Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-I need a final recommendation as to which of these two, mutually exclusive deals to accept. I need to find the one with the highest

-I need a final recommendation as to which of these two, mutually exclusive deals to accept. I need to find the one with the highest equivilent annual annuity. the findings need to be backed up with the replacement chain analysis. thank you.

edit: the baseline data is the data given in the problem. My professor confirmed this in class.

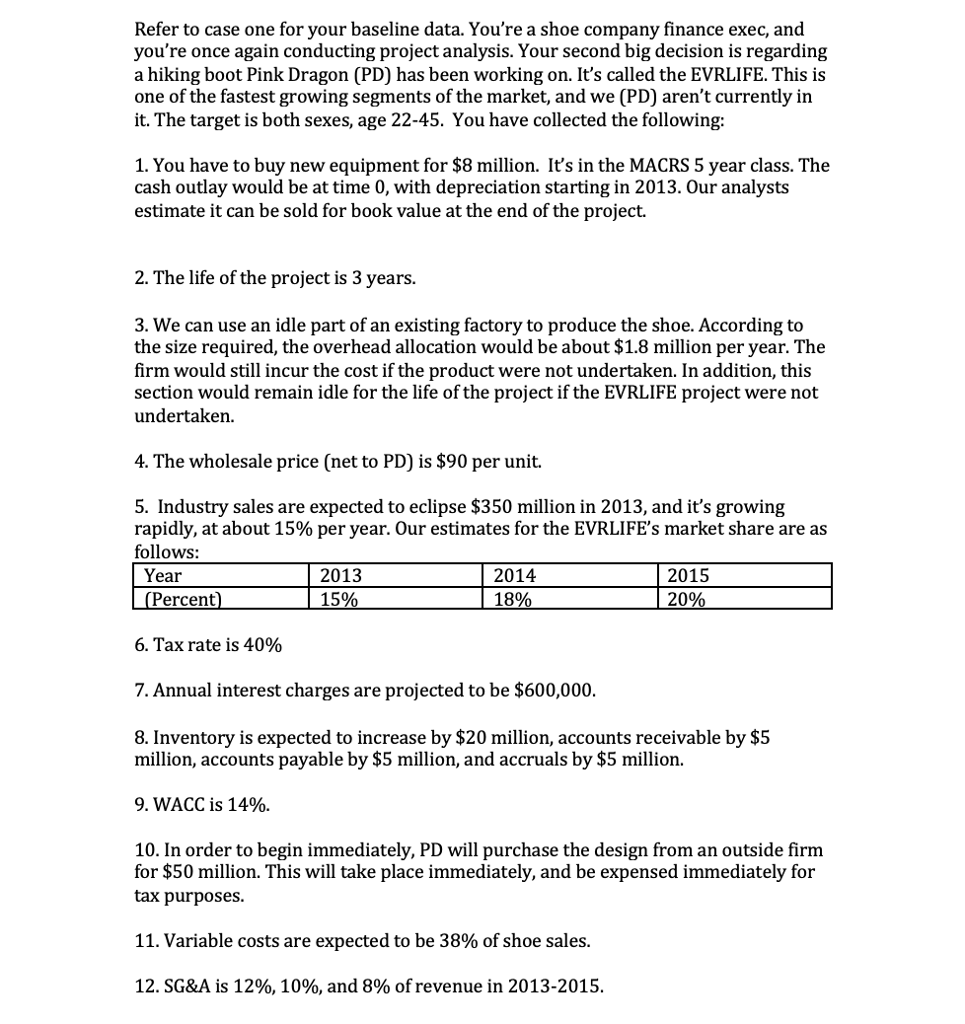

Refer to case one for your baseline data. You're a shoe company finance exec, and you're once again conducting project analysis. Your second big decision is regarding a hiking boot Pink Dragon (PD) has been working on. It's called the EVRLIFE. This is one of the fastest growing segments of the market, and we (PD) aren't currently in it. The target is both sexes, age 22-45. You have collected the following 1. You have to buy new equipment for $8 million. It's in the MACRS 5 year class. The cash outlay would be at time 0, with depreciation starting in 2013. Our analysts estimate it can be sold for book value at the end of the project. 2. The life of the project is 3 years. 3. We can use an idle part of an existing factory to produce the shoe. According to the size required, the overhead allocation would be about $1.8 million per year. The firm would still incur the cost if the product were not undertaken. In addition, this section would remain idle for the life of the project if the EVRLIFE project were not undertaken 4. The wholesale price (net to PD) is $90 per unit. 5. Industry sales are expected to eclipse $350 million in 2013, and it's growing rapidly, at about 15% per year. Our estimates for the EVRLIFE's market share are as follows: Year 2013 15 2014 18 2015 20 Percent 6. Tax rate is 40% 7. Annual interest charges are projected to be $600,000. 8. Inventory is expected to increase by $20 million, accounts receivable by $5 million, accounts payable by $5 million, and accruals by $5 million. 9. WACC is 14%. 10. In order to begin immediately, PD will purchase the design from an outside firm for $50 million. This will take place immediately, and be expensed immediately for tax purposes 11. Variable costs are expected to be 38% of shoe sales 12. SG&A is 12%, 10%, and 8% of revenue in 2013-2015Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started