Answered step by step

Verified Expert Solution

Question

1 Approved Answer

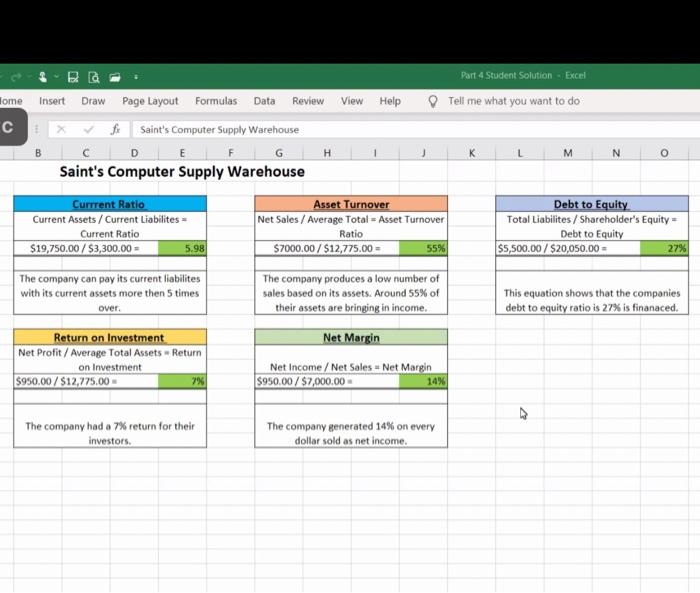

i need a memo based on those result. please look at my numbers carefully before answering . somebody already answered wrong . thank you ACC301

i need a memo based on those result. please look at my numbers carefully before answering . somebody already answered wrong . thank you

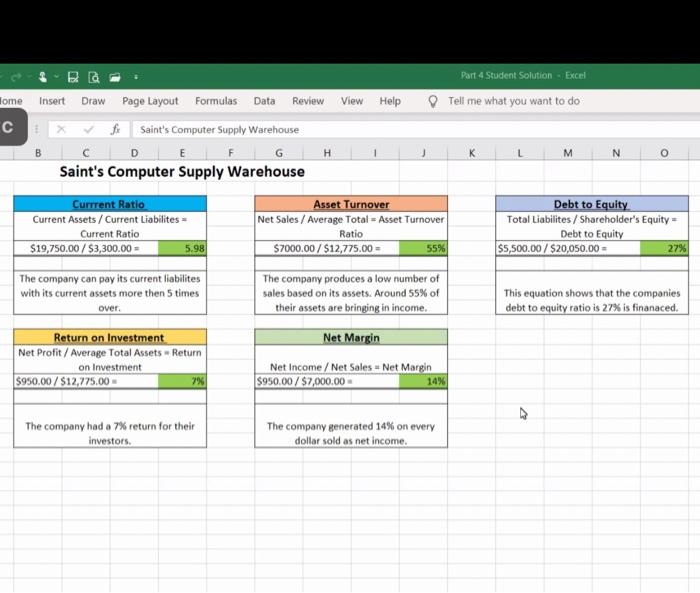

ACC301 Case Instructions Fall 2021-4.docx Part 5 - Client Memo Student Responsibility - Prepare a Client Memo explaining how potential investors and creditors will use the Company's financial statements to make business decisions. (Prepared in Word. Use Memo Format. See "Writing a Memo" in the case module in canvas. Memo will be graded on grammar) Due Date: Wednesday, 10/6/21 by 11:59pm M N Ba Part 4 Student Solution Excel ome Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to do fx Saint's Computer Supply Warehouse D E F G Saint's Computer Supply Warehouse Current Ratio Asset Turnover Debt to Equity Current Assets / Current Liabilites - Net Sales / Average Total - Asset Turnover Total Liabilites / Shareholder's Equity Current Ratio Ratio Debt to Equity $19,750.00 / $3,300.00 = 5.98 57000.00 / $12,775.00 - 55% $5,500.00 / $20,050.00 = 27% The company can pay its current liabilites The company produces a low number of with its current assets more then 5 times sales based on its assets. Around 55% of This equation shows that the companies their assets are bringing in income. debt to equity ratio is 27% is financed. over Net Margin Return on Investment Net Profit/ Average Total Assets Return on Investment $950,00 / $12,775.00 7% Net Income / Net Sales Net Margin $950.00 / $7,000.00 14% The company had a 7% return for their investors. The company generated 14% on every dollar sold as net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started