Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need anwers to this activity please Assume you are investor and planning to invest your money in riskless financial securities. You decides to invest

i need anwers to this activity please

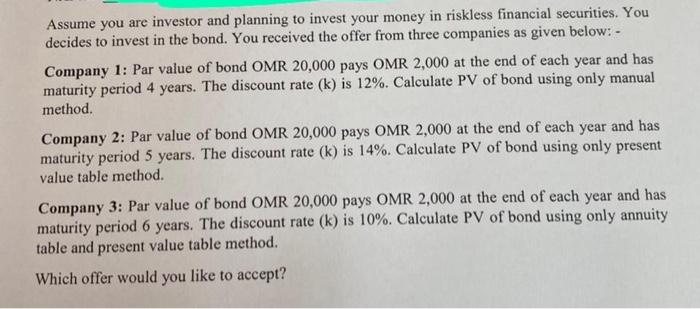

Assume you are investor and planning to invest your money in riskless financial securities. You decides to invest in the bond. You received the offer from three companies as given below:- Company 1: Par value of bond OMR 20,000 pays OMR 2,000 at the end of each year and has maturity period 4 years. The discount rate (k) is 12%. Calculate PV of bond using only manual method. Company 2: Par value of bond OMR 20,000 pays OMR 2,000 at the end of each year and has maturity period 5 years. The discount rate (k) is 14%. Calculate PV of bond using only present value table method. Company 3: Par value of bond OMR 20,000 pays OMR 2,000 at the end of each year and has maturity period 6 years. The discount rate (k) is 10%. Calculate PV of bond using only annuity table and present value table method. Which offer would you like to accept

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started