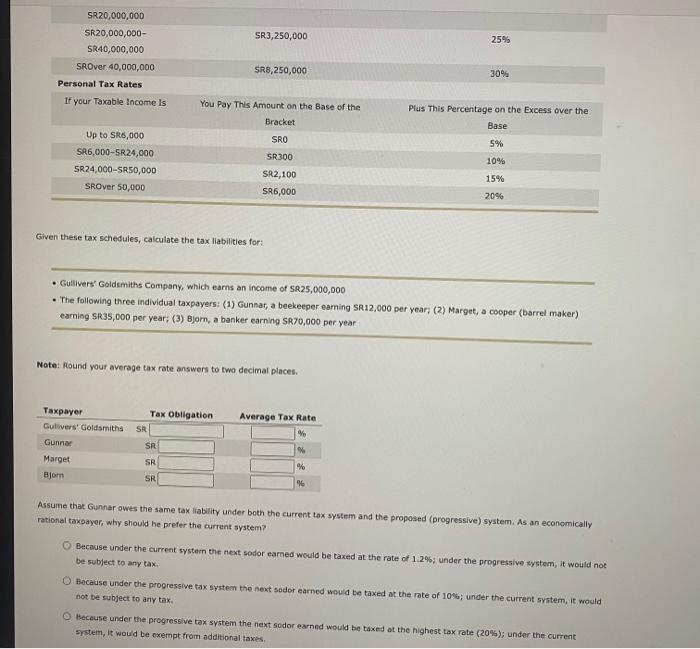

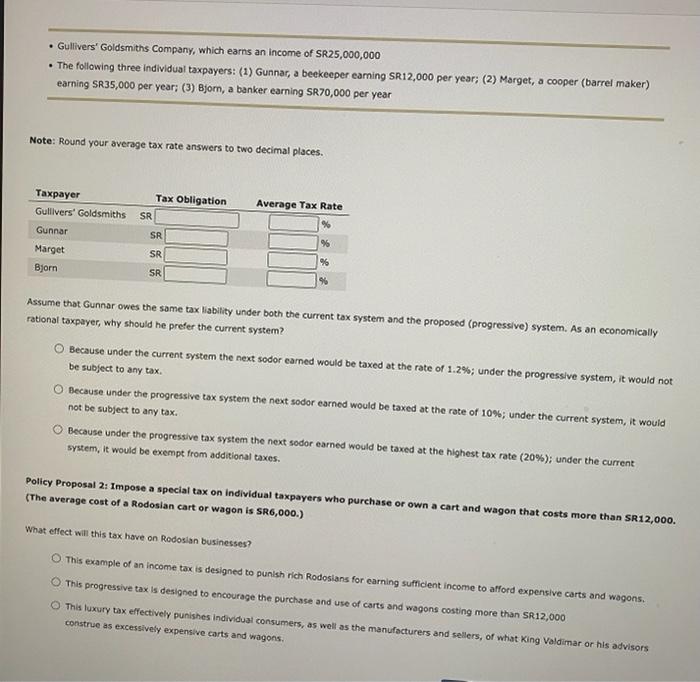

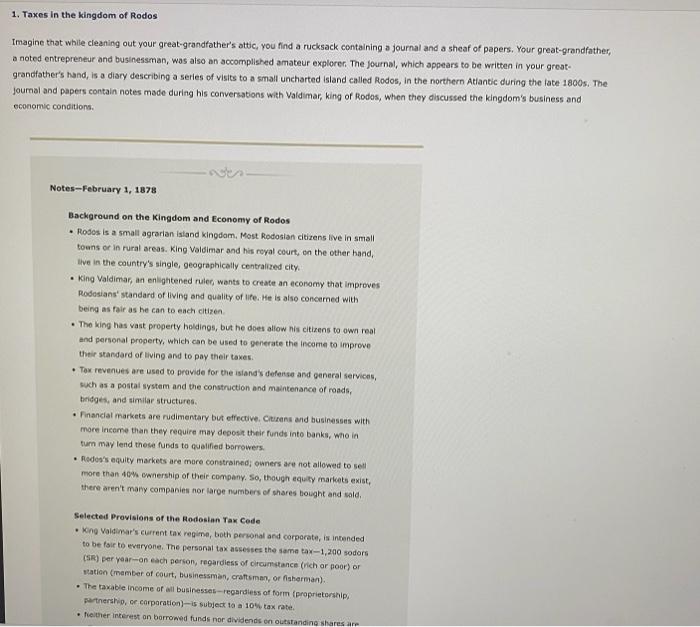

1. Taxes in the kingdom of Rodos Imagine that while cleaning out your great-grandfather's attic, you find a rucksack containing a journal and a sheaf of papers. Your great-grandfather, anoted entrepreneur and businessman, was also an accomplished amateur explorer. The Journal, which appears to be written in your great- grandfather's hand, is a diary describing a series of visits to a small uncharted island called Rodos, in the northern Atlantic during the late 1800s. The Journal and papers contain notes made during his conversations with Valdimar, king of Rodos, when they discussed the kingdom's business and economic conditions Notes-February 1, 1878 Background on the Kingdom and Economy of Rodos Rodos is a small agrarian Island Kingdom. Most Rodosian citizens live in small towns or in rural areas. King Valdimar and his royal court, on the other hand, live in the country's single, geographically centralized city King Valdimar, an enlightened rulet, wants to create an economy that improves Rodosians' standard of living and quality of life. He is also concerned with being as far as he can to each citizen The King has vast property holdings, but he does allow his citizens to own real and personal property, which can be used to generate the income to improve their standard of living and to pay their taxes Tax revenues are used to provide for the island's defense and general services, such as a postal system and the construction and maintenance of roads, hridges, and similar structures. Financial markets are rudimentary but effective Citizens and businesses with more income than they require may deposit their funds into banks, who in turn may lend these funds to qualified borrowers Rodos's equity markets are more constrained owners are not allowed to sell more than 40% ownership of their company. So, though equity markets exist, there aren't many companies nor large numbers of shares bought and sold Selected Provisions of the Rodoslan Tax Code King Valdimar's current tax regime, both personal and corporate, is intended to be fair to everyone. The personal tax assesses the same tax-1,200 sodors (SR) per year on each person, regardless of circumstance (rich or poor) or station member of court, businessman, craftsman, or fisherman) The taxable income of all businesses regardiess of form proprietorship, partnership, or corporation)-is subject to a 10% tax rate Neither interest on borrowed funds nor dividends on outstanding shares ar . Neither interest on borrowed funds nor dividends on outstanding shares are allowed to be paid using pre-tax income. Normal operating expenses, however, are tax deductible. As you read through the journal notes, you decide to take the rucksack to your finance class tomorrow to enhance the class discussion of the effect of taxes on decision making. However, to ensure that you are ready for this discussion, you've prepared and answered the following outline of topics and questions to be addressed. (Hint: For a brief reminder of relevant terms, click on the Definitions tab. Also, don't confuse the behaviors of the average Rodosian with your own-particularly when attempting to predict future behaviors.) Term Disposable income Excise tax Luxury tax Flat tax system Definitions Description The income that remains after the deduction of taxes and other mandatory charges. This balance is available for spending or saving as desired. This tax, which is levied on the consumption of certain products, is frequently included in the price of the product. A tax levied on products or services that are deemed to be unnecessary, excessive, er nonessential to a normal standard of living Also called a proportional tax system, this scheme requires each taxpayer to pay the same tax rate. An example of a flat rate is a sales tax. This tax scheme imposes lower tax rates on less affluent taxpayers and higher tax rates on wealthier taxpayers. This scheme requires each taxpayer to pay the same dollar amount regardless of income. An example of a regressive tax is a user fee for a bridge or toll road. This tax is levied on products or services that the government perceives as vices. This tax, which also generates additional government revenue, is intended to