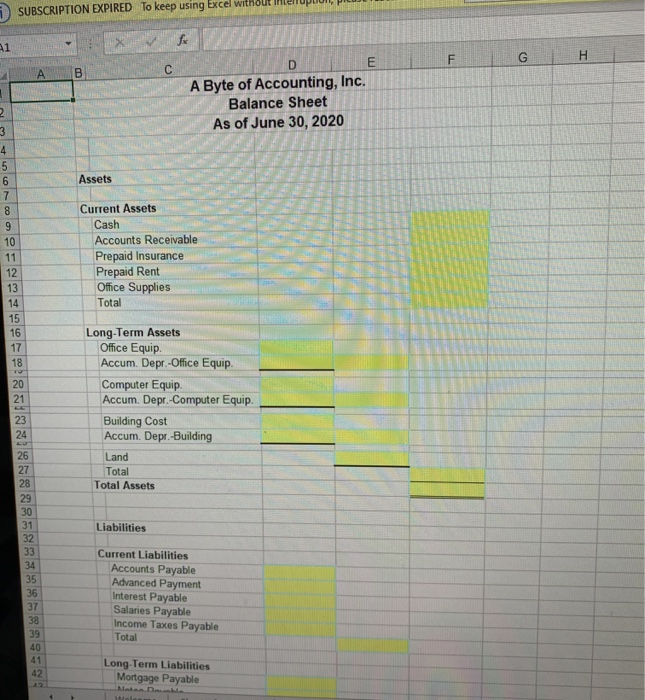

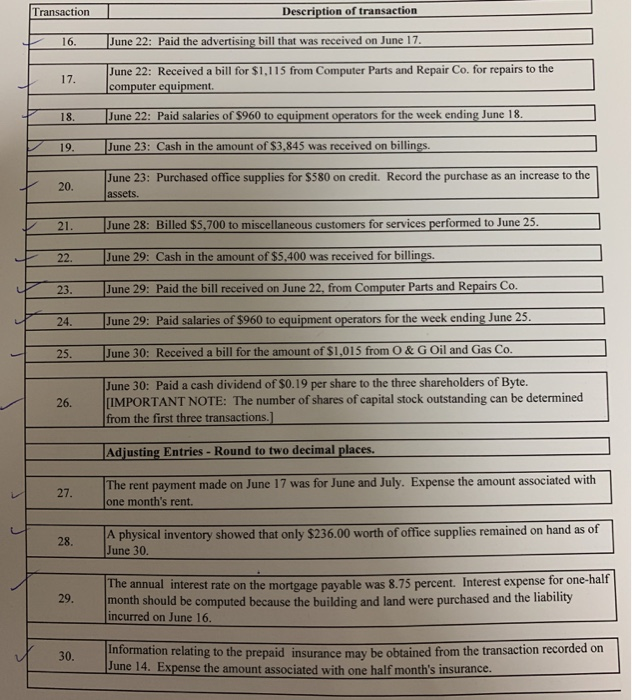

i need assistance with #32-39, the income statement, changes in retained earrnings, and balance sheet. i posted all transactions.

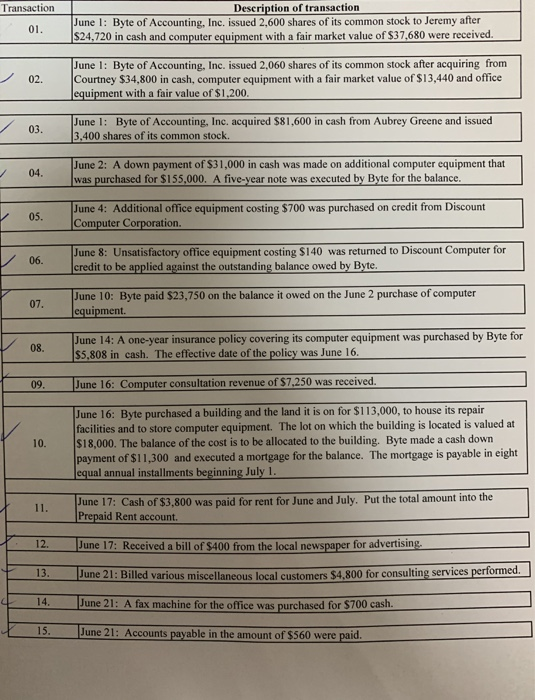

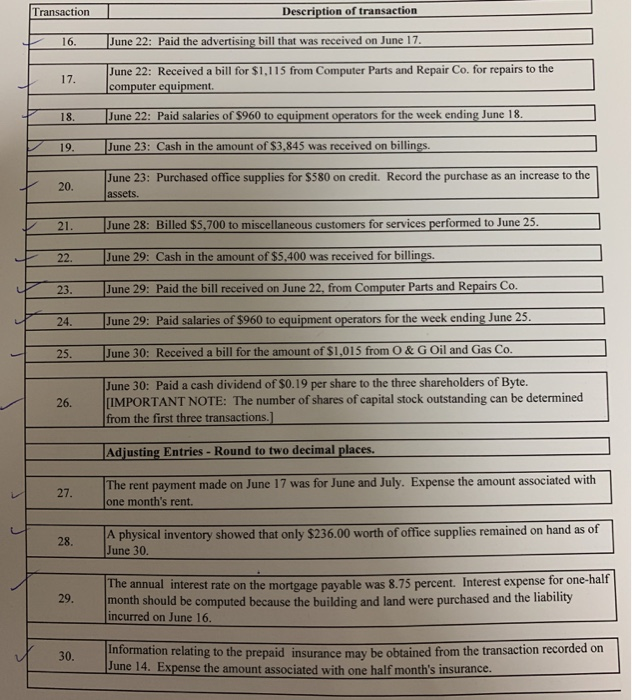

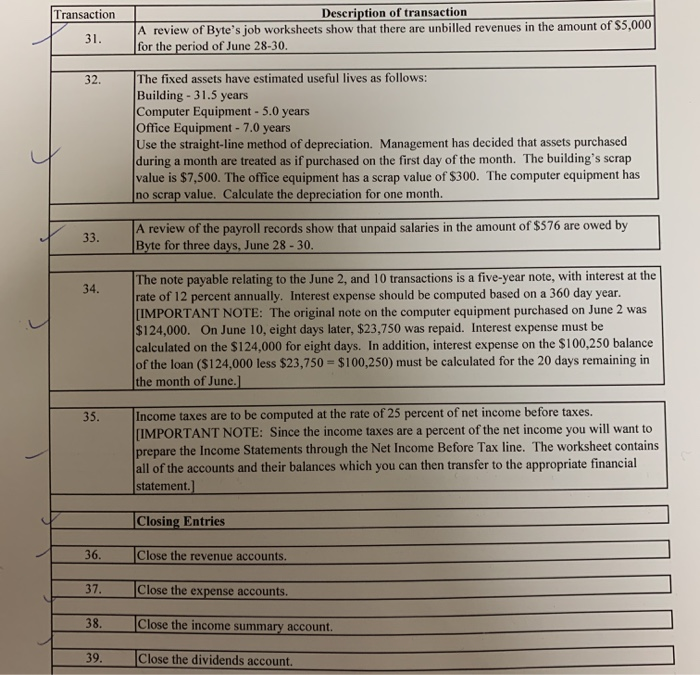

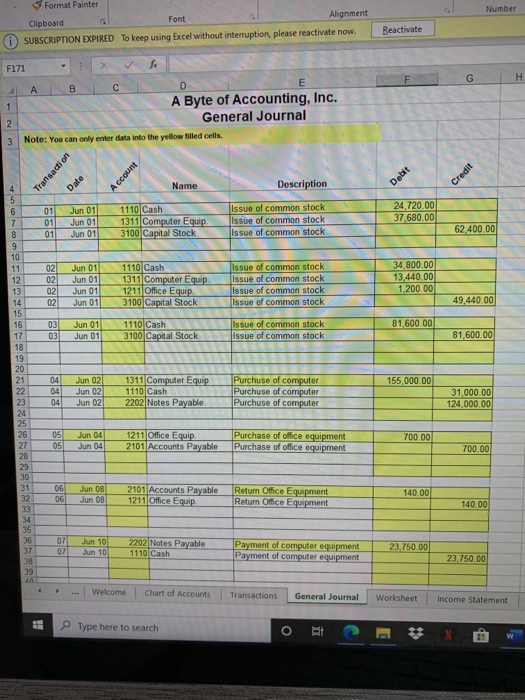

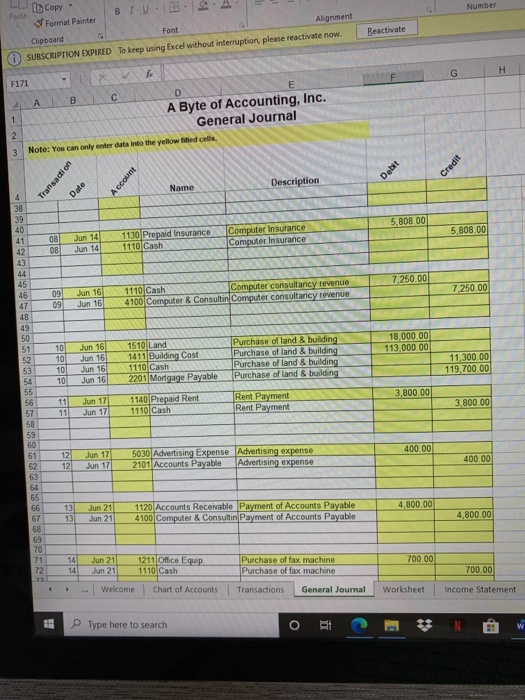

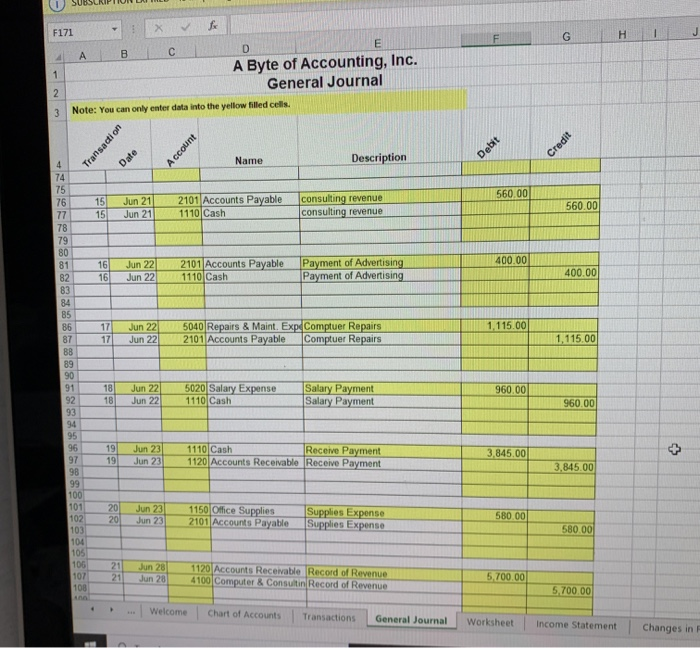

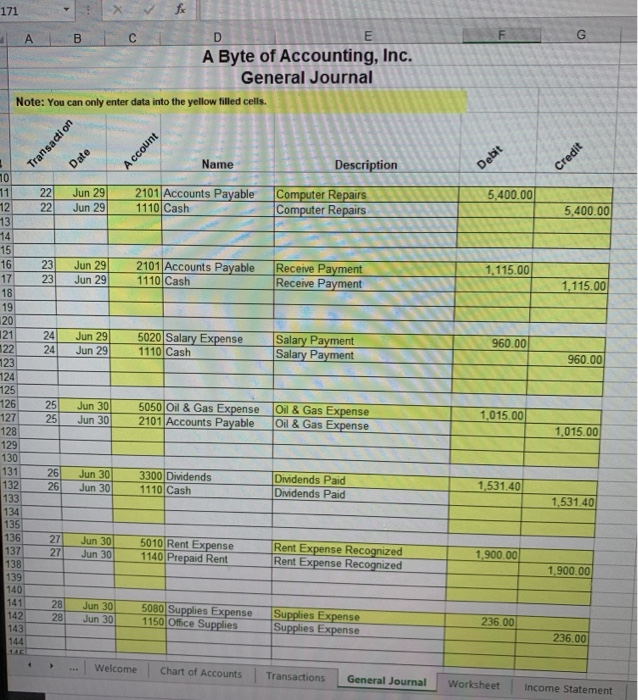

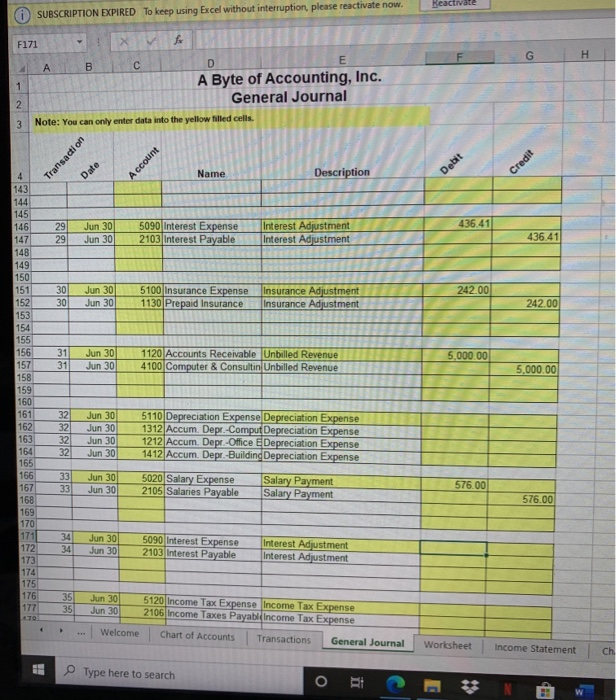

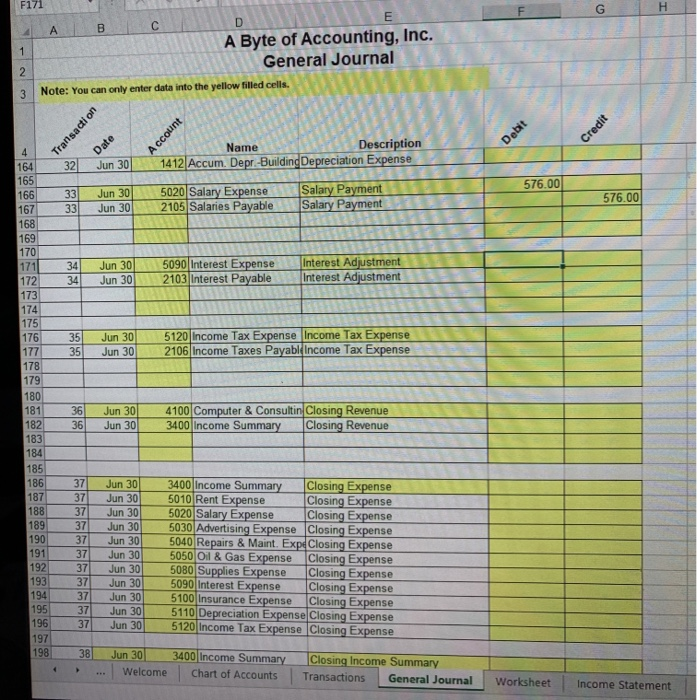

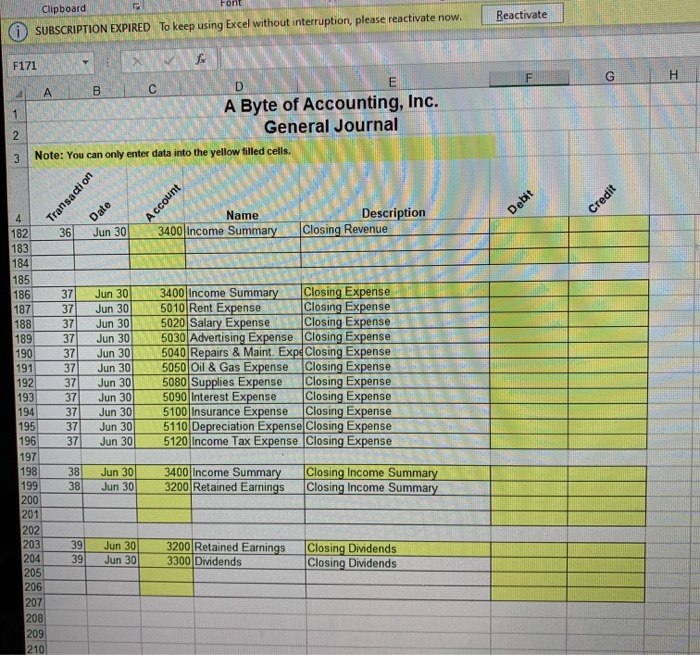

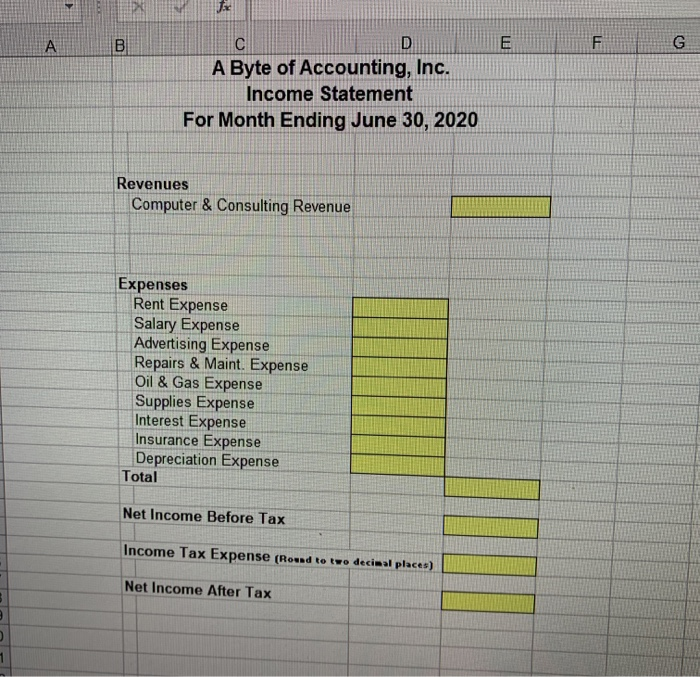

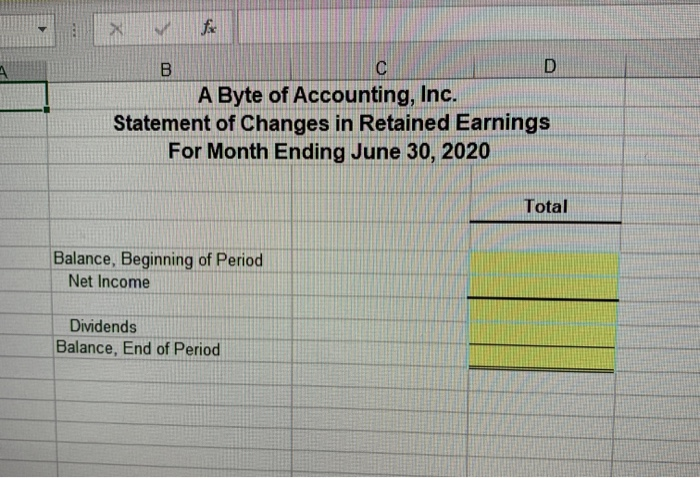

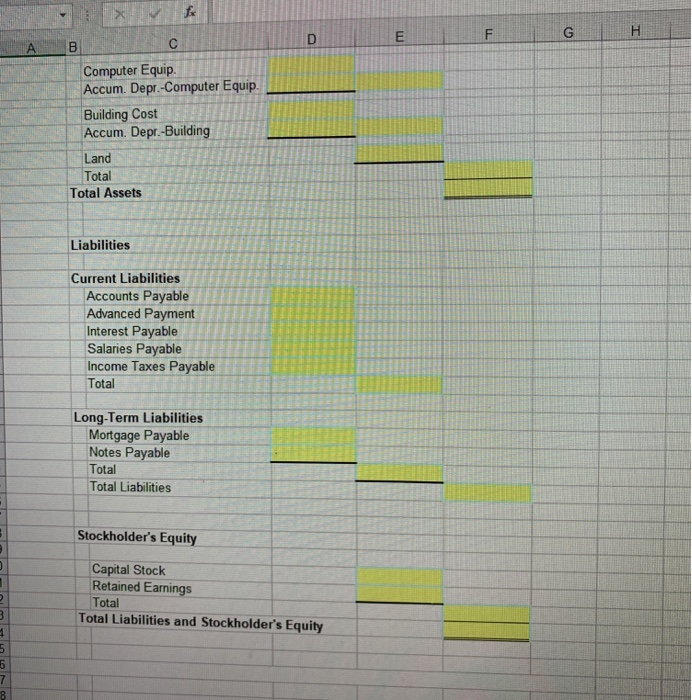

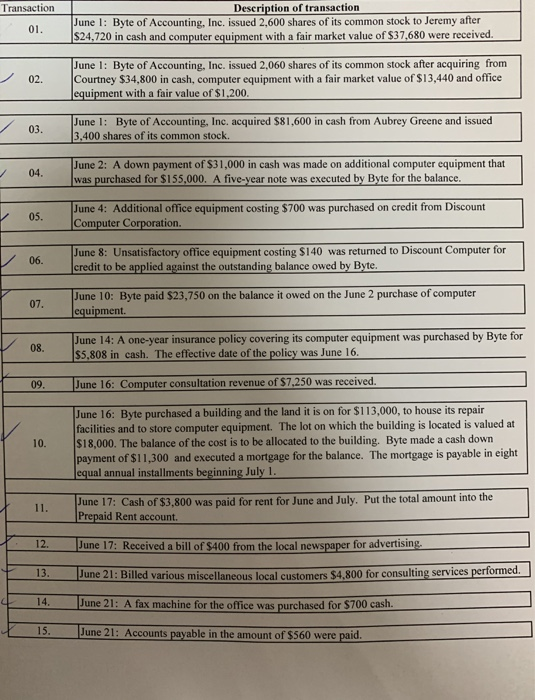

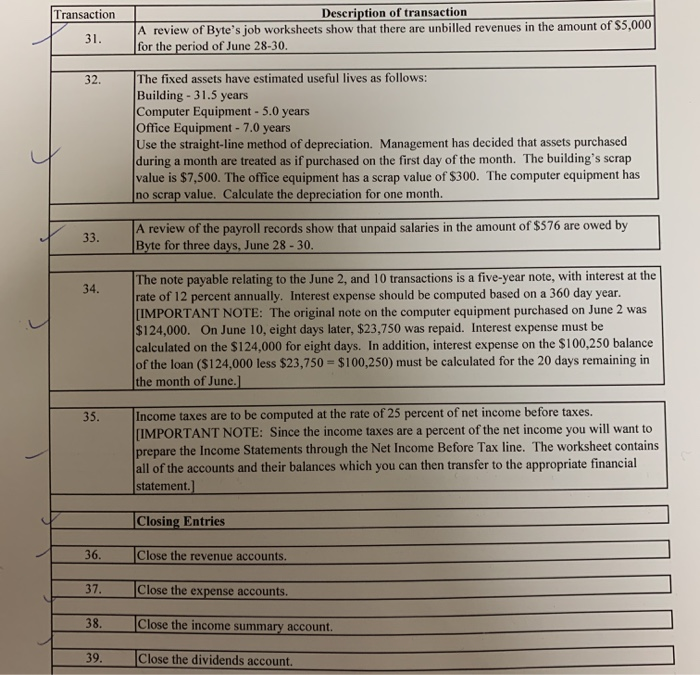

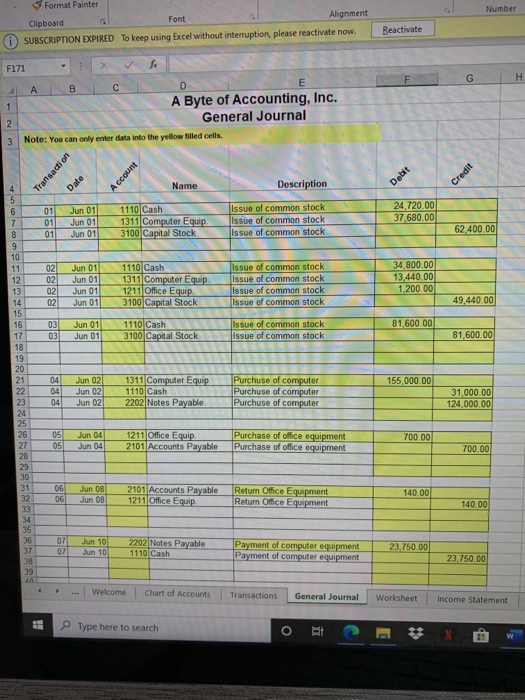

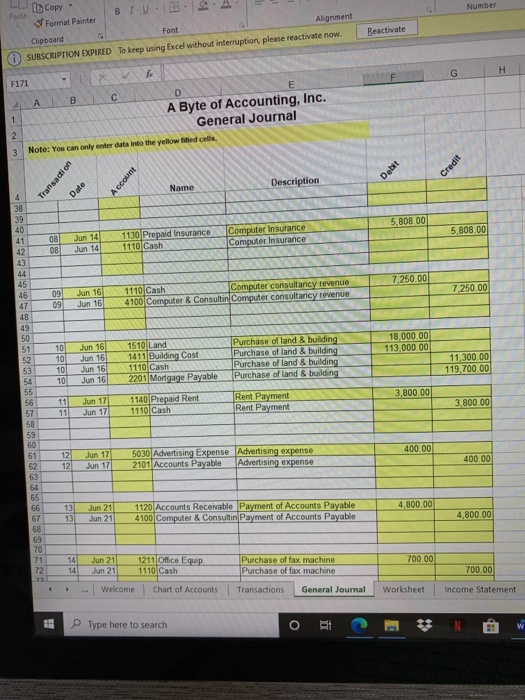

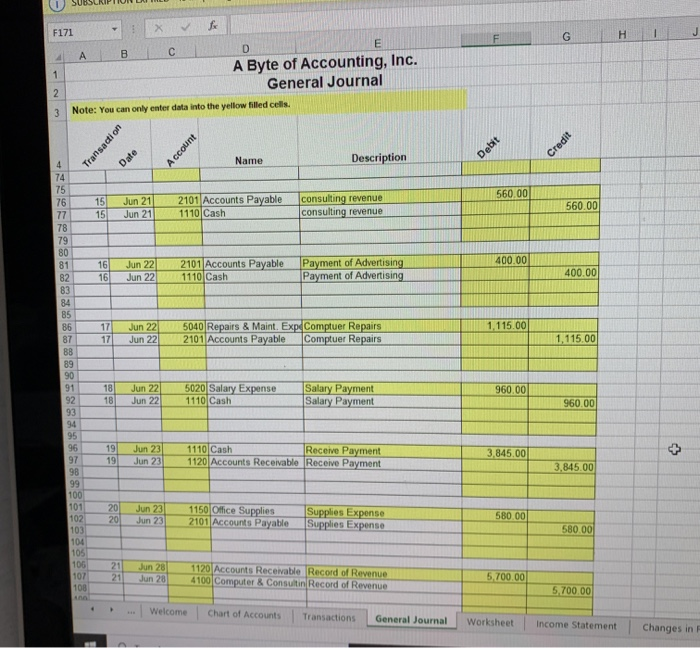

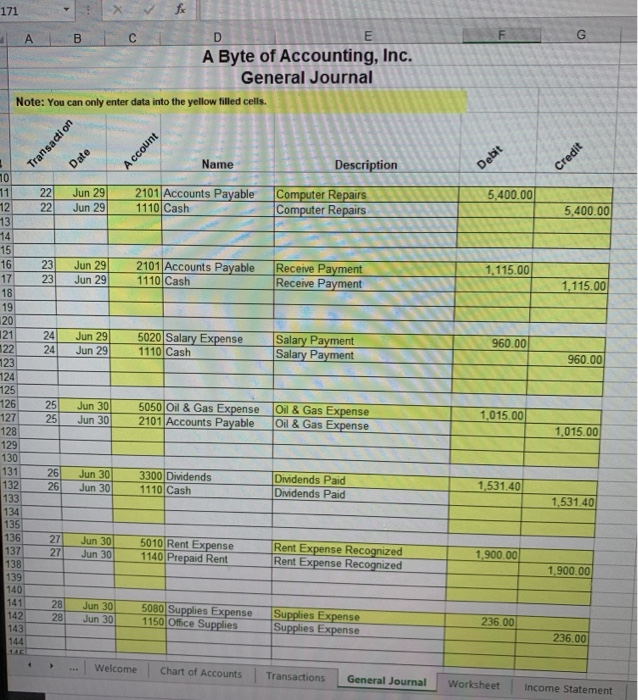

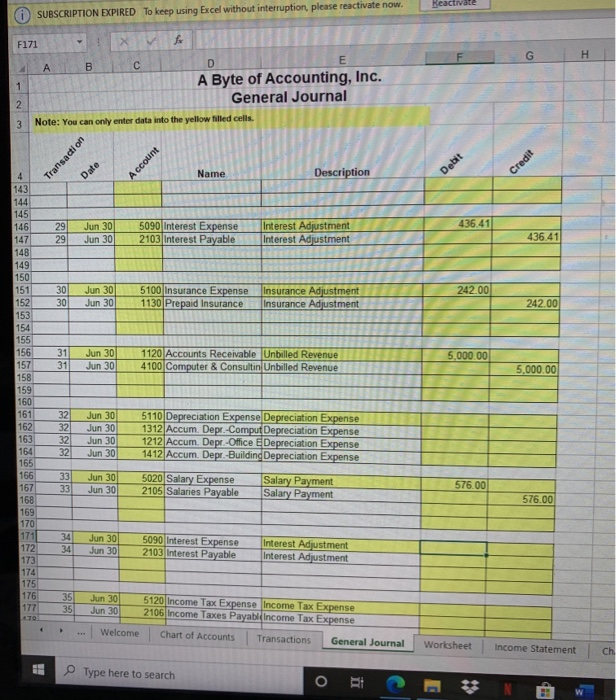

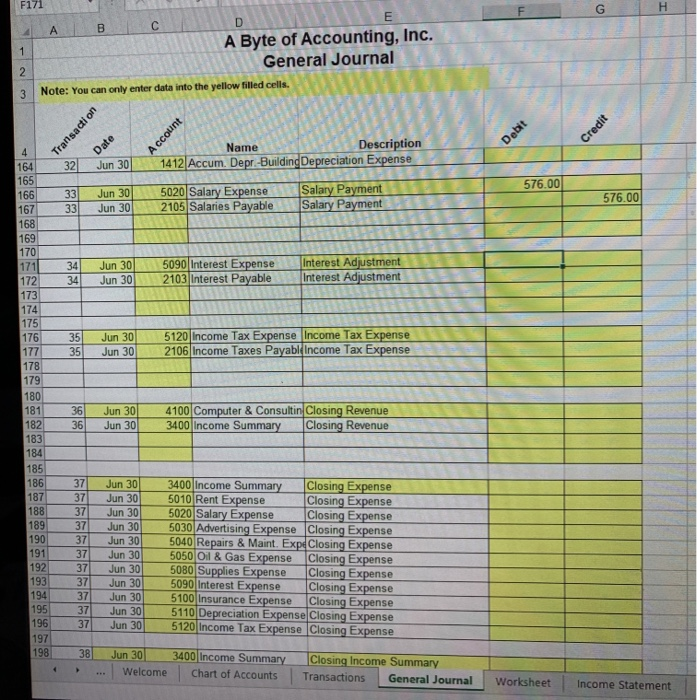

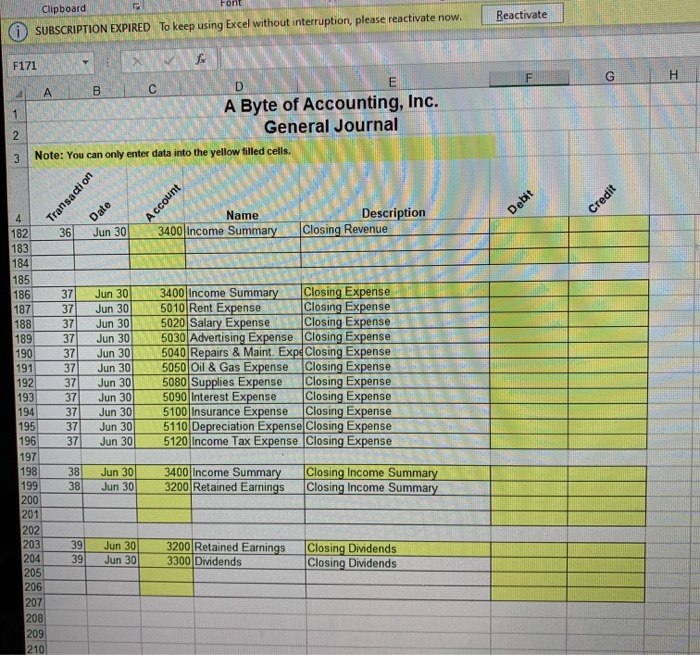

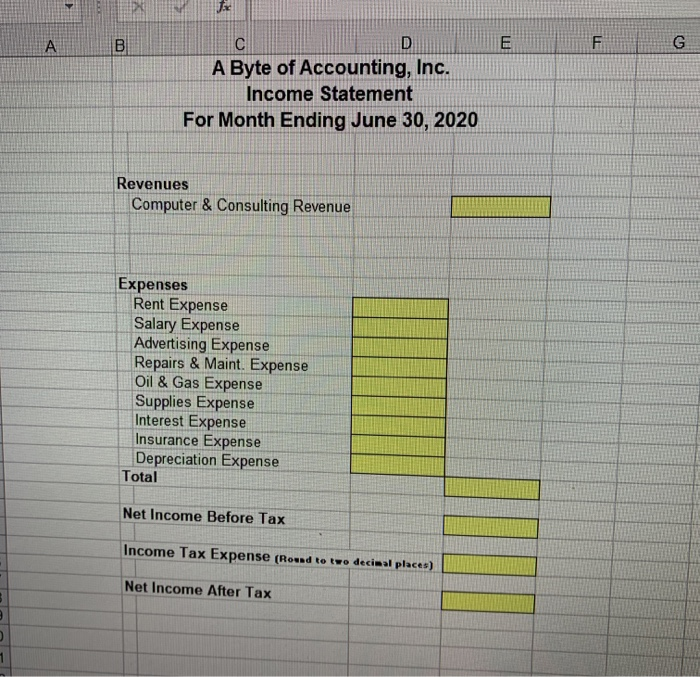

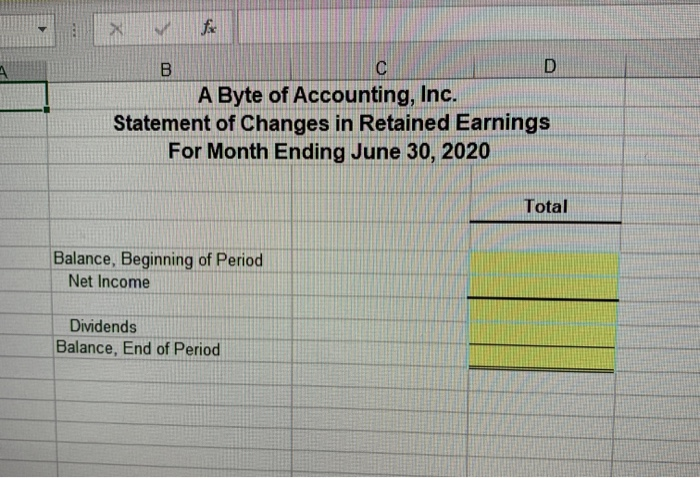

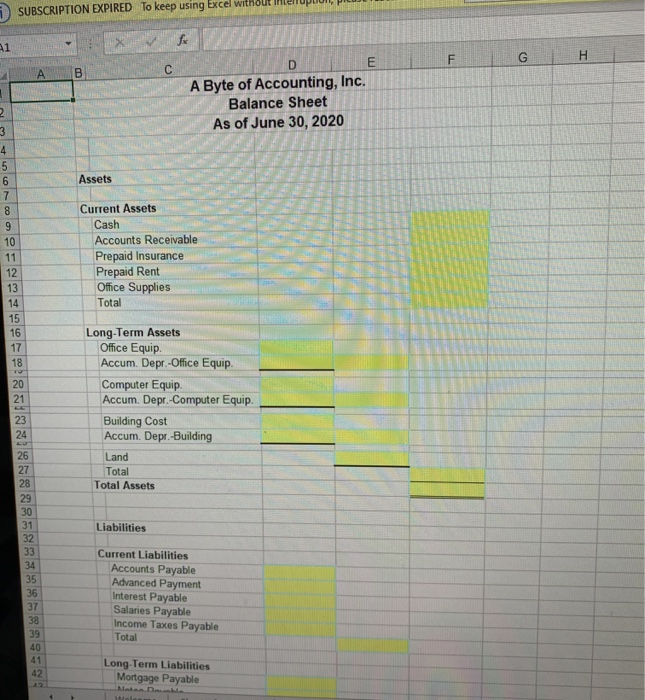

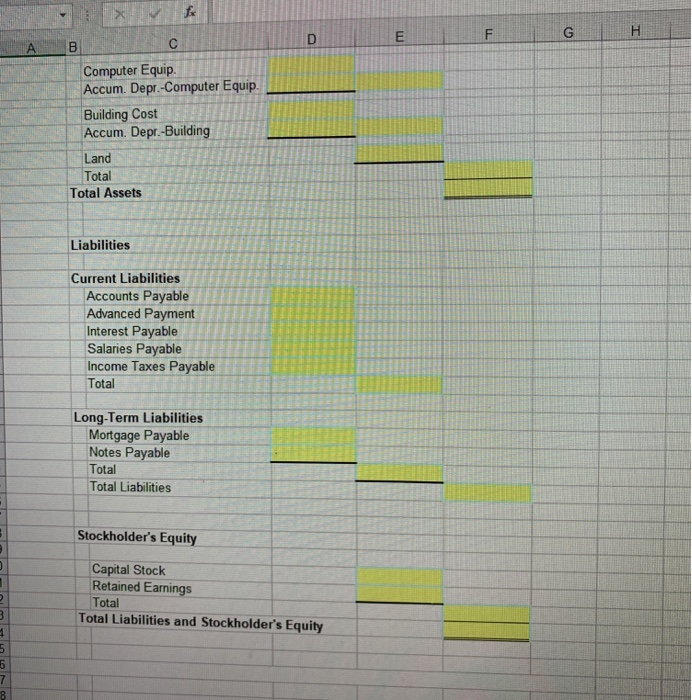

Transaction 01. Description of transaction June 1: Byte of Accounting, Inc. issued 2,600 shares of its common stock to Jeremy after $24,720 in cash and computer equipment with a fair market value of $37,680 were received 02. June 1: Byte of Accounting, Inc. issued 2,060 shares of its common stock after acquiring from Courtney $34,800 in cash, computer equipment with a fair market value of $13,440 and office equipment with a fair value of $1,200. 03. June 1: Byte of Accounting, Inc. acquired $81,600 in cash from Aubrey Greene and issued 3,400 shares of its common stock. 04. June 2: A down payment of $31,000 in cash was made on additional computer equipment that was purchased for $155,000. A five-year note was executed by Byte for the balance. 05. June 4: Additional office equipment costing $700 was purchased on credit from Discount Computer Corporation. 06. June 8: Unsatisfactory office equipment costing $140 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 07. June 10: Byte paid $23,750 on the balance it owed on the June 2 purchase of computer equipment 08. June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $5.808 in cash. The effective date of the policy was June 16. 09. June 16: Computer consultation revenue of $7.250 was received. 10. June 16: Byte purchased a building and the land it is on for $113,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $18,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $11,300 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments beginning July 1. 11. June 17: Cash of $3,800 was paid for rent for June and July. Put the total amount into the Prepaid Rent account. 12. June 17: Received a bill of $400 from the local newspaper for advertising. 13. June 21: Billed various miscellaneous local customers $4.800 for consulting services performed. 14. June 21: A fax machine for the office was purchased for $700 cash. 15. June 21: Accounts payable in the amount of $560 were paid. Transaction Description of transaction 16. June 22: Paid the advertising bill that was received on June 17. 17. June 22: Received a bill for $1,115 from Computer Parts and Repair Co. for repairs to the computer equipment 18. June 22: Paid salaries of $960 to equipment operators for the week ending June 18. 19. June 23: Cash in the amount of $3,845 was received on billings. 20. June 23: Purchased office supplies for $580 on credit. Record the purchase as an increase to the assets. 21. June 28: Billed $5,700 to miscellaneous customers for services performed to June 25. 22. June 29: Cash in the amount of $5,400 was received for billings. 23. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $960 to equipment operators for the week ending June 25. 25. June 30: Received a bill for the amount of $1,015 from O&G Oil and Gas Co. 26. June 30: Paid a cash dividend of $0.19 per share to the three shareholders of Byte. [IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions. Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June and July. Expense the amount associated with one month's rent. 28. A physical inventory showed that only $236.00 worth of office supplies remained on hand as of June 30. 29. The annual interest rate on the mortgage payable was 8.75 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance. Transaction Description of transaction A review of Byte's job worksheets show that there are unbilled revenues in the amount of $5,000 for the period of June 28-30. 