Answered step by step

Verified Expert Solution

Question

1 Approved Answer

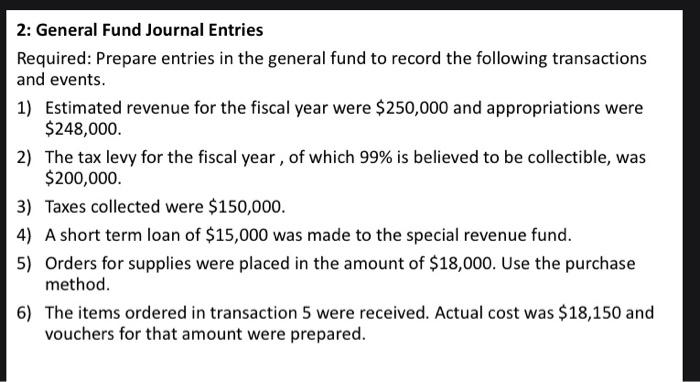

I need answers from 1-12 2: General Fund Journal Entries Required: Prepare entries in the general fund to record the following transactions and events. 1)

I need answers from 1-12

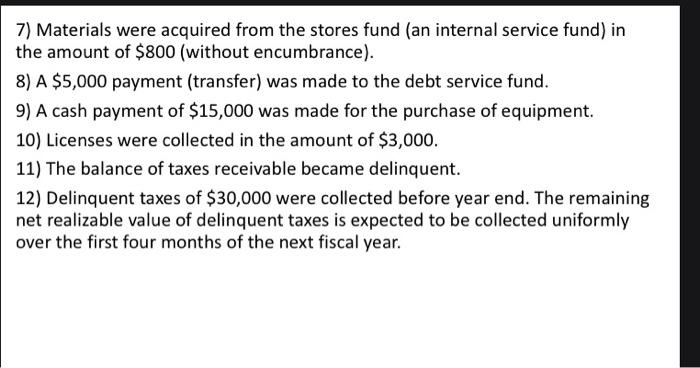

2: General Fund Journal Entries Required: Prepare entries in the general fund to record the following transactions and events. 1) Estimated revenue for the fiscal year were $250,000 and appropriations were $248,000. 2) The tax levy for the fiscal year, of which 99% is believed to be collectible, was $200,000. 3) Taxes collected were $150,000. 4) A short term loan of $15,000 was made to the special revenue fund. 5) Orders for supplies were placed in the amount of $18,000. Use the purchase method. 6) The items ordered in transaction 5 were received. Actual cost was $18,150 and vouchers for that amount were prepared. 7) Materials were acquired from the stores fund (an internal service fund) in the amount of $800 (without encumbrance). 8) A $5,000 payment (transfer) was made to the debt service fund. 9) A cash payment of $15,000 was made for the purchase of equipment. 10) Licenses were collected in the amount of $3,000. 11) The balance of taxes receivable became delinquent. 12) Delinquent taxes of $30,000 were collected before year end. The remaining net realizable value of delinquent taxes is expected to be collected uniformly over the first four months of the next fiscal year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started