Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I know this is a lot of work but I really need help I will give very good feedback/ good rating to whom ever does

I know this is a lot of work but I really need help I will give very good feedback/ good rating to whom ever does it.

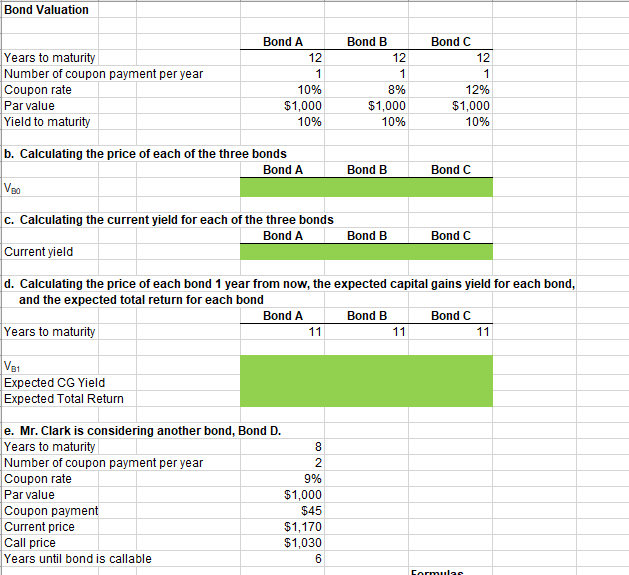

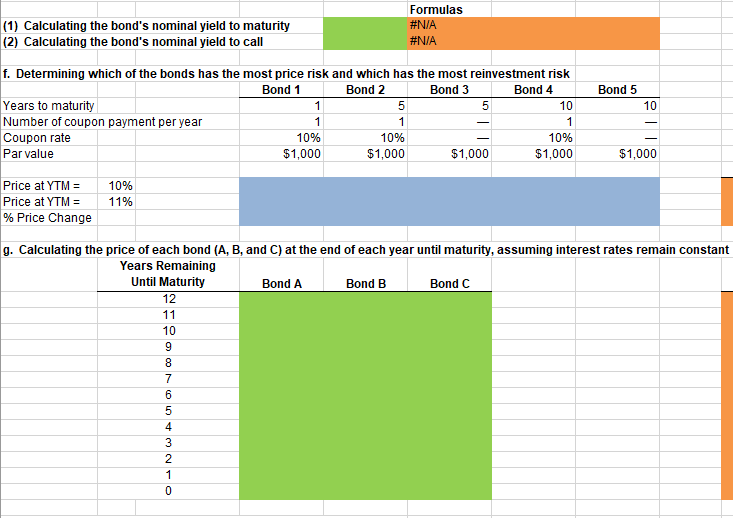

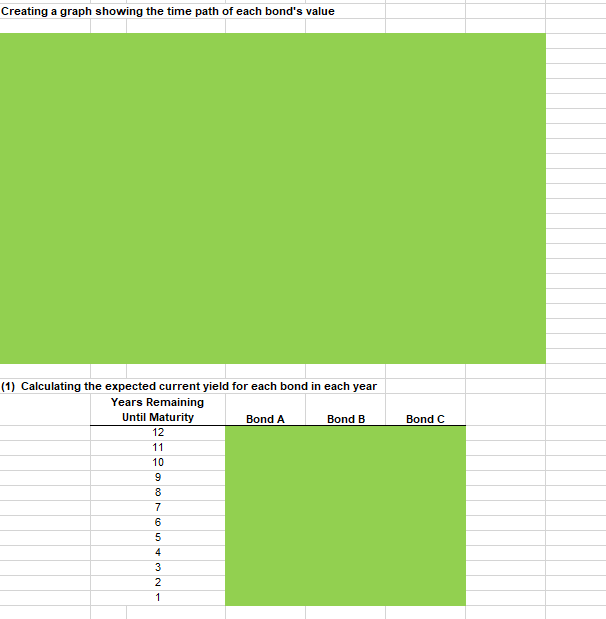

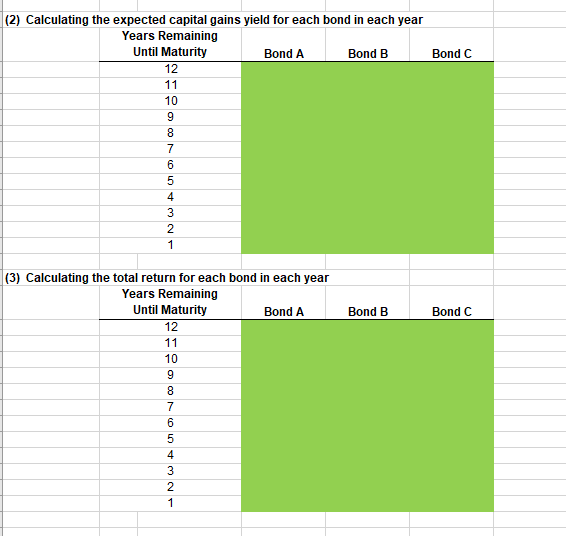

Bond Valuation Years to maturity Number of coupon payment per year Coupon rate Par value Yield to maturity Bond A 12 1 10% $1,000 10% Bond B 12 1 8% $1,000 10% Bond C 12 1 12% $1,000 10% b. Calculating the price of each of the three bonds Bond A VB0 Bond B Bond C c. Calculating the current yield for each of the three bonds Bond A Current yield Bond B Bond C d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, and the expected total return for each bond Bond A Bond B Bond C Years to maturity 11 11 11 V81 Expected CG Yield Expected Total Return Noo e. Mr. Clark is considering another bond, Bond D. Years to maturity 8 Number of coupon payment per year 2 Coupon rate 9% Par value $1,000 Coupon payment $45 Current price $1,170 Call price $1,030 Years until bond is callable 6 Gormular (1) Calculating the bond's nominal yield to maturity (2) Calculating the bond's nominal yield to call Formulas #N/A #N/A Bond 5 10 f. Determining which of the bonds has the most price risk and which has the most reinvestment risk Bond 1 Bond 2 Bond 3 Bond 4 Years to maturity 1 5 5 10 Number of coupon payment per year 1 1 1 Coupon rate 10% 10% 10% Par value $1,000 $1,000 $1,000 $1,000 $1,000 10% Price at YTM = Price at YTM = % Price Change 11% g. Calculating the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant Years Remaining Until Maturity Bond A Bond B Bond C 12 11 10 9 8 7 6 5 4 3 2 O NW 0 Creating a graph showing the time path of each bond's value (1) Calculating the expected current yield for each bond in each year Years Remaining Until Maturity Bond A Bond B 12 Bond C 11 10 9 8 7 6 5 4 3 2 1 Bond C (2) Calculating the expected capital gains yield for each bond in each year Years Remaining Until Maturity Bond A Bond B 12 11 10 9 8 7 CONGO + 5 4 3 2 Bond B Bond C (3) Calculating the total return for each bond in each year Years Remaining Until Maturity Bond A 12 11 10 9 8 7 6 5 4 3 2 1 NWAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started