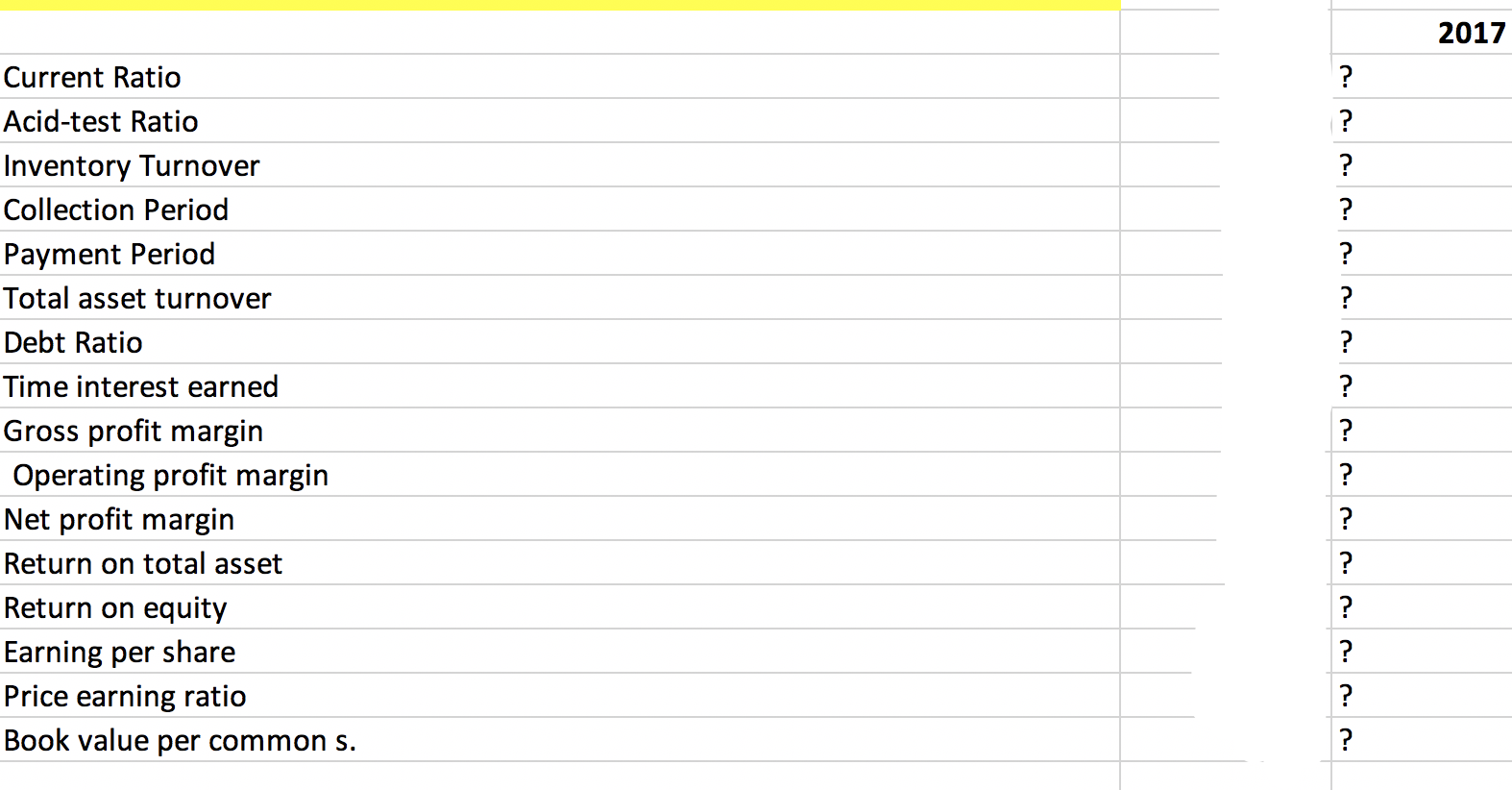

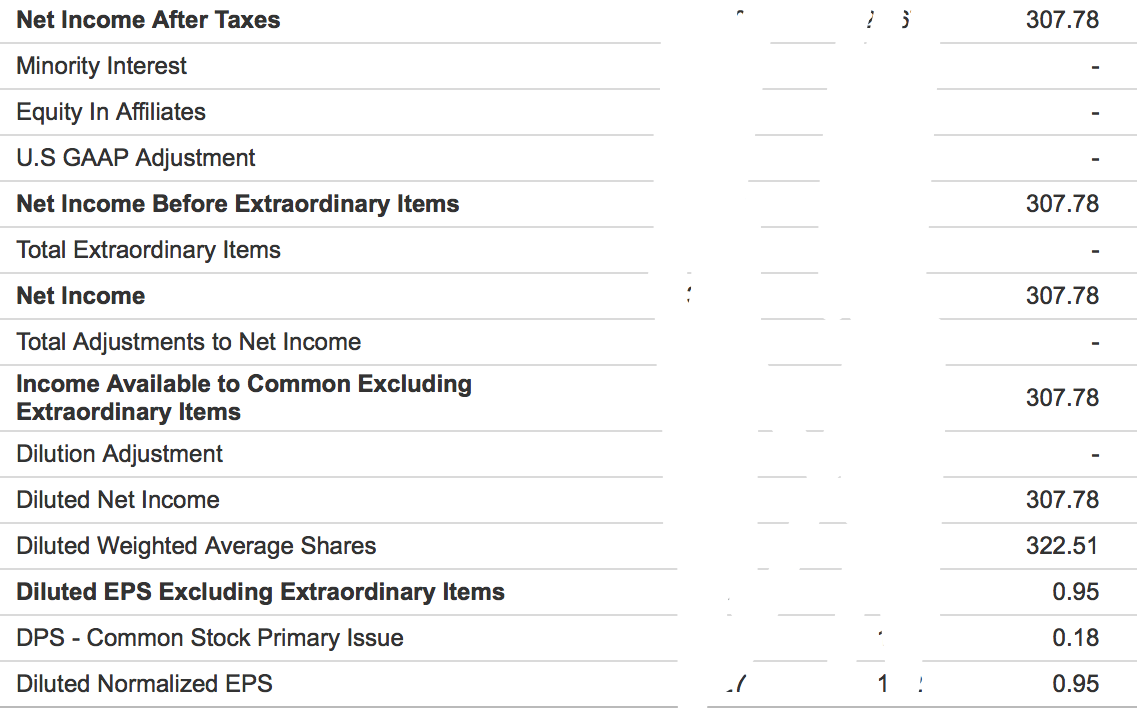

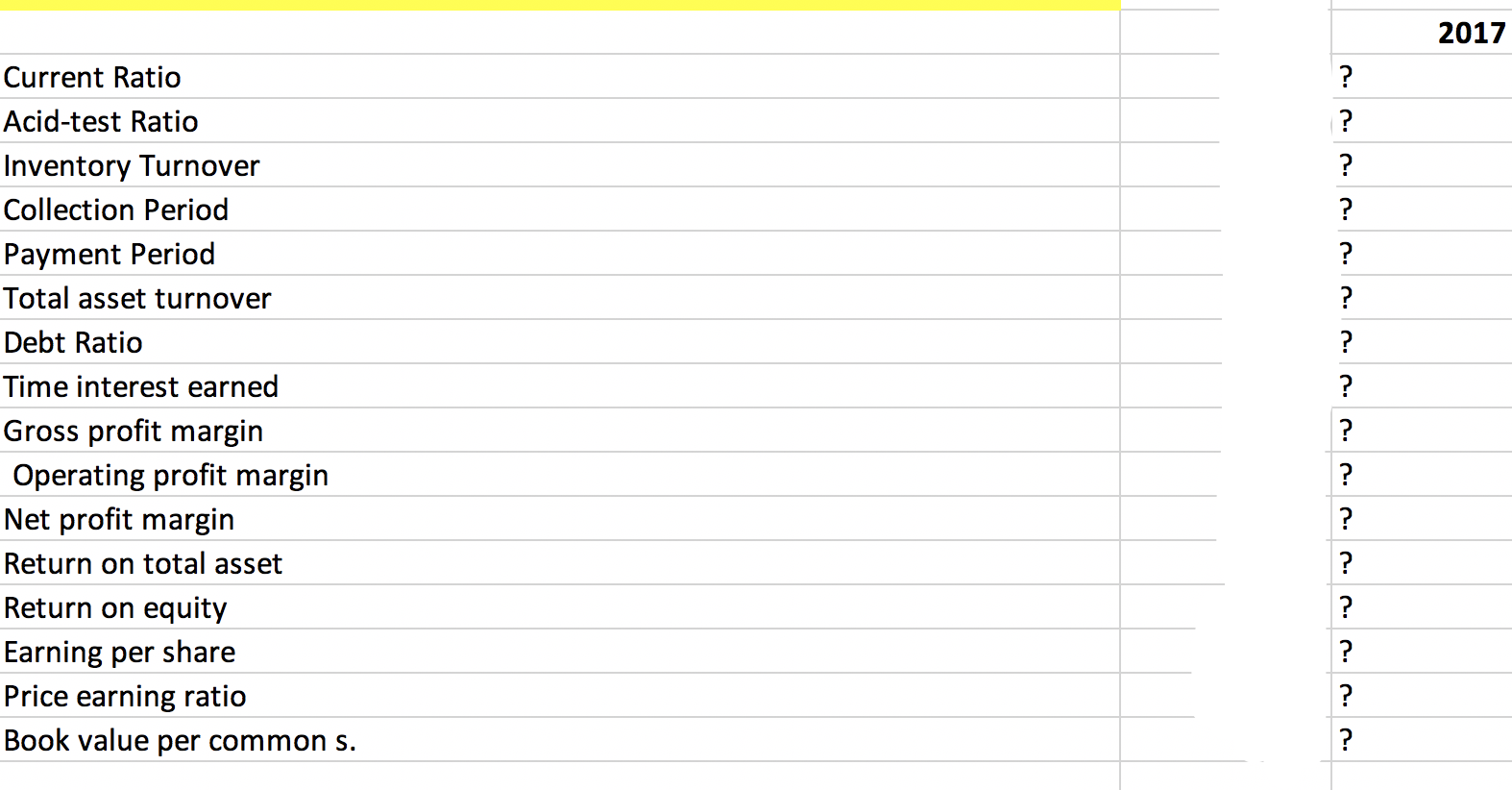

I need 2017 ratios

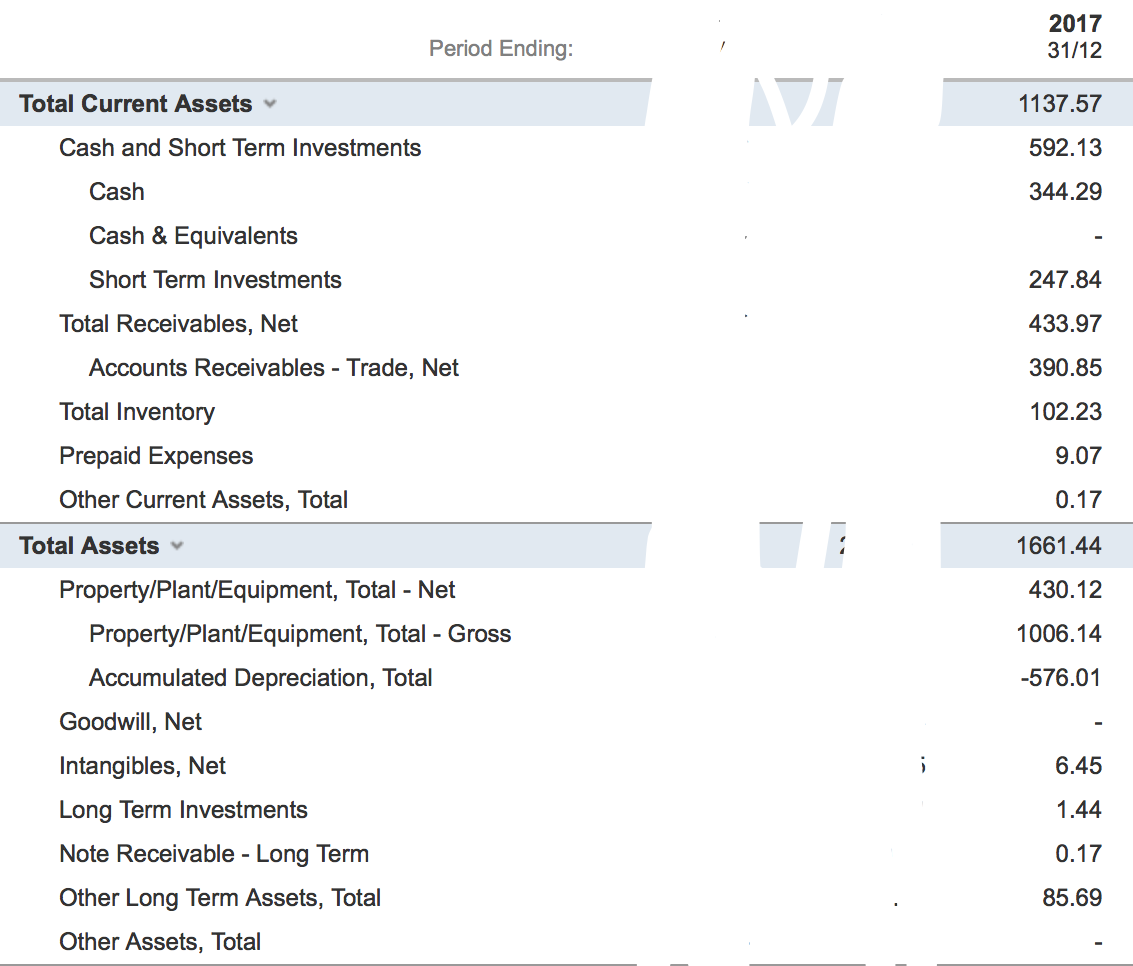

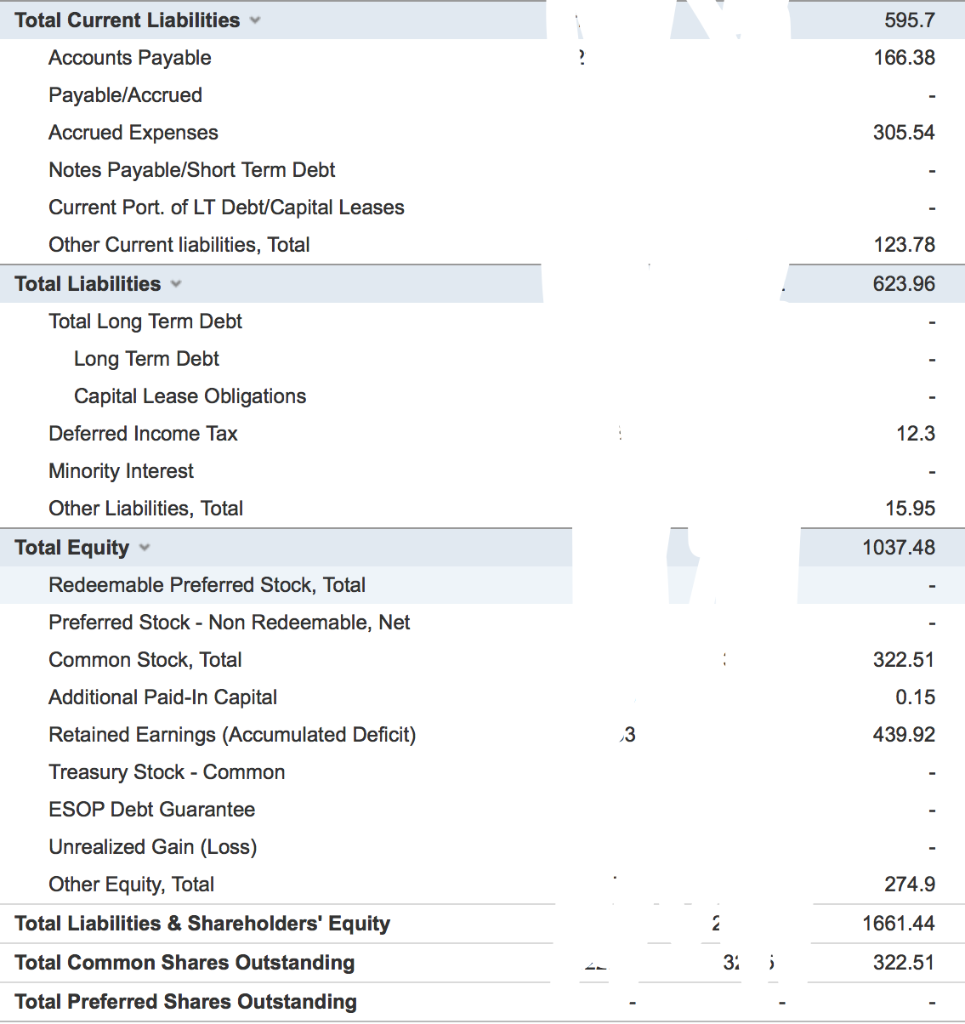

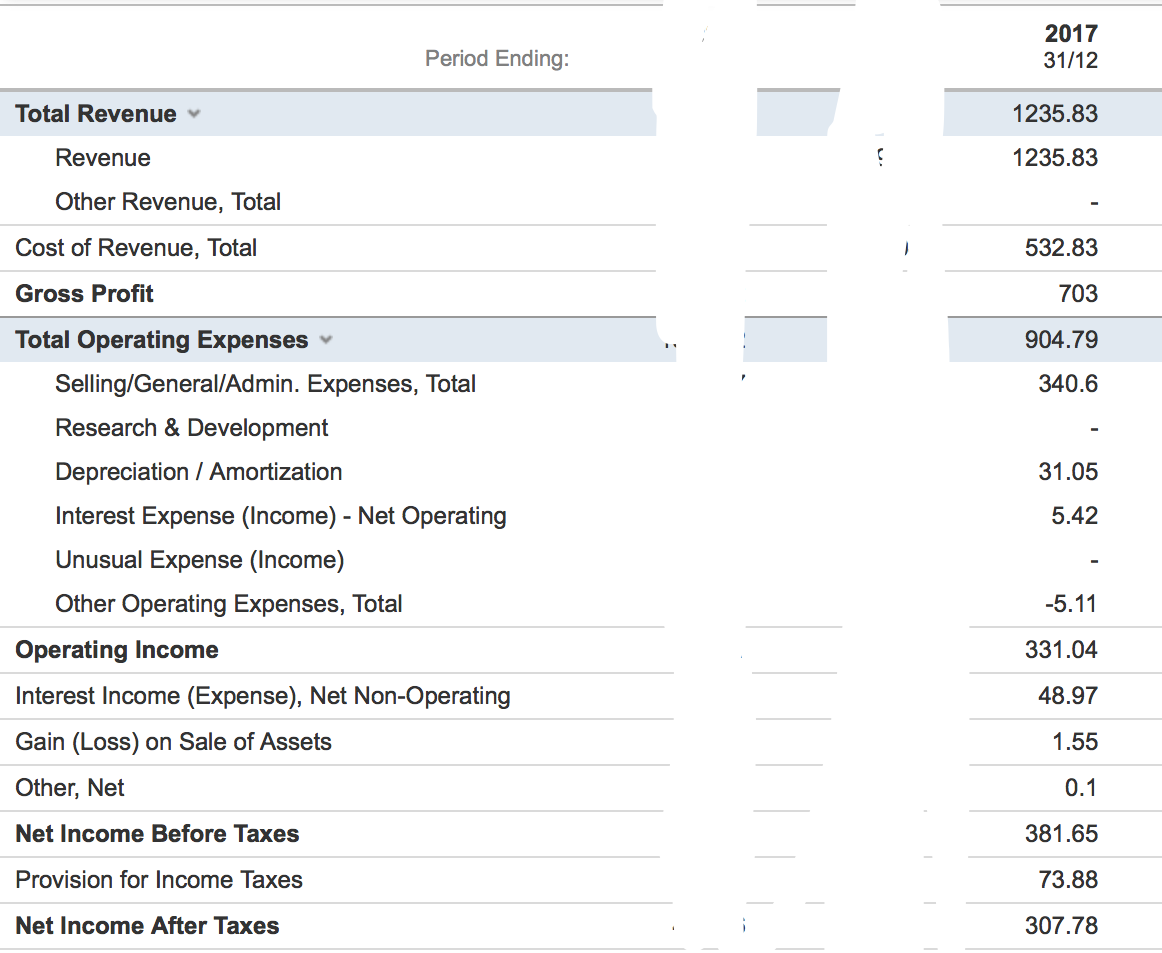

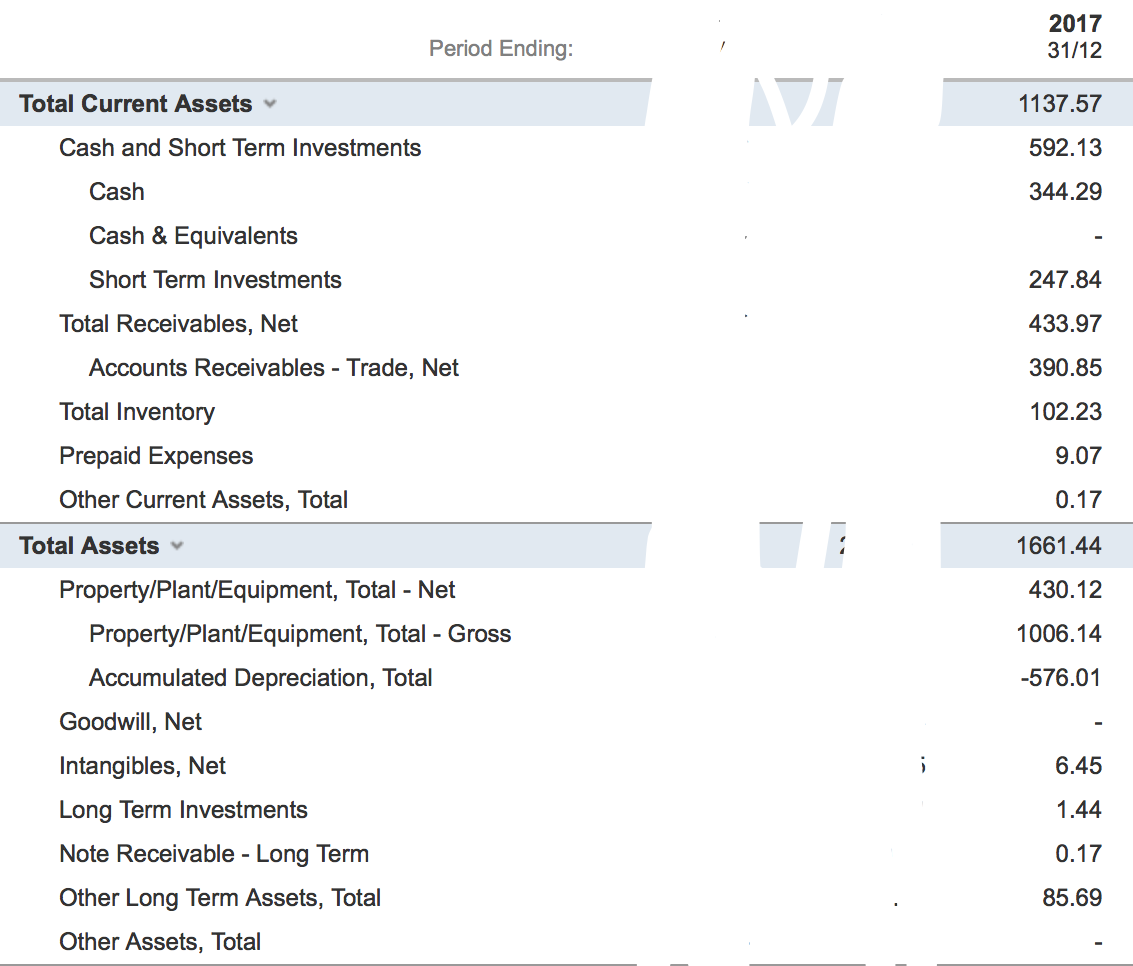

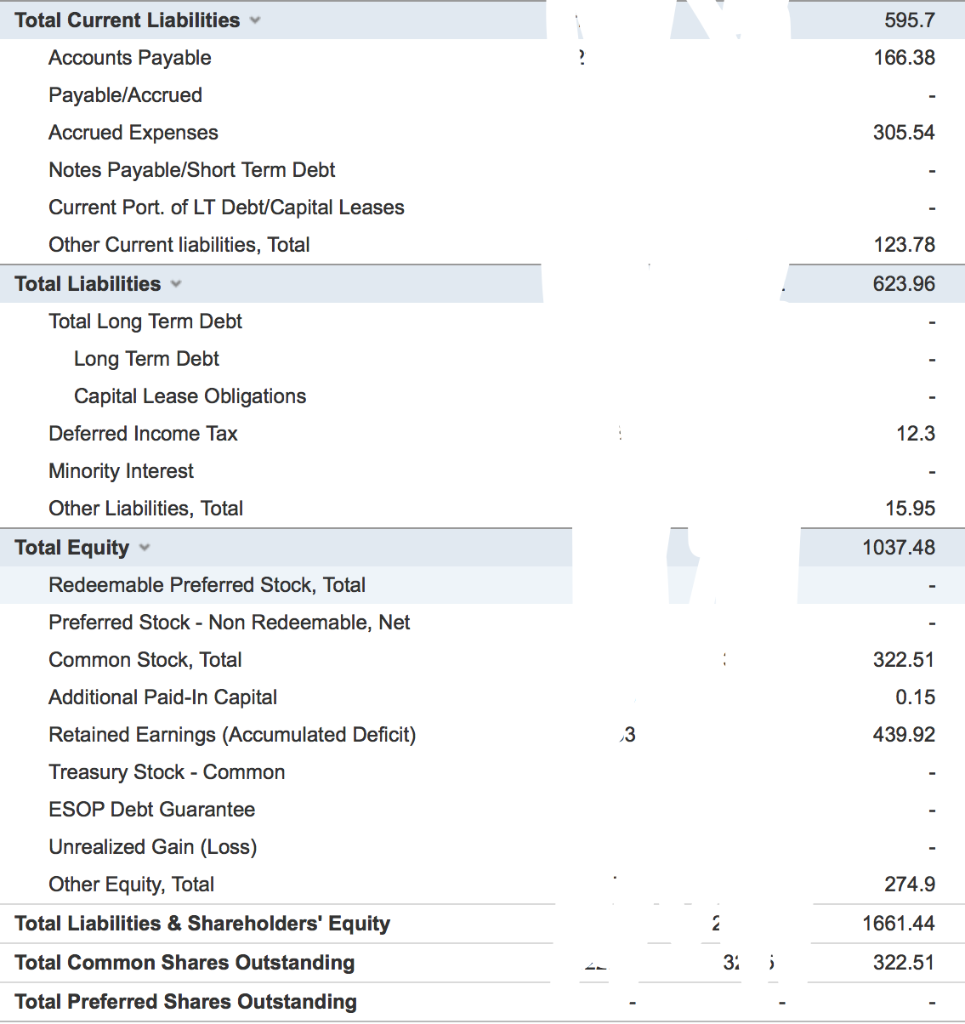

