Answered step by step

Verified Expert Solution

Question

1 Approved Answer

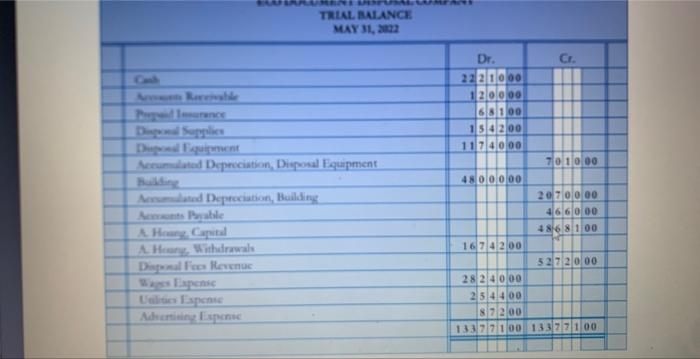

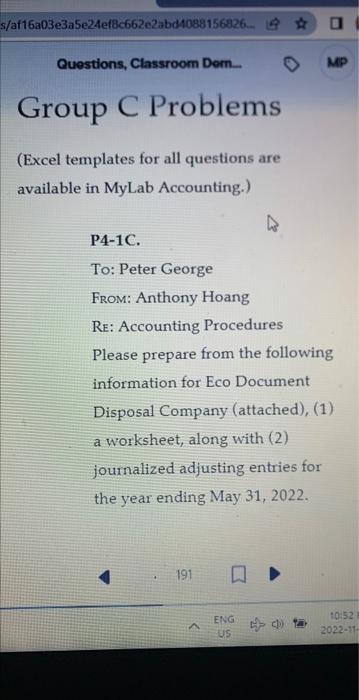

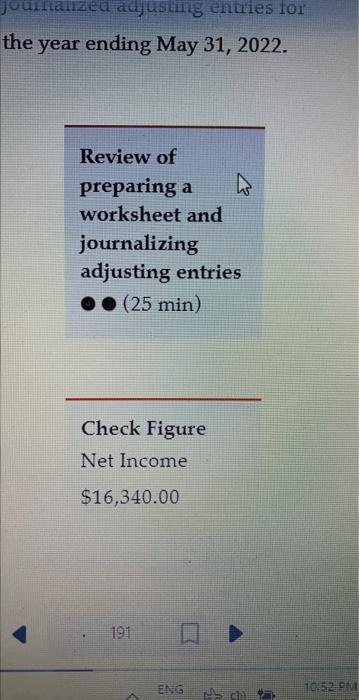

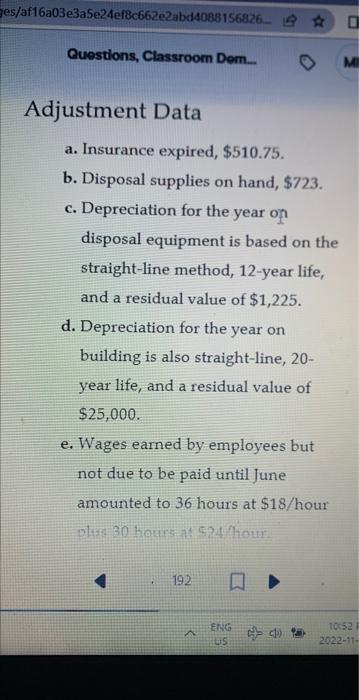

i need complete WORKSHEET for this please please please and thank you (Excel templates for all questions are available in MyLab Accounting.) P4-1C. To: Peter

i need complete WORKSHEET for this please please please and thank you

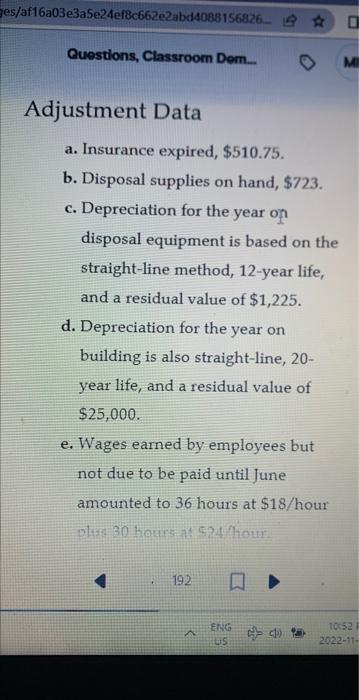

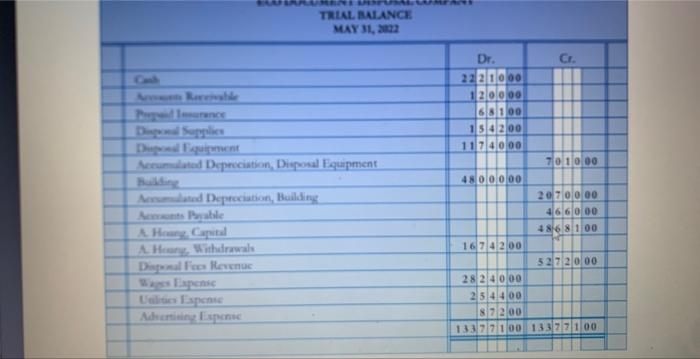

(Excel templates for all questions are available in MyLab Accounting.) P4-1C. To: Peter George From: Anthony Hoang RE: Accounting Procedures Please prepare from the following information for Eco Document Disposal Company (attached), (1) a worksheet, along with (2) journalized adjusting entries for the year ending May 31, 2022. the year ending May 31, 2022. Review of preparing a worksheet and journalizing adjusting entries (25min) Check Figure Net Income $16,340.00 Adjustment Data a. Insurance expired, $510.75. b. Disposal supplies on hand, $723. c. Depreciation for the year on disposal equipment is based on the straight-line method, 12-year life, and a residual value of $1,225. d. Depreciation for the year on building is also straight-line, 20 year life, and a residual value of $25,000 e. Wages earned by employees but not due to be paid until June amounted to 36 hours at $18 /hour olitia 30 hoursat 924 hour Questions, Classroom Dem... year life, and a residual value of $25,000. e. Wages earned by employees but not due to be paid until June amounted to 36 hours at $18/ hour plus 30 hours at $24 /hour. THANL ANANEH. Ma) 11, at?2 (Excel templates for all questions are available in MyLab Accounting.) P4-1C. To: Peter George From: Anthony Hoang RE: Accounting Procedures Please prepare from the following information for Eco Document Disposal Company (attached), (1) a worksheet, along with (2) journalized adjusting entries for the year ending May 31, 2022. the year ending May 31, 2022. Review of preparing a worksheet and journalizing adjusting entries (25min) Check Figure Net Income $16,340.00 Adjustment Data a. Insurance expired, $510.75. b. Disposal supplies on hand, $723. c. Depreciation for the year on disposal equipment is based on the straight-line method, 12-year life, and a residual value of $1,225. d. Depreciation for the year on building is also straight-line, 20 year life, and a residual value of $25,000 e. Wages earned by employees but not due to be paid until June amounted to 36 hours at $18 /hour olitia 30 hoursat 924 hour Questions, Classroom Dem... year life, and a residual value of $25,000. e. Wages earned by employees but not due to be paid until June amounted to 36 hours at $18/ hour plus 30 hours at $24 /hour. THANL ANANEH. Ma) 11, at?2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started