Answered step by step

Verified Expert Solution

Question

1 Approved Answer

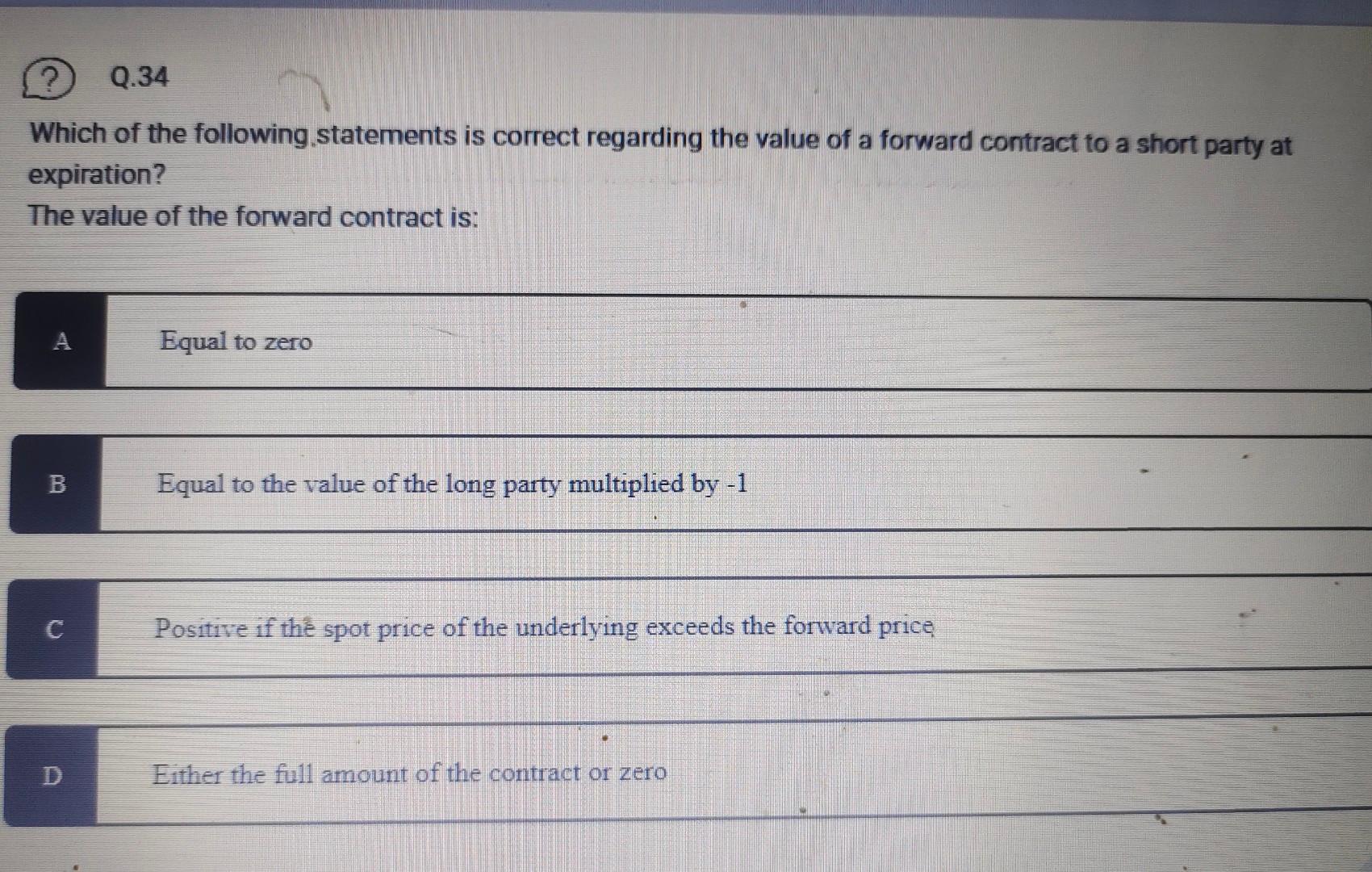

I need 100% correct answer will be upvote Which of the following statements is correct regarding the value of a forward contract to a short