discourage the consumption of these goods or services without making their use illegal. Progressive tax system Regressive tax system Sintax 1. What general observations can be made regarding tax systems in general and the Rodosian tax code? A. In general, there are three different types of tax systems progressive, regressive, and flat tax systems. The existing Rodosian system imposed on individual (personal) taxpayers is an example of a regressive system mehr CENGAGE | MINDTAP Extra Credit Finance in Action - Taxes wwwwwwwwwwwwwwwwwwwwwww! Individual (personal) taxpayers is an example of a regressive system. One benefit of the existing system is that it increases the kingdom's tax base because every citizen pays taxes; as a result, every taxpayer should care about how King Valdimar spends his tax revenue. However, as the wealth or income of an individual taxpayer decreases, the proportion of his or her income or wealth spent on taxes_Increases B. In contrast, the existing system imposed on businesses is an example of a flat system. A benefit of this arrangement is that all business organizations--regardless of income or asset holdings-pay the same tax rate II. How does the current tax system affect the decisions, behaviors, and condition of an individual Rodosian citizen and/or business? A In general, taxes are classified as an expense and decrease both an individual's disposable income and a business's after-tax profits. B An advantage of the existing personal tax requirement is that it allows an individual Rodosian to keep more of his or her income as his or her total income increases. The requirement of a constant annual tax payment of SR1,200 means that as his or her annual income increases from SR12,000 per year to SR35,000, the proportion of his or her income lost to taxes decreases from 10.00% to 3.43% In general, this type of tax arrangement should be expected to encourage the average Individual Rodosian to improve his or her income and quality of life. c. A second advantage of Rodos's existing personal tax arrangement is its simplicity, which makes it less expensive to comply with the requirement. Everything else being equal, this characteristic tends to increase a tizen's disposable income D. Similarly, an advantage of the current business tax requirement is that is identical for all business organizations. According to this arrangement, a business organization will be able to retain SR1.00 for every pre-tax sodor camed. From these after tax profits, it will then pay any Interest owed on its borrowed capital and any dividends to its shareholders. Given these provisions, the current system does not encourage the use of one form of financing (debt versus equity) over the other. This is because the arrangement allows for the tax deductibility of only a business's equity Financing The sheat of papers accompanying the journal describes several potential revisions to the Rodosian personal and butiness tax code, including replacing the existing system with a progressive tax system, the assessment of different luxury and sin taxes, and/or modifications of the provisions of the current system. Two of the specific proposals include the following: Polley Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates If your Taxable income is You Pay This Amount on the base of the Bracket SRO SR500,000 SR1,250,000 Plus This Percentage on the Excess over the Base 10% 15% 204 Up to 545,000,000 SR5,000,000-5R10,000,000 SR10,000,000- SR20,000,000 5R20,000,000- SR40,000,000 SROver 40,000,000 Personal Tax Rates If your Texable income is SR3,250,000 25% 513,250,000 30% You Pay This Amount on the base of the Bracket Plus This Percentage on the Excess over the SR3,250,000 25% SR20,000,000 SR20,000,000- SR40,000,000 SROver 40,000,000 Personal Tax Rates If your Taxable income Is SR8,250,000 30% You Pay This Amount on the base of the Bracket SRO Plus This Percentage on the Excess over the Base 5% Up to R6,000 SA6,000-5R24,000 SR24,000-SR50,000 SROver 50,000 10% SR300 SR2,100 SR6,000 15% 20% Given these tax schedules, calculate the tax liabilities for: Gullivers' Goldsmiths Company, which earns an income of SR25,000,000 The following three individual taxpayers: (1) Gunnar, a beekeeper earning SR12,000 per year; (2) Marget, a cooper (barrelmaker) earning SR35,000 per year: (3) Bjorn, a banker