I must create choose a merchandising or manufacturing company and make a powerpoint presentation of their annual report for the most recent 2 years reported. The company I chose was Netflix, since it is so popular in current times. The info is provided below. I need help!

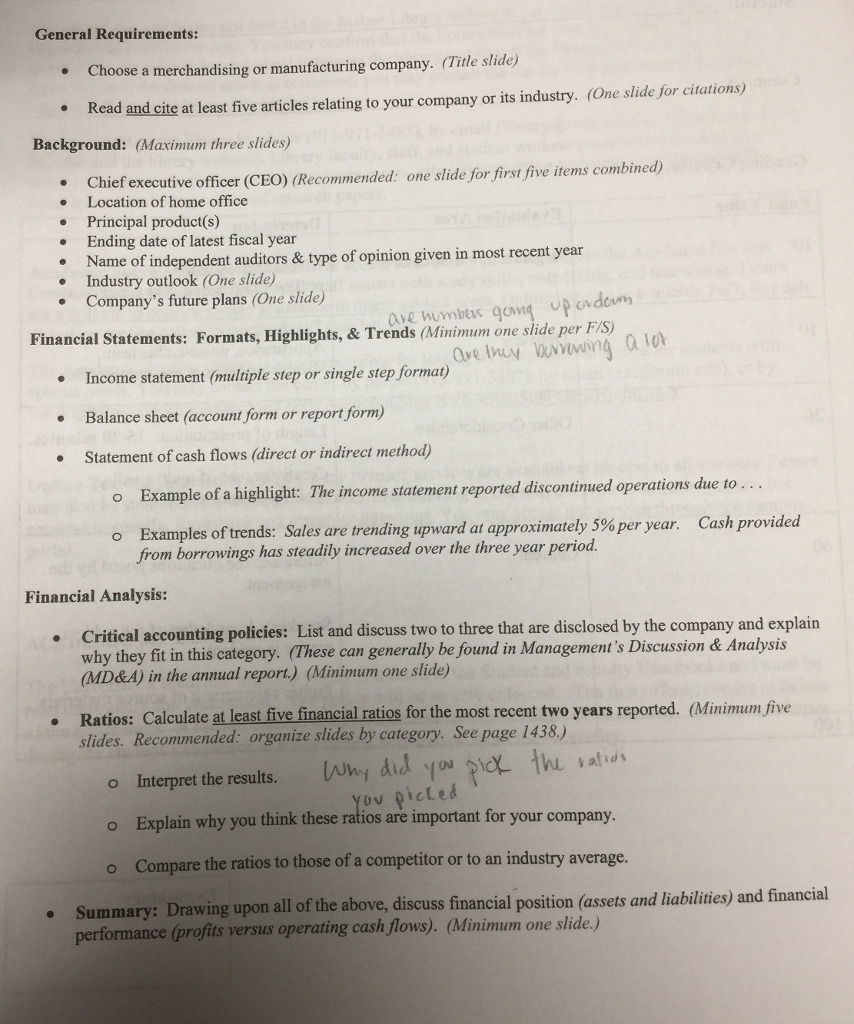

General Requirements: hoose a merchandising or manufacturing company. (Title slide) Read and cite at least five articles relating to your company or its industry. (One slide for citations) Background Maximum three slide Chief executive officer (CEo) (Recommended. one side for first five items combined) Location of home office Principal product(s) Ending date of latest fiscal year recent year Name of independent auditors & type of opinion given in most Industry outlook (One slide) Company's future plans (One side) Financial Statements: Formats, Highlights, & Trends (Minimum one slide per FIS) Income statement (multiple step or single step format Balance sheet account form or report form Statement of cash flows (direct or indirect method) o Example of a highlight: The income statement reported discontinued operations due to o Examples of trends: Sales are trending upward at approximately 5% per year. Cash provided from borrowings has steadily increased over the three year period Financial Analysis: Critical accounting policies: List and discuss two to three that are disclosed by the company and explain why they fit in this category. ese can generally be found in Management's Discussion & Analysis (h (MD&A) in the annual report) (Minimum one slide) Ratios: Calculate at least five financial ratios for the most recent two years reported. (Minimum five organize slides by category. See page l438.) thu valid o Interpret the results. Why di o Explain why you think these ratios are important for your company Compare the ratios to those of a competitor or to an industry average. Summary: Drawing upon all of the above, discuss financial position (assets and liabilities and financial performance profits versus operating cash flows). (Mi nimum one slide.) General Requirements: hoose a merchandising or manufacturing company. (Title slide) Read and cite at least five articles relating to your company or its industry. (One slide for citations) Background Maximum three slide Chief executive officer (CEo) (Recommended. one side for first five items combined) Location of home office Principal product(s) Ending date of latest fiscal year recent year Name of independent auditors & type of opinion given in most Industry outlook (One slide) Company's future plans (One side) Financial Statements: Formats, Highlights, & Trends (Minimum one slide per FIS) Income statement (multiple step or single step format Balance sheet account form or report form Statement of cash flows (direct or indirect method) o Example of a highlight: The income statement reported discontinued operations due to o Examples of trends: Sales are trending upward at approximately 5% per year. Cash provided from borrowings has steadily increased over the three year period Financial Analysis: Critical accounting policies: List and discuss two to three that are disclosed by the company and explain why they fit in this category. ese can generally be found in Management's Discussion & Analysis (h (MD&A) in the annual report) (Minimum one slide) Ratios: Calculate at least five financial ratios for the most recent two years reported. (Minimum five organize slides by category. See page l438.) thu valid o Interpret the results. Why di o Explain why you think these ratios are important for your company Compare the ratios to those of a competitor or to an industry average. Summary: Drawing upon all of the above, discuss financial position (assets and liabilities and financial performance profits versus operating cash flows). (Mi nimum one slide.)