Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know the accounts are all correct. I just do not know thr remaining numbers and I'm not sure if what i put for income

I know the accounts are all correct. I just do not know thr remaining numbers and I'm not sure if what i put for income tax expense is right either.

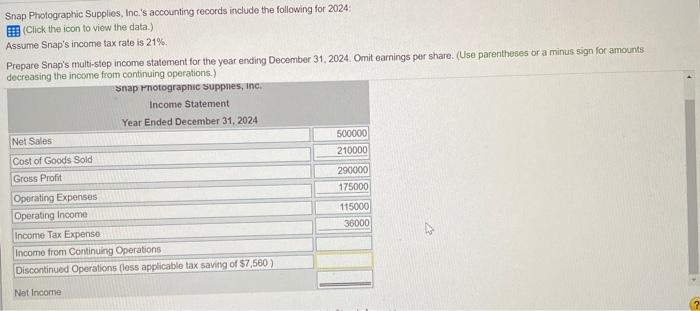

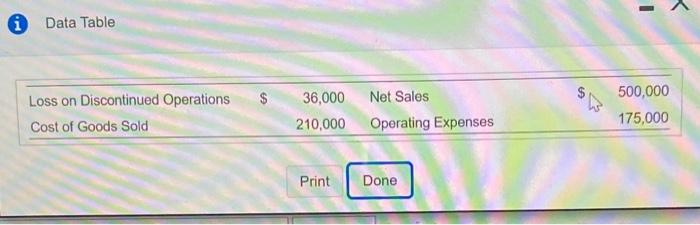

Snap Photographic Supplies, Inc.'s accounting records include the following for 2024 (Click the icon to view the data.) Assume Snap's income tax rate is 21% Prepare Snap's multi-step income statement for the year ending December 31, 2024. Omit earnings per share. (Use parentheses or a minus sign for amounts decreasing the income from continuing operations.) Snap Photographic Suppnes, Inc. Income Statement Year Ended December 31, 2024 Net Sales 500000 Cost of Goods Sold 210000 Gross Profit 290000 Operating Expenses 175000 Operating Income 115000 Income Tax Expense 36000 Income from Continuing Operations Discontinued Operations (less applicable tax saving of $7,580) Net Income ? Data Table Loss on Discontinued Operations Cost of Goods Sold 36,000 210,000 Net Sales Operating Expenses 500,000 175,000 Print Done Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started