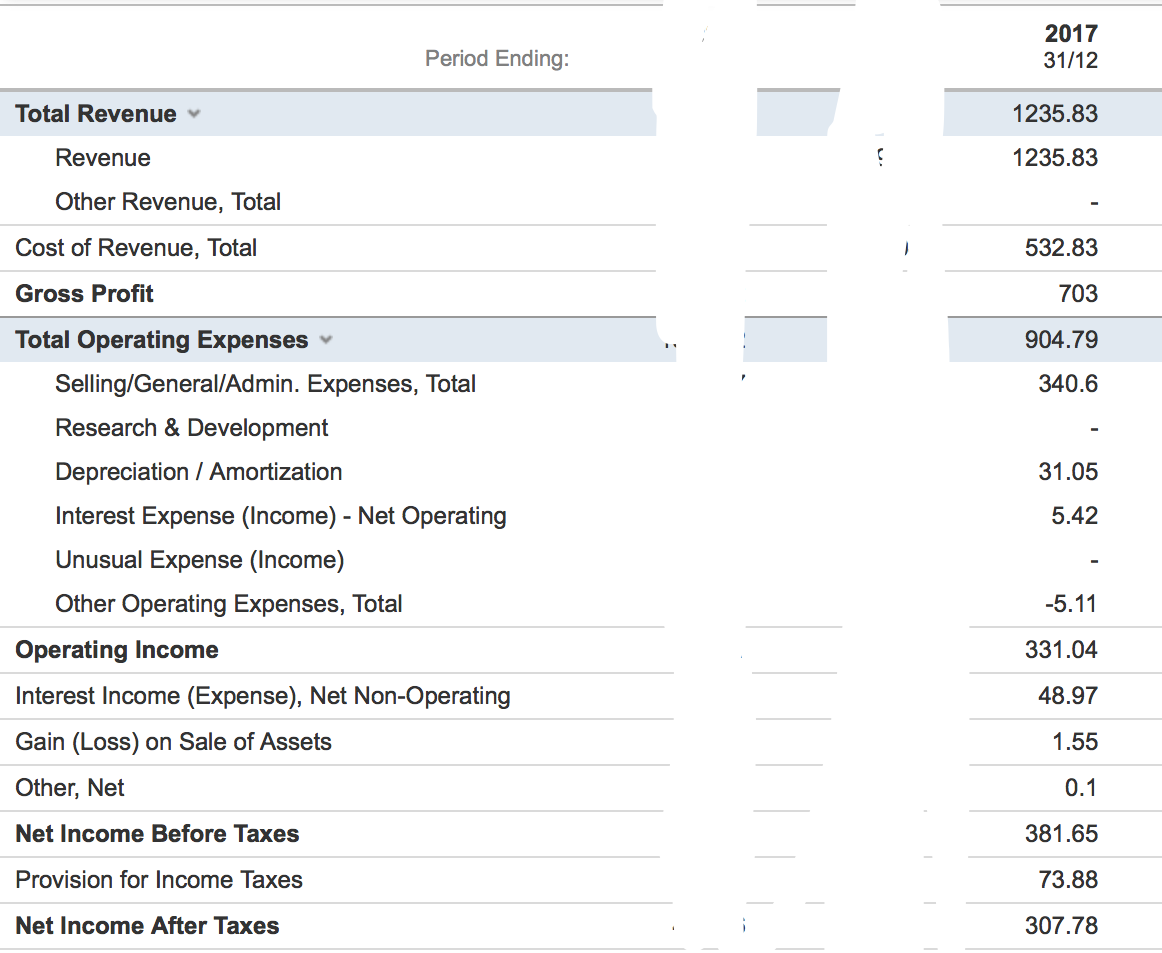

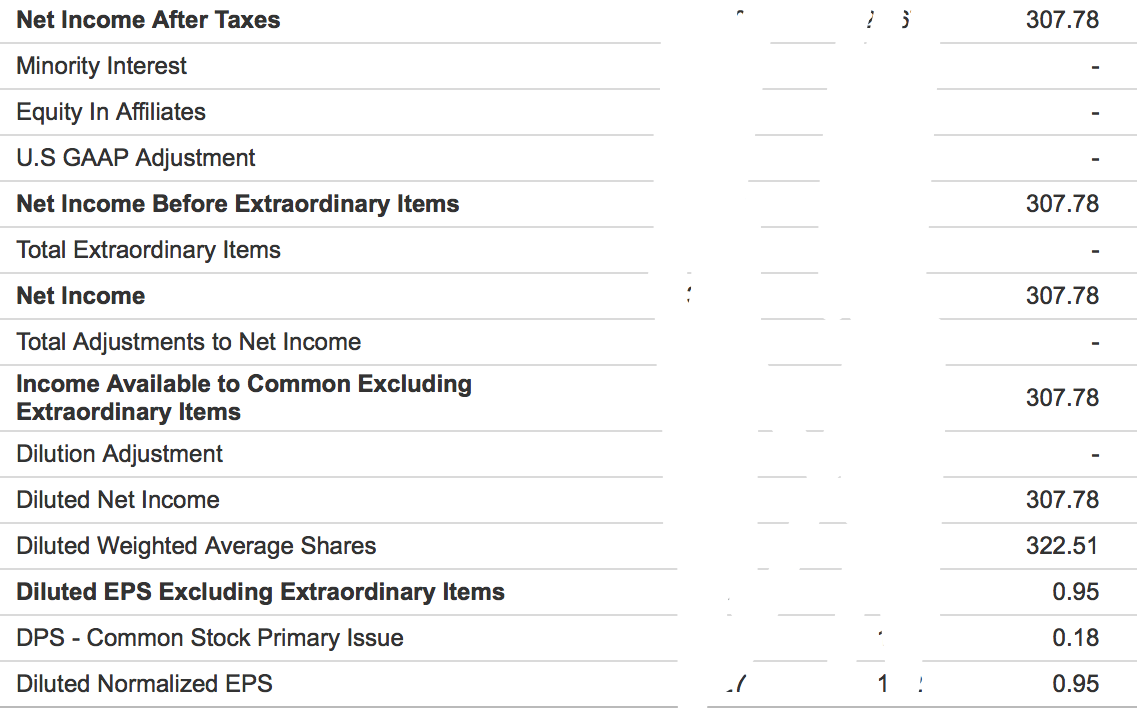

2017 ? ? ? ? ? ? ? no Current Ratio Acid-test Ratio Inventory Turnover Collection Period Payment Period Total asset turnover Debt Ratio Time interest earned Gross profit margin Operating profit margin Net profit margin Return on total asset