earning SR70,000 per year Note: Round your average tax rate answers to two decimal places. Tax Obligation SR Average Tax Rate % Taxpayer Gulvvers' Goldsmiths Gunnar Marget Bjorn SR SR % SR Assume that Gunnar owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the current syster the next sodor earned would be taxed at the rate of 1.2%; under the progressive system, it would not be subject to any tax. O Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject to any tax. O because under the progressive tax system the next sodor earned would be taxed at the highest tax rate (20%), under the current system, it would be exempt from additional taxes Gullivers' Goldsmiths Company, which earns an income of SR25,000,000 The following three individual taxpayers: (1) Gunnar, a beekeeper earning SR12,000 per year; (2) Marget, a cooper (barrel maker) earning SR35,000 per year; (3) Bjorn, a banker earning SR70,000 per year Note: Round your average tax rate answers to two decimal places. Taxpayer Gullivers' Goldsmiths Tax Obligation Average Tax Rate SR SR % Gunnar Marget Bjorn SR % SR 96 Assume that Gunnar owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the current system the next sodor earned would be taxed at the rate of 1.2%; under the progressive system, it would not be subject to any tax Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject to any tax. Because under the progressive tax system the next sodor earned would be taxed at the highest tax rate (20%); under the current system, it would be exempt from additional taxes. Policy Proposal 2: Impose a special tax on individual taxpayers who purchase or own a cart and wagon that costs more than SR12,000. (The average cost of a Rodosian cart or wagon is SR6,000.) What effect will this tax have on Rodosian businesses ? This example of an income tax is designed to punish rich Rodoslans for earning sufficient income to afford expensive carts and wagons. This progressive tax is designed to encourage the purchase and use of carts and wagons costing more than SR12,000 This luxury tax effectively punishes Individual consumers, as well as the manufacturers and sellers, of what King Valdimar or his advisors construe as excessively expensive carts and wagons. 1. Taxes in the kingdom of Rodos Imagine that while cleaning out your great-grandfather's attic, you find a rucksack containing a journal and a sheaf of papers. Your great-grandfather, anoted entrepreneur and businessman, was also an accomplished amateur explorer. The Journal, which appears to be written in your great- grandfather's hand, is a diary describing a series of visits to a small uncharted island called Rodos, in the northern Atlantic during the late 1800s. The Journal and papers contain notes made during his conversations with Valdimar, king of Rodos, when they discussed the kingdom's business and economic conditions Notes-February 1, 1878 Background on the Kingdom and Economy of Rodos Rodos is a small agrarian Island Kingdom. Most Rodosian citizens live in small towns or in rural areas. King Valdimar and his royal court, on the other hand, live in the country's single, geographically centralized city King Valdimar, an enlightened rulet, wants to create an economy that improves Rodosians' standard of living and quality of life. He is also concerned with being as far as he can to each citizen The King has vast property holdings, but he does allow his citizens to own real and personal property, which can be used to generate the income to improve their standard of living and to pay their taxes Tax revenues are used to provide for the island's defense and general services, such as a postal system and the construction and maintenance of roads, hridges, and similar structures. Financial markets are rudimentary but effective Citizens and businesses with more income than they require may deposit their funds into banks, who in turn may lend these funds to qualified borrowers Rodos's equity markets are more constrained owners are not allowed to sell more than 40% ownership of their company. So, though equity markets exist, there aren't many companies nor large numbers of shares bought and sold Selected Provisions of the Rodoslan Tax Code King Valdimar's current tax regime, both personal and corporate, is intended to be fair to everyone. The personal tax assesses the same