Question

I. Leases On January 1, 2020, Cage Company contracts to lease equipment for 5 years, agreeing to make a payment of $120,987 at the beginning

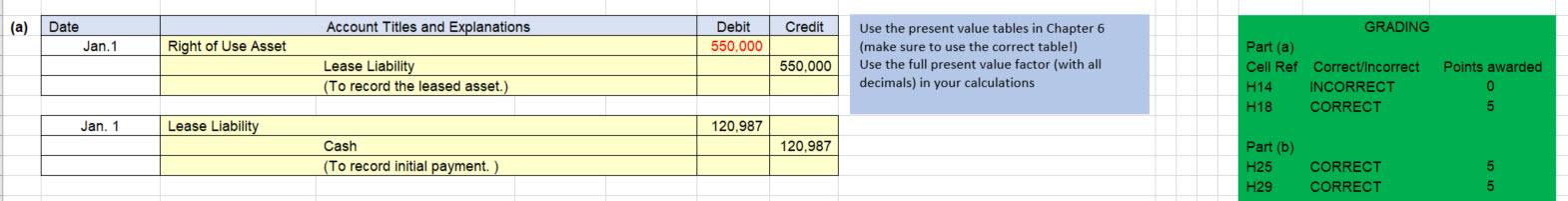

I. Leases On January 1, 2020, Cage Company contracts to lease equipment for 5 years, agreeing to make a payment of $120,987 at the beginning of each year, starting January 1, 2020. The leased equipment is to be capitalized at $550,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Cages incremental borrowing rate is 6%, and the implicit rate in the lease is 5%, which is known by Cage. Title to the equipment transfers to Cage at the end of the lease. The asset has an estimated useful life of 5 years and no residual value. Instructions: (a) Prepare the journal entry or entries that Cage should record on January 1, 2020. (Show two separate entries. One for recording the leased asset and one to record the initial payment).

NOTE: Use the present value tables in Chapter 6 (make sure to use the correct table!) Use the full present value factor (with all decimals) in your calculations.

As you can see below, my answer is incorrect.

(a) Account Titles and Explanations Credit Date Jan. 1 Debit 550.000 Right of Use Asset Use the present value tables in Chapter 6 (make sure to use the correct table!) Use the full present value factor (with all decimals) in your calculations 550.000 Lease Liability (To record the leased asset.) GRADING Part (a) Cell Ref Correct/Incorrect H14 INCORRECT H18 CORRECT Points awarded 0 5 Jan. 1 Lease Liability 120.987 120.987 Part (b) Cash (To record initial payment. ) H25 H29 CORRECT CORRECT 5 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started