31. 32 The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. 33 A review of the payroll records show that unpaid salaries in the amount of $576 are owed by Byte for three days, June 28 - 30. 34. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $124,000. On June 10, eight days later, $23,750 was repaid. Interest expense must be calculated on the $124,000 for eight days. In addition, interest expense on the $100,250 balance of the loan ($124,000 less $23,750 = $100,250) must be calculated for the 20 days remaining in the month of June.] 35. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.) Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account. Number Format Painter Clipboard Font Alignment i SUBSCRIPTION EXPIRED To keep using Excel without interruption, please reactivate now. Beactivate F171 So H 4 A B D E A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. 2 3 Transaction Account Credit Name Description Date Debit 4 5 6 24,720.00 37 680.00 7 01 01 01 Jun 01 Jun 01 Jun 01 1110 Cash 1311 Computer Equip. 3100 Capital Stock Issue of common stock Issue of common stock Issue of common stock 62,400.00 00 02 02 02 02 Jun 01 Jun 01 Jun 01 Jun 01 1110 Cash 1311 Computer Equip 1211 Office Equip 3100 Capital Stock issue of common stock Issue of common stock Issue of common stock Issue of common stock 34,800.00 13,440.00 1,200.00 49,440.00 81,600 00 03 03 Jun 01 Jun 01 1110 Cash 3100 Capital Stock Issue of common stock Issue of common stock 81,600.00 155,000.00 04 04 04 Jun 02 Jun 02 Jun 02 1311 Computer Equip 1110 Cash 2202 Notes Payable Purchuse of computer Purchuse of computer Purchuse of computer 31,000.00 124,000.00 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 05 05 Jun 04 Jun 04 700.00 1211 Office Equip 2101 Accounts Payable Purchase of office equipment Purchase of office equipment 700.00 06 06 Jun 08 Jun 08 2101 Accounts Payable 1211 Office Equip Return Office Equipment Return Office Equipment 140.00 140.00 07 07 Jun 10 Jun 10 2202 Notes Payable 1110 Cash Payment of computer equipment Payment of computer equipment 23,750.00 23.750.00 Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement Type here to search o BI In copy Is Number Pasto BIU Format Painter Clipboard Font Alignment SUBSCRIPTION EXPIRED To keep using Excel without interruption, please reactivate now. Reactivate G H F171 1 B D A Byte of Accounting, Inc. General Journal 3 Note: You can only enter data into the yellow filled cells. 2 Credit Transaction Date Account Description Debit Name 4 38 39 40 41 42 5,808.00 5,808.00 08 08 Jun 14 Jun 14 1130 Prepaid Insurance 1110 Cash Computer Insurance Computer Insurance 7,250.00 7.250.00 09 09 Jun 16 Jun 16 1110 Cash Computer consultancy revenue 4100 Computer & Consultin Computer consultancy revenue 18,000.00 113,000.00 S8 pleet 10 10 10 10 Jun 16 Jun 16 Jun 16 Jun 16 Purchase of land & building Purchase of land & building Purchase of land & building Purchase of Land & building 1510 Land 1411 Building Cost 1110 Cash 2201 Mortgage Payable 1140 Prepaid Rent 1110 Cash 11,300.00 119,700.00 3,800.00 11 11 Jun 17 Jun 17 Rent Payment Rent Payment 3,800.00 44 45 45 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 61 68 69 70 71 72 400 00 12 12 Jun 17 Jun 17 5030 Advertising Expense Advertising expense 2101 Accounts Payable Advertising expense 400.00 4,800.00 13 13 Jun 21 Jun 21 1120 Accounts Receivable Payment of Accounts Payable 4100 Computer & Consultin Payment of Accounts Payable 4,800.00 700.00 14 14 Jun 21 Jun 21 1211 Office Equip 1110 Cash Purchase of fax machine Purchase of fax machine 700.00 Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement Type here to search O BI ** E F171 F J G H E D A B 1 A Byte of Accounting, Inc. General Journal 2 3 Note: You can only enter data into the yellow filled cells. Transaction Account Debit Credit Description Date Name 560.00 15 15 Jun 21 Jun 21 2101 Accounts Payable 1110 Cash consulting revenue consulting revenue 560.00 400.00 16 16 Jun 22 Jun 22 2101 Accounts Payable 1110 Cash Payment of Advertising Payment of Advertising 400.00 1.115.00 17 17 Jun 22 Jun 22 5040 Repairs & Maint. Exp Comptuer Repairs 2101 Accounts Payable Comptuer Repairs 1,115.00 4 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 18 18 Jun 22 Jun 22 5020 Salary Expense 1110 Cash 960.00 Salary Payment Salary Payment 960.00 19 19 Jun 23 Jun 23 1110 Cash Receive Payment 1120 Accounts Receivable Receive Payment 3,845.00 3,845.00 20 20 Jun 23 Jun 23 1150 Office Supplies 2101 