Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need complete solution of this question plz its a complete question related to account cycle Q#01: i. The random order account balances (in S)

i need complete solution of this question plz

its a complete question related to account cycle

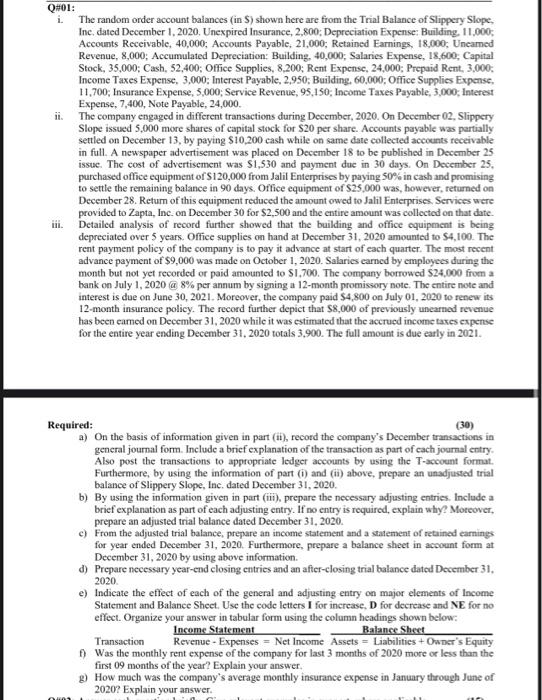

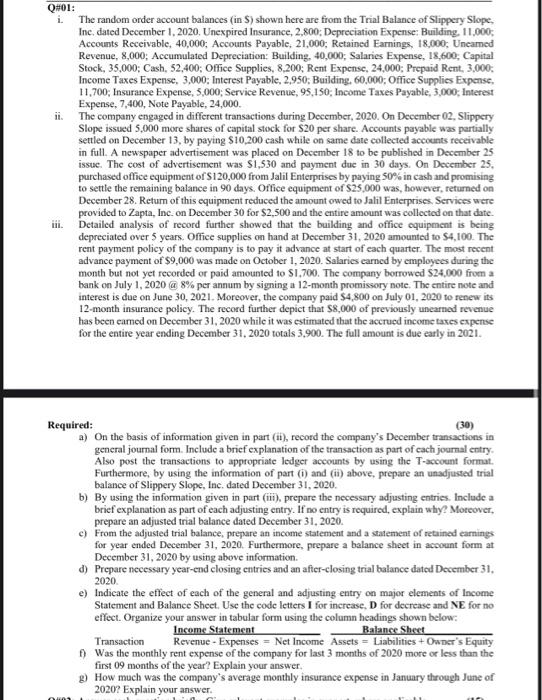

Q#01: i. The random order account balances (in S) shown here are from the Trial Balance of Slippery Slope, Inc.dated December 1, 2020. Unexpired Insurance, 2,800: Depreciation Expense: Building. 11.000 Accounts Receivable, 40,000; Accounts Payable, 21,000: Retained Earnings, 18,000: Uncamed Revenue, 8,000; Accumulated Depreciation: Building, 40,000: Salaries Expense, 18,600 Capital Stock, 35,000; Cash, 52,400; Office Supplies, 8.200; Rent Expensc, 24,000: Prepaid Rent, 3,000: Income Taxes Expense 3.000: Interest Payable, 2,950: Building, 60,000: Office Supplies Expense, 11.700; Insurance Expense. 5,000Service Revenue, 95,150 Income Taxes Payable, 3,000; Interest Expense. 7,400, Note Payable, 24,000 ii. The company engaged in different transactions during December, 2020. On December 02, Slippery Slope issued 5,000 more shares of capital stock for $20 per share. Accounts payable was partially settled on December 13, by paying Sio,200 cash while on same date collected accounts receivable in full. A newspaper advertisement was placed on December 18 to be published in December 25 issue. The cost of advertisement was $1,530 and payment due in 30 days. On December 25, purchased office equipment of S120,000 from Jalil Enterprises by paying 50% in cash and promising to settle the remaining balance in 90 days. Office equipment of S25.000 was, however, returned on December 28. Return of this equipment reduced the amount owed to Jalil Enterprises, Services were provided to Zapta, Inc. on December 30 for $2,500 and the entire amount was collected on that date. iii. Detailed analysis of record further showed that the building and office equipment is being depreciated over 5 years. Office supplies on hand at December 31, 2020 amounted to $4,100. The rent payment policy of the company is to pay it advance at start of each quarter. The most recent advance payment of $9,000 was made on October 1, 2020. Salaries carned by employees during the month but not yet recorded or paid amounted to S1.700. The company borrowed $24,000 from a bank on July 1, 2020 @ 8% per annum by signing a 12-month promissory note. The entire note and interest is due on June 30, 2021. Moreover, the company paid $4,800 on July 01, 2020 to renew its 12-month insurance policy. The record further depict that $8,000 of previously unearned revenue has been eamed on December 31, 2020 while it was estimated that the accrued income taxes expense for the entire year ending December 31, 2020 totals 3,900. The full amount is due early in 2021. Required: (30) a) On the basis of information given in part (ii), record the company's December transactions in general journal form. Include a brief explanation of the transaction as part of cach journal entry Also post the transactions to appropriate ledger accounts by using the T-account format. Furthermore, by using the information of part) and (ii) above, prepare an unadjusted trial balance of Slippery Slope, Inc. dated December 31, 2020 b) By using the information given in part (i), prepare the necessary adjusting entries. Include a brief explanation as part of each adjusting entry. If no entry is required, explain why? Moreover, prepare an adjusted trial balance dated December 31, 2020. c) From the adjusted trial balance, prepare an income statement and a statement of retained earnings for year ended December 31, 2020. Furthermore, prepare a balance sheet in account form at December 31, 2020 by using above information. d) Prepare necessary year-end closing entries and an after-closing trial balance dated December 31, 2020 e) Indicate the effect of each of the general and adjusting entry on major elements of Income Statement and Balance Sheet. Use the code letters I for increase. D for decrease and NE for no effect. Organize your answer in tabular form using the column headings shown below: Income Statement Balance Sheet Transaction Revenue - Expenses = Net Income Assets = Liabilities + Owner's Equity Was the monthly rent expense of the company for last 3 months of 2020 more or less than the first 09 months of the year? Explain your answer 8) How much was the company's average monthly insurance expense in January through June of 2020? Explain your answer. Q#01: i. The random order account balances (in S) shown here are from the Trial Balance of Slippery Slope, Inc.dated December 1, 2020. Unexpired Insurance, 2,800: Depreciation Expense: Building. 