Question: I NEED ANSWER FOR ALL QUESTIONS QUESTION 2: Darul Iman Bhd is a chemical manufacturing company in Kerteh Industrial Park, Terengganu. Due to the increase

I NEED ANSWER FOR ALL QUESTIONS

I NEED ANSWER FOR ALL QUESTIONS

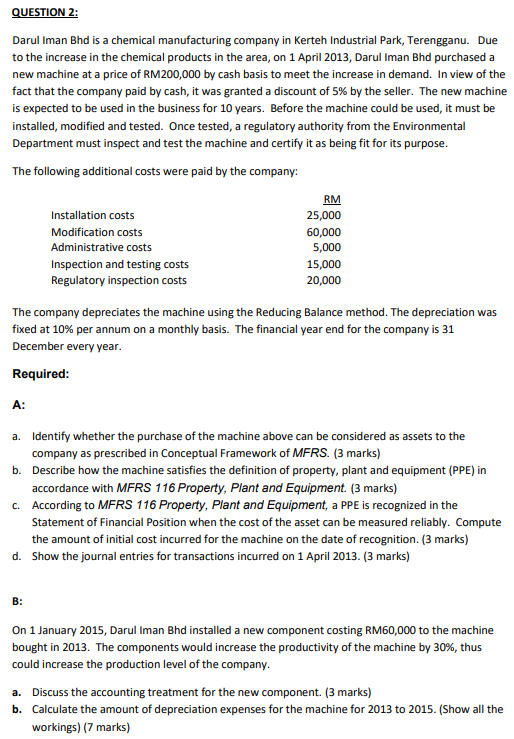

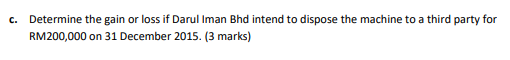

QUESTION 2: Darul Iman Bhd is a chemical manufacturing company in Kerteh Industrial Park, Terengganu. Due to the increase in the chemical products in the area, on 1 April 2013, Darul Iman Bhd purchased a new machine at a price of RM200,000 by cash basis to meet the increase in demand. In view of the fact that the company paid by cash, it was granted a discount of 5% by the seller. The new machine is expected to be used in the business for 10 years. Before the machine could be used, it must be installed, modified and tested. Once tested, a regulatory authority from the Environmental Department must inspect and test the machine and certify it as being fit for its purpose. The following additional costs were paid by the company: The company depreciates the machine using the Reducing Balance method. The depreciation was fixed at 10% per annum on a monthly basis. The financial year end for the company is 31 December every year. Required: A: a. Identify whether the purchase of the machine above can be considered as assets to the company as prescribed in Conceptual Framework of MFRS. (3 marks) b. Describe how the machine satisfies the definition of property, plant and equipment (PPE) in accordance with MFRS 116 Property, Plant and Equipment. (3 marks) c. According to MFRS 116 Property, Plant and Equipment, a PPE is recognized in the Statement of Financial Position when the cost of the asset can be measured reliably. Compute the amount of initial cost incurred for the machine on the date of recognition. ( 3 marks) d. Show the journal entries for transactions incurred on 1 April 2013. (3 marks) B: On 1 January 2015, Darul Iman Bhd installed a new component costing RM60,000 to the machine bought in 2013. The components would increase the productivity of the machine by 30%, thus could increase the production level of the company. a. Discuss the accounting treatment for the new component. ( 3 marks) b. Calculate the amount of depreciation expenses for the machine for 2013 to 2015. (Show all the workings) (7 marks) c. Determine the gain or loss if Darul Iman Bhd intend to dispose the machine to a third party for RM200,000 on 31 December 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts