Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need, even thought I already post this question here in chegg, but it was answered wrong. Santana Rey, owner of Business Solutions, realizes that

I need, even thought I

already post this question here in chegg, but it was answered wrong.

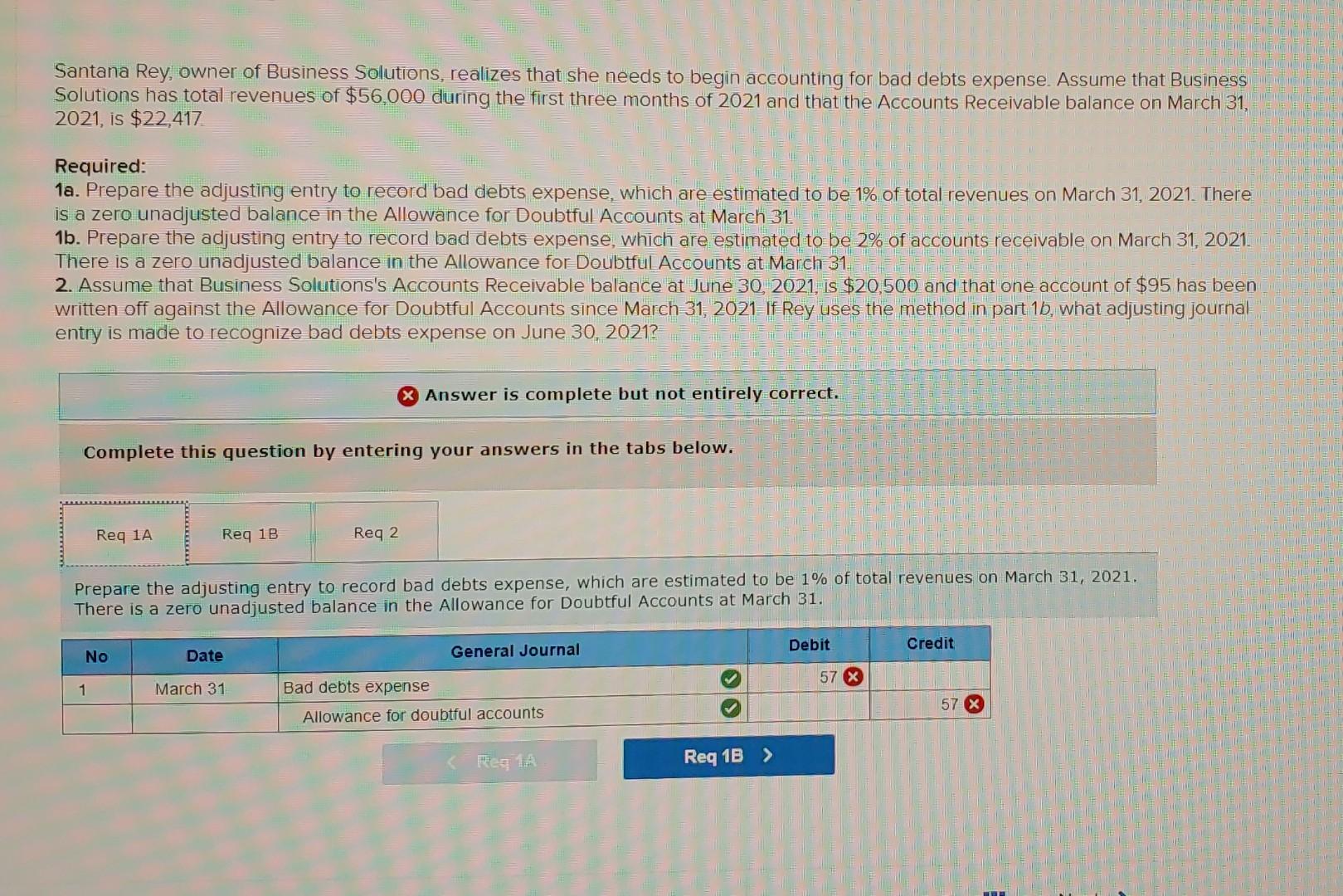

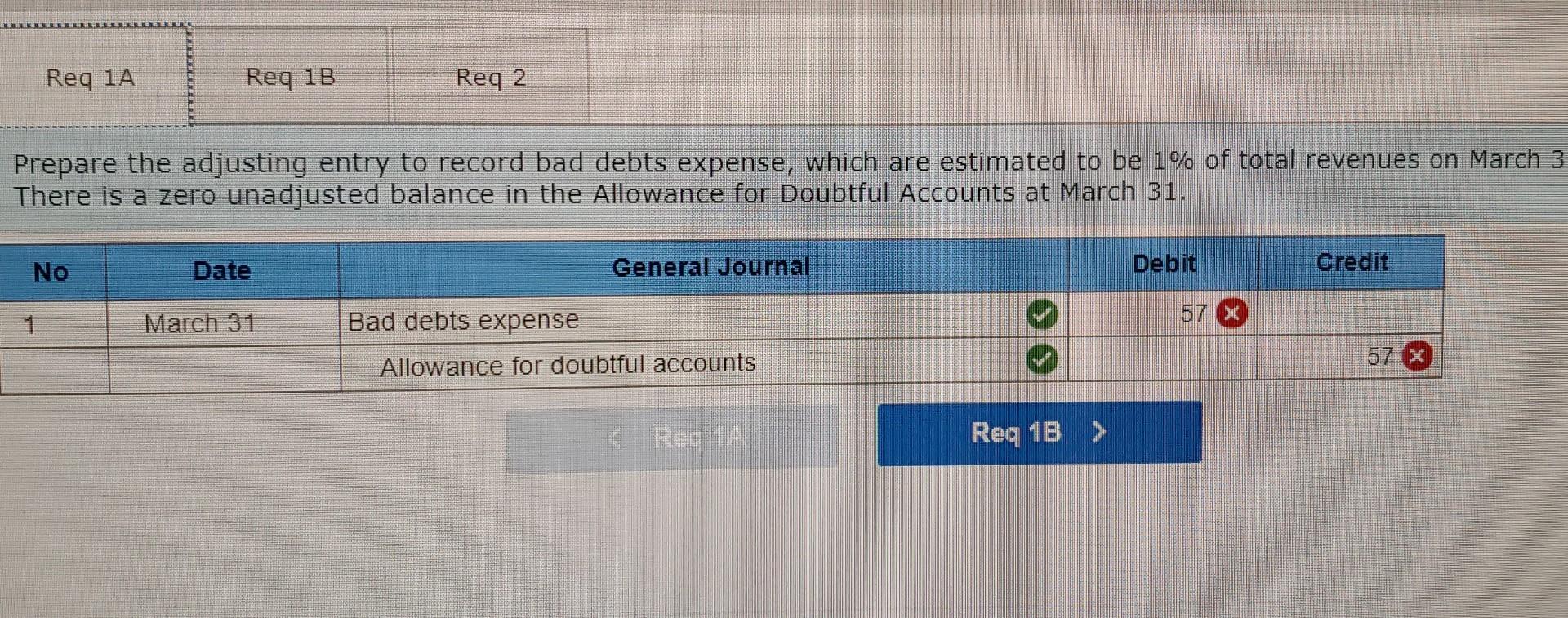

