I know the balance sheet is kind of blurry but it was the best picture I could get

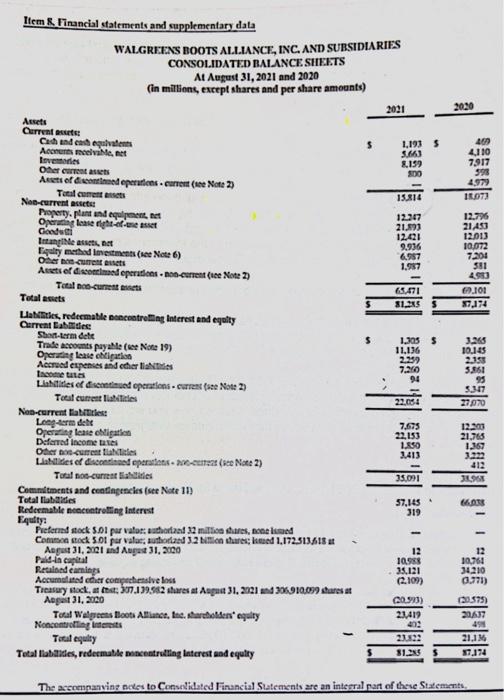

The next page shows Walgreen Boots Alliance's balance sheet and related inventory note (below) from the 10K for yearend August 31, 2021. The amounts reported for Inventories are for the combined sum of the United States segment and the International segment inventories. a. Compute the 2021 current ratio based on information provided on the balance statement. b. Now using the information provided in the Inventories note to make appropriate adjustments to approximate FIFO, recompute the 2021 current ratio. c. Compute the Inventory Turnover Ratio using the information provided on the balance statement. Sales and CGS for the year ended August 31, 2021 amounted to $132,509M (so $132.5B ) and $104,442M($104.4B ). d. Now using the information provided in the Inventories note to make appropriate adjustments to approximate FIFO, recompute the 2021 Inventory Turnover Ratio. e. Comment on the comparisons between unadjusted and adjusted ratios. f. CVS is the largest pharmacy chain in the US with 24.5% of the market with $122.6B in sales. Walgreens US segment (alone) is the second largest chain with 18% of the market and $90.3B in sales. The inventories note on p 113 of the December 31,202110K for CVS stated that they value inventories at lower of cost or net realizable value using the weighted average cost method. Discuss how you would go about comparing the current ratio and inventory turnover ratios for Walgreens with CVS. From Notes in Walgreens 2021 10-K. see next page for Balance Sheets. Inventories The Company values inventories on a lower of cost and net realizable value or market basis. Inventories include product costs, inbound freight, direct labor, warehousing costs for retail pharmacy operations and distribution of products and vendor allowances not classified as a reduction of advertising expense. The Company's United States segment inventory is accounted for using the last-in-first-out ("LIFO") method. The total carrying value of the segment inventory accounted for under the LIFO method was $6.2 billion and $6.4 billion at August 31, 2021 and 2020, respectively. At August 31, 2021 and 2020, United States segment inventory would have been greater by $3.3 billion and $3.3 billion, respectively, if they had been valued on a lower of first-in-first-out ("FIFO") cost and net realizable value. The Company's International segment inventory is accounted for using average cost and the FIFO method. The total carrying value of the inventory for Intemational segment was $2.0 billion and $1.5 billion at August 31 , 2021 and 2020 , respectively. Ifem R. Timancial statements and cupplementary data WALGREFAS BOOTS AL.I.HNCF, INC. AND SUBSIDLARIFS CONSOLIDATED BATANCE SIITKTS Latstatits, redecmable nsecoatremis Interest and equity Curreat Eastrties: Curreat Eabtietes: Soan-term dete The next page shows Walgreen Boots Alliance's balance sheet and related inventory note (below) from the 10K for yearend August 31, 2021. The amounts reported for Inventories are for the combined sum of the United States segment and the International segment inventories. a. Compute the 2021 current ratio based on information provided on the balance statement. b. Now using the information provided in the Inventories note to make appropriate adjustments to approximate FIFO, recompute the 2021 current ratio. c. Compute the Inventory Turnover Ratio using the information provided on the balance statement. Sales and CGS for the year ended August 31, 2021 amounted to $132,509M (so $132.5B ) and $104,442M($104.4B ). d. Now using the information provided in the Inventories note to make appropriate adjustments to approximate FIFO, recompute the 2021 Inventory Turnover Ratio. e. Comment on the comparisons between unadjusted and adjusted ratios. f. CVS is the largest pharmacy chain in the US with 24.5% of the market with $122.6B in sales. Walgreens US segment (alone) is the second largest chain with 18% of the market and $90.3B in sales. The inventories note on p 113 of the December 31,202110K for CVS stated that they value inventories at lower of cost or net realizable value using the weighted average cost method. Discuss how you would go about comparing the current ratio and inventory turnover ratios for Walgreens with CVS. From Notes in Walgreens 2021 10-K. see next page for Balance Sheets. Inventories The Company values inventories on a lower of cost and net realizable value or market basis. Inventories include product costs, inbound freight, direct labor, warehousing costs for retail pharmacy operations and distribution of products and vendor allowances not classified as a reduction of advertising expense. The Company's United States segment inventory is accounted for using the last-in-first-out ("LIFO") method. The total carrying value of the segment inventory accounted for under the LIFO method was $6.2 billion and $6.4 billion at August 31, 2021 and 2020, respectively. At August 31, 2021 and 2020, United States segment inventory would have been greater by $3.3 billion and $3.3 billion, respectively, if they had been valued on a lower of first-in-first-out ("FIFO") cost and net realizable value. The Company's International segment inventory is accounted for using average cost and the FIFO method. The total carrying value of the inventory for Intemational segment was $2.0 billion and $1.5 billion at August 31 , 2021 and 2020 , respectively. Ifem R. Timancial statements and cupplementary data WALGREFAS BOOTS AL.I.HNCF, INC. AND SUBSIDLARIFS CONSOLIDATED BATANCE SIITKTS Latstatits, redecmable nsecoatremis Interest and equity Curreat Eastrties: Curreat Eabtietes: Soan-term dete