Answered step by step

Verified Expert Solution

Question

1 Approved Answer

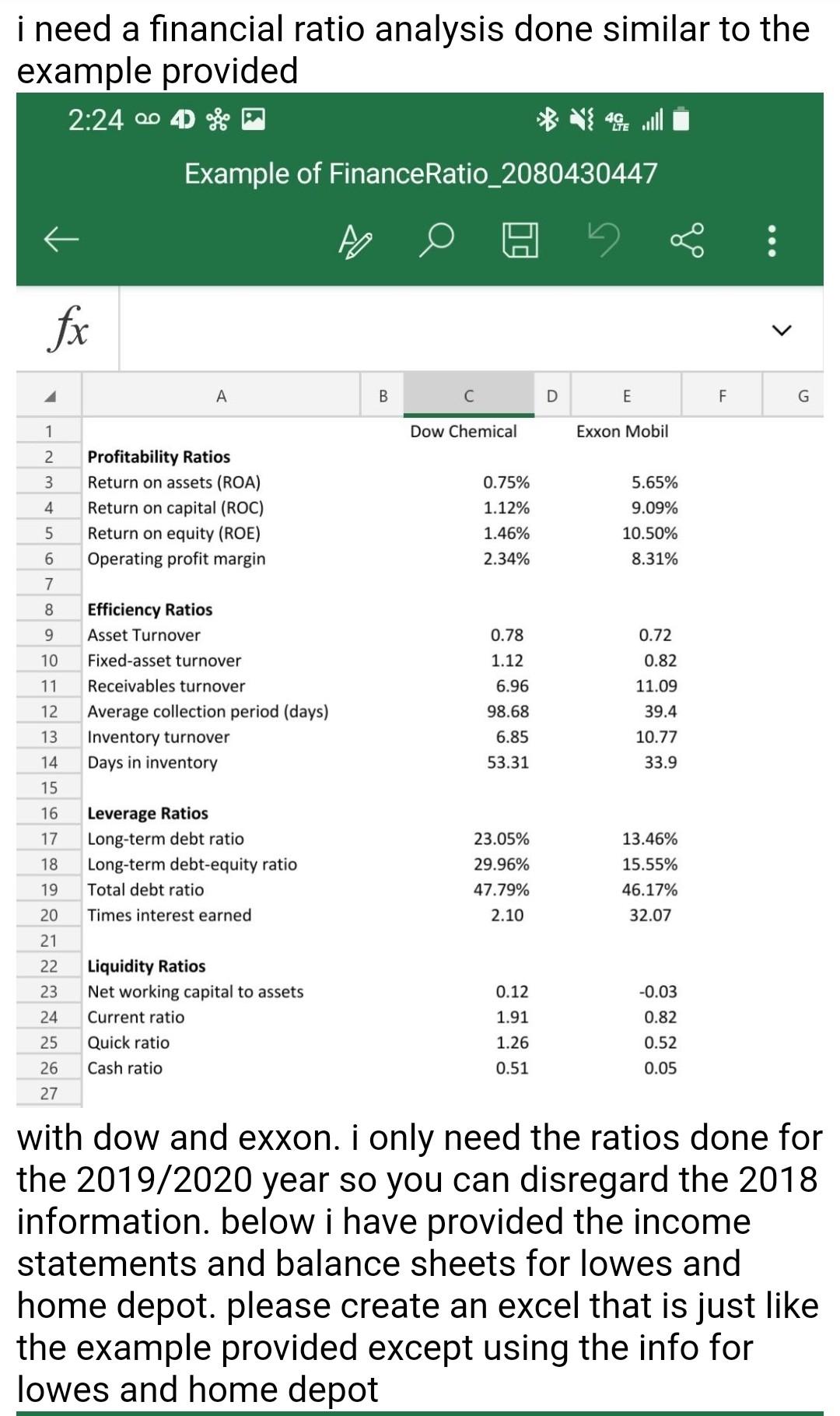

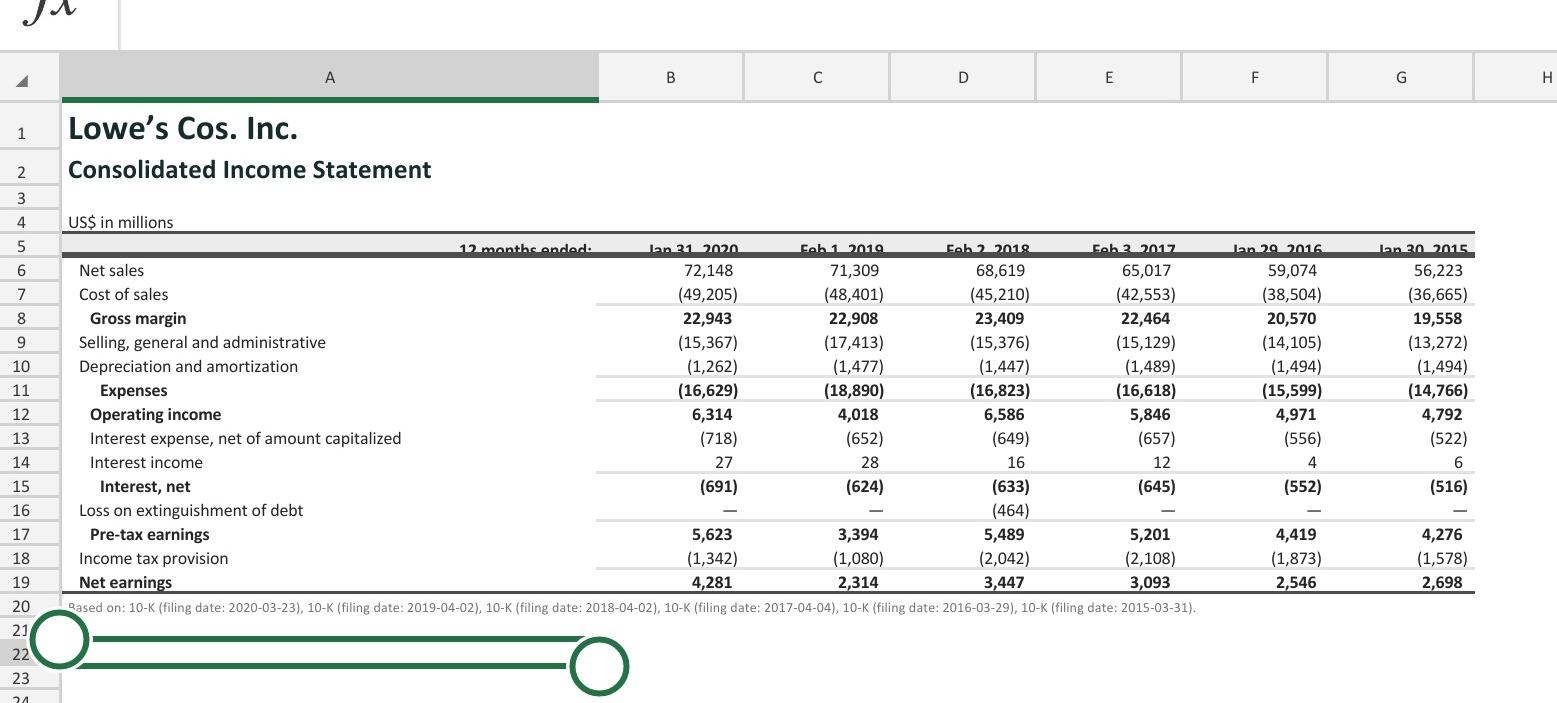

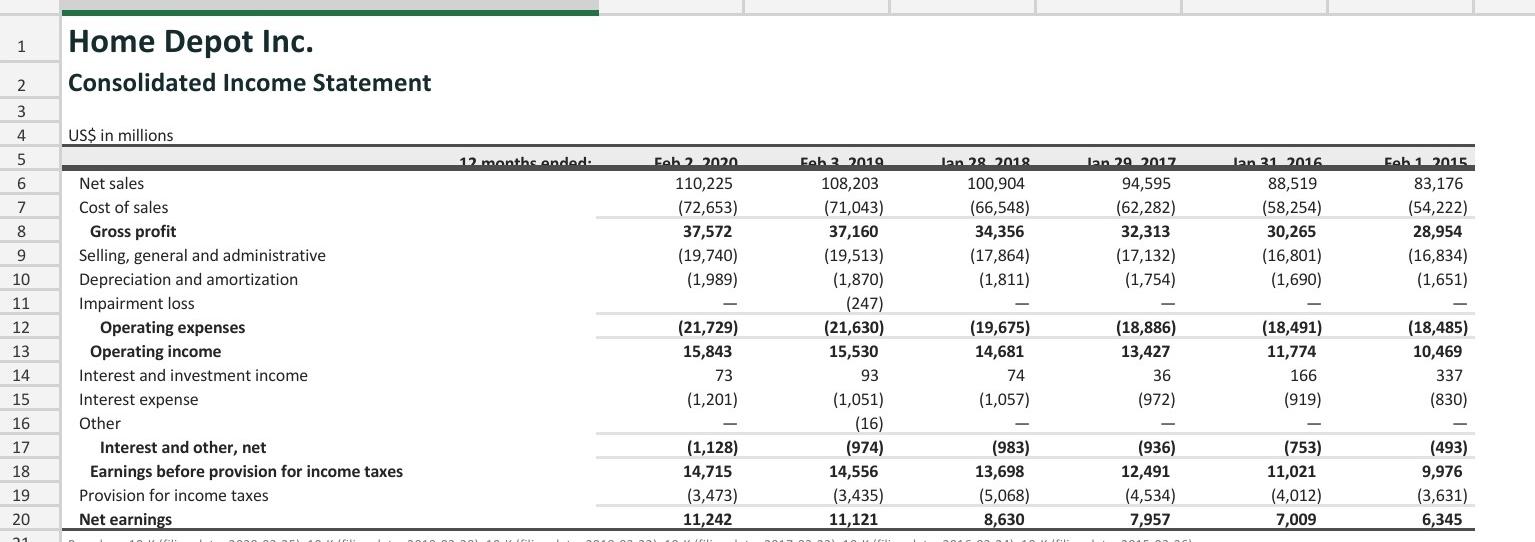

i need a financial ratio analysis done similar to the example provided 2:24 004 Example of Finance Ratio_2080430447 fx A C D E F G

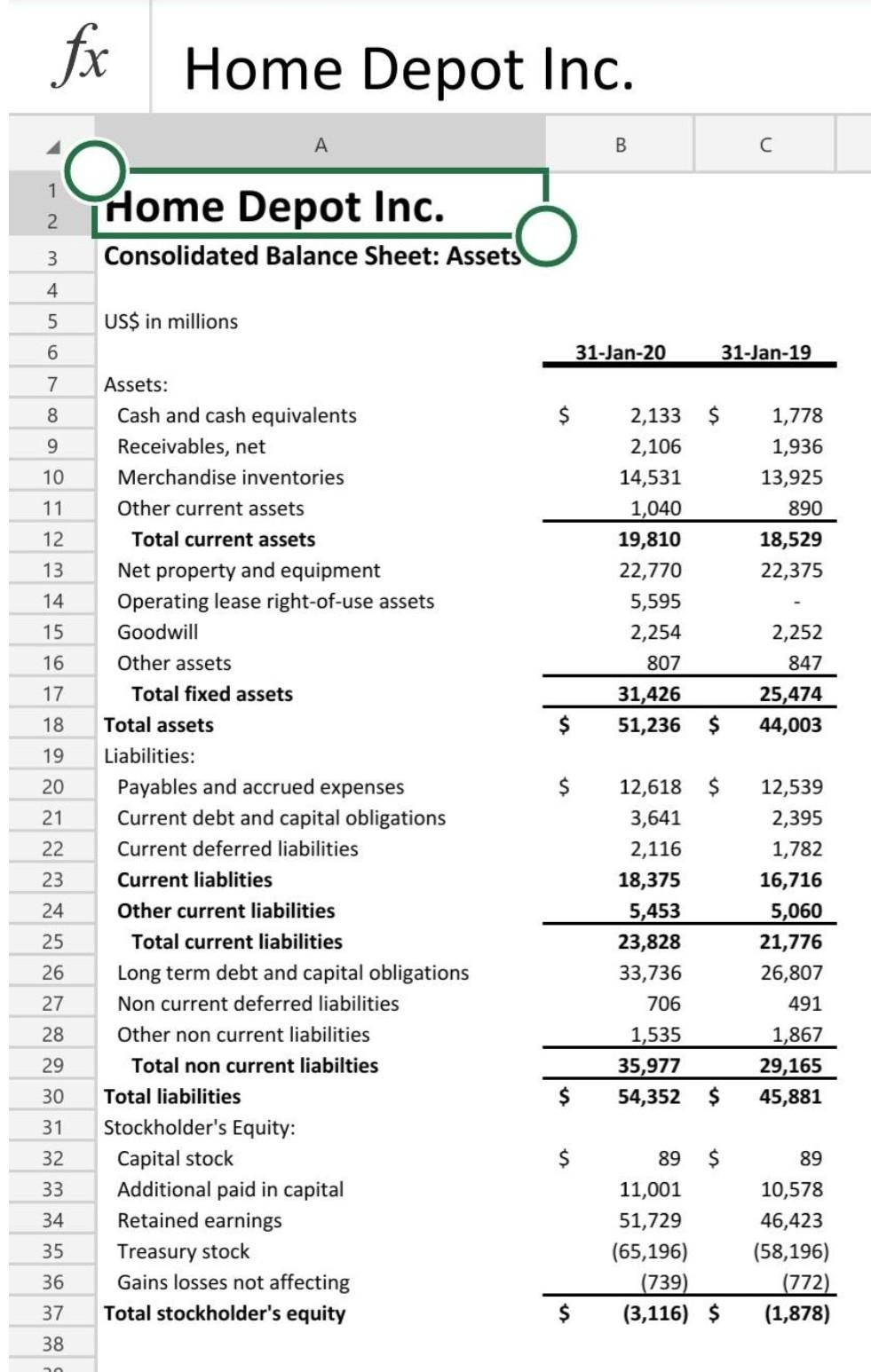

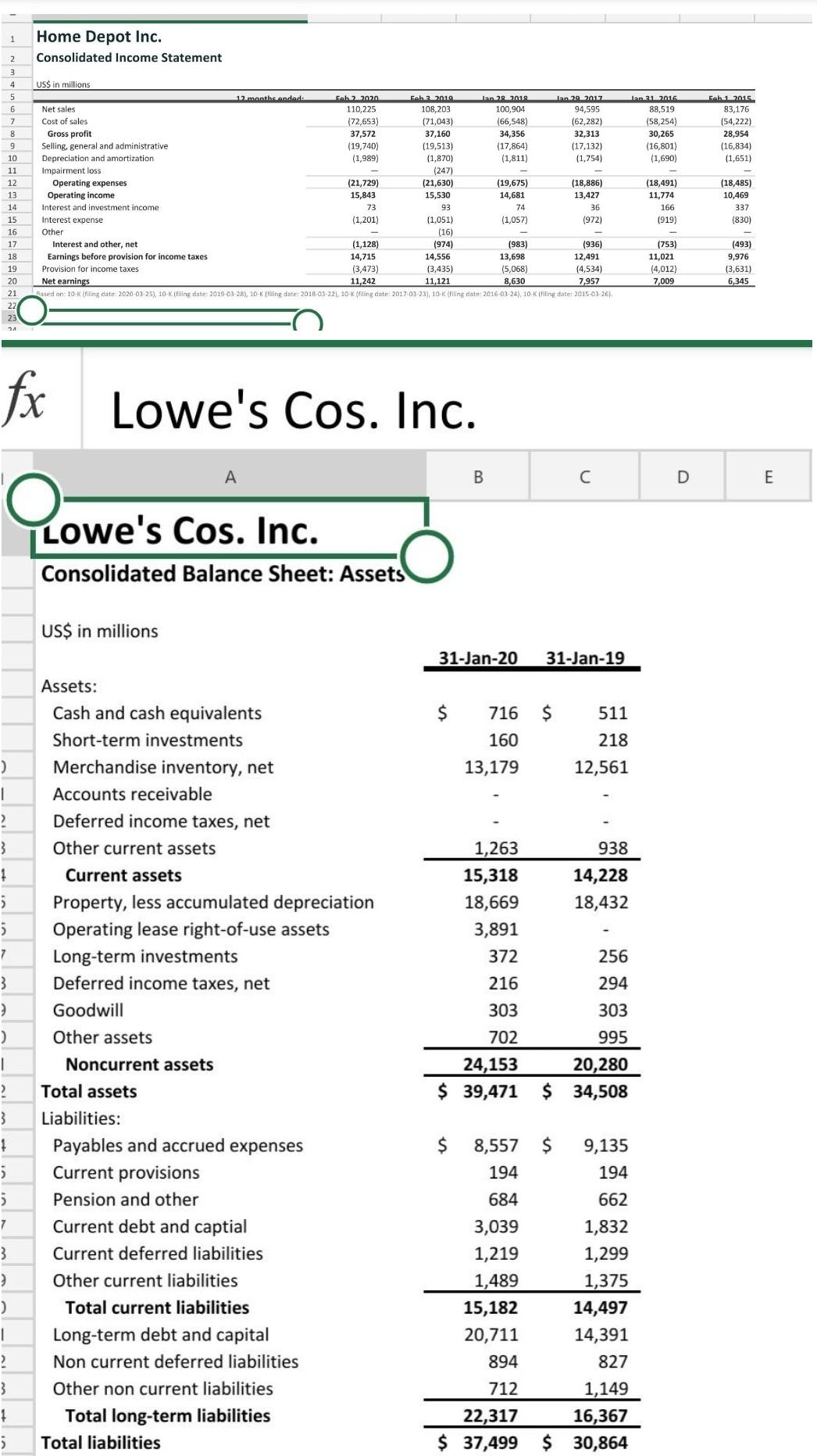

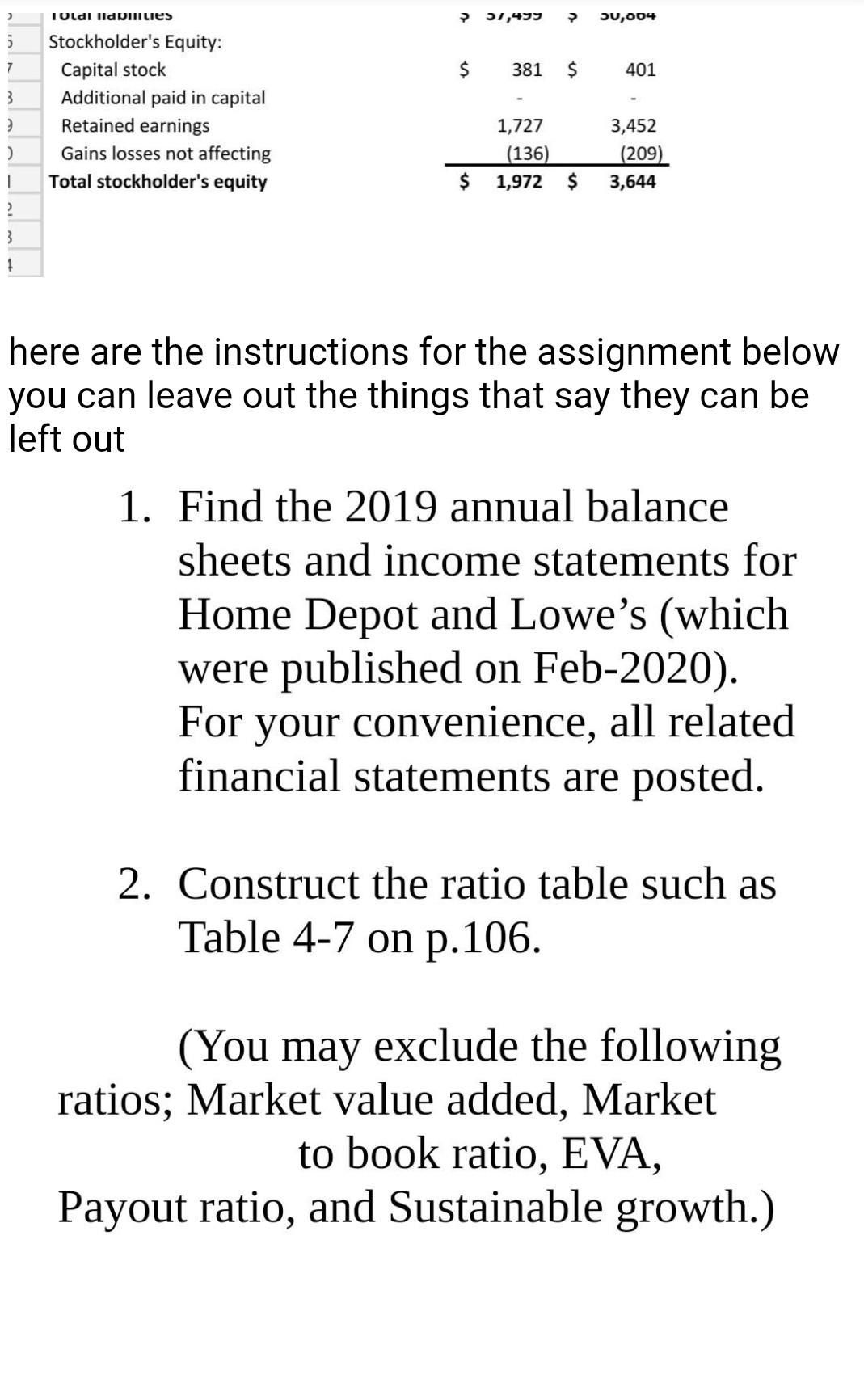

i need a financial ratio analysis done similar to the example provided 2:24 004 Example of Finance Ratio_2080430447 fx A C D E F G 1 Dow Chemical Exxon Mobil 2. 3 4 Profitability Ratios Return on assets (ROA) Return on capital (ROC) Return on equity (ROE) Operating profit margin 0.75% 1.12% 1.46% 2.34% 5.65% 9.09% 10.50% 8.31% 5 6 7 8 9 0.72 10 0.82 11 12 13 Efficiency Ratios Asset Turnover Fixed-asset turnover Receivables turnover Average collection period (days) Inventory turnover Days in inventory 0.78 1.12 6.96 98.68 6.85 11.09 39.4 10.77 33.9 53.31 14 15 