Answered step by step

Verified Expert Solution

Question

1 Approved Answer

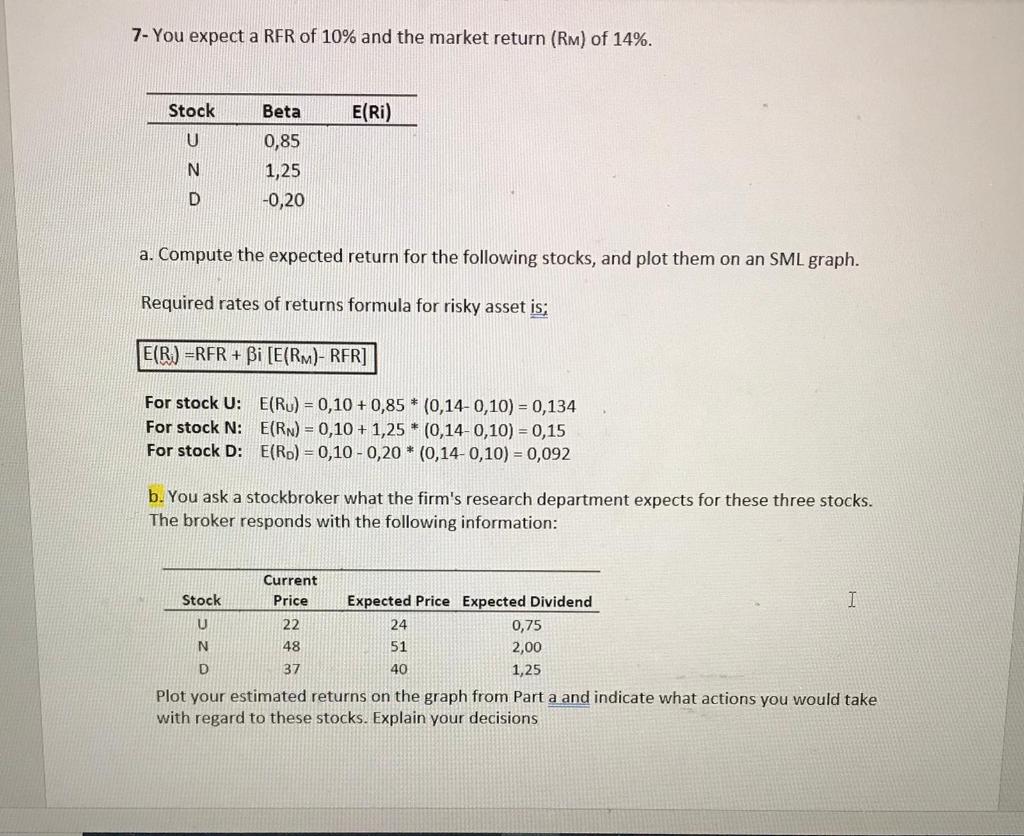

I need a help on Question B, could someone help ? 7- You expect a RFR of 10% and the market return (RM) of 14%.

I need a help on Question B, could someone help ?

7- You expect a RFR of 10% and the market return (RM) of 14%. Stock Beta E(Ri) U 0,85 1,25 -0,20 D a. Compute the expected return for the following stocks, and plot them on an SML graph. Required rates of returns formula for risky asset is; E(R) =RFR + Bi [E(RM)- RFR] For stock U: E(RU) = 0,10 +0,85 * (0,14-0,10) = 0,134 For stock N: E(RN) = 0,10 +1,25 * (0,14-0,10) = 0,15 For stock D: E(Ro) = 0,10 -0,20 * (0,14-0,10) = 0,092 b. You ask a stockbroker what the firm's research department expects for these three stocks. The broker responds with the following information: Current Stock Price Expected Price Expected Dividend I U 22 24 0,75 N 48 51 2,00 D 37 40 1,25 Plot your estimated returns on the graph from Part a and indicate what actions you would take with regard to these stocks. Explain your decisionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started