Answered step by step

Verified Expert Solution

Question

1 Approved Answer

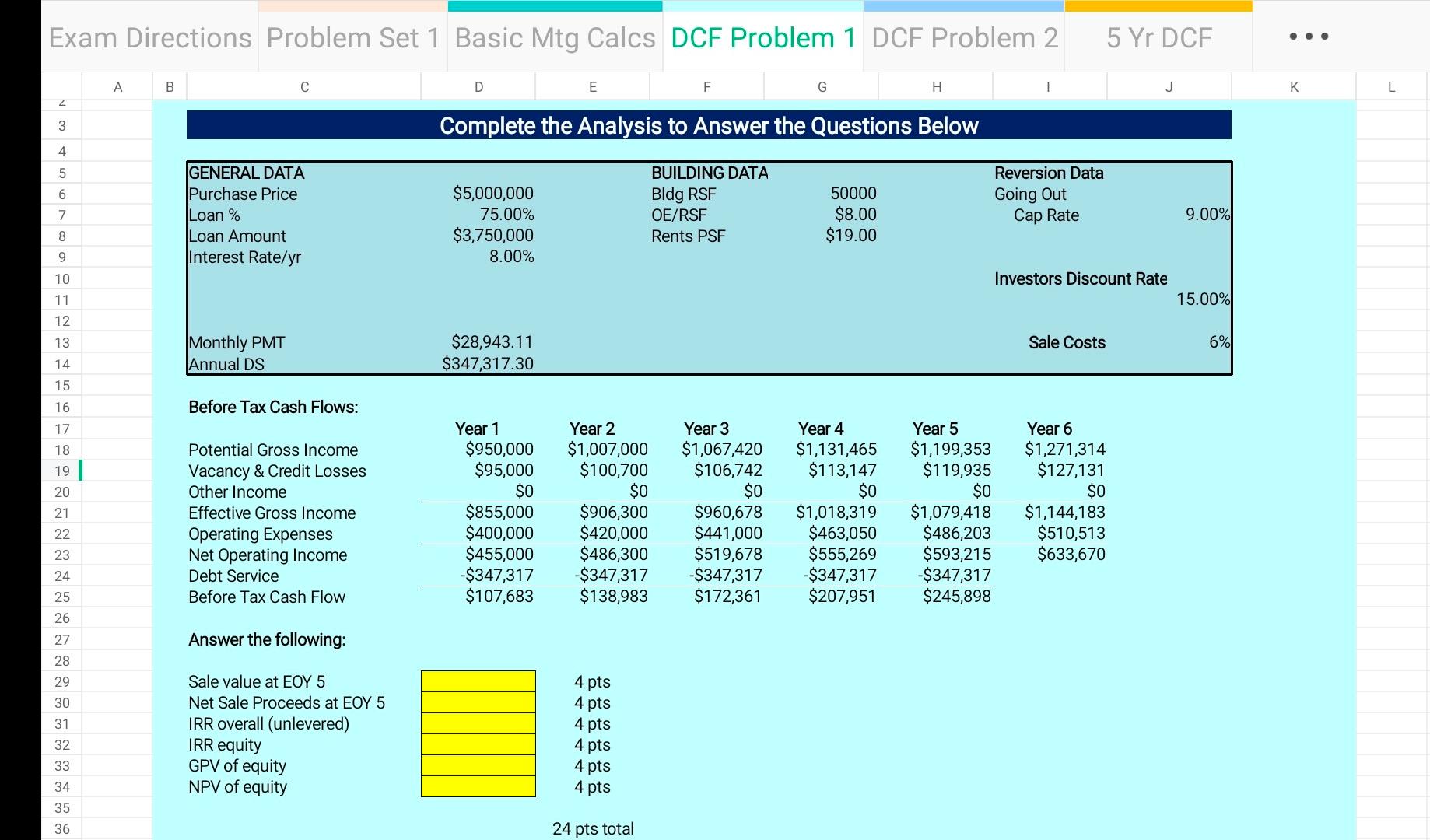

I need 100% correct answer will be upvote Exam Directions Problem Set 1 Basic Mtg Calcs DCF Problem 1 DCF Problem 25 Yr DCF begin{tabular}{|l|l|}

