I know that there is arbitrage since P = 17.5% but it actual expect is supposed to be 18%. But can i know how do you find the weights of P in each of these 3 asset?

This is the question. Part (b)

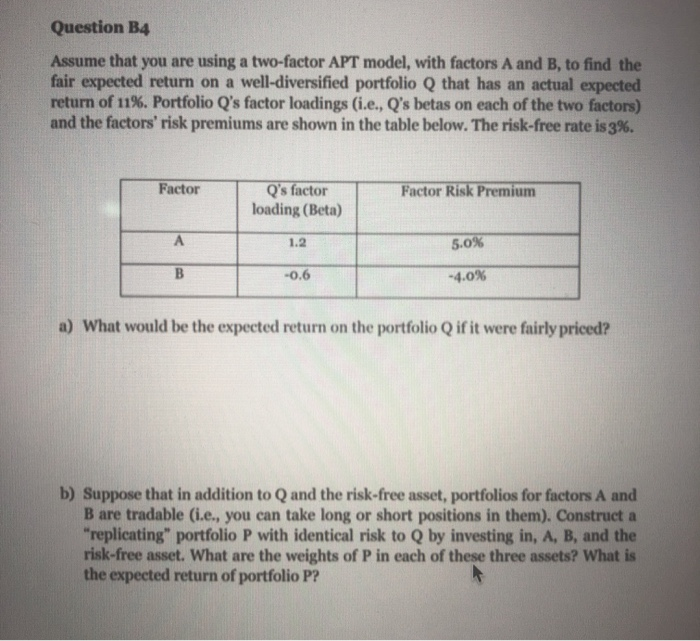

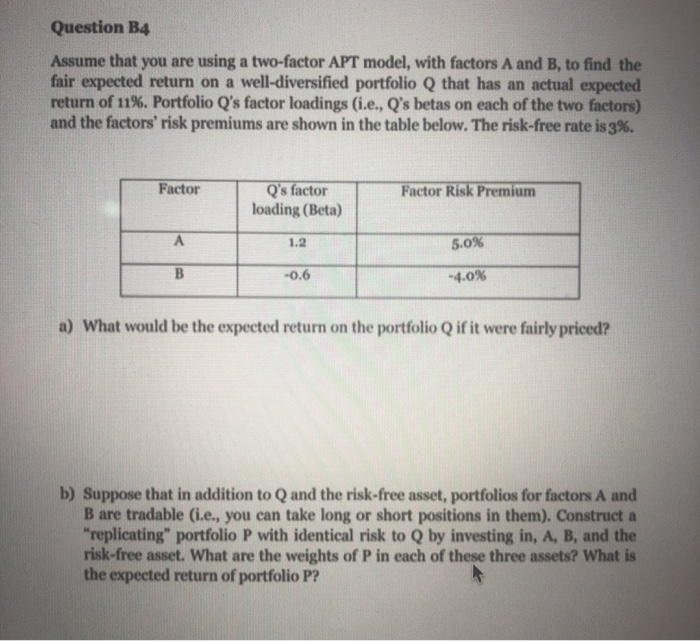

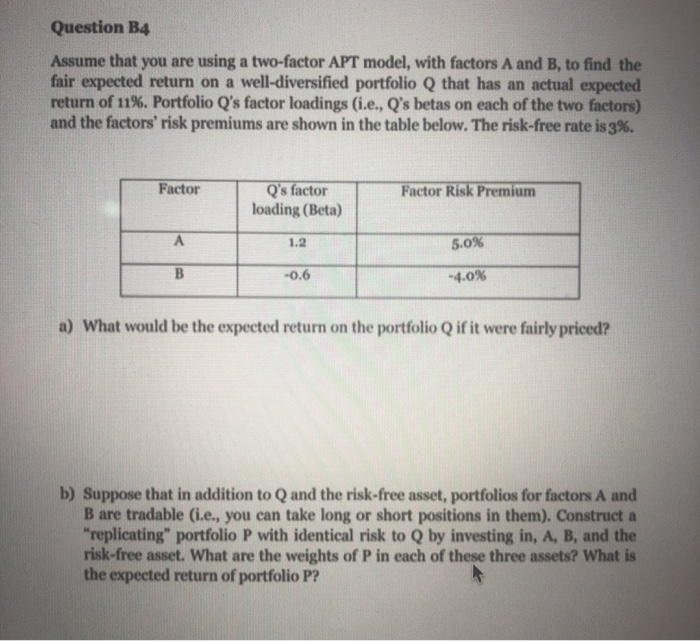

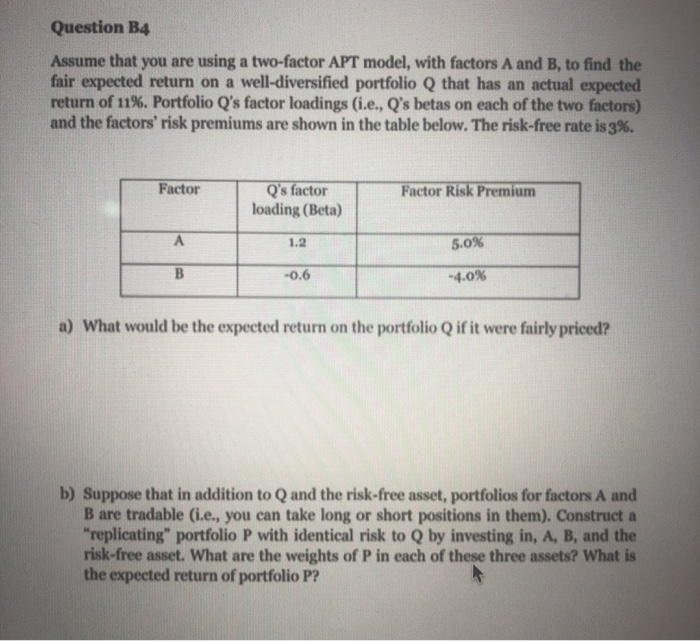

Question B4 Assume that you are using a two-factor APT model, with factors A and B, to find the fair expected return on a well-diversified portfolio Q that has an actual expected return of 11%. Portfolio Q's factor loadings (i.e., Q's betas on each of the two factors) and the factors' risk premiums are shown in the table below. The risk-free rate is 3%. Factor Factor Risk Premium Q's factor loading (Beta) 1.2 5.0% B -0.6 -4.0% a) What would be the expected return on the portfolio Q if it were fairly priced? b) Suppose that in addition to Q and the risk-free asset, portfolios for factors A and B are tradable (i.e., you can take long or short positions in them). Construct a "replicating" portfolio P with identical risk to Q by investing in, A, B, and the risk-free asset. What are the weights of P in each of these three assets? What is the expected return of portfolio P? Question B4 Assume that you are using a two-factor APT model, with factors A and B, to find the fair expected return on a well-diversified portfolio Q that has an actual expected return of 11%. Portfolio Q's factor loadings (i.e., Q's betas on each of the two factors) and the factors' risk premiums are shown in the table below. The risk-free rate is 3%. Factor Factor Risk Premium Q's factor loading (Beta) 1.2 5.0% B -0.6 -4.0% a) What would be the expected return on the portfolio Q if it were fairly priced? b) Suppose that in addition to Q and the risk-free asset, portfolios for factors A and B are tradable (i.e., you can take long or short positions in them). Construct a "replicating" portfolio