Question

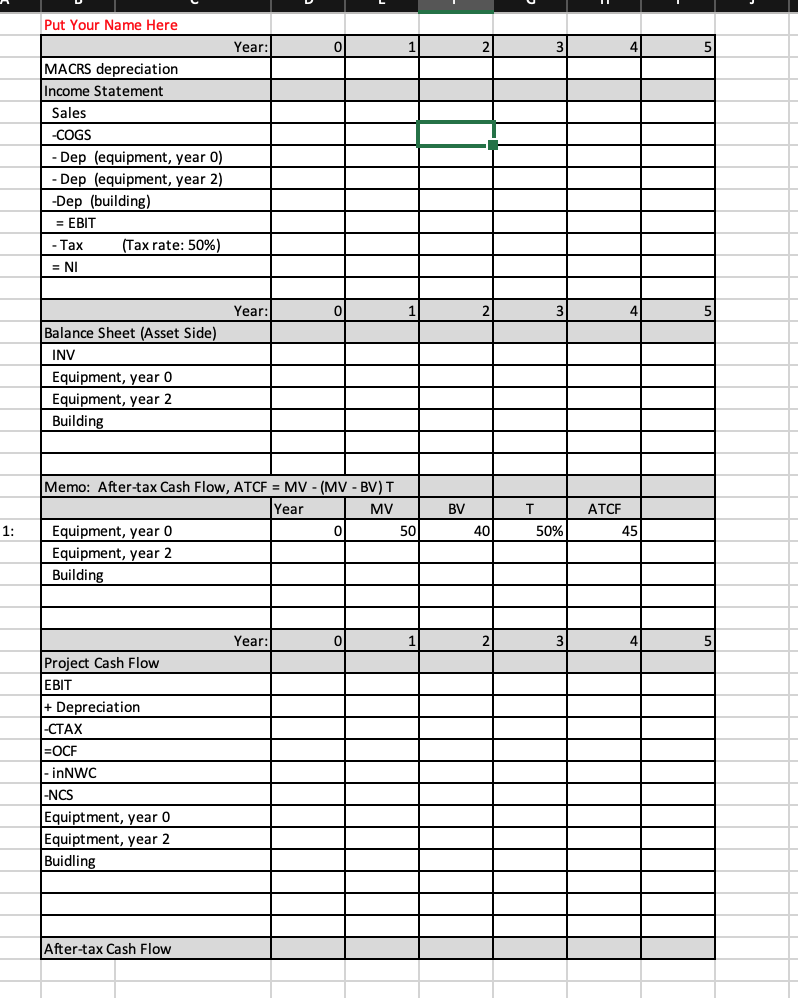

I need a step by step to figure out how to answer this problem: Project Details Management is analyzing this project over a 5-year horizon.

I need a step by step to figure out how to answer this problem:

Project Details

-

Management is analyzing this project over a 5-year horizon.

-

Perstorps marginal tax rate is 50%.

-

A suitable piece of land on which to build the factory can be purchased immediately for essentially zero cost.

The land is expected to have no value at the end of the projects life.

-

A factory building can be constructed immediately for a cost of $50m. The IRS requires the factory to be

depreciated over 25 years using straight-line depreciation (i.e., at a rate of $2m per year). The building is

expected to have a market value of $20m at the end of the projects life.

-

Perstorp currently owns used equipment which can be installed in the factory immediately. This equipment is

being depreciated by $10m each year and now has a book value of $40m but it could be sold today for $50m. It is expected to have zero market value at the end of the projects life. This equipment would fill 50% of the factorys square footage.

-

Management would spend $50m in two years (i.e., at Year 2) to fill the other half of the factory with equipment. (Management estimates that many customers will require 2 years to collect on their hurricane insurance policies and plan new homes.) The IRS places this equipment in the 3-year MACRS life class, which has the following depreciation percentages: year 1, 0.2; year 2, 0.4; year 3, 0.2; year 4, 0.2. This equipment is expected to have a market value of $20m at the end of the projects life.

-

Management expects sales revenues of $300m in each of years 1 and 2, and $600m in each of years 3 and 4. Management expects sales revenue to drop to $500m in year 5. The cost of goods sold is 90% of sales revenue.

-

Management will spend $54m immediately to acquire inventories of raw materials needed to start production.

This is 20% of coming-year cost-of-goods-sold. At the end of each year in the projects life the factory must have inventories equal to 20% of coming-year cost-of-goods-sold. This inventory investment will be recaptured at the end of the projects life.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started