I need 100% correct answer will be upvote

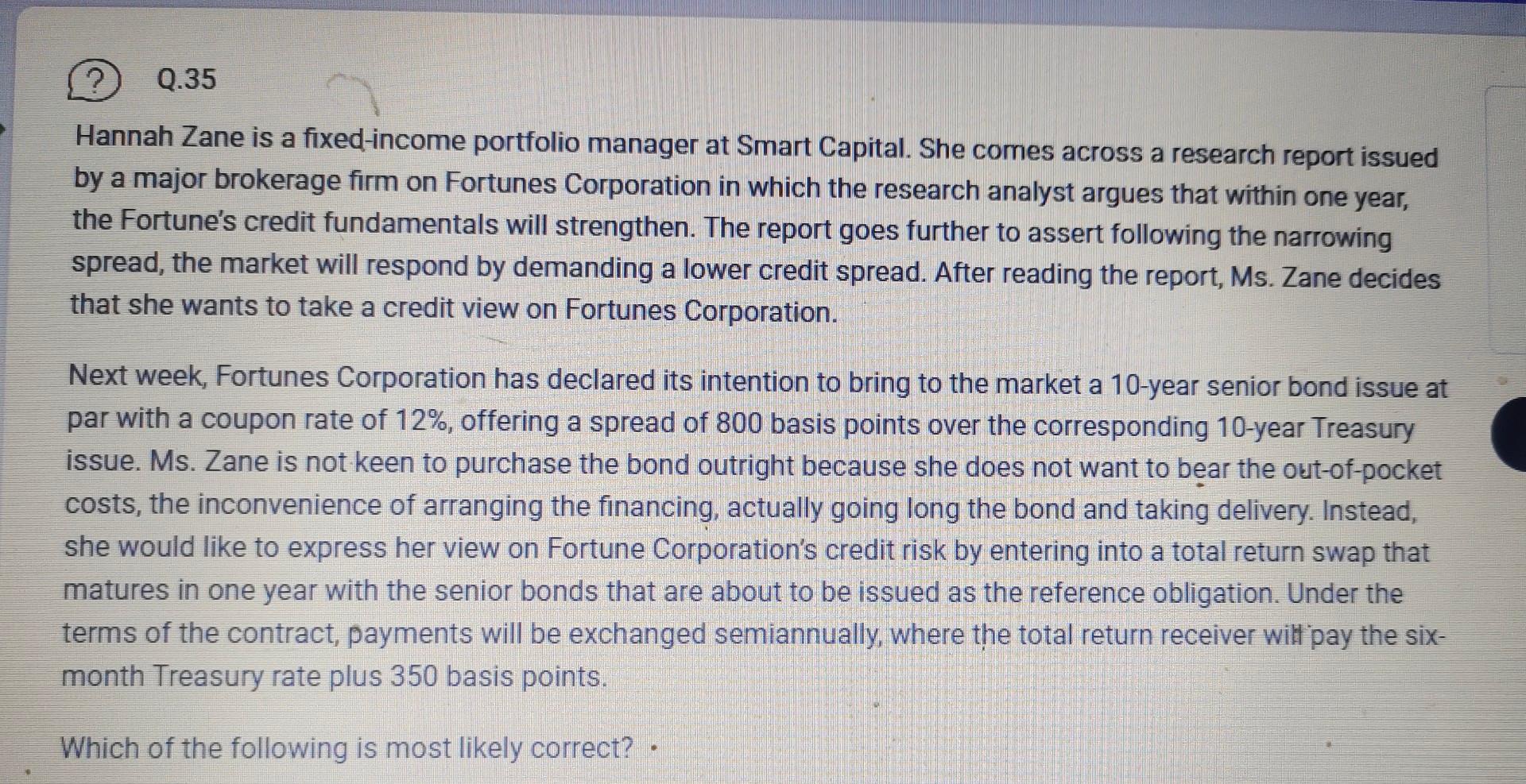

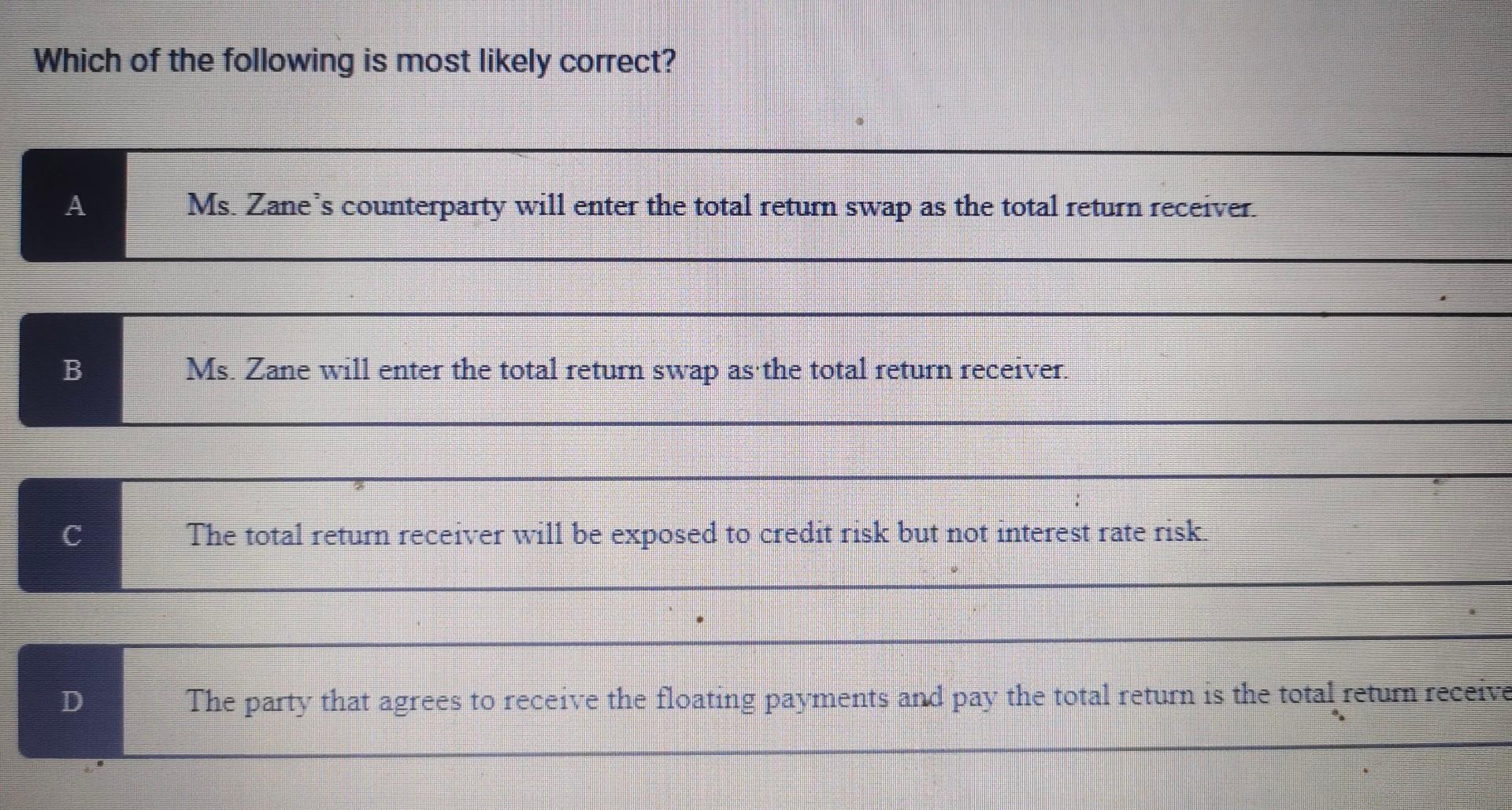

Which of the following statements is correct regarding the value of a forward contract to a short party at expiration? The value of the forward contract is: A Equal to zero B Equal to the value of the long party multiplied by -1 Hannah Zane is a fixed-income portfolio manager at Smart Capital. She comes across a research report issued by a major brokerage firm on Fortunes Corporation in which the research analyst argues that within one year, the Fortune's credit fundamentals will strengthen. The report goes further to assert following the narrowing spread, the market will respond by demanding a lower credit spread. After reading the report, Ms. Zane decides that she wants to take a credit view on Fortunes Corporation. Next week, Fortunes Corporation has declared its intention to bring to the market a 10-year senior bond issue at par with a coupon rate of 12%, offering a spread of 800 basis points over the corresponding 10 -year Treasury issue. Ms. Zane is not keen to purchase the bond outright because she does not want to bear the out-of-pocket costs, the inconvenience of arranging the financing, actually going long the bond and taking delivery. Instead, she would like to express her view on Fortune Corporation's credit risk by entering into a total return swap that matures in one year with the senior bonds that are about to be issued as the reference obligation. Under the terms of the contract, payments will be exchanged semiannually, where the total return receiver witl pay the sixmonth Treasury rate plus 350 basis points. Which of the following is most likely correct? Which of the following is most likely correct? A Ms. Zane's counterparty will enter the total return swap as the total return receiver. B Ms. Zane will enter the total return swap as the total return receiver. C The total return receiver will be exposed to credit risk but not interest rate risk. D The party that agrees to receive the floating payments and pay the total return is the total return receitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started