tax-1,200 sodors (SR) per year on each person, regardless of circumstance (rich or poor) or station member of court, businessman, craftsman, or fisherman) The taxable income of all businesses regardiess of form proprietorship, partnership, or corporation)-is subject to a 10% tax rate Neither interest on borrowed funds nor dividends on outstanding shares ar . Neither interest on borrowed funds nor dividends on outstanding shares are allowed to be paid using pre-tax income. Normal operating expenses, however, are tax deductible. As you read through the journal notes, you decide to take the rucksack to your finance class tomorrow to enhance the class discussion of the effect of taxes on decision making. However, to ensure that you are ready for this discussion, you've prepared and answered the following outline of topics and questions to be addressed. (Hint: For a brief reminder of relevant terms, click on the Definitions tab. Also, don't confuse the behaviors of the average Rodosian with your own-particularly when attempting to predict future behaviors.) Term Disposable income Excise tax Luxury tax Flat tax system Definitions Description The income that remains after the deduction of taxes and other mandatory charges. This balance is available for spending or saving as desired. This tax, which is levied on the consumption of certain products, is frequently included in the price of the product. A tax levied on products or services that are deemed to be unnecessary, excessive, er nonessential to a normal standard of living Also called a proportional tax system, this scheme requires each taxpayer to pay the same tax rate. An example of a flat rate is a sales tax. This tax scheme imposes lower tax rates on less affluent taxpayers and higher tax rates on wealthier taxpayers. This scheme requires each taxpayer to pay the same dollar amount regardless of income. An example of a regressive tax is a user fee for a bridge or toll road. This tax is levied on products or services that the government perceives as vices. This tax, which also generates additional government revenue, is intended to discourage the consumption of these goods or services without making their use illegal. Progressive tax system Regressive tax system Sintax 1. What general observations can be made regarding tax systems in general and the Rodosian tax code? A. In general, there are three different types of tax systems progressive, regressive, and flat tax systems. The existing Rodosian system imposed on individual (personal) taxpayers is an example of a regressive system mehr CENGAGE | MINDTAP Extra Credit Finance in Action - Taxes wwwwwwwwwwwwwwwwwwwwwww! Individual (personal) taxpayers is an example of a regressive system. One benefit of the existing system is that it increases the kingdom's tax base because every citizen pays taxes; as a result, every taxpayer should care about how King Valdimar spends his tax revenue. However, as the wealth or income of an individual taxpayer decreases, the proportion of his or her income or wealth spent on taxes_Increases B. In contrast, the existing system imposed on businesses is an example of a flat system. A benefit of this arrangement is that all business organizations--regardless of income or asset holdings-pay the same tax rate II. How does the current tax system affect the decisions, behaviors, and condition of an individual Rodosian citizen and/or business? A In general, taxes are classified as an expense and decrease both an individual's disposable income and a business's after-tax profits. B An advantage of the existing personal tax requirement is that it allows an individual Rodosian to keep more of his or her income as his or her total income increases. The requirement of a constant annual tax payment of SR1,200 means that as his or her annual income increases from SR12,000 per year to SR35,000, the proportion of his or her income lost to taxes decreases from 10.00% to 3.43% In general, this type of tax arrangement should be expected to encourage the average Individual Rodosian to improve his or her income and quality of life. c. A second advantage of Rodos's existing personal tax arrangement is its simplicity, which makes it less expensive to comply with the requirement. Everything else being equal, this characteristic tends to increase a tizen's disposable income