P with identical risk to Q by investing in, A, B, and the risk-free asset. What are the weights of P in each of these three assets? What is the expected return of portfolio P? Question B4 Assume that you are using a two-factor APT model, with factors A and B, to find the fair expected return on a well-diversified portfolio Q that has an actual expected return of 11%. Portfolio Q's factor loadings (i.e., Q's betas on each of the two factors) and the factors' risk premiums are shown in the table below. The risk-free rate is 3%. Factor Factor Risk Premium Q's factor loading (Beta) 1.2 5.0% B -0.6 -4.0% a) What would be the expected return on the portfolio Q if it were fairly priced? b) Suppose that in addition to Q and the risk-free asset, portfolios for factors A and B are tradable (i.e., you can take long or short positions in them). Construct a "replicating" portfolio P with identical risk to Q by investing in, A, B, and the risk-free asset. What are the weights of P in each of these three assets? What is the expected return of portfolio P? Question B4 Assume that you are using a two-factor APT model, with factors A and B, to find the fair expected return on a well-diversified portfolio Q that has an actual expected return of 11%. Portfolio Q's factor loadings (i.e., Q's betas on each of the two factors) and the factors' risk premiums are shown in the table below. The risk-free rate is 3%. Factor Factor Risk Premium Q's factor loading (Beta) 1.2 5.0% B -0.6 -4.0% a) What would be the expected return on the portfolio Q if it were fairly priced? b) Suppose that in addition to Q and the risk-free asset, portfolios for factors A and B are tradable (i.e., you can take long or short positions in them). Construct a "replicating" portfolio P with identical risk to Q by investing in, A, B, and the risk-free asset. What are the weights of P in each of these three assets? What is the expected return of portfolio P