Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need #5 i only need the very last question #5 Unlucky Blue Jean Company Conventional Retail Method Inventory and COGS During 2019. Unlucky Blue

i need #5

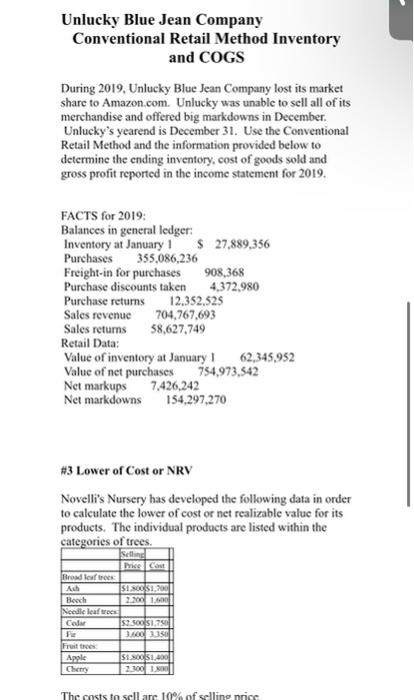

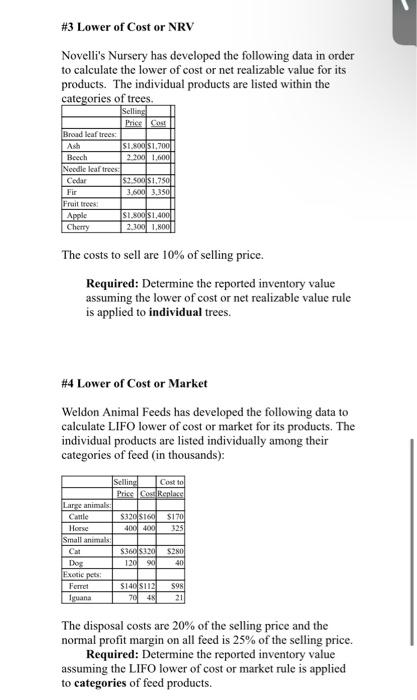

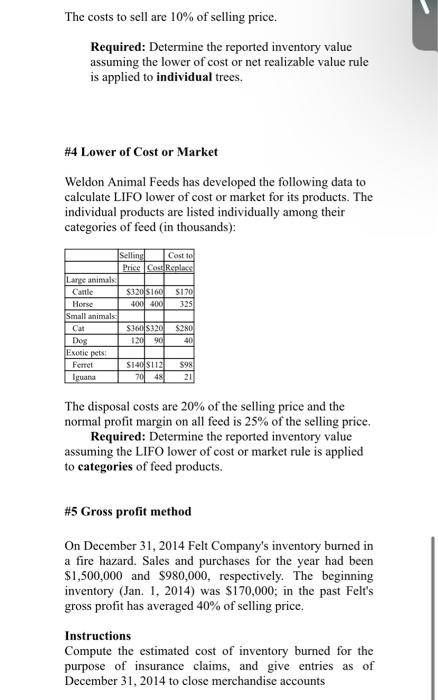

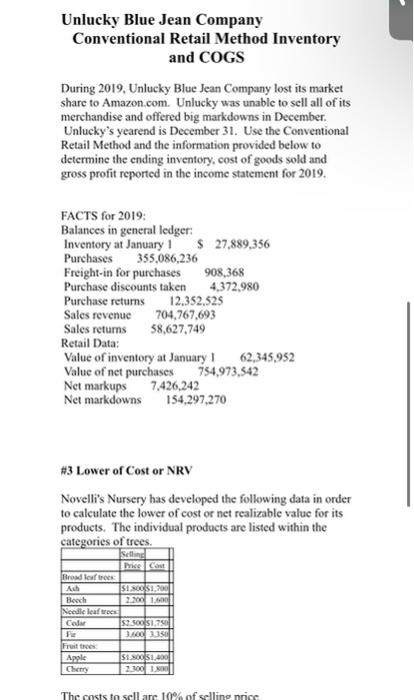

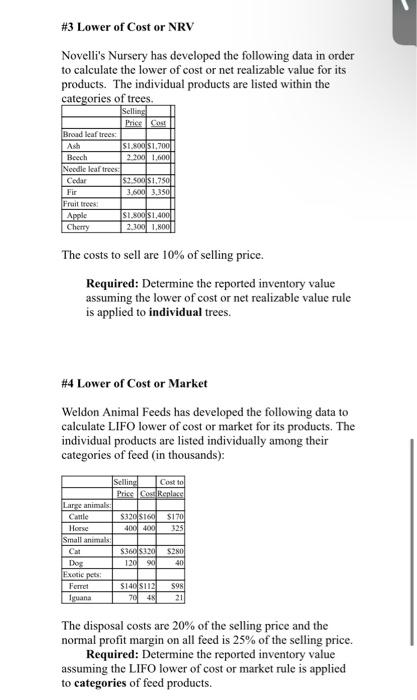

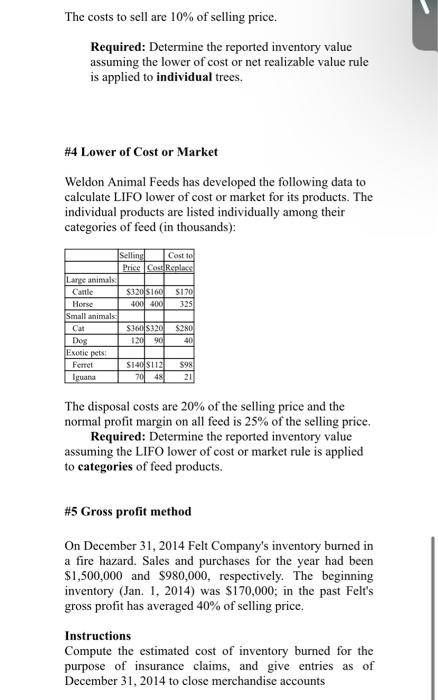

i only need the very last question #5 Unlucky Blue Jean Company Conventional Retail Method Inventory and COGS During 2019. Unlucky Blue Jean Company lost its market Share to Amazon.com. Unlucky was unable to sell all of its merchandise and offered big markdowns in December. Unlucky's yearend is December 31. Use the Conventional Retail Method and the information provided below to determine the ending inventory, cost of goods sold and gross profit reported in the income statement for 2019. FACTS for 2019: Balances in general ledger: Inventory at January 1 $ 27,889,356 Purchases 355,086,236 Freight-in for purchases 908,368 Purchase discounts taken 4,372,980 Purchase returns 12.352,525 Sales revenue 704,767,693 Sales returns 58,627,749 Retail Data: Value of inventory at January 1 62,345,952 Value of net purchases 754,973,542 Net markups 7.426.242 Net markdowns 154,297,270 #3 Lower of Cost or NRV Novellis Nursery has developed the following data in order to calculate the lower of cost or net realizable value for its products. The individual products are listed within the categories of trees. Setind Price Cost Broad leaf tree Aub $100 $1,7001 Beach 2.300 1.600 Needle leaf trees Code is so 1.1 FE BUS Frustres Apple SIS. 2001 Cherry 2.300 1.00 The costs to sell are 10% of selling price #3 Lower of Cost or NRV Novelli's Nursery has developed the following data in order to calculate the lower of cost or net realizable value for its products. The individual products are listed within the categories of trees. Selling Price Cost S1.800 $1,700 2.200 1.600 Broad leaf trees Ash Beech Needle leaf trees Cedar Fir Fruit trees Apple Cherry $2.500 1.750 3.600 3,350 $1,800 1,400 2.300 1.800 