i need complete problem solving strps and final answer

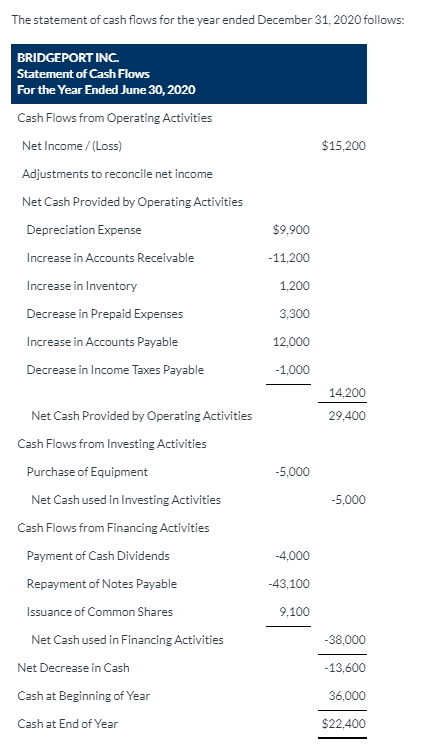

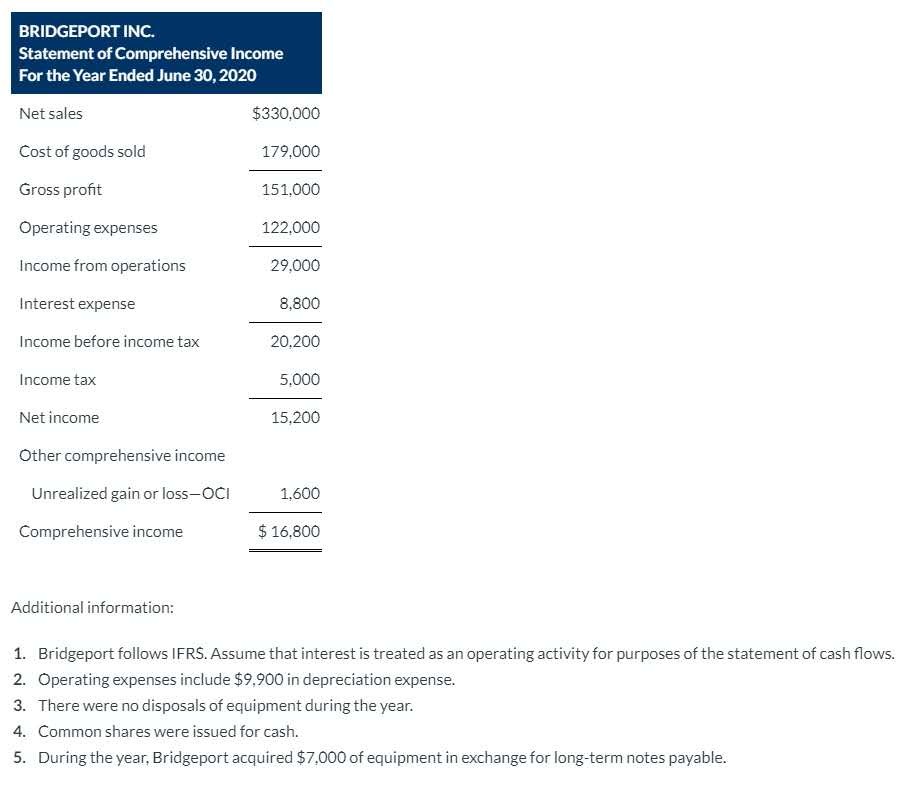

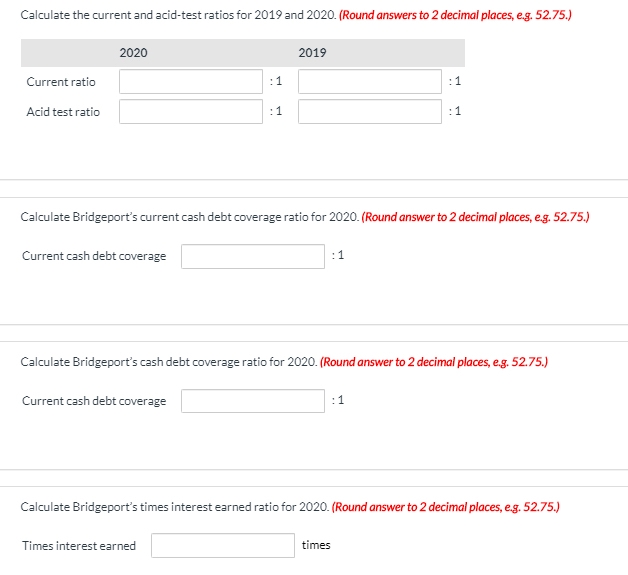

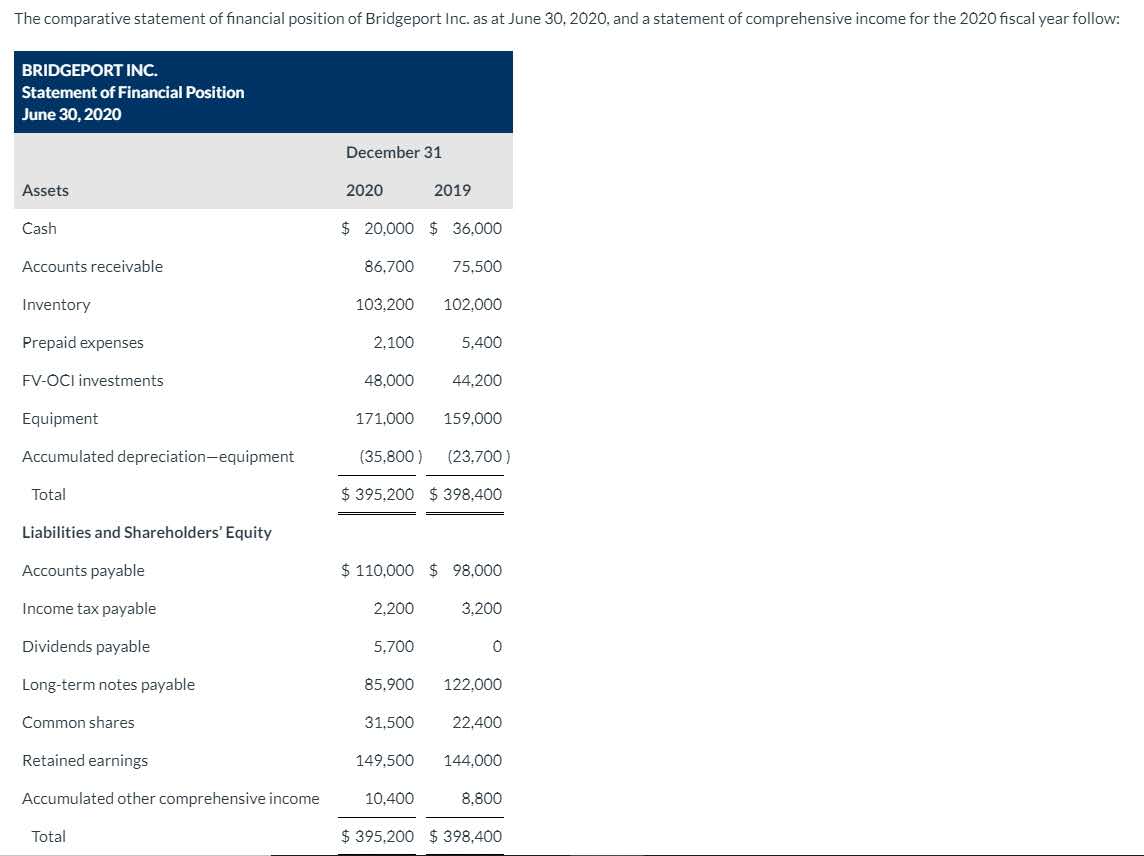

The statement of cash flows for the year ended December 31, 2020 follows: BRIDGEPORT INC. Statement of Cash Flows For the Year Ended June 30, 2020 Cash Flows from Operating Activities Net Income / (Loss) $15,200 Adjustments to reconcile net income Net Cash Provided by Operating Activities Depreciation Expense $9,900 Increase in Accounts Receivable -11,200 Increase in Inventory 1,200 Decrease in Prepaid Expenses 3,300 Increase in Accounts Payable 12,000 Decrease in Income Taxes Payable -1,000 14.200 Net Cash Provided by Operating Activities 29,400 Cash Flows from Investing Activities Purchase of Equipment -5,000 Net Cash used in Investing Activities -5,000 Cash Flows from Financing Activities Payment of Cash Dividends -4,000 Repayment of Notes Payable -43.100 Issuance of Common Shares 9.100 Net Cash used in Financing Activities -38,000 Net Decrease in Cash -13,600 Cash at Beginning of Year 36,000 Cash at End of Year $22,400BRIDGEPORTINC. Statement of Comprehensive Income For the Year Ended June 30, 2020 Net sales $330,000 Cost of goods sold 1?9,000 Gross prot 151,000 Operating expenses 122,000 income from operations 29,000 interest expense 3,800 Income before income tax 20,200 Income tax 5,000 Net income 15,200 Other comprehensive income Unrealized gain or lossOCI 1,600 Comprehensive income $ 16,300 Additional information: . Bridgeport follows IF RS. Assume that interest is treated as an operating activity for purposes of the