Question

I know this is considered more than one question, but I don't know how to break it up and ask individual questions. Please help. Garca

I know this is considered more than one question, but I don't know how to break it up and ask individual questions. Please help.

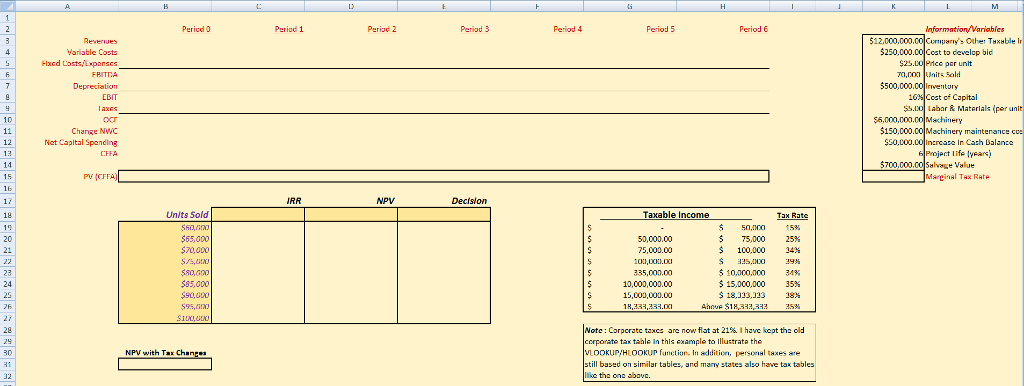

Garca and Martinez manufacture widgets and currently have $12 million in taxable income. The company recently spent $250,000 to put together a bid for a government contract, and this morning they were notified that they won the contract. The contract requires the firm to provide 70,000 widgets a year for 6 years, and the government will pay $25 for each widget. To satisfy the new contract, Garca and Martinez estimate they will need an additional $6,000,000 worth of machinery. The machinery costs $150,000 a year to operate and maintain. Garca and Martinez plan to depreciate the machinery over the 6 years to the expected salvage value of $700,000. The company will immediately need to invest $500,000 in inventory, an amount that will be maintained over the six years. Similarly, the company must hold an additional $50,000 in cash over the projects life. Both investments will be recovered when the project is completed. The marginal cost of producing a widget is $5.00 and the cost of capital is 16%. Calculate the projects NPV by linking to the information Ive provided in the Excel worksheet. 1. Calculate the net capital spending for each period in Row 12. (5 points) 2. Calculate the change in net working capital for each period in Row 11. (5 points) 3. Calculate the operating cash flow for each period in Row 10. a. Use the DDB function in Row 7 to calculate the accelerated (double-declining) depreciation for each year. Use an absolute cell reference (i.e. $C$2) so that if copying the cell in Column C into Column H returns the correct answer for depreciation. Note: by placing a $ in front of C, when you copy the cell, the formula will always point at Column C. Placing a $ in front of the 2 means the formula will always point at Row 2. (5 points) b. Use the VLOOKUP function on the provided tax table to calculate the marginal tax rate in cell K15. Use that marginal tax rate to calculate taxes in each year in Row 9. (5 points) 4. Calculate the cash flow from assets in Row 13 and then evaluate the project. a. Use the PV function to calculate the present value of CFFA for each year in Row 15. In the PV function, you should use a relative reference (no dollar signs) for the year provided in Row 2, but reference the cost of capital in cell F28 with an absolute reference (so that copying and pasting cell C15 into cell H15 will return the correct answer in both cells). (5 points) b. Use the NPV function in D18 to calculate the net present value of the project. (5 points) c. Use the IRR function in C18 to calculate the internal rate of return on the project. (5 points) d. In cell E18, use an IF function to return the words Accept the Project if the NPV is positive and Reject the Project if the NPV is negative. (5 points) 5. Construct a scenario analysis for units sold (quantities are listed in Column B starting in Row 19) by constructing a data table using Excels What-If Analysis located in the data tab. a. The table should include the IRR, NPV, and Decision for each quantity; i.e. for each quantity Excel will calculate these three items in the table which will extend from C19 to E27. (5 points) b. Use a conditional format (found in the Home tab) to highlight the NPV in red if the NPV is negative, and green if it is positive. Use a conditional format to highlight the IRR in red if the IRR is greater than the cost of capital, and in green if it is less than the cost of capital. (5 points)

Pericd 0 Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 512,000,000.00Comparry's Other Taxeble I variable Costs 250,000.00Ccst to develop bicd Flxed Costs Lpanscs Pice per unit 70,000nits Sold 5500,000.0OInvetoy Ccat of Capital Labar & Materials pr unit $6,000,000.00 Machinery Change NWC Net Capltal Spending 150,000.00 Machinery maintenance co $50.c00.coInrcaze In Cath Balante Project life lypans) 5700,000.00 Salvase Value Py (CFFA) Marginal TAx RAte Decislon Units Sold Taxable Income Tax Rate $65,000 $70,000 $50,n00 15% $ 75,000 25% $ 100,000 34 $10,000,000 $15,000,000 s 18,323,333 34% 35% 18 $85,000 : Corpcratc taxes are now,flat at 21%, I have kept thc old ccrporate tax tahle in this example to illustrate the NPV with Tax Chan ookuPHLOOKUP function. In addition, personel taxes are till based on similar tables,and many states also have tax llke the one abav Pericd 0 Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 512,000,000.00Comparry's Other Taxeble I variable Costs 250,000.00Ccst to develop bicd Flxed Costs Lpanscs Pice per unit 70,000nits Sold 5500,000.0OInvetoy Ccat of Capital Labar & Materials pr unit $6,000,000.00 Machinery Change NWC Net Capltal Spending 150,000.00 Machinery maintenance co $50.c00.coInrcaze In Cath Balante Project life lypans) 5700,000.00 Salvase Value Py (CFFA) Marginal TAx RAte Decislon Units Sold Taxable Income Tax Rate $65,000 $70,000 $50,n00 15% $ 75,000 25% $ 100,000 34 $10,000,000 $15,000,000 s 18,323,333 34% 35% 18 $85,000 : Corpcratc taxes are now,flat at 21%, I have kept thc old ccrporate tax tahle in this example to illustrate the NPV with Tax Chan ookuPHLOOKUP function. In addition, personel taxes are till based on similar tables,and many states also have tax llke the one abavStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started