I need 100% correct answer will be upvote

Exam Directions Problem Set 1 Basic Mtg Calcs DCF Problem 1 DCF Problem 25 Yr DCF \\begin{tabular}{|l|l|} \\hline & A \\\\ \\hline 3 & \\\\ \\hline 4 & \\\\ \\hline 5 & \\\\ \\hline 6 & \\\\ \\hline 7 & \\\\ \\hline 8 & \\\\ \\hline 9 & \\\\ \\hline 10 \\\\ \\hline 11 & \\\\ \\hline 12 & \\\\ \\hline 13 & \\\\ \\hline 14 & \\\\ \\hline 15 & \\\\ \\hline 16 \\\\ \\hline 17 & \\\\ \\hline 18 \\\\ \\hline 19 & \\\\ \\hline 20 & \\\\ \\hline 21 & \\\\ \\hline 22 & \\\\ \\hline 23 & \\\\ \\hline 24 & \\\\ \\hline 25 & \\\\ \\hline 26 & \\\\ \\hline 27 & \\\\ \\hline 28 & \\\\ \\hline 29 & \\\\ \\hline 30 & \\\\ \\hline 31 & \\\\ \\hline 32 & \\\\ \\hline 33 & \\\\ \\hline 34 & \\\\ \\hline 35 & \\\\ \\hline 36 & \\\\ \\hline \\end{tabular} C D E F G \\( \\mathrm{H} \\) J K L Complete the Analysis to Answer the Questions Below Before Tax Cash Flows: Potential Gross Income Vacancy \\& Credit Losses Other Income Effective Gross Income Operating Expenses Net Operating Income Debt Service Before Tax Cash Flow Answer the following: Sale value at EOY 5 Net Sale Proceeds at EOY 5 IRR overall (unlevered) IRR equity GPV of equity NPV of equity \\begin{tabular}{rrrrrr} Year 1 & \\multicolumn{1}{c}{ Year 2 } & \\multicolumn{1}{c}{ Year 3 } & \\multicolumn{1}{c}{ Year 4} & \\multicolumn{1}{c}{ Year 5} & Year 6 \\\\ \\( \\$ 950,000 \\) & \\( \\$ 1,007,000 \\) & \\( \\$ 1,067,420 \\) & \\( \\$ 1,131,465 \\) & \\( \\$ 1,199,353 \\) & \\( \\$ 1,271,314 \\) \\\\ \\( \\$ 95,000 \\) & \\( \\$ 100,700 \\) & \\( \\$ 106,742 \\) & \\( \\$ 113,147 \\) & \\( \\$ 119,935 \\) & \\( \\$ 127,131 \\) \\\\ \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) \\\\ \\hline\\( \\$ 855,000 \\) & \\( \\$ 906,300 \\) & \\( \\$ 960,678 \\) & \\( \\$ 1,018,319 \\) & \\( \\$ 1,079,418 \\) & \\( \\$ 1,144,183 \\) \\\\ \\( \\$ 400,000 \\) & \\( \\$ 420,000 \\) & \\( \\$ 441,000 \\) & \\( \\$ 463,050 \\) & \\( \\$ 486,203 \\) & \\( \\$ 510,513 \\) \\\\ \\hline\\( \\$ 455,000 \\) & \\( \\$ 486,300 \\) & \\( \\$ 519,678 \\) & \\( \\$ 555,269 \\) & \\( \\$ 593,215 \\) & \\( \\$ 633,670 \\) \\\\ \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\\\ \\hline\\( \\$ 107,683 \\) & \\( \\$ 138,983 \\) & \\( \\$ 172,361 \\) & \\( \\$ 207,951 \\) & \\( \\$ 245,898 \\) & \\end{tabular} \\begin{tabular}{|l|} \\hline \\\\ \\hline \\\\ \\hline \\\\ \\hline \\\\ \\hline \\end{tabular} 4 pts 4 pts 4 pts \\( 4 \\mathrm{pts} \\) 4 pts 4 pts 24 pts total Exam Directions