16 17 13.46% 18 Leverage Ratios Long-term debt ratio Long-term debt-equity ratio Total debt ratio Times interest earned 15.55% 23.05% 29.96% 47.79% 2.10 19 20 21 46.17% 32.07 22 23 24 Liquidity Ratios Net working capital to assets Current ratio Quick ratio Cash ratio 0.12 1.91 1.26 0.51 -0.03 0.82 0.52 0.05 25 26 27 with dow and exxon. i only need the ratios done for the 2019/2020 year so you can disregard the 2018 information. below i have provided the income statements and balance sheets for lowes and home depot. please create an excel that is just like the example provided except using the info for lowes and home depot fx Home Depot Inc. O Home Depot Inc. A B C 2 3 Consolidated Balance Sheet: Assets 4 5 US$ in millions 6 31-Jan-20 31-Jan-19 7 8 $ 9 10 1,778 1,936 13,925 890 18,529 22,375 11 12 2,133 2,106 14,531 1,040 19,810 22,770 5,595 2,254 807 31,426 51,236 $ 13 14 15 16 17 2,252 847 25,474 44,003 18 $ 19 $ 20 21 22 Assets: Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Net property and equipment Operating lease right-of-use assets Goodwill Other assets Total fixed assets Total assets Liabilities: Payables and accrued expenses Current debt and capital obligations Current deferred liabilities Current liablities Other current liabilities Total current liabilities Long term debt and capital obligations Non current deferred liabilities Other non current liabilities Total non current liabilties Total liabilities Stockholder's Equity: Capital stock Additional paid in capital Retained earnings Treasury stock Gains losses not affecting Total stockholder's equity 23 24 25 26 27 28 12,618 $ 3,641 2,116 18,375 5,453 23,828 33,736 706 1,535 35,977 54,352 $ 12,539 2,395 1,782 16,716 5,060 21,776 26,807 491 1,867 29,165 45,881 29 30 31 $ 32 33 34 89 $ 11,001 51,729 (65,196) (739) (3,116) $ 89 10,578 46,423 (58,196) (772) (1,878) 35 36 37 $ 38 1 Home Depot Inc. Consolidated Income Statement 2 Jan 21 2015 88,519 (58,254) 30,265 (16,801) (1,690) Fah1.2015 83,176 (54.222) 28,954 (16,834) (1,651) (18,491) US$ in millions 12 months