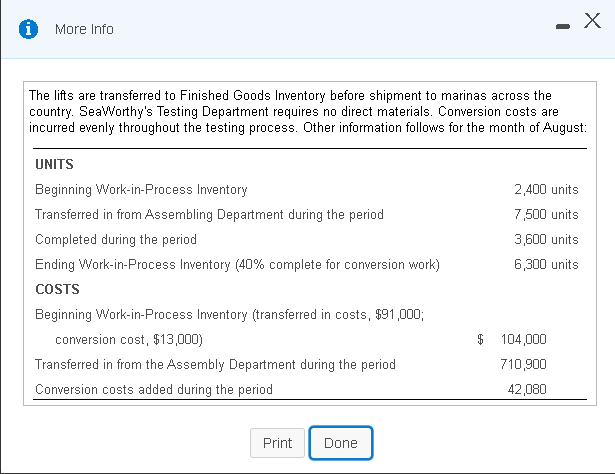

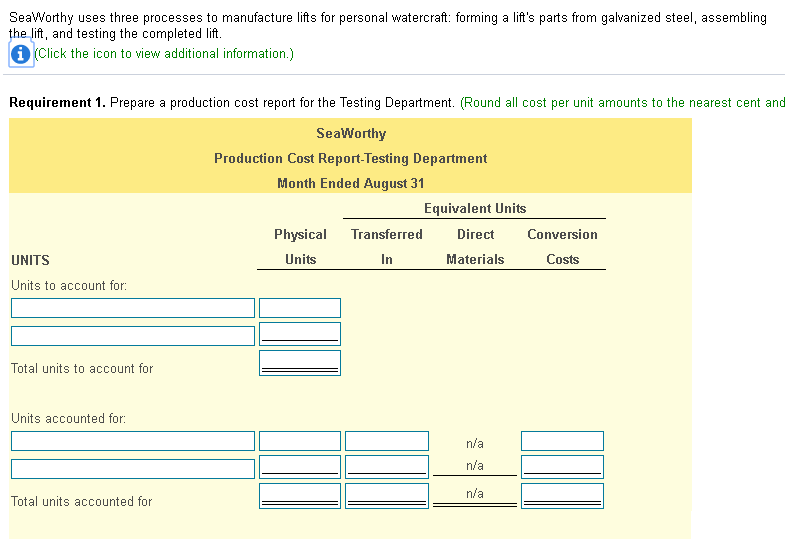

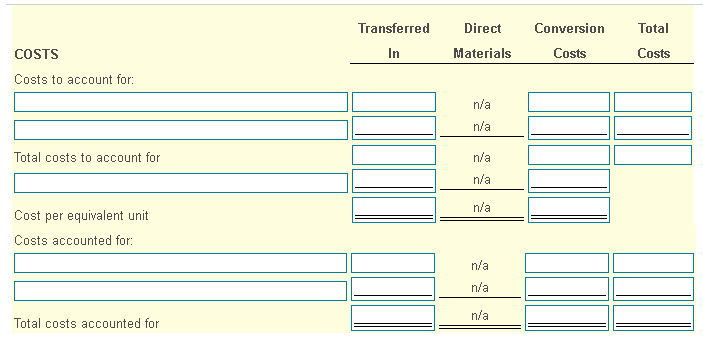

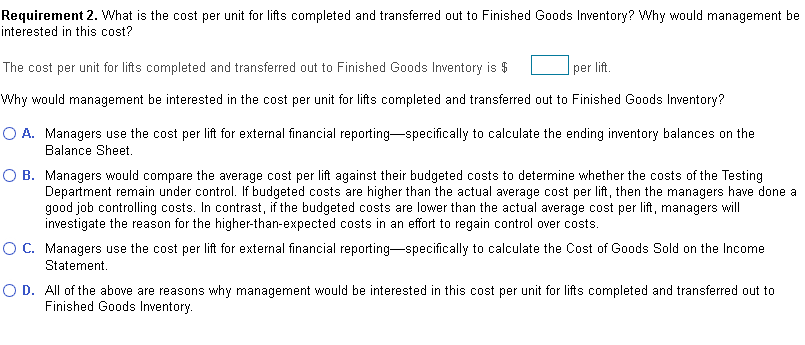

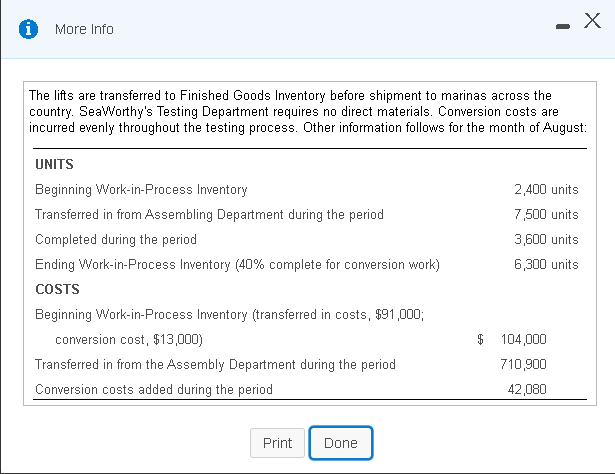

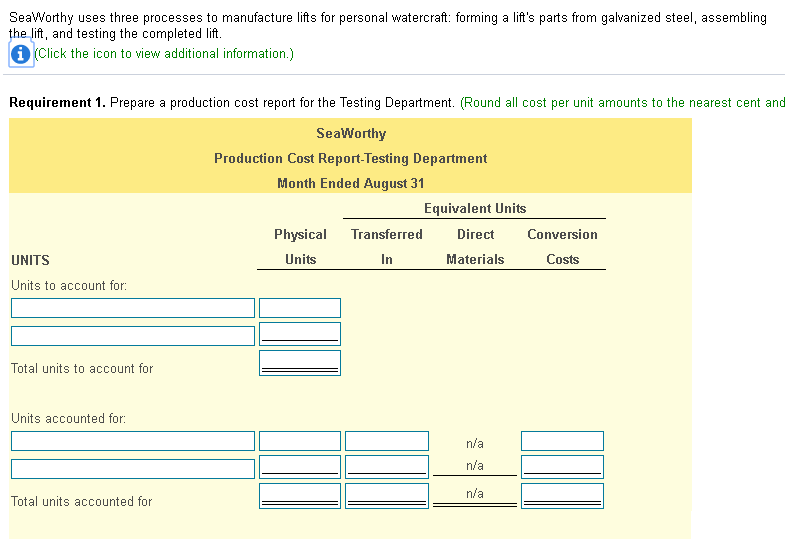

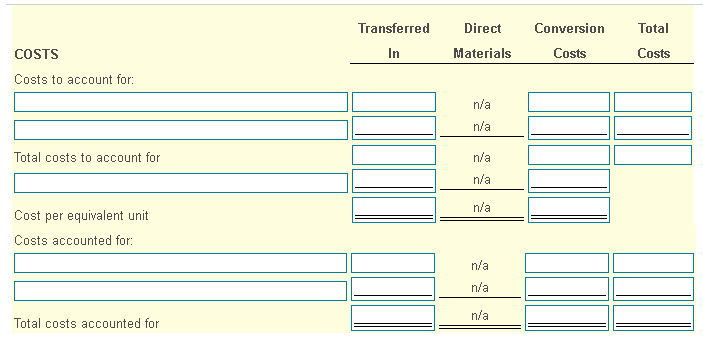

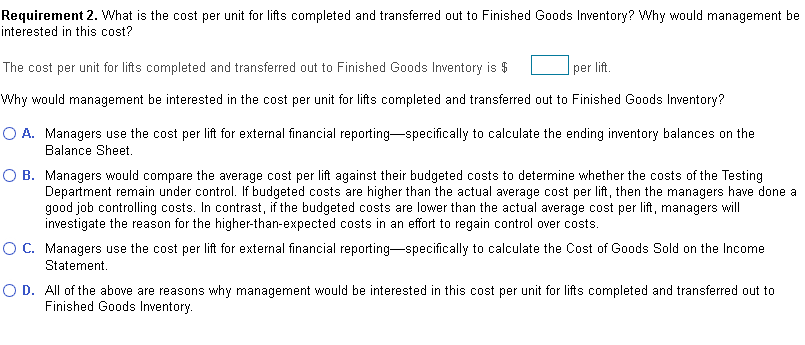

i More Info The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country. SeaWorthy's Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August: UNITS 2,400 units 7,500 units 3,600 units 6,300 units Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work-in-Process Inventory (40% complete for conversion work) COSTS Beginning Work-in-Process Inventory (transferred in costs, $91,000; conversion cost, $13,000) Transferred in from the Assembly Department during the period $ 104,000 710,900 42,080 Conversion costs added during the period Print Done SeaWorthy uses three processes to manufacture lifts for personal watercraft: forming a lift's parts from galvanized steel, assembling the lift, and testing the completed lift. (Click the icon to view additional information.) Requirement 1. Prepare a production cost report for the Testing Department. (Round all cost per unit amounts to the nearest cent and SeaWorthy Production Cost Report-Testing Department Month Ended August 31 Equivalent Units Physical Transferred Direct Conversion Units In Materials Costs UNITS Units to account for: Total units to account for Units accounted for: Total units accounted for Transferred In Direct Materials Conversion Costs Total Costs COSTS Costs to account for: Total costs to account for Cost per equivalent unit Costs accounted for: Total costs accounted for Requirement 2. What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost? The cost per unit for lifts completed and transferred out to Finished Goods Inventory is $ per lift. Why would management be interested in the cost per unit for lifts completed and transferred out to Finished Goods Inventory? O A. Managers use the cost per lift for external financial reportingspecifically to calculate the ending inventory balances on the Balance Sheet. OB. Managers would compare the average cost per lift against their budgeted costs to determine whether the costs of the Testing Department remain under control. If budgeted costs are higher than the actual average cost per lift, then the managers have done a good job controlling costs. In contrast, if the budgeted costs are lower than the actual average cost per lift, managers will investigate the reason for the higher-than-expected costs in an effort to regain control over costs. OC. Managers use the cost per lift for external financial reportingspecifically to calculate the Cost of Goods Sold on the Income Statement OD. All of the above are reasons why management would be interested in this cost per unit for lifts completed and transferred out to Finished Goods Inventory