Problem Set 1 Basic Mtg Calcs DCF Problem 1 DCF Problem 25 Yr DCF \\begin{tabular}{|l|l|} \\hline & A \\\\ \\hline 3 & \\\\ \\hline 4 & \\\\ \\hline 5 & \\\\ \\hline 6 & \\\\ \\hline 7 & \\\\ \\hline 8 & \\\\ \\hline 9 & \\\\ \\hline 10 \\\\ \\hline 11 & \\\\ \\hline 12 & \\\\ \\hline 13 & \\\\ \\hline 14 & \\\\ \\hline 15 & \\\\ \\hline 16 \\\\ \\hline 17 & \\\\ \\hline 18 \\\\ \\hline 19 & \\\\ \\hline 20 & \\\\ \\hline 21 & \\\\ \\hline 22 & \\\\ \\hline 23 & \\\\ \\hline 24 & \\\\ \\hline 25 & \\\\ \\hline 26 & \\\\ \\hline 27 & \\\\ \\hline 28 & \\\\ \\hline 29 & \\\\ \\hline 30 & \\\\ \\hline 31 & \\\\ \\hline 32 & \\\\ \\hline 33 & \\\\ \\hline 34 & \\\\ \\hline 35 & \\\\ \\hline 36 & \\\\ \\hline \\end{tabular} C D E F G \\( \\mathrm{H} \\) J K L Complete the Analysis to Answer the Questions Below Before Tax Cash Flows: Potential Gross Income Vacancy \\& Credit Losses Other Income Effective Gross Income Operating Expenses Net Operating Income Debt Service Before Tax Cash Flow Answer the following: Sale value at EOY 5 Net Sale Proceeds at EOY 5 IRR overall (unlevered) IRR equity GPV of equity NPV of equity \\begin{tabular}{rrrrrr} Year 1 & \\multicolumn{1}{c}{ Year 2 } & \\multicolumn{1}{c}{ Year 3 } & \\multicolumn{1}{c}{ Year 4} & \\multicolumn{1}{c}{ Year 5} & Year 6 \\\\ \\( \\$ 950,000 \\) & \\( \\$ 1,007,000 \\) & \\( \\$ 1,067,420 \\) & \\( \\$ 1,131,465 \\) & \\( \\$ 1,199,353 \\) & \\( \\$ 1,271,314 \\) \\\\ \\( \\$ 95,000 \\) & \\( \\$ 100,700 \\) & \\( \\$ 106,742 \\) & \\( \\$ 113,147 \\) & \\( \\$ 119,935 \\) & \\( \\$ 127,131 \\) \\\\ \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) \\\\ \\hline\\( \\$ 855,000 \\) & \\( \\$ 906,300 \\) & \\( \\$ 960,678 \\) & \\( \\$ 1,018,319 \\) & \\( \\$ 1,079,418 \\) & \\( \\$ 1,144,183 \\) \\\\ \\( \\$ 400,000 \\) & \\( \\$ 420,000 \\) & \\( \\$ 441,000 \\) & \\( \\$ 463,050 \\) & \\( \\$ 486,203 \\) & \\( \\$ 510,513 \\) \\\\ \\hline\\( \\$ 455,000 \\) & \\( \\$ 486,300 \\) & \\( \\$ 519,678 \\) & \\( \\$ 555,269 \\) & \\( \\$ 593,215 \\) & \\( \\$ 633,670 \\) \\\\ \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\( -\\$ 347,317 \\) & \\\\ \\hline\\( \\$ 107,683 \\) & \\( \\$ 138,983 \\) & \\( \\$ 172,361 \\) & \\( \\$ 207,951 \\) & \\( \\$ 245,898 \\) & \\end{tabular} \\begin{tabular}{|l|} \\hline \\\\ \\hline \\\\ \\hline \\\\ \\hline \\\\ \\hline \\end{tabular} 4 pts 4 pts 4 pts \\( 4 \\mathrm{pts} \\) 4 pts 4 pts 24 pts totalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started