andede Eph 2.2020 Feb.2.2019 Jan 2018 Jan 29 2017 Net sales 110,225 108,203 100,904 94,595 Cost of sales (72,653) (71,043) (66,548) (62,282) Gross profit 37,572 37,160 34,356 32,313 Selling, general and administrative (19,740) (19,513) (17,864) (17,132) Depreciation and amortization (1,989) (1,870) (1,811) (1,754 Impairment loss (247) Operating expenses cal (21,729) (21,630) (19,675) (18,886) 16 14,681 Interest and investment income 73 93 74 26 36 Interest expense (1,201) (1,057) (972) Other (16) (16) Interest and other, net (1,128) (974) (983) (936) Earnings before provision for income taxes 14,715 14,556 13,698 12,491 Provision for income taxes (3,473) (3,435) (5,068) (4,534) Net earnings 11,121 8,630 7,957 Sased on: 10-K (filling date: 2020-03-25), 10-K (Filing date: 2019-02-28), 10-K filing date: 2015-03-221.10-K filing date: 2017-03-23), 10-K (Filing date: 2016-03-24), 10-Kifiling date: 2015-03-26). Operating income 13 15,843 13,427 11,774 166 (919) (18,485) 10,469 337 (830) (1,051) 13 16 16 17 14 18 19 20 21 (753) 11,021 (4,012) (493) 9,976 (3,631) 6,345 11,242 7,009 24 fx Lowe's Cos. Inc. A B C E O Lowe's Cos. Inc. Consolidated Balance Sheet: Assets US$ in millions 31-Jan-20 31-Jan-19 $ 716 $ 511 218 160 ) 13,179 12,561 1 ? 3 1 5 938 14,228 18,432 1,263 15,318 18,669 3,891 372 216 5 7 256 3 294 303 303 702 ) 995 1 Assets: Cash and cash equivalents Short-term investments Merchandise inventory, net Accounts receivable Deferred income taxes, net Other current assets Current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes, net Goodwill Other assets Noncurrent assets Total assets Liabilities: Payables and accrued expenses Current provisions Pension and other Current debt and captial Current deferred liabilities Other current liabilities Total current liabilities Long-term debt and capital Non current deferred liabilities Other non current liabilities Total long-term liabilities Total liabilities 24,153 $ 39,471 20,280 34,508 ? 3 1 5 5 7 3 3 $ 8,557 $ 9,135 194 194 684 662 3,039 1,832 1,219 1,299 1,489 1,375 15,182 14,497 20,711 14,391 894 827 712 1,149 22,317 16,367 $ 37,499 $ 30,864 ) 1 2 3 1 5 2 Toldi lidDulles 51,499 50,004 3 7 $ 381 $ 401 3 Stockholder's Equity: Capital stock Additional paid in capital Retained earnings Gains losses not affecting Total stockholder's equity 2 1,727 (136) 1,972 $ 3,452 (209) 3,644 $ ? 3 1 here are the instructions for the assignment below you can leave out the things that say they can be left out 1. Find the 2019 annual balance sheets and income statements for Home Depot and Lowe's (which were published on Feb-2020). For your convenience, all related financial statements are posted. 2. Construct the ratio table such as Table 4-7 on p.106. (You may exclude the following ratios; Market value added, Market to book ratio, EVA, Payout ratio, and Sustainable growth.) A B D E F G H 1 Lowe's Cos. Inc. Consolidated Income Statement 2 3 4 5 6 7 8 9 Jan 29 2016 59,074 (38,504) 20,570 (14,105) (1,494) (15,599) 4,971 (556) Lan 20.2015 56,223 (36,665) 19,558 (13,272) (1,494) (14,766) 4,792 (522) 10 US$ in millions 12 months andad. Jan 21_2020 Feb 1 2019 Sab 2. 