Accounts Payable Supplies Expense Supplies Expense 580.00 580.00 21 21 Jun 28 Jun 28 1120 Accounts Receivable Record of Revenue 4100 Computer & Consultin Record of Revenue 5,700.00 5.700.00 Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement Changes in 171 f B G D E A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Transaction Account 3 Date Name Description Debit Credit 22 22 Jun 29 Jun 29 2101 Accounts Payable 1110 Cash 5,400.00 Computer Repairs Computer Repairs 5,400.00 23 23 Jun 29 Jun 29 2101 Accounts Payable 1110 Cash Receive Payment Receive Payment 1.115.00 1,115.00 24 24 Jun 29 Jun 29 5020 Salary Expense 1110 Cash Salary Payment Salary Payment 960.00 960.00 10 11 12 13 14 15 16 17 18 19 20 121 22 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 25 25 Jun 30 Jun 30 5050 Oil & Gas Expense 2101 Accounts Payable Oil & Gas Expense Oil & Gas Expense 1,015.00 1,015.00 26 26 Jun 30 Jun 30 3300 Dividends 1110 Cash Dividends Paid Dividends Paid 1,531.40 1,531.40 27 27 Jun 30 Jun 30 5010 Rent Expense 1140 Prepaid Rent Rent Expense Recognized Rent Expense Recognized 1,900.00 1,900.00 28 28 Jun 30 Jun 30 5080 Supplies Expense 1150 Office Supplies Supplies Expense Supplies Expense 236.00 143 144 236.00 Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement Reactivate i SUBSCRIPTION EXPIRED To keep using Excel without interruption, please reactivate now. - F171 G H B D E A Byte of Accounting, Inc. General Journal Note: You can only enter data into the yellow filled cells. Transaction Account Credit Date Name Description Debit 436 41 29 29 Jun 30 Jun 30 5090 Interest Expense 2103 Interest Payable Interest Adjustment Interest Adjustment 436.41 242.00 30 30 Jun 30 Jun 30 5100 Insurance Expense 1130 Prepaid Insurance Insurance Adjustment Insurance Adjustment 242.00 4 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 31 31 Jun 30 Jun 30 1120 Accounts Receivable Unbilled Revenue 4100 Computer & Consultin Unbilled Revenue 5.000.00 5.000.00 32 32 32 32 Jun 30 Jun 30 Jun 30 Jun 30 5110 Depreciation Expense Depreciation Expense 1312 Accum. Depr.-Comput Depreciation Expense 1212 Accum. Depr.-Office E Depreciation Expense 1412 Accum. Depr.