i need a b and c same question diff part

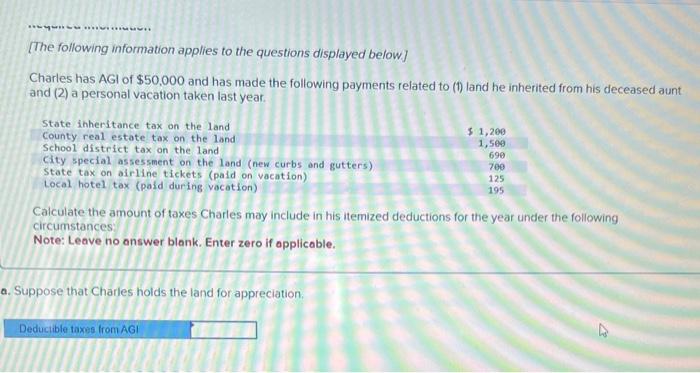

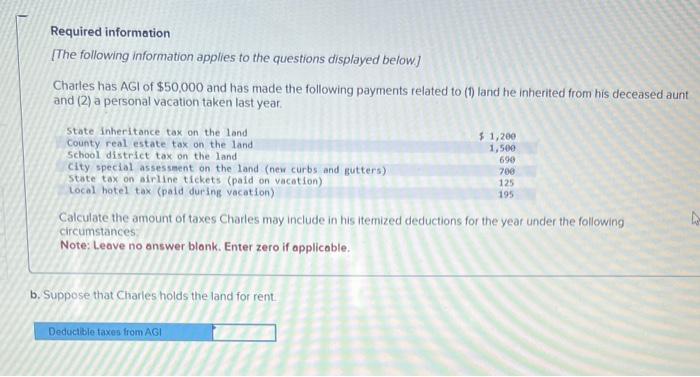

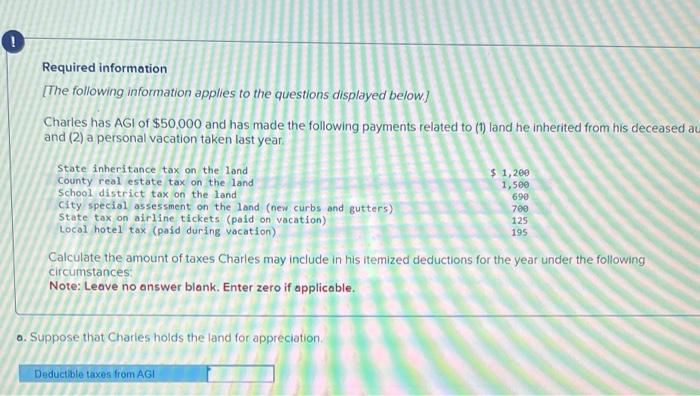

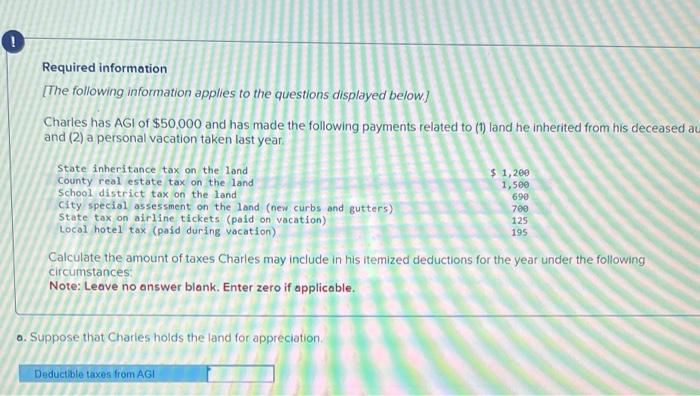

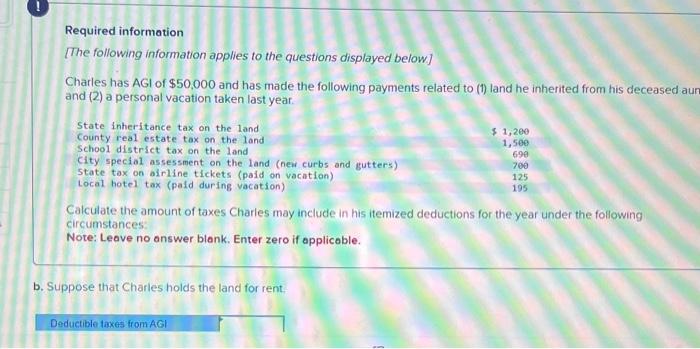

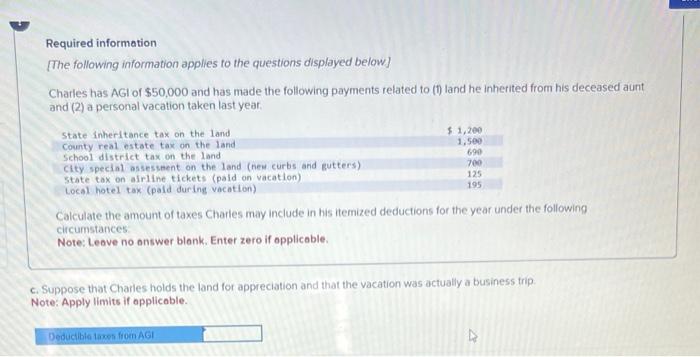

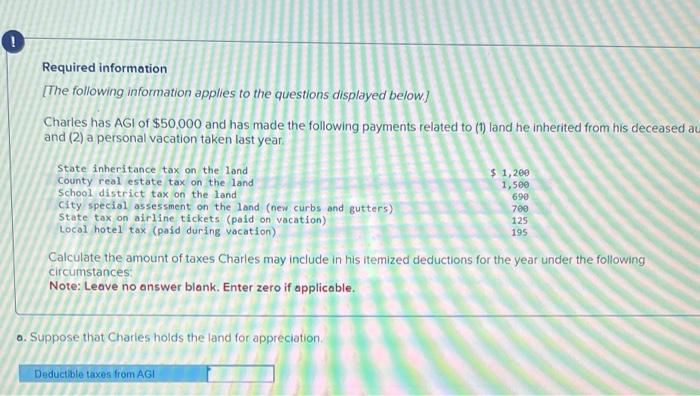

[The following information applies to the questions displayed below] Charles has AGl of $50,000 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. a. Suppose that Charles holds the land for appreciation. Required information [The following information applies to the questions displayed below] Charles has AGl of $50,000 and has made the following payments related to (i) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no onswer blank. Enter zero if applicable. b. Suppose that Charles holds the land for rent. Required information [The following information applies to the questions displayed below] Charles has AGl of $50,000 and has made the following payments related to (1) land he inherited from his deceased a and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. a. Suppose that Charles holds the land for appreciation. Required information [The following information applies to the questions displayed below] Charles has AGl of $50,000 and has made the following payments related to (1) land he inherited from his deceased at and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. b. Suppose that Charles holds the land for rent. Required information The following information applies fo the questions displayed below] Charles has AGl of $50,000 and has made the following payments related to (t) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances Note: Leave no answer blank. Enter zero if applicable. c. Suppose that Charles holds the land for appreciation and that the vacation was actually a business trip. Note: Apply limits if applicable