Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need both answered A property can be purchased for $105,000 subject to an assumable loan at 9% (below market rates) with 15 years remaining,

i need both answered

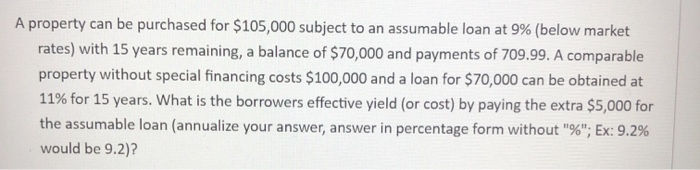

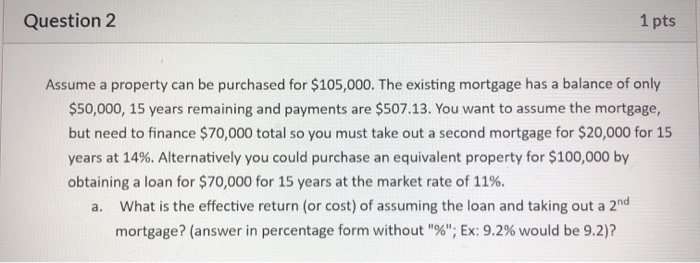

A property can be purchased for $105,000 subject to an assumable loan at 9% (below market rates) with 15 years remaining, a balance of $70,000 and payments of 709.99. A comparable property without special financing costs $100,000 and a loan for $70,000 can be obtained at 11% for 15 years. What is the borrowers effective yield (or cost) by paying the extra $5,000 for the assumable loan (annualize your answer, answer in percentage form without "%", Ex: 9.2% would be 9.2)? Question 2 1 pts Assume a property can be purchased for $105,000. The existing mortgage has a balance of only $50,000, 15 years remaining and payments are $507.13. You want to assume the mortgage, but need to finance $70,000 total so you must take out a second mortgage for $20,000 for 15 years at 14%. Alternatively you could purchase an equivalent property for $100,000 by obtaining a loan for $70,000 for 15 years at the market rate of 11%. a. What is the effective return (or cost) of assuming the loan and taking out a 2nd mortgage? (answer in percentage form without "%"; Ex: 9.2% would be 9.2)? A property can be purchased for $105,000 subject to an assumable loan at 9% (below market rates) with 15 years remaining, a balance of $70,000 and payments of 709.99. A comparable property without special financing costs $100,000 and a loan for $70,000 can be obtained at 11% for 15 years. What is the borrowers effective yield (or cost) by paying the extra $5,000 for the assumable loan (annualize your answer, answer in percentage form without "%", Ex: 9.2% would be 9.2)? Question 2 1 pts Assume a property can be purchased for $105,000. The existing mortgage has a balance of only $50,000, 15 years remaining and payments are $507.13. You want to assume the mortgage, but need to finance $70,000 total so you must take out a second mortgage for $20,000 for 15 years at 14%. Alternatively you could purchase an equivalent property for $100,000 by obtaining a loan for $70,000 for 15 years at the market rate of 11%. a. What is the effective return (or cost) of assuming the loan and taking out a 2nd mortgage? (answer in percentage form without "%"; Ex: 9.2% would be 9.2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started