-Building Depreciation Expense 5020 Salary Expense Salary Payment 2105 Salaries Payable Salary Payment 33 33 Jun 30 Jun 30 576.00 576.00 168 169 34 34 Jun 30 Jun 30 5090 Interest Expense 2103 Interest Payable Interest Adjustment Interest Adjustment 170 171 172 173 174 175 176 177 70 35 35 Jun 30 Jun 30 5120 Income Tax Expense Income Tax Expense 2106 Income Taxes Payabl Income Tax Expense Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement ch O Type here to search o i F171 G H E D A B 1 A Byte of Accounting, Inc. General Journal 2 3 Note: You can only enter data into the yellow filled cells. Transaction Account Credit Date Debit 32 Jun 30 Name Description 1412 Accum. Depr. -Building Depreciation Expense 5020 Salary Expense Salary Payment 2105 Salaries Payable Salary Payment 576.00 33 33 Jun 30 Jun 30 576.00 34 34 Jun 30 Jun 30 5090 Interest Expense 2103 Interest Payable Interest Adjustment Interest Adjustment 35 35 Jun 30 Jun 30 5120 Income Tax Expense Income Tax Expense 2106 Income Taxes Payable Income Tax Expense 4 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 36 36 Jun 30 Jun 30 4100 Computer & Consultin Closing Revenue 3400 Income Summary Closing Revenue 37 37 37 37 37 37 37 37 37 37 37 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 3400 Income Summary Closing Expense 5010 Rent Expense Closing Expense 5020 Salary Expense Closing Expense 5030 Advertising Expense Closing Expense 5040 Repairs & Maint. Exp Closing Expense 5050 Oil & Gas Expense Closing Expense 5080 Supplies Expense Closing Expense 5090 Interest Expense Closing Expense 5100 Insurance Expense Closing Expense 5110 Depreciation Expense Closing Expense 5120 Income Tax Expense Closing Expense 38 Jun 30 3400 Income Summary Welcome Chart of Accounts Closing Income Summary Transactions General Journal Worksheet Income Statement Font Clipboard SUBSCRIPTION EXPIRED To keep using Excel without interruption, please reactivate now. Reactivate X F171 F G H E D A BI 1 A Byte of Accounting, Inc. General Journal 2 3 Note: You can only enter data into the yellow filled cells. Transaction Date Account Debit Credit Name 3400 Income Summary Description Closing Revenue 36 Jun 30 4 182 183 184 185 186 187 188 189 190 191 37 37 37 37 37 37 37 37 37 37 37 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 3400 Income Summary Closing