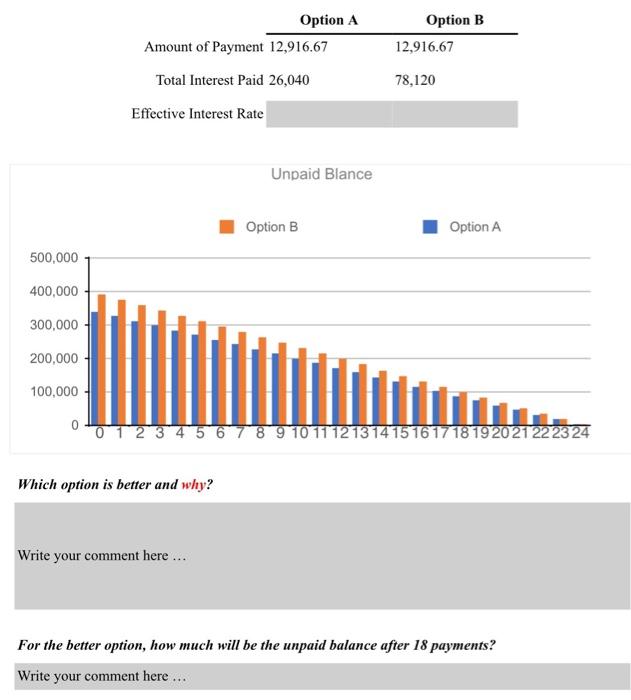

i need answers of the grey cells which is effective interest rate and which option is better and last question

