Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need answer of this question hurry Q.1 Explain the properties of Baumol (1952) and Miller-ORR (1961) models for the management cash. Moreover, use following

i need answer of this question hurry

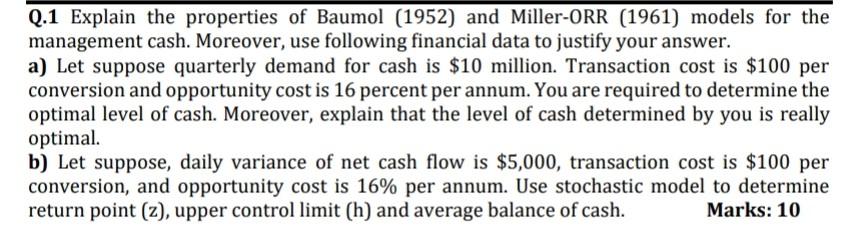

Q.1 Explain the properties of Baumol (1952) and Miller-ORR (1961) models for the management cash. Moreover, use following financial data to justify your answer. a) Let suppose quarterly demand for cash is $10 million. Transaction cost is $100 per conversion and opportunity cost is 16 percent per annum. You are required to determine the optimal level of cash. Moreover, explain that the level of cash determined by you is really optimal. b) Let suppose, daily variance of net cash flow is $5,000, transaction cost is $100 per conversion, and opportunity cost is 16% per annum. Use stochastic model to determine return point (z), upper control limit (h) and average balance of cash. Marks: 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started