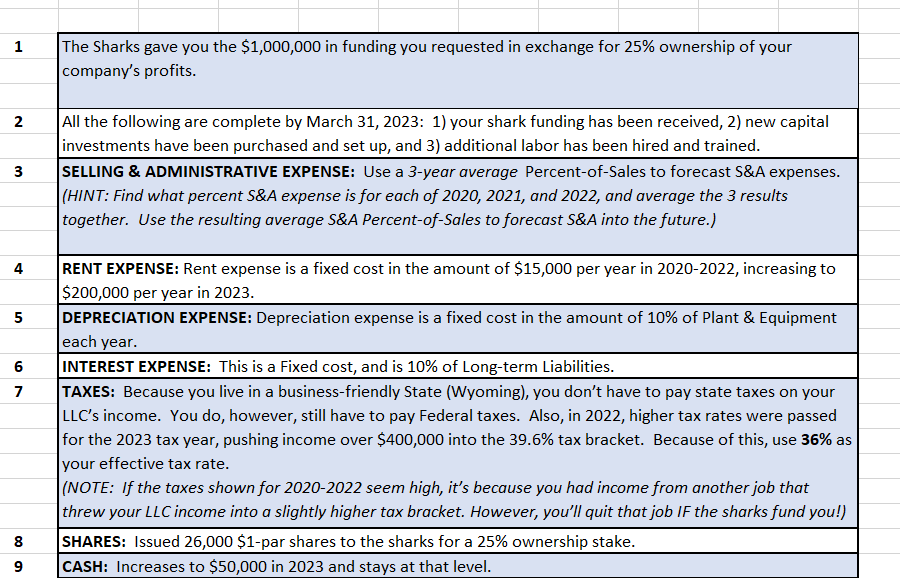

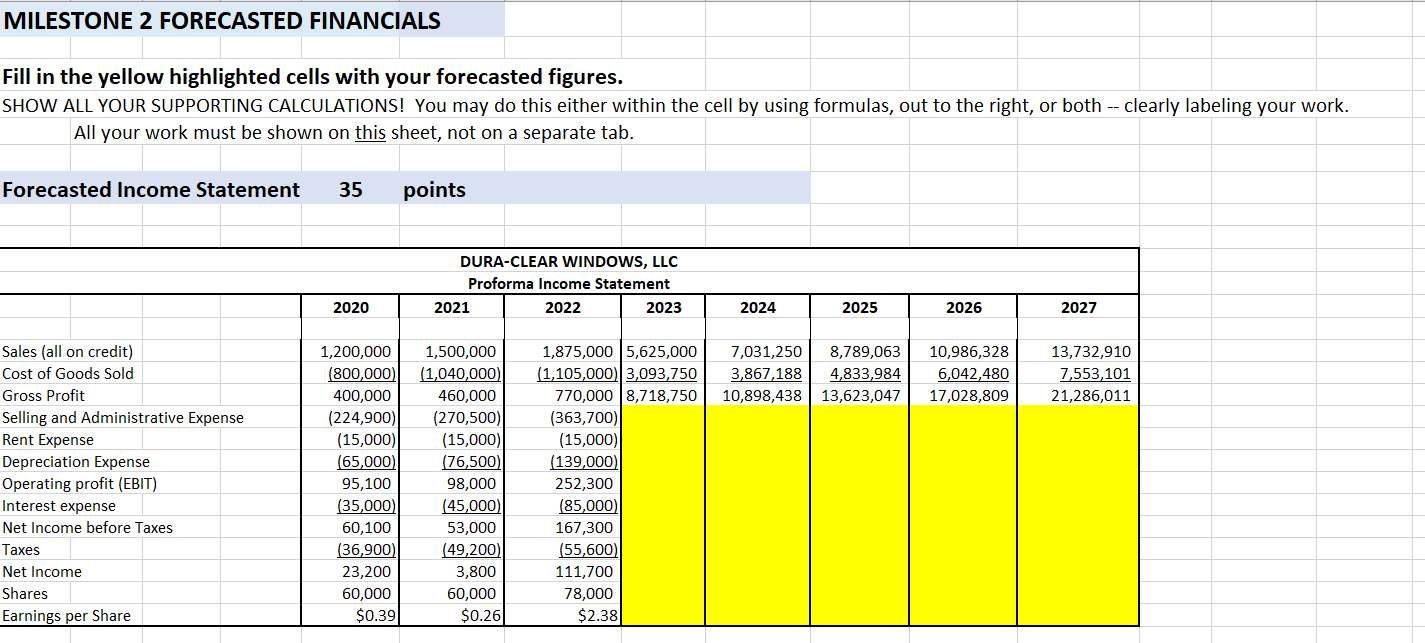

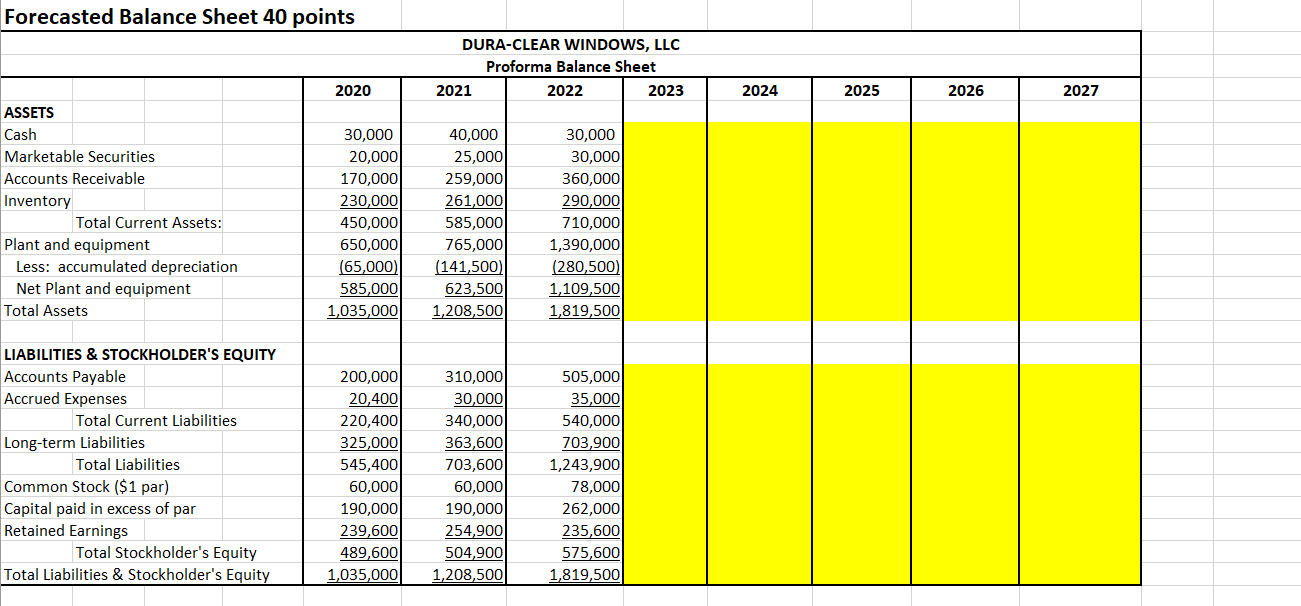

I need assistance in this. I have posted the information that was given and would like help and the break down of how those answers were acquired. Based on the assumptions provided, I have to obtain the data to put into the yellow fields in the spreadsheet. I am looking for the answers and how to get the them for the fields in yellow.