D. Similarly, an advantage of the current business tax requirement is that is identical for all business organizations. According to this arrangement, a business organization will be able to retain SR1.00 for every pre-tax sodor camed. From these after tax profits, it will then pay any Interest owed on its borrowed capital and any dividends to its shareholders. Given these provisions, the current system does not encourage the use of one form of financing (debt versus equity) over the other. This is because the arrangement allows for the tax deductibility of only a business's equity Financing The sheat of papers accompanying the journal describes several potential revisions to the Rodosian personal and butiness tax code, including replacing the existing system with a progressive tax system, the assessment of different luxury and sin taxes, and/or modifications of the provisions of the current system. Two of the specific proposals include the following: Polley Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates If your Taxable income is You Pay This Amount on the base of the Bracket SRO SR500,000 SR1,250,000 Plus This Percentage on the Excess over the Base 10% 15% 204 Up to 545,000,000 SR5,000,000-5R10,000,000 SR10,000,000- SR20,000,000 5R20,000,000- SR40,000,000 SROver 40,000,000 Personal Tax Rates If your Texable income is SR3,250,000 25% 513,250,000 30% You Pay This Amount on the base of the Bracket Plus This Percentage on the Excess over the SR3,250,000 25% SR20,000,000 SR20,000,000- SR40,000,000 SROver 40,000,000 Personal Tax Rates If your Taxable income Is SR8,250,000 30% You Pay This Amount on the base of the Bracket SRO Plus This Percentage on the Excess over the Base 5% Up to R6,000 SA6,000-5R24,000 SR24,000-SR50,000 SROver 50,000 10% SR300 SR2,100 SR6,000 15% 20% Given these tax schedules, calculate the tax liabilities for: Gullivers' Goldsmiths Company, which earns an income of SR25,000,000 The following three individual taxpayers: (1) Gunnar, a beekeeper earning SR12,000 per year; (2) Marget, a cooper (barrelmaker) earning SR35,000 per year: (3) Bjorn, a banker earning SR70,000 per year Note: Round your average tax rate answers to two decimal places. Tax Obligation SR Average Tax Rate % Taxpayer Gulvvers' Goldsmiths Gunnar Marget Bjorn SR SR % SR Assume that Gunnar owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the current syster the next sodor earned would be taxed at the rate of 1.2%; under the progressive system, it would not be subject to any tax. O Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject to any tax. O because under the progressive tax system the next sodor earned would be taxed at the highest tax rate (20%), under the current system, it would be exempt from additional taxes Gullivers' Goldsmiths Company, which earns an income of SR25,000,000 The following three individual taxpayers: (1) Gunnar, a beekeeper earning SR12,000 per year; (2) Marget, a cooper (barrel maker) earning SR35,000 per year; (3) Bjorn, a banker earning SR70,000 per year Note: Round your average tax rate answers to two decimal places. Taxpayer Gullivers' Goldsmiths Tax Obligation Average Tax Rate SR SR % Gunnar Marget Bjorn SR % SR 96 Assume that Gunnar owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the current system the next sodor earned would be taxed at the rate of 1.2%; under the progressive system, it would not be subject to any tax Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject to any tax. Because under the progressive tax system the next sodor earned would be taxed at the highest tax rate (20%); under the current system, it would be exempt from additional taxes. Policy Proposal 2: Impose a special tax on individual taxpayers who purchase or own a cart and wagon that costs more than SR12,000. (The average cost of a Rodosian cart or wagon is SR6,000.) What effect will this tax have on Rodosian businesses ? This example of an income tax is designed to punish rich Rodoslans for earning sufficient income to afford expensive carts and wagons. This progressive tax is designed to encourage the purchase and use of carts and wagons costing more than SR12,000 This luxury tax effectively punishes Individual consumers, as well as the manufacturers and sellers, of what King Valdimar or his advisors construe as excessively expensive carts and wagons