I need corrections on the questions work below (very easy, most of my work is correct)

Question 1

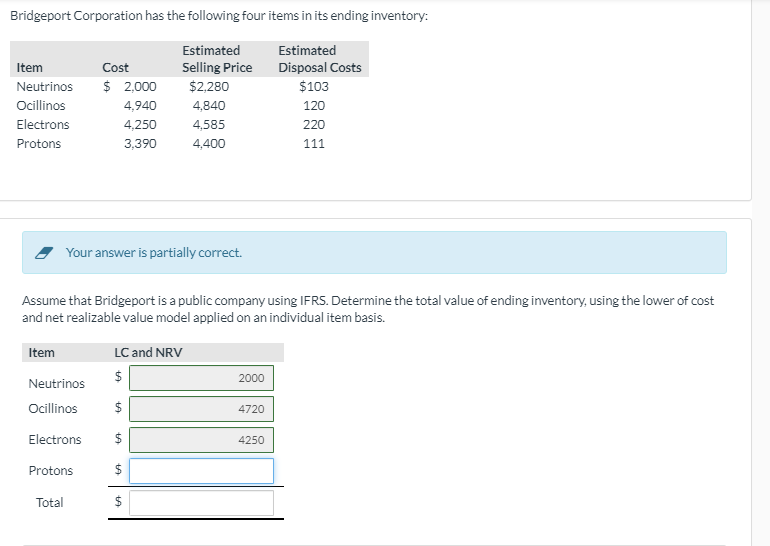

Refer to Bridgeport.png, fill in the missing values (Protons and Total)

Bridgeport.png

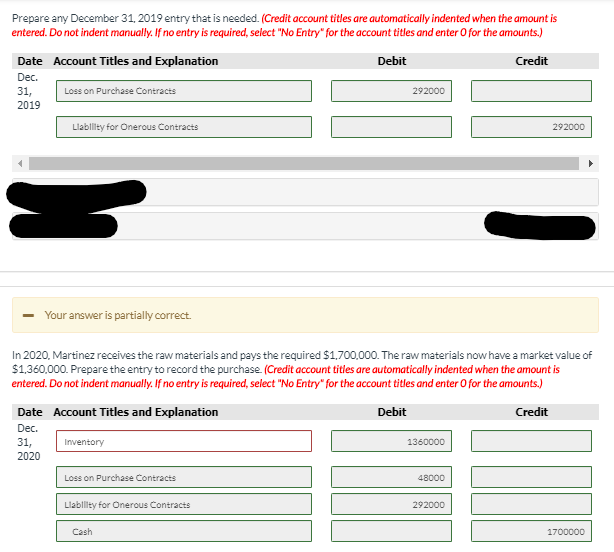

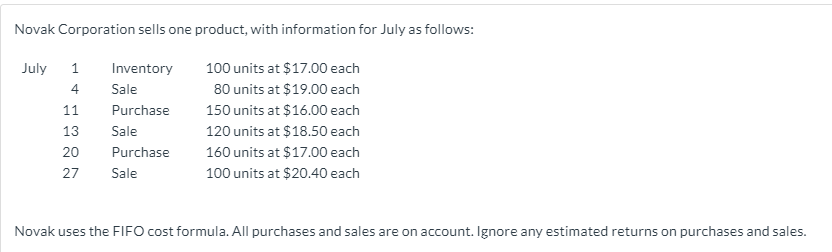

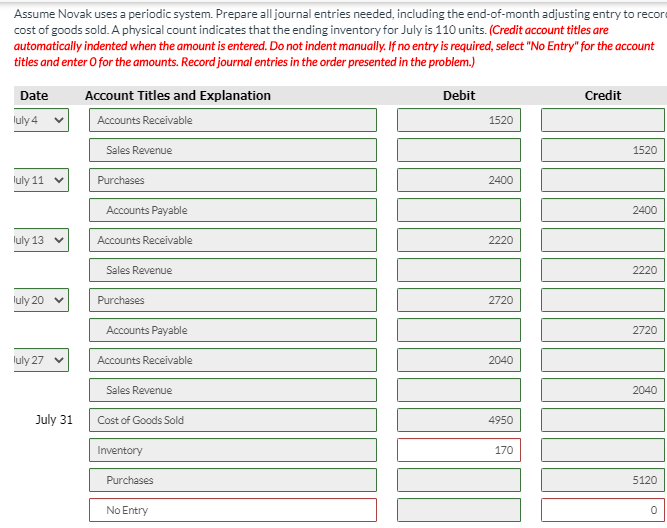

Bridgeport Corporation has the following four items in its ending inventory: Estimated Estimated Item Cost Selling Price Disposal Costs Neutrinos $ 2,000 $2,280 $103 Ocillinos 4,940 4,840 120 Electrons 4,250 4,585 220 Protons 3,390 4,400 111 Your answer is partially correct. Assume that Bridgeport is a public company using IFRS. Determine the total value of ending inventory, using the lower of cost and net realizable value model applied on an individual item basis. Item LC and NRV Neutrinos LA 2000 Ocillinos LA 4720 Electrons 4250 Protons TotalPrepare any December 31, 2019 entry that is needed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, Loss on Purchase Contracts 292000 2019 Liability for Onerous Contracts 292000 - Your answer is partially correct. In 2020, Martinez receives the raw materials and pays the required $1,700,000. The raw materials now have a market value of $1,360.000. Prepare the entry to record the purchase (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, Inventory 1360000 2020 Loss on Purchase Contracts 48000 Liability for Onerous Contracts 292000 Cash 1700000Novak Corporation sells one product, with information for July as follows: July 1 Inventory 100 units at $17.00 each 4 Sale 80 units at $19.00 each 11 Purchase 150 units at $16.00 each 13 Sale 120 units at $18.50 each 20 Purchase 160 units at $17.00 each 27 Sale 100 units at $20.40 each Novak uses the FIFO cost formula. All purchases and sales are on account. Ignore any estimated returns on purchases and sales.Assume Novak uses a periodic system. Prepare all journal entries needed, including the end-of-month adjusting entry to recor cost of goods sold. A physical count indicates that the ending inventory for July is 110 units. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit July 4 Accounts Receivable 1520 Sales Revenue 1520 July 11 Purchases 2400 Accounts Payable 2400 uly 13 Accounts Receivable 2220 Sales Revenue 2220 uly 20 Purchases 2720 Accounts Payable 2720 July 27 v Accounts Receivable 2040 Sales Revenue 2040 July 31 Cost of Goods Sold 4950 Inventory 170 Purchases 5120 No Entry 0