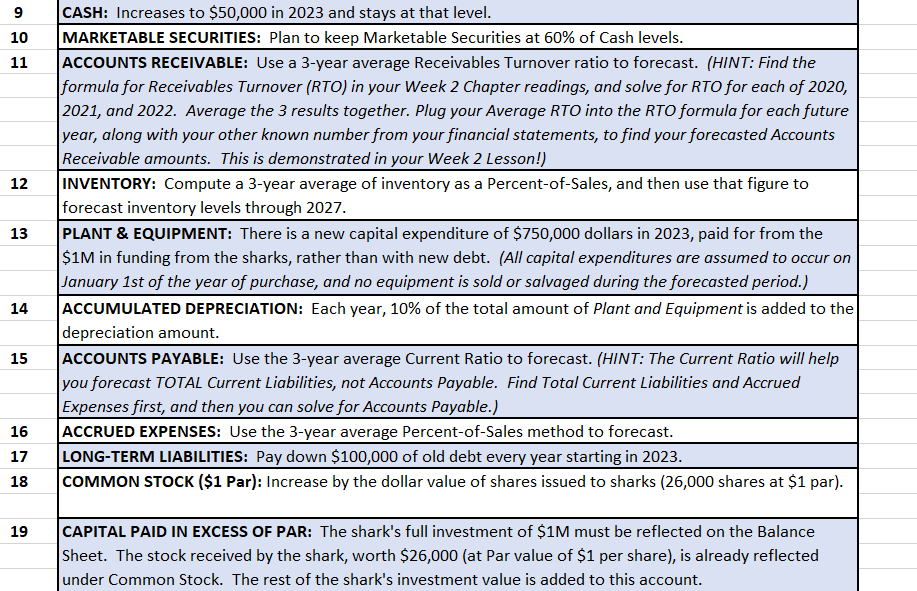

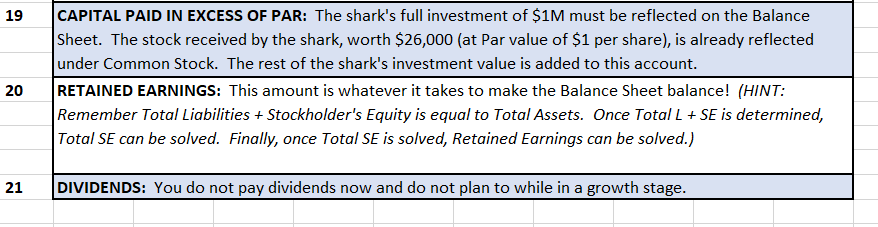

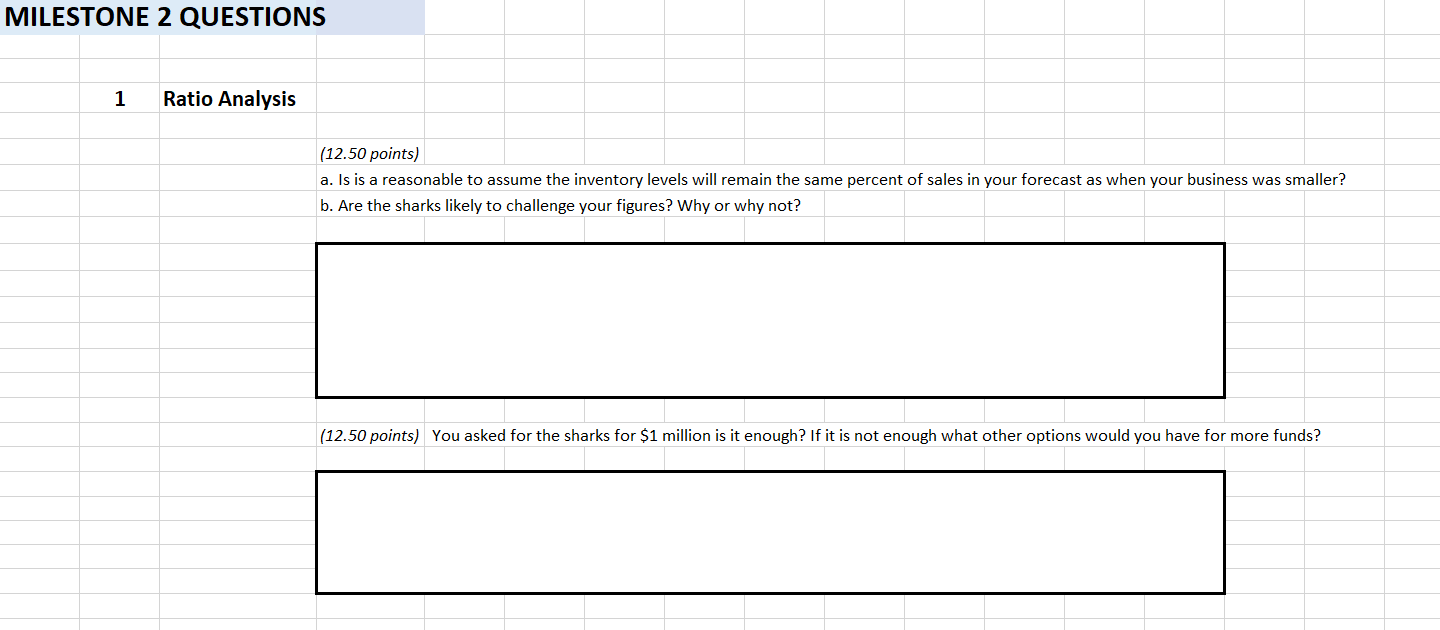

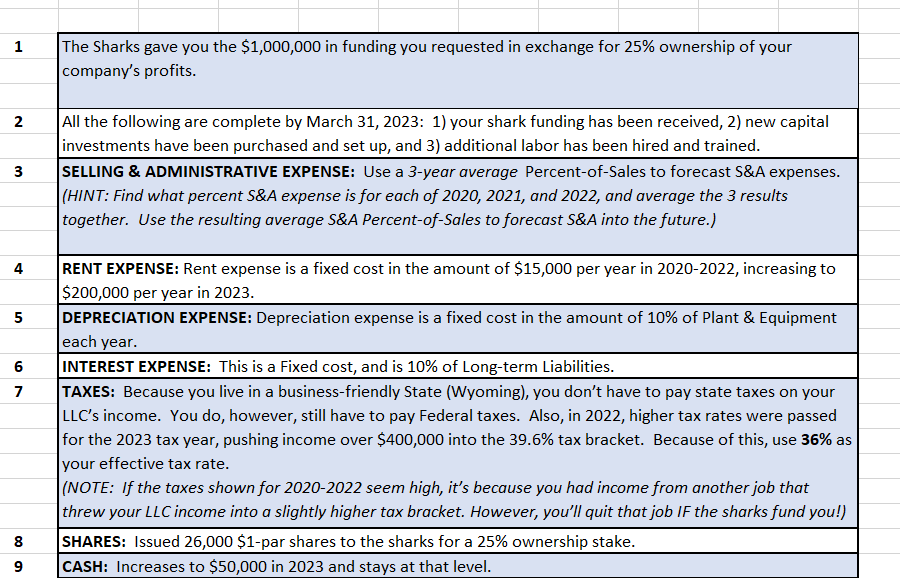

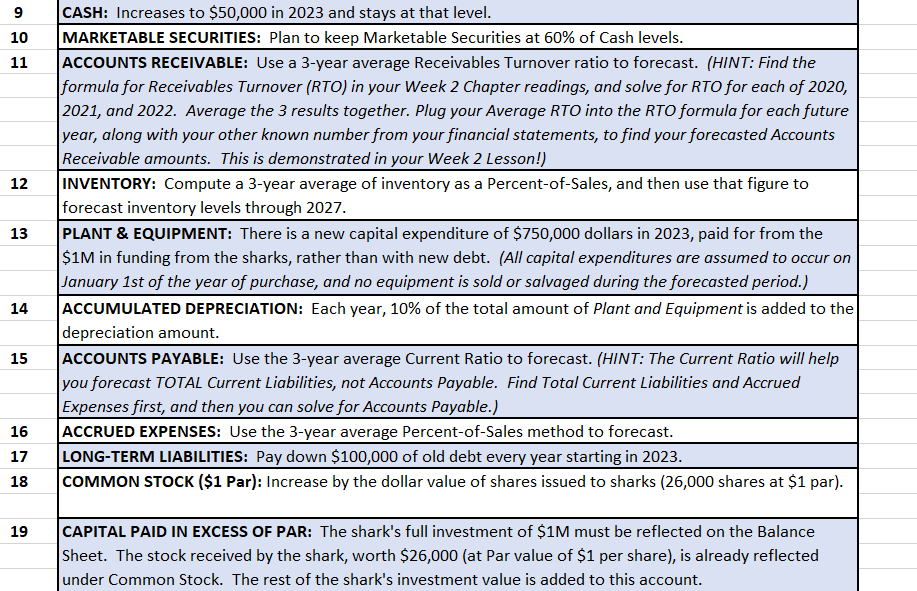

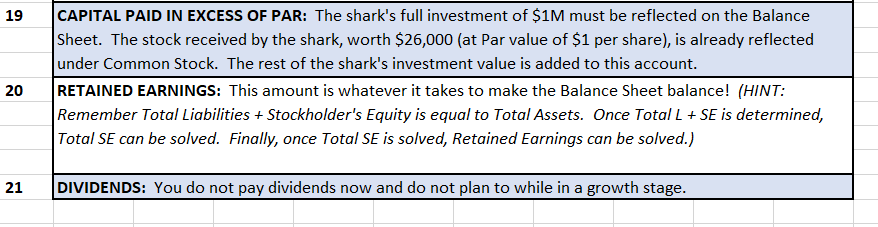

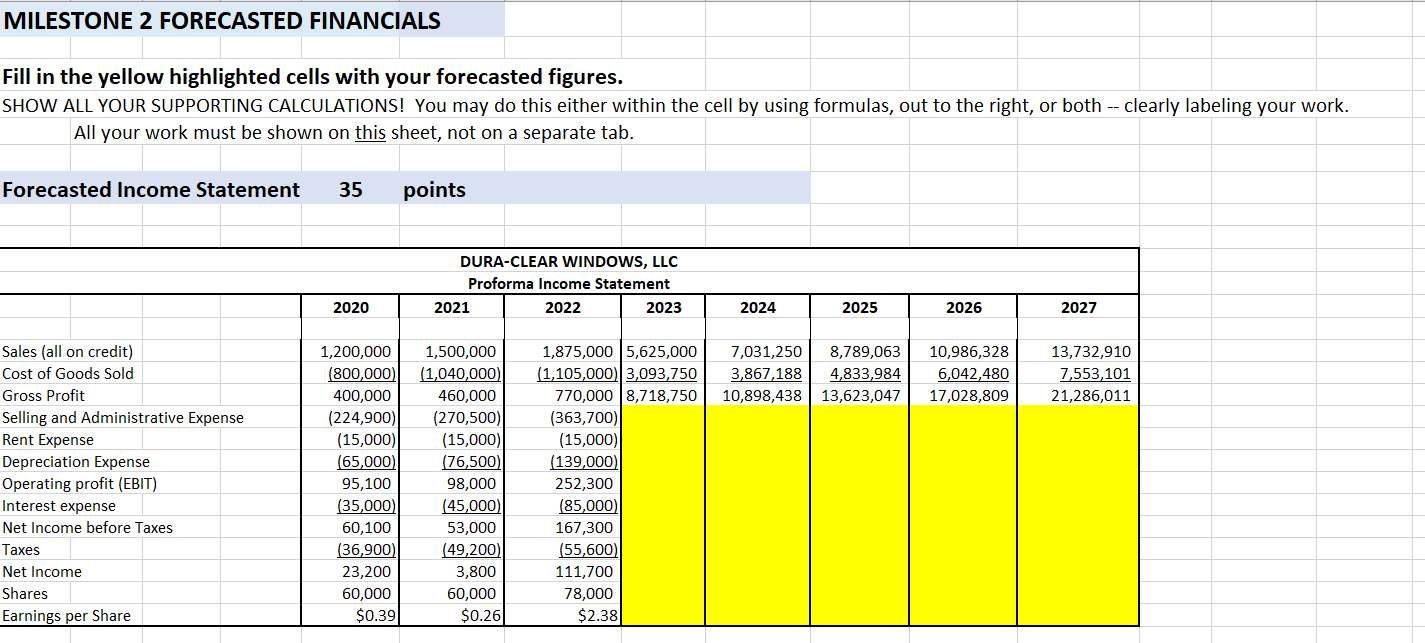

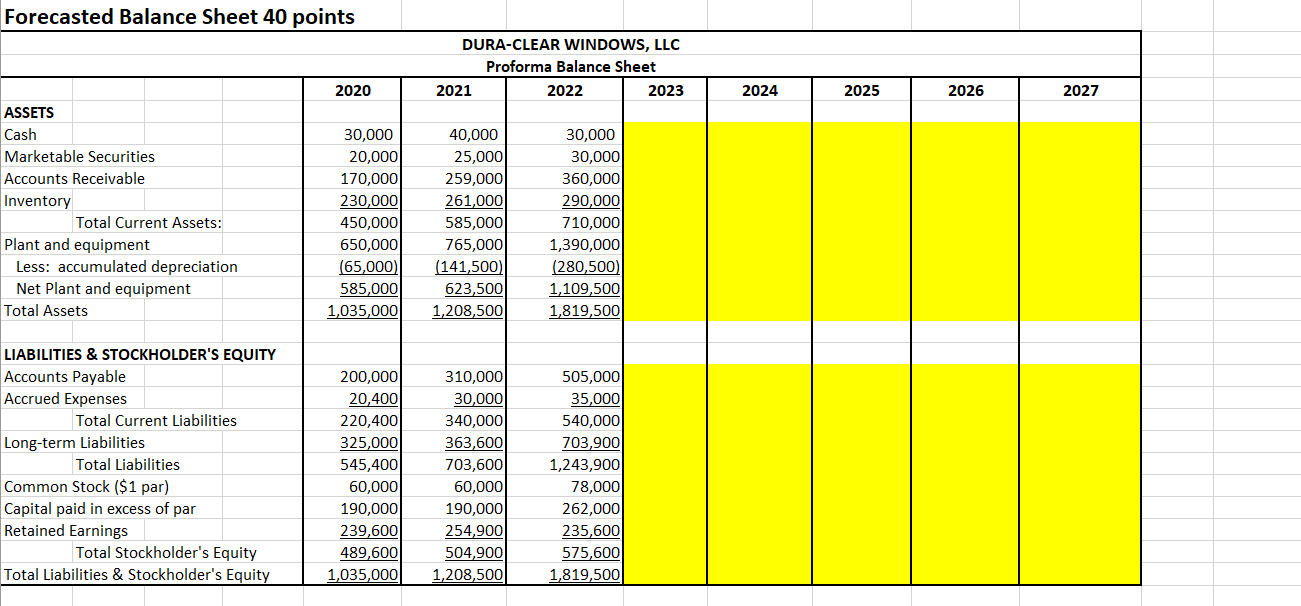

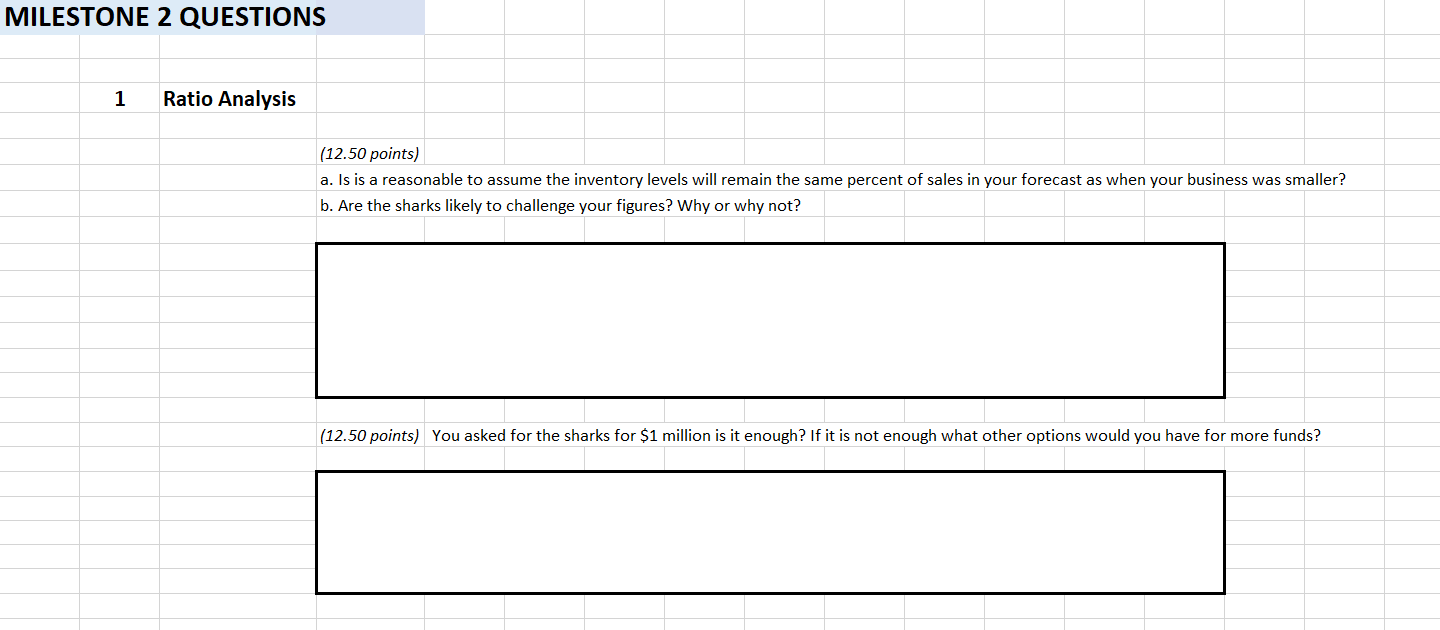

CASH: Increases to $50,000 in 2023 and stays at that level. MARKETABLE SECURITIES: Plan to keep Marketable Securities at 60% of Cash levels. ACCOUNTS RECEIVABLE: Use a 3-year average Receivables Turnover ratio to forecast. (HINT: Find the formula for Receivables Turnover (RTO) in your Week 2 Chapter readings, and solve for RTO for each of 2020, 2021, and 2022. Average the 3 results together. Plug your Average RTO into the RTO formula for each future year, along with your other known number from your financial statements, to find your forecasted Accounts Receivable amounts. This is demonstrated in your Week 2 Lesson!) INVENTORY: Compute a 3-year average of inventory as a Percent-of-Sales, and then use that figure to forecast inventory levels