2018 Feb 2017 Net sales 72,148 71,309 68,619 65,017 Cost of sales (49,205) (48,401) (45,210) (42,553) Gross margin 22,943 22,908 23,409 22,464 Selling, general and administrative (15,367) (17,413) (15,376) (15,129) Depreciation and amortization (1,262) (1,477) (1,447) (1,489) Expenses (16,629) (18,890) (16,823) (16,618) Operating income 6,314 4,018 6,586 5,846 Interest expense, net of amount capitalized (718) (652) (649) (657) Interest income 27 Interest, net (691) (624) (633) (645) Loss on extinguishment of debt (464) Pre-tax earnings 5,623 3,394 5,489 5,201 Income tax provision (1,342) (1,080) (2,042) (2,108) Net earnings 4,281 2,314 3,447 3,093 Rased on: 10-K (filing date: 2020-03-23), 10-K (filing date: 2019-04-02), 10-K (filing date: 2018-04-02), 10-K (filing date: 2017-04-04), 10-K (filing date: 2016-03-29), 10-K (filing date: 2015-03-31). 11 12 13 14 15 (552) (516) 16 17 18 4,419 (1,873) 2,546 4,276 (1,578) 2,698 19 20 21 22 23 24 1 Home Depot Inc. Consolidated Income Statement 2 3 4 US$ in millions 5 12 months andado 6 7 Feb 2.2020 110,225 (72,653) 37,572 (19,740) (1,989) an 29_2012 100,904 (66,548) 34,356 (17,864) (1,811) Jan 29.2017 94,595 (62,282) 32,313 (17,132) (1,754) lan 21_2016 88,519 (58,254) 30,265 (16,801) (1,690) sob 1 2015 83,176 (54,222) 28,954 (16,834) (1,651) 8 9 10 11 12 Net sales Cost of sales Gross profit Selling, general and administrative Depreciation and amortization Impairment loss Operating expenses Operating income Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings 13 Feb 2_2019 108,203 (71,043) 37,160 (19,513) (1,870) (247) (21,630) 15,530 93 (1,051) (16) (974) 14,556 (3,435) 11,121 (21,729) 15,843 73 (1,201) (19,675) 14,681 74 (1,057) (18,886) 13,427 36 (972) (18,491) 11,774 166 (18,485) 10,469 337 (830) 14 15 (919) 16 17 18 (1,128) 14,715 (3,473) 11,242 (983) 13,698 (5,068) 8,630 (936) 12,491 (4,534) 7,957 (753) 11,021 (4,012) 7,009 (493) 9,976 (3,631) 6,345 19 20 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started