11.000 Accounts Receivable, 40,000; Accounts Payable, 21,000: Retained Earnings, 18,000: Uncamed Revenue, 8,000; Accumulated Depreciation: Building, 40,000: Salaries Expense, 18,600 Capital Stock, 35,000; Cash, 52,400; Office Supplies, 8.200; Rent Expensc, 24,000: Prepaid Rent, 3,000: Income Taxes Expense 3.000: Interest Payable, 2,950: Building, 60,000: Office Supplies Expense, 11.700; Insurance Expense. 5,000Service Revenue, 95,150 Income Taxes Payable, 3,000; Interest Expense. 7,400, Note Payable, 24,000 ii. The company engaged in different transactions during December, 2020. On December 02, Slippery Slope issued 5,000 more shares of capital stock for $20 per share. Accounts payable was partially settled on December 13, by paying Sio,200 cash while on same date collected accounts receivable in full. A newspaper advertisement was placed on December 18 to be published in December 25 issue. The cost of advertisement was $1,530 and payment due in 30 days. On December 25, purchased office equipment of S120,000 from Jalil Enterprises by paying 50% in cash and promising to settle the remaining balance in 90 days. Office equipment of S25.000 was, however, returned on December 28. Return of this equipment reduced the amount owed to Jalil Enterprises, Services were provided to Zapta, Inc. on December 30 for $2,500 and the entire amount was collected on that date. iii. Detailed analysis of record further showed that the building and office equipment is being depreciated over 5 years. Office supplies on hand at December 31, 2020 amounted to $4,100. The rent payment policy of the company is to pay it advance at start of each quarter. The most recent advance payment of $9,000 was made on October 1, 2020. Salaries carned by employees during the month but not yet recorded or paid amounted to S1.700. The company borrowed $24,000 from a bank on July 1, 2020 @ 8% per annum by signing a 12-month promissory note. The entire note and interest is due on June 30, 2021. Moreover, the company paid $4,800 on July 01, 2020 to renew its 12-month insurance policy. The record further depict that $8,000 of previously unearned revenue has been eamed on December 31, 2020 while it was estimated that the accrued income taxes expense for the entire year ending December 31, 2020 totals 3,900. The full amount is due early in 2021. Required: (30) a) On the basis of information given in part (ii), record the company's December transactions in general journal form. Include a brief explanation of the transaction as part of cach journal entry Also post the transactions to appropriate ledger accounts by using the T-account format. Furthermore, by using the information of part) and (ii) above, prepare an unadjusted trial balance of Slippery Slope, Inc. dated December 31, 2020 b) By using the information given in part (i), prepare the necessary adjusting entries. Include a brief explanation as part of each adjusting entry. If no entry is required, explain why? Moreover, prepare an adjusted trial balance dated December 31, 2020. c) From the adjusted trial balance, prepare an income statement and a statement of retained earnings for year ended December 31, 2020. Furthermore, prepare a balance sheet in account form at December 31, 2020 by using above information. d) Prepare necessary year-end closing entries and an after-closing trial balance dated December 31, 2020 e) Indicate the effect of each of the general and adjusting entry on major elements of Income Statement and Balance Sheet. Use the code letters I for increase. D for decrease and NE for no effect. Organize your answer in tabular form using the column headings shown below: Income Statement Balance Sheet Transaction Revenue - Expenses = Net Income Assets = Liabilities + Owner's Equity Was the monthly rent expense of the company for last 3 months of 2020 more or less than the first 09 months of the year? Explain your answer 8) How much was the company's average monthly insurance expense in January through June of 2020? Explain your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started