Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need 2-6 answered by someone besides the person that answered it last because it was very messy and not very helpful. 1:55 PM ooo

I need 2-6 answered by someone besides the person that answered it last because it was very messy and not very helpful.

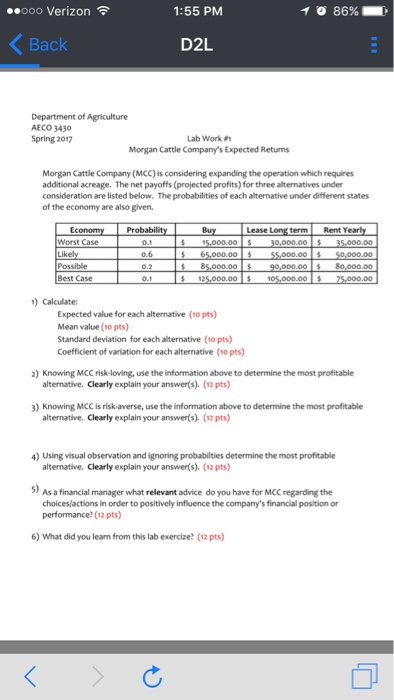

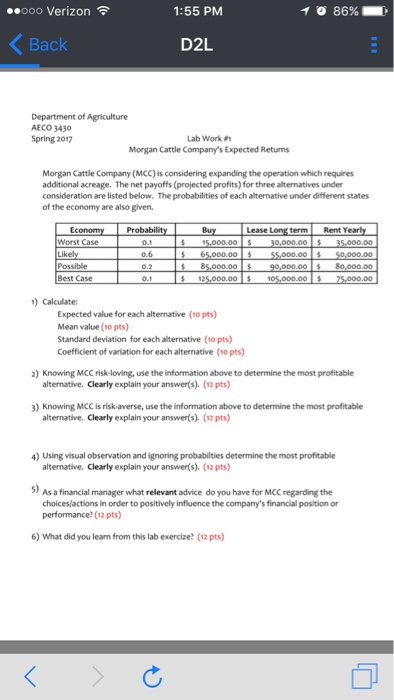

1:55 PM ooo Verizon 86% Back D2L Department of Agriculture AECO 3430 Spring 2017 Lab Work Morgan Cattle Company's Expected Retums Morgan Cattle Company (MCC) is considering expanding the operation whichrequires additional acreage. The net payoffs (projected profits for three altemativesunder consideration are listed below. The probabilities of each altermative under different states of the economy are also given. Economy Probability Buy Lease Longterm Rent Yearly Worst Case 5,000.00 0,000.00 35.000.001 Possible 8s000.00 S 90,000.00 80,000.00 Best Case 0.1 125.000.00 S 105.000,00 ooooo 1) Calculate: Expected value for each alternative (no pts) Mean value (opts) Standard deviation for each alternative (10 pts) Coefficient of variation for each alternative (o pts) 2) Knowing McC risk-loving, use the information above to determine the most profitable alternative. Clearly explain your answer(s). (12 pts) 3) Knowing McC is risk averse, use the information above to determine the most profitable alternative. Clearly explain your answer(s) (12pts) 4) Using visual observation and ignoring probabilities determine the most profitable alternative. Clearly explain your answer(s) (12 pts) 5) As a financial manager what relevant advice do you have for McCregarding the choices actions in order to positively influence the company's financial position or performance (12 pts) 6) What did you learn from this lab exercize (12pts) 1:55 PM ooo Verizon 86% Back D2L Department of Agriculture AECO 3430 Spring 2017 Lab Work Morgan Cattle Company's Expected Retums Morgan Cattle Company (MCC) is considering expanding the operation whichrequires additional acreage. The net payoffs (projected profits for three altemativesunder consideration are listed below. The probabilities of each altermative under different states of the economy are also given. Economy Probability Buy Lease Longterm Rent Yearly Worst Case 5,000.00 0,000.00 35.000.001 Possible 8s000.00 S 90,000.00 80,000.00 Best Case 0.1 125.000.00 S 105.000,00 ooooo 1) Calculate: Expected value for each alternative (no pts) Mean value (opts) Standard deviation for each alternative (10 pts) Coefficient of variation for each alternative (o pts) 2) Knowing McC risk-loving, use the information above to determine the most profitable alternative. Clearly explain your answer(s). (12 pts) 3) Knowing McC is risk averse, use the information above to determine the most profitable alternative. Clearly explain your answer(s) (12pts) 4) Using visual observation and ignoring probabilities determine the most profitable alternative. Clearly explain your answer(s) (12 pts) 5) As a financial manager what relevant advice do you have for McCregarding the choices actions in order to positively influence the company's financial position or performance (12 pts) 6) What did you learn from this lab exercize (12pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started