The costs to sell are 10% of selling price. Required: Determine the reported inventory value assuming the lower of cost or net realizable value rule is applied to individual trees. #4 Lower of Cost or Market Weldon Animal Feeds has developed the following data to calculate LIFO lower of cost or market for its products. The individual products are listed individually among their categories of feed (in thousands): Selling Cost to Price Cow Replace Large animals Carle $320 S16 $170 Horse 400 400 325 Small animals Cat $300 $320 S280 Dog 120 90 400 Exotic per Ferret S14 S1121 598 Iguana 704 21 The disposal costs are 20% of the selling price and the normal profit margin on all feed is 25% of the selling price. Required: Determine the reported inventory value assuming the LIFO lower of cost or market rule is applied to categories of feed products. The costs to sell are 10% of selling price. Required: Determine the reported inventory value assuming the lower of cost or net realizable value rule is applied to individual trees. #4 Lower of Cost or Market Weldon Animal Feeds has developed the following data to calculate LIFO lower of cost or market for its products. The individual products are listed individually among their categories of feed (in thousands): Selling Cost to Price Cost Replace Large animals Cattle S320 $100 $170 Horse 400 4001 325 Small animals Cat 5360120 $280 Dog 120 90 40 Exotic pets Ferret $140 $112 70 48 598 21 Iguana The disposal costs are 20% of the selling price and the normal profit margin on all feed is 25% of the selling price. Required: Determine the reported inventory value assuming the LIFO lower of cost or market rule is applied to categories of feed products. #5 Gross profit method On December 31, 2014 Felt Company's inventory burned in a fire hazard. Sales and purchases for the year had been $1,500,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2014) was $170,000; in the past Felt's gross profit has averaged 40% of selling price. Instructions Compute the estimated cost of inventory burned for the purpose of insurance claims, and give entries as of December 31, 2014 to close merchandise accounts