through 2027. PLANT \& EQUIPMENT: There is a new capital expenditure of \$750,000 dollars in 2023, paid for from the $1M in funding from the sharks, rather than with new debt. (All capital expenditures are assumed to occur on January 1st of the year of purchase, and no equipment is sold or salvaged during the forecasted period.) ACCUMULATED DEPRECIATION: Each year, 10\% of the total amount of Plant and Equipment is added to the depreciation amount. ACCOUNTS PAYABLE: Use the 3-year average Current Ratio to forecast. (HINT: The Current Ratio will help you forecast TOTAL Current Liabilities, not Accounts Payable. Find Total Current Liabilities and Accrued Expenses first, and then you can solve for Accounts Payable.) ACCRUED EXPENSES: Use the 3-year average Percent-of-Sales method to forecast. LONG-TERM LIABILITIES: Pay down $100,000 of old debt every year starting in 2023. COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at $1 par). 19 CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of \$1M must be reflected on the Balance Sheet. The stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. 9 CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of $1M must be reflected on the Balance Sheet. The stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. RETAINED EARNINGS: This amount is whatever it takes to make the Balance Sheet balance! (HINT: Remember Total Liabilities + Stockholder's Equity is equal to Total Assets. Once Total L + SE is determined, Total SE can be solved. Finally, once Total SE is solved, Retained Earnings can be solved.) MILESTONE 2 FORECASTED FINANCIALS Fill in the yellow highlighted cells with your forecasted figures. SHOW ALL YOUR SUPPORTING CALCULATIONS! You may do this either within the cell by using formulas, out to the right, or both -- clearly labeling your work. All your work must be shown on this sheet, not on a separate tab. Forecasted Balance Sheet 40 points DURA-CLEAR WINDOWS, LLC Proforma Balance Sheet MILESTONE 2 QUESTIONS 1 Ratio Analysis (12.50 points) a. Is is a reasonable to assume the inventory levels will remain the same percent of sales in your forecast as when your business was smaller? b. Are the sharks likely to challenge your figures? Why or why not? (12.50 