I need assistance with this question please?

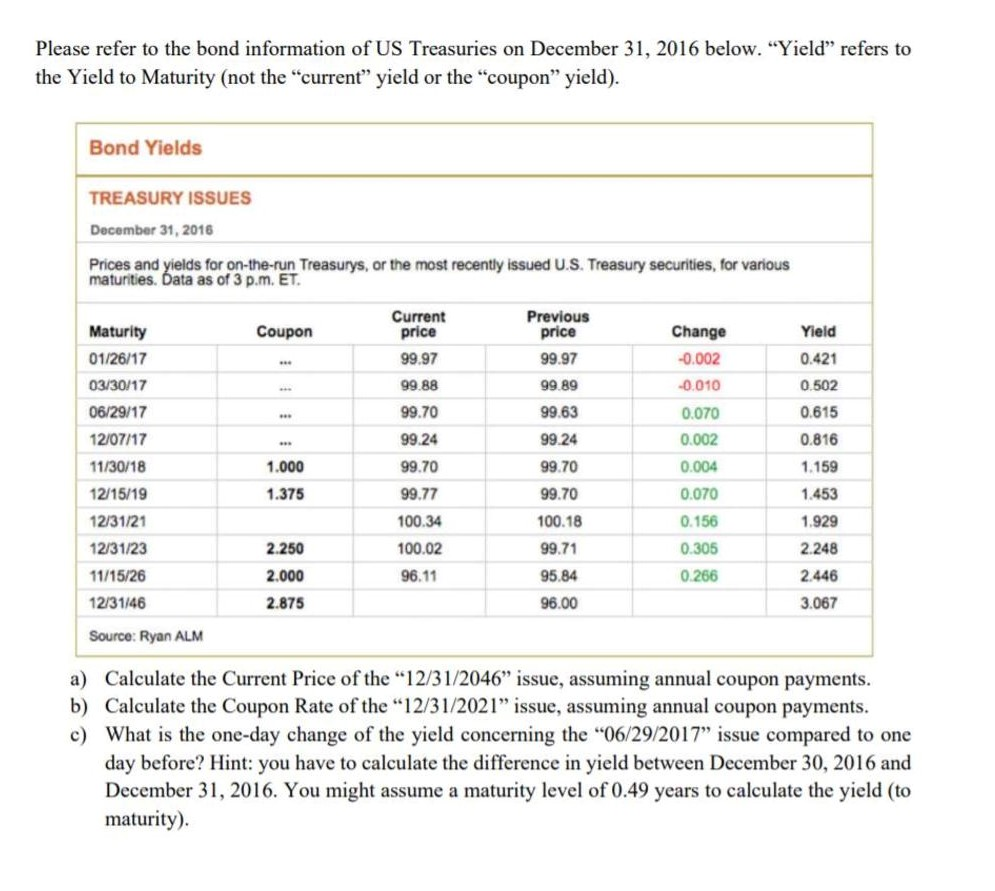

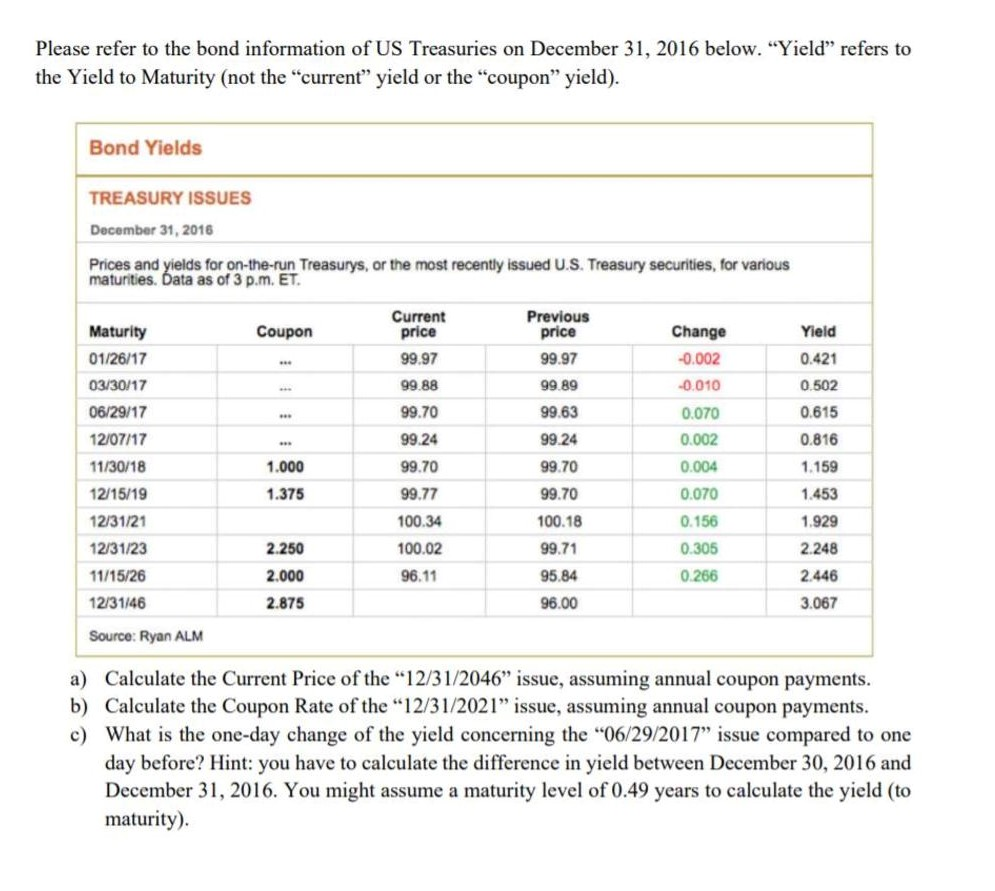

Please refer to the bond information of US Treasuries on December 31, 2016 below. "Yield refers to the Yield to Maturity (not the "current" yield or the "coupon yield). Bond Yields TREASURY ISSUES December 31, 2016 Prices and yields for on-the-run Treasurys, or the most recently issued U.S. Treasury securities, for various maturities. Data as of 3 p.M. ET. Coupon Current price 99.97 99.88 99.70 99.24 99.70 99.77 Maturity 01/26/17 03/30/17 06/29/17 12/07/17 11/30/18 12/15/19 12/31/21 12/31/23 11/15/26 12/31/46 Yield 0.421 0.502 0.615 0.816 Change -0.002 -0.010 0.070 0.002 0.004 0.070 Previous price 99.97 99.89 99.63 99.24 99.70 99.70 100.18 99.71 95.84 96.00 1.000 1.375 1.159 100.34 2.250 100.02 96.11 0.156 0.305 0.266 1.453 1.929 2.248 2.446 3.067 2.000 2.875 Source: Ryan ALM a) Calculate the Current Price of the "12/31/2046" issue, assuming annual coupon payments. b) Calculate the Coupon Rate of the 12/31/2021 issue, assuming annual coupon payments. c) What is the one-day change of the yield concerning the "06/29/2017" issue compared to one day before? Hint: you have to calculate the difference in yield between December 30, 2016 and December 31, 2016. You might assume a