Answered step by step

Verified Expert Solution

Question

1 Approved Answer

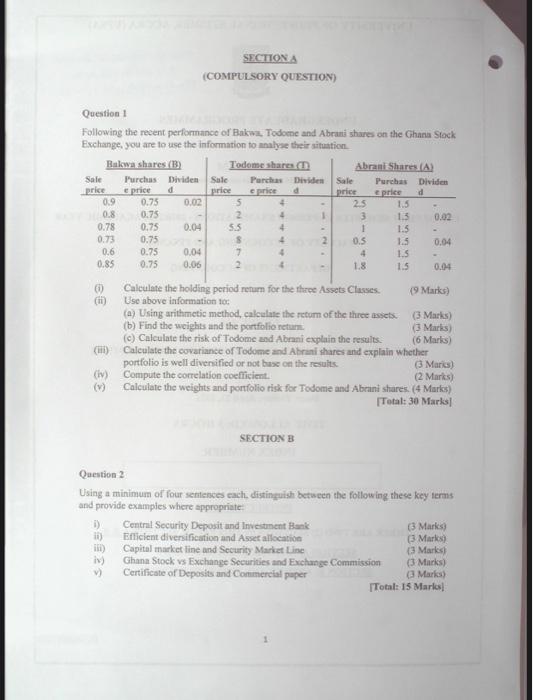

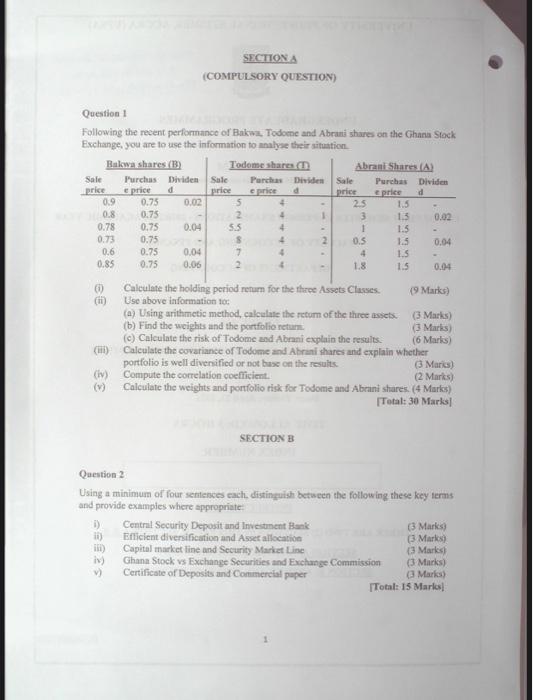

i need answers ans solution to this question pleae thank you Question 1 Following the recent performanco of Bakwz. Todome and Abrani shakes on the