points) You asked for the sharks for $1 million is it enough? If it is not enough what other options would you have for more funds? CASH: Increases to $50,000 in 2023 and stays at that level. MARKETABLE SECURITIES: Plan to keep Marketable Securities at 60% of Cash levels. ACCOUNTS RECEIVABLE: Use a 3-year average Receivables Turnover ratio to forecast. (HINT: Find the formula for Receivables Turnover (RTO) in your Week 2 Chapter readings, and solve for RTO for each of 2020, 2021, and 2022. Average the 3 results together. Plug your Average RTO into the RTO formula for each future year, along with your other known number from your financial statements, to find your forecasted Accounts Receivable amounts. This is demonstrated in your Week 2 Lesson!) INVENTORY: Compute a 3-year average of inventory as a Percent-of-Sales, and then use that figure to forecast inventory levels through 2027. PLANT \& EQUIPMENT: There is a new capital expenditure of \$750,000 dollars in 2023, paid for from the $1M in funding from the sharks, rather than with new debt. (All capital expenditures are assumed to occur on January 1st of the year of purchase, and no equipment is sold or salvaged during the forecasted period.) ACCUMULATED DEPRECIATION: Each year, 10\% of the total amount of Plant and Equipment is added to the depreciation amount. ACCOUNTS PAYABLE: Use the 3-year average Current Ratio to forecast. (HINT: The Current Ratio will help you forecast TOTAL Current Liabilities, not Accounts Payable. Find Total Current Liabilities and Accrued Expenses first, and then you can solve for Accounts Payable.) ACCRUED EXPENSES: Use the 3-year average Percent-of-Sales method to forecast. LONG-TERM LIABILITIES: Pay down $100,000 of old debt every year starting in 2023. COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at $1 par). 19 CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of \$1M must be reflected on the Balance Sheet. The stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. 9 CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of $1M must be reflected on the Balance Sheet. The stock received by the shark, worth $26,000 (at Par value of $1 per share), is already reflected under Common Stock. The rest of the shark's investment value is added to this account. RETAINED EARNINGS: This amount is whatever it takes to make the Balance Sheet balance! (HINT: Remember Total Liabilities + Stockholder's Equity is equal to Total Assets. Once Total L + SE is determined, Total SE can be solved. Finally, once Total SE is solved, Retained Earnings can be solved.) MILESTONE 2 FORECASTED FINANCIALS Fill in the yellow highlighted cells with your forecasted figures. SHOW ALL YOUR SUPPORTING CALCULATIONS! You may do this either within the cell by using formulas, out to the right, or both -- clearly labeling your work. All your work must be shown on this sheet, not on a separate tab. Forecasted Balance Sheet 40 points DURA-CLEAR WINDOWS, LLC Proforma Balance Sheet MILESTONE 2 QUESTIONS 1 Ratio Analysis (12.50 points) a. Is is a reasonable to assume the inventory levels will remain the same percent of sales in your forecast as when your business was smaller? b. Are the sharks likely to challenge your figures? Why or why not? (12.50 points) You asked for the sharks for $1 million is it enough? If it is not enough what other options would you have for more funds