i know the correct answers for Annual worth but im unsure on how to get the answer

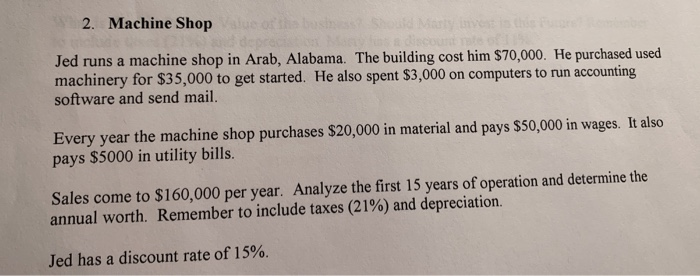

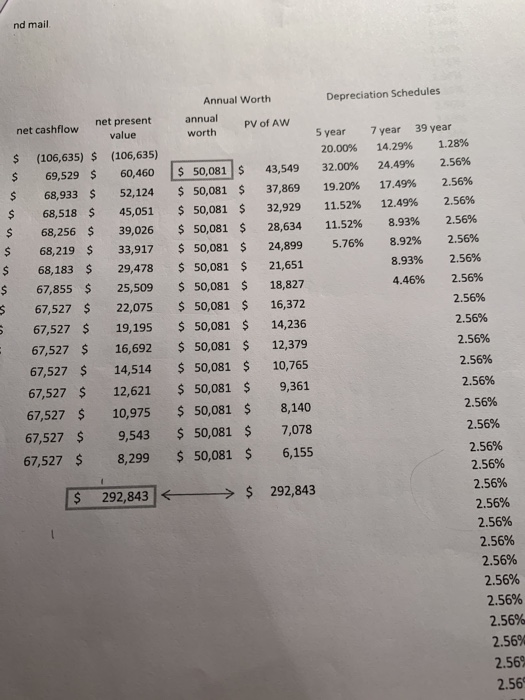

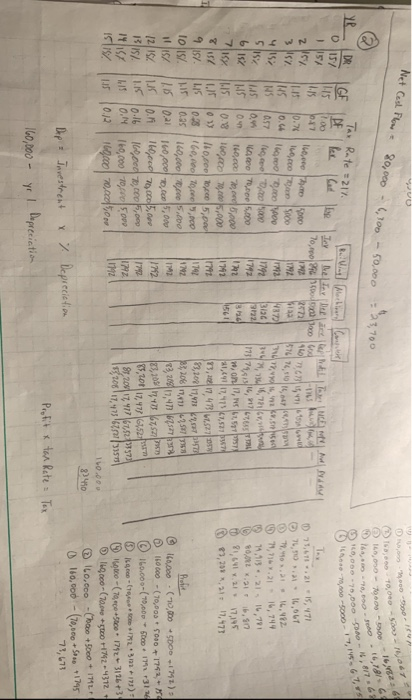

2. Machine Shop Jed runs a machine shop in Arab, Alabama. The building cost him $70,000. He purchased used machinery for $35,000 to get started. He also spent $3,000 on computers to run accounting software and send mail. Every year the machine shop purchases $20,000 in material and pays $50,000 in wages. It also pays $5000 in utility bills. Sales come to $160,000 per year. Analyze the first 15 years of operation and determine the annual worth. Remember to include taxes (21%) and depreciation. Jed has a discount rate of 15%. nd mail Depreciation Schedules Annual Worth annual PV of AW worth 5 year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% net present net cashflow value $ (106,635) $ (106,635) $ 69,529 $ 60,460 68,933 $ 52,124 68,518 $ 45,051 68,256 $ 39,026 68,219 $ 33,917 68,183 $ 29,478 67,855 $ 25,509 67,527 $ 22,075 67,527 $ 19,195 67,527 $ 16,692 67,527 $ 14,514 67,527 $ 12,621 67,527 $ 10,975 67,527 $ 9,543 67,527 $ 8,299 $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ $ 50,081 $ 43,549 37,869 32,929 28,634 24,899 21,651 18,827 16,372 14,236 12,379 10,765 9,361 8,140 7,078 6,155 7 year 39 year 14.29% 1.28% 24.49% 2.56% 17.49% 2.56% 12.49% 2.56% 8.93% 2.56% 8.92% 2.56% 8.93% 2.56% 4.46% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.56% 2.569 $ 292,843 $ 292,843 2.569 2.56 Net Cash Flow - 80,000 -6,100 - 50,000 My - 00- 23,700 1, 700 0 , 0 10,000 -70,000 -16, - 16,7875 G - 17 Tax 76.00 - G 7,5 Rate =217. lett - w hen von W 75,61.21 15,171 7,50 1 16,067 7,440.21 14.482 7,736.21 16,744 11.113.21 16,791 802.11b,90 81,641.21 17,195 83,29* *.21 17,473 = 6 puble Care Jerex ex de LEMM 70,65001 od 16.00 h 1 2572 1626945 160, Der Sco 57474,016,047 10000 1 0 ,000 15000 3,7347 160 TO 15.00 pass bus pri 160.000d 5.000 won 17, 1957 160.000 790005,000 , 17.47301,521 160.000 10,00 5,000 15,19,473 .527 353 160,000 ,000 ,000 17,00 kr 0.35 160,000 ,00 5.000 208 -25373 10.11 160,000 ,000,000 13,20 17,47 lbstha 160,00 700005,000 23,101,47 m 16 cod 70,000,00 85,209 17,4776452 169,000 70,00 5 one 2001741767.5237 1520817,4736763357 10.2 169.000 70,000 100.000 83450 Dips Investrent x % Depreciation Profit & tax Rate Tax 160,000 - yel Depreciation Profit I. (10,000+5000 -1741) 10000 - (10,000+ 0. 1752 10.00-( 10,00 500 M 3124 14.00 - 1 2 .3m +13) - (760 1742 3116+3 149.00-10.04 +60 *24372 10.00 - +500 + 17111 160.000 - 10,000+S +1795 73,671