Return on equity Earning per share Price earning ratio Book value per common s. ? ? ? ? ? ? ? ? Period Ending: 2017 31/12 Total Current Assets 1137.57 Cash and Short Term Investments 592.13 Cash 344.29 Cash & Equivalents Short Term Investments 247.84 433.97 390.85 Total Receivables, Net Accounts Receivables - Trade, Net Total Inventory Prepaid Expenses Other Current Assets, Total 102.23 9.07 0.17 Total Assets 1661.44 430.12 1006.14 -576.01 Property/Plant/Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation, Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets, Total 6.45 1.44 0.17 85.69 Total Current Liabilities 595.7 166.38 305.54 Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt/Capital Leases Other Current liabilities, Total 123.78 Total Liabilities 623.96 Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax 12.3 Minority Interest 15.95 1037.48 Other Liabilities, Total Total Equity Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee 322.51 0.15 3 439.92 274.9 Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity Total Common Shares Outstanding Total Preferred Shares Outstanding 2 1661.44 3: 322.51 Period Ending: 2017 31/12 Total Revenue 1235.83 Revenue 1235.83 Other Revenue, Total Cost of Revenue, Total 532.83 Gross Profit 703 904.79 340.6 31.05 5.42 Total Operating Expenses Selling/General/Admin. Expenses, Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses, Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net -5.11 331.04 48.97 1.55 0.1 Net Income Before Taxes 381.65 Provision for Income Taxes 73.88 Net Income After Taxes 307.78 Net Income After Taxes ? 307.78 Minority Interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items Total Extraordinary Items 307.78 Net Income 307.78 Total Adjustments to Net Income Income Available to Common Excluding Extraordinary Items Dilution Adjustment 307.78 Diluted Net Income 307.78 322.51 Diluted Weighted Average Shares Diluted EPS Excluding Extraordinary Items DPS - Common Stock Primary Issue 0.95 0.18 Diluted Normalized EPS 7 1 0.95