statement of cash flows. . Operating expenses include $9,900 in depreciation expense, 1 2 3. There were no disposals of equipment during the year. 4. Common shares were issued for cash. 5 . Duringthe year, Bridgeport acquired $7,000 of equipment in exchange for longterm notes payable. Calculate the current and acid-test ratios for 2019 and 2020. (Round answers to 2 decimal places, e.g. 52.75.) 2020 2019 Current ratio : 1 1 Acid test ratio : 1 Calculate Bridgeport's current cash debt coverage ratio for 2020. (Round answer to 2 decimal places, e.g. 52.75.) Current cash debt coverage : 1 Calculate Bridgeport's cash debt coverage ratio for 2020. (Round answer to 2 decimal places, e.g. 52.75.) Current cash debt coverage : 1 Calculate Bridgeport's times interest earned ratio for 2020. (Round answer to 2 decimal places, e.g. 52.75.) Times interest earned timesThe comparative statement of financial position of Bridgeport Inc. as at June 30, 2020, and a statement of comprehensive income for the 2020 fiscal year follow: BRIDGEPORT INC. Statement of Financial Position June 30, 2020 December 31 Assets 2020 2019 Cash $ 20,000 $ 36,000 Accounts receivable 86,700 75,500 Inventory 103,200 102,000 Prepaid expenses 2,100 5,400 FV-OCI investments 48,000 44,200 Equipment 171,000 159,000 Accumulated depreciation-equipment (35,800 ) (23,700 ) Total $ 395,200 $ 398,400 Liabilities and Shareholders' Equity Accounts payable $ 110,000 $ 98,000 Income tax payable 2,200 3,200 Dividends payable 5,700 0 Long-term notes payable 85,900 122,000 Common shares 31,500 22,400 Retained earnings 149.500 144,000 Accumulated other comprehensive income 10,400 8,800 Total $ 395,200 $ 398,400