Answered step by step

Verified Expert Solution

Question

1 Approved Answer

== i. Ms. Afiya has the opportunity to invest RM20,000 in a project that will generate cash inflows of RM5,000 at the end of

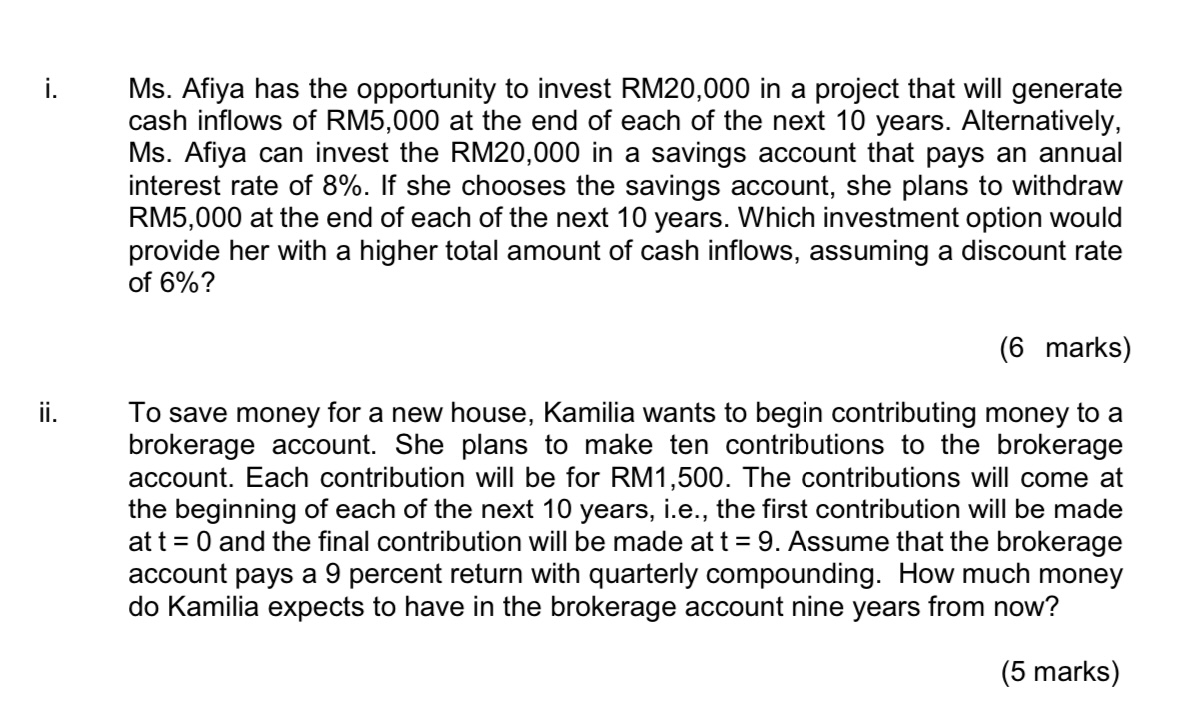

== i. Ms. Afiya has the opportunity to invest RM20,000 in a project that will generate cash inflows of RM5,000 at the end of each of the next 10 years. Alternatively, Ms. Afiya can invest the RM20,000 in a savings account that pays an annual interest rate of 8%. If she chooses the savings account, she plans to withdraw RM5,000 at the end of each of the next 10 years. Which investment option would provide her with a higher total amount of cash inflows, assuming a discount rate of 6%? (6 marks) To save money for a new house, Kamilia wants to begin contributing money to a brokerage account. She plans to make ten contributions to the brokerage account. Each contribution will be for RM1,500. The contributions will come at the beginning of each of the next 10 years, i.e., the first contribution will be made at t=0 and the final contribution will be made at t = 9. Assume that the brokerage account pays a 9 percent return with quarterly compounding. How much money do Kamilia expects to have in the brokerage account nine years from now? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To compare the two investment options we need to calculate the present value of cash inflows for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started