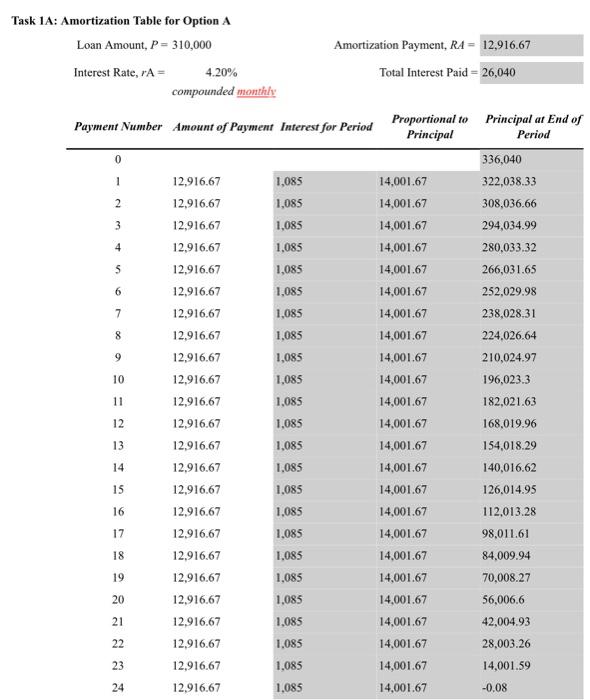

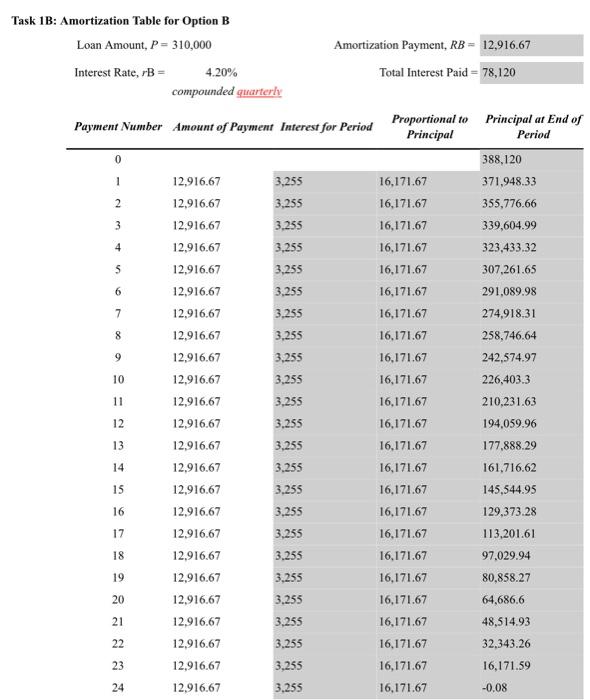

0 1 3 4 8 Task 1A: Amortization Table for Option A Loan Amount, P= 310,000 Amortization Payment, RA = 12,916.67 Interest Rate, rA - 4.20% Total Interest Paid = 26,040 compounded monthly Payment Number Amount of Payment Interest for Period Proportional to Principal at End of Principal Period 336,040 12,916.67 1,085 14.001.67 322,038.33 2 12,916.67 1,085 14,001.67 308,036.66 12,916.67 1,085 14,001.67 294,034.99 12,916.67 1.085 14,001.67 280.033.32 S 12,916.67 1,085 14,001.67 266,031.65 6 12,916.67 1,085 14.001.67 252,029.98 7 12,916.67 1,085 14.001.67 238,028.31 12,916.67 1,085 14.001.67 224.026.64 9 12,916.67 1,085 14.001.67 210,024.97 10 12,916.67 1,085 14.001.67 196,023.3 11 12,916.67 1,085 14.001.67 182,021.63 12 12,916.67 1,085 14,001.67 168,019.96 13 12,916.67 1,085 14.001.67 154,018.29 14 12,916.67 14,001.67 140,016.62 15 12,916.67 1,085 14,001.67 126.014.95 16 12,916.67 1,085 14,001.67 112,013.28 17 12,916,67 1,085 14.001.67 98,011.61 18 12,916.67 1,085 14,001.67 84,009.94 19 12,916.67 1,085 14,001.67 70,008.27 20 12,916.67 1,085 14,001.67 56,006.6 21 12,916.67 1,085 14.001.67 42,004.93 12,916.67 1,085 14,001.67 28,003.26 23 12,916.67 1,085 14,001.67 14,001.59 24 12,916.67 1,085 14.001.67 -0.08 1,085 Task 1B: Amortization Table for Option B Loan Amount, P-310,000 Interest Rate, rB = 4.20% compounded quarterly Amortization Payment, RB = 12,916.67 Total Interest Paid = 78,120 Payment Number Amount of Payment Interest for Period Proportional to Principal at End of Principal Period 0 388,120 1 12,916.67 3,255 16,171.67 371,948.33 2 12,916.67 3,255 16,171.67 355,776.66 3 12,916.67 3.255 16,171.67 339,604.99 4 12,916.67 3.255 16.171.67 323,433.32 S 12,916.67 3,255 16,171.67 307,261.65 6 12,916.67 3.255 16,171.67 291,089.98 7 12,916.67 3,255 16,171.67 274,918.31 8 12,916.67 3,255 16,171.67 258,746.64 9 12,916.67 3,255 16,171.67 242,574.97 10 12,916.67 3.255 16,171.67 226,403.3 11 12,916.67 3.255 16,171.67 210,231.63 12 12,916.67 3.255 16,171.67 194,059.96 13 12,916.67 3,255 16,171.67 177.888.29 14 12,916.67 3.255 16,171.67 161,716.62 15 12,916.67 3.255 16,171.67 145,544.95 16 12,916.67 3,255 16,171.67 129,373.28 17 12,916,67 3.255 16,171.67 113,201.61 18 12,916.67 3.255 16,171.67 97,029.94 19 12,916.67 3.255 16,171.67 80,858.27 20 12,916.67 3.255 16,171.67 64,686,6 21 12,916.67 3,255 16,171.67 48,514.93 12,916.67 3.255 16,171.67 32.343.26 23 12,916.67 3,255 16,171.67 16,171.59 24 12,916.67 3.255 16,171.67 -0.08 Option B 12,916.67 Option A Amount of Payment 12,916.67 Total Interest Paid 26,040 Effective Interest Rate 78,120 Unpaid Blance Option B Option A 500,000 400,000 300,000 200,000 100,000 0 0 1 2 3 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Which option is better and why? Write your comment here ... For the better option, how much will be the unpaid balance after 18 payments? Write your comment here