maturity level of 0.49 years to calculate the yield (to maturity). Please refer to the bond information of US Treasuries on December 31, 2016 below. "Yield refers to the Yield to Maturity (not the "current" yield or the "coupon yield). Bond Yields TREASURY ISSUES December 31, 2016 Prices and yields for on-the-run Treasurys, or the most recently issued U.S. Treasury securities, for various maturities. Data as of 3 p.M. ET. Coupon Current price 99.97 99.88 99.70 99.24 99.70 99.77 Maturity 01/26/17 03/30/17 06/29/17 12/07/17 11/30/18 12/15/19 12/31/21 12/31/23 11/15/26 12/31/46 Yield 0.421 0.502 0.615 0.816 Change -0.002 -0.010 0.070 0.002 0.004 0.070 Previous price 99.97 99.89 99.63 99.24 99.70 99.70 100.18 99.71 95.84 96.00 1.000 1.375 1.159 100.34 2.250 100.02 96.11 0.156 0.305 0.266 1.453 1.929 2.248 2.446 3.067 2.000 2.875 Source: Ryan ALM a) Calculate the Current Price of the "12/31/2046" issue, assuming annual coupon payments. b) Calculate the Coupon Rate of the 12/31/2021 issue, assuming annual coupon payments. c) What is the one-day change of the yield concerning the "06/29/2017" issue compared to one day before? Hint: you have to calculate the difference in yield between December 30, 2016 and December 31, 2016. You might assume a maturity level of 0.49 years to calculate the yield (to maturity)