i need answers ans solution to this question pleae thank you

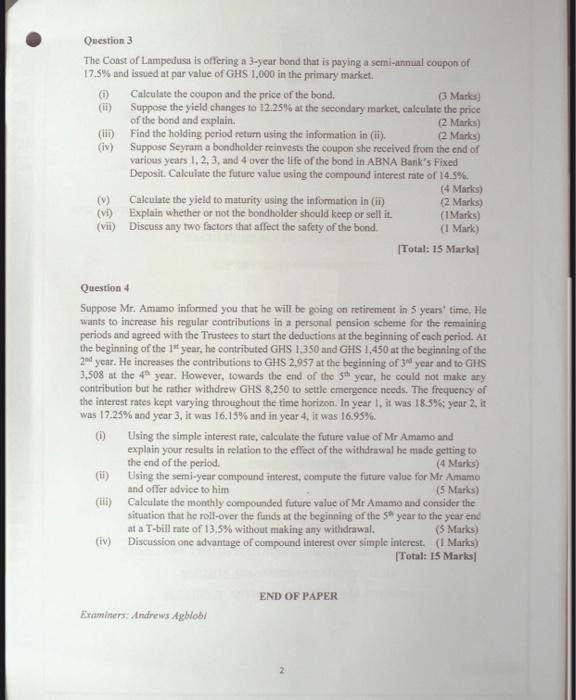

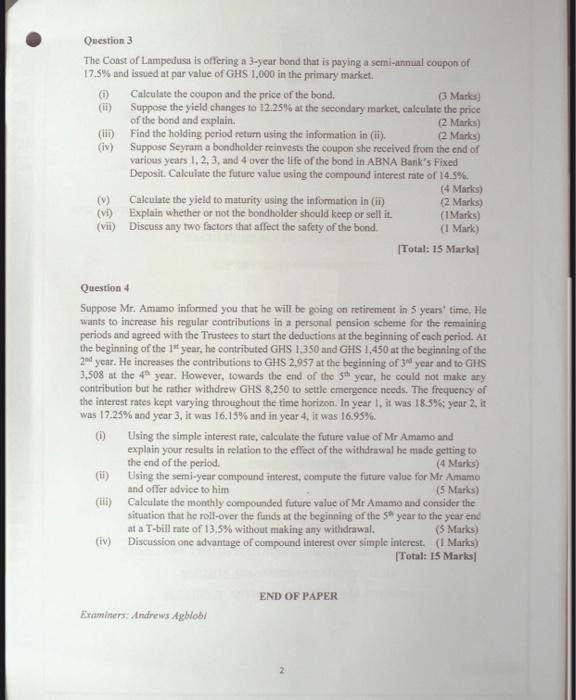

Question 1 Following the recent performanco of Bakwz. Todome and Abrani shakes on the Ghana Slock Exchange, you are to use the information to malyse thair aituation. (i) Caleulate the holding period renum for the three Assets Classes. (9 Marks) (ii) Use above information lot (a) Using arithmetic method, calcalate the return of the three assets. (3. Masks) (b) Find the wcights and the portfolio return. (3 Maris) (c) Calculate the risk of Todome and Abrani cxplain the results. (6 Marks) (iii) Caleulate the covariance of Todome and Abrani thares and explain whether portfolio is well divenified or not buse on the results. (3) Marics) (iv) Compute the correlation coefficient. (2. Marks) (v) Calculate the weights and pornfolio risk for Todome and Abrani shares. (4 Marks) [Total: 30 Marks] SECTION B Qaestion 2 Using a minimum of four sentences each, distinguish between the following these key terms and provide exampies where appropriate: i) Central Security Deposit and lnvestment Bank ii) Bflicient diversiffeation and Assef allocation (3) Marks) iii) Capital tharket line and Security Market Line (3 Marks). iv) Ghana Stock vs Exchange Securities and Fixchange Comanission (3) Marks) v) Certificate of Deposits and Cominerelal paper (3. Marks) (3) Marks) Trotale I5 Marics) Question 3 The Const of Lampedusa is offering a 3-year bond that is paying a semi-unnual coupon of 17.5% and issued at par value of GHS 1,000 in the primary market. (i) Calculate the coupon and the price of the bond. (3 Marks) (ii) Suppose the yield changes to 12.25% at the secondary market, calculate the price of the bond and explain. (2) Marks) (iii) Find the holding period return using the information in (ii). (2) Marks) (iv) Suppose Seyram a bondholder reinvests the coupon she received from the end of various years 1,2,3, and 4 over the life of the bond in ABNA Bank's Fixed Deposit. Calculate the future value using the compound interest rate of 14.5%. (v) Calculate the yield to maturity using the information in (ii) (4. Marks) (vi) Explain whether or not the bondholder should keep or sell it. (2 Marks) (vii) Discuss any two factors that affect the safery of the bond. (1Marks) (I Mark) [Total: 15 Marks] Question 4 Suppose Mr. Amamo informed you that he will be going on retirement in 5 years time. He wants to increase his regular contributions in a personal pension scheme for the remainirg periods and agreed with the Trustees to start the deductions at the beginning of each period. At the beginning of the 1 st year, he contributed GHS 1,350 and GHS 1,450 at the beginning of the 2ad year. He incresses the contributions to GHS 2,957 at the beginning of 3ns year and to GHS 3,508 at the 4t year. However, towards the end of the 5th year, he could not make any contribution but he rather withdrew GHS 8,250 to settle emergence needs. The frequency of the interest rates kept varying throughout the time horizon. In year 1 , it was 18.5%6;y ear 2 , it was 17.25% and year 3 , it was 16.15% and in year 4 , it was 16.95%. (i) Using the simple interest rate, calculate the future value of Mr Amamo and explain your results in relation to the effect of the withdrawal he made getting to the end of the period. (4 Marks) (ii) Using the semi-year compound interest, compute the future value for Mr Amamo and offer advice to him (5 Mariss) (iii) Calculate the monthly compounded future value of Mr Amamo and consider the situation that he roll-over the funds at the beginning of the 5n year to the year end at a T-bill rate of 13.5% without making any withdrawal. (5 Marks) (iv) Discussion one advantuge of compound interest over simple interest. (I Mariss). [Total: I5 Marks|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started