Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know the answers i just need steps to understand how to solve part b, c and d. you can skip part a. thank you.

I know the answers i just need steps to understand how to solve part b, c and d. you can skip part a. thank you.

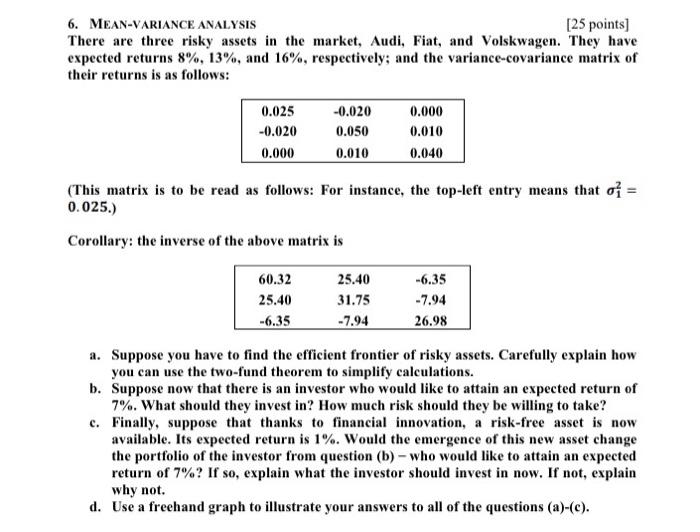

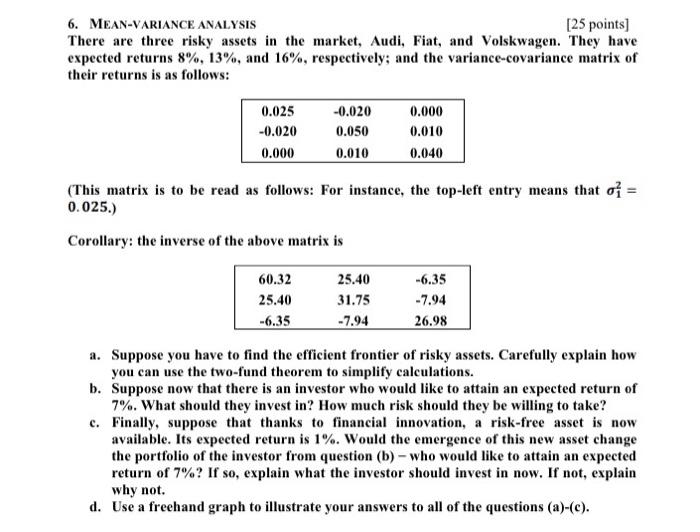

6. MEAN-VARIANCE ANALYSIS [25 points] There are three risky assets in the market, Audi, Fiat, and Volskwagen. They have expected returns 8%,13%, and 16%, respectively; and the variance-covariance matrix of their returns is as follows: (This matrix is to be read as follows: For instance, the top-left entry means that 12= 0.025. Corollary: the inverse of the above matrix is a. Suppose you have to find the efficient frontier of risky assets. Carefully explain how you can use the two-fund theorem to simplify calculations. b. Suppose now that there is an investor who would like to attain an expected return of 7%. What should they invest in? How much risk should they be willing to take? c. Finally, suppose that thanks to financial innovation, a risk-free asset is now available. Its expected return is 1%. Would the emergence of this new asset change the portfolio of the investor from question (b) - who would like to attain an expected return of 7% ? If so, explain what the investor should invest in now. If not, explain why not. d. Use a freehand graph to illustrate your answers to all of the questions (a)-(c). 6. MEAN-VARIANCE ANALYSIS [25 points] There are three risky assets in the market, Audi, Fiat, and Volskwagen. They have expected returns 8%,13%, and 16%, respectively; and the variance-covariance matrix of their returns is as follows: (This matrix is to be read as follows: For instance, the top-left entry means that 12= 0.025. Corollary: the inverse of the above matrix is a. Suppose you have to find the efficient frontier of risky assets. Carefully explain how you can use the two-fund theorem to simplify calculations. b. Suppose now that there is an investor who would like to attain an expected return of 7%. What should they invest in? How much risk should they be willing to take? c. Finally, suppose that thanks to financial innovation, a risk-free asset is now available. Its expected return is 1%. Would the emergence of this new asset change the portfolio of the investor from question (b) - who would like to attain an expected return of 7% ? If so, explain what the investor should invest in now. If not, explain why not. d. Use a freehand graph to illustrate your answers to all of the questions (a)-(c)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started