i only need the very last question #5 Unlucky Blue Jean Company Conventional Retail Method Inventory and COGS During 2019. Unlucky Blue Jean Company lost its market Share to Amazon.com. Unlucky was unable to sell all of its merchandise and offered big markdowns in December. Unlucky's yearend is December 31. Use the Conventional Retail Method and the information provided below to determine the ending inventory, cost of goods sold and gross profit reported in the income statement for 2019. FACTS for 2019: Balances in general ledger: Inventory at January 1 $ 27,889,356 Purchases 355,086,236 Freight-in for purchases 908,368 Purchase discounts taken 4,372,980 Purchase returns 12.352,525 Sales revenue 704,767,693 Sales returns 58,627,749 Retail Data: Value of inventory at January 1 62,345,952 Value of net purchases 754,973,542 Net markups 7.426.242 Net markdowns 154,297,270 #3 Lower of Cost or NRV Novellis Nursery has developed the following data in order to calculate the lower of cost or net realizable value for its products. The individual products are listed within the categories of trees. Setind Price Cost Broad leaf tree Aub $100 $1,7001 Beach 2.300 1.600 Needle leaf trees Code is so 1.1 FE BUS Frustres Apple SIS. 2001 Cherry 2.300 1.00 The costs to sell are 10% of selling price #3 Lower of Cost or NRV Novelli's Nursery has developed the following data in order to calculate the lower of cost or net realizable value for its products. The individual products are listed within the categories of trees. Selling Price Cost S1.800 $1,700 2.200 1.600 Broad leaf trees Ash Beech Needle leaf trees Cedar Fir Fruit trees Apple Cherry $2.500 1.750 3.600 3,350 $1,800 1,400 2.300 1.800 The costs to sell are 10% of selling price. Required: Determine the reported inventory value assuming the lower of cost or net realizable value rule is applied to individual trees. #4 Lower of Cost or Market Weldon Animal Feeds has developed the following data to calculate LIFO lower of cost or market for its products. The individual products are listed individually among their categories of feed (in thousands): Selling Cost to Price Cow Replace Large animals Carle $320 S16 $170 Horse 400 400 325 Small animals Cat $300 $320 S280 Dog 120 90 400 Exotic per Ferret S14 S1121 598 Iguana 704 21 The disposal costs are 20% of the selling price and the normal profit margin on all feed is 25% of the selling price. Required: Determine the reported inventory value assuming the LIFO lower of cost or market rule is applied to categories of feed products. The costs to sell are 10% of selling price. Required: Determine the reported inventory value assuming the lower of cost or net realizable value rule is applied to individual trees. #4 Lower of Cost or Market Weldon Animal Feeds has developed the following data to calculate LIFO lower of cost or market for its products. The individual products are listed individually among their categories of feed (in thousands): Selling Cost to Price Cost Replace Large animals Cattle S320 $100 $170 Horse 400 4001 325 Small animals Cat 5360120 $280 Dog 120 90 40 Exotic pets Ferret $140 $112 70 48 598 21 Iguana The disposal costs are 20% of the selling price and the normal profit margin on all feed is 25% of the selling price. Required: Determine the reported inventory value assuming the LIFO lower of cost or market rule is applied to categories of feed products. #5 Gross profit method On December 31, 2014 Felt Company's inventory burned in a fire hazard. Sales and purchases for the year had been $1,500,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2014) was $170,000; in the past Felt's gross profit has averaged 40% of selling price. Instructions Compute the estimated cost of inventory burned for the purpose of insurance claims, and give entries as of December 31, 2014 to close merchandise accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started