Expense 5010 Rent Expense Closing Expense 5020 Salary Expense Closing Expense 5030 Advertising Expense Closing Expense 5040 Repairs & Maint. ExpeClosing Expense 5050 Oil & Gas Expense Closing Expense 5080 Supplies Expense Closing Expense 5090 Interest Expense Closing Expense 5100 Insurance Expense Closing Expense 5110 Depreciation Expense Closing Expense 5120 Income Tax Expense Closing Expense 192 193 194 195 196 197 198 199 38 38 Jun 30 Jun 30 3400 Income Summary 3200 Retained Earnings Closing Income Summary Closing Income Summary 200 39 39 Jun 30 Jun 30 3200 Retained Earnings 3300 Dividends Closing Dividends Closing Dividends 201 202 203 204 205 206 207 208 209 210 A B E F G D A Byte of Accounting, Inc. Income Statement For Month Ending June 30, 2020 Revenues Computer & Consulting Revenue Expenses Rent Expense Salary Expense Advertising Expense Repairs & Maint. Expense Oil & Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Net Income Before Tax Income Tax Expense (Round to two decimal places) Net Income After Tax 5 x v B D A Byte of Accounting, Inc. Statement of Changes in Retained Earnings For Month Ending June 30, 2020 Total Balance, Beginning of Period Net Income Dividends Balance, End of Period SUBSCRIPTION EXPIRED To keep using Excel without fo 1 F G H B A D E A Byte of Accounting, Inc. Balance Sheet As of June 30, 2020 2 4 5 6 Assets 7 8 9 10 11 12 13 14 15 16 17 18 Current Assets Cash Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total 20 21 Long-Term Assets Office Equip Accum. Depr.-Office Equip Computer Equip Accum. Depr.-Computer Equip. Building Cost Accum. Depr.-Building Land Total Total Assets 23 24 Liabilities 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Current Liabilities Accounts Payable Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total Long-Term Liabilities Mortgage Payable 22 al F E G H D B Computer Equip Accum. Depr.-Computer Equip. Building Cost Accum. Depr.-Building Land Total Total Assets Liabilities Current Liabilities Accounts Payable Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total Long-Term Liabilities Mortgage Payable Notes Payable Total Total Liabilities Stockholder's Equity Capital Stock Retained Earnings Total Total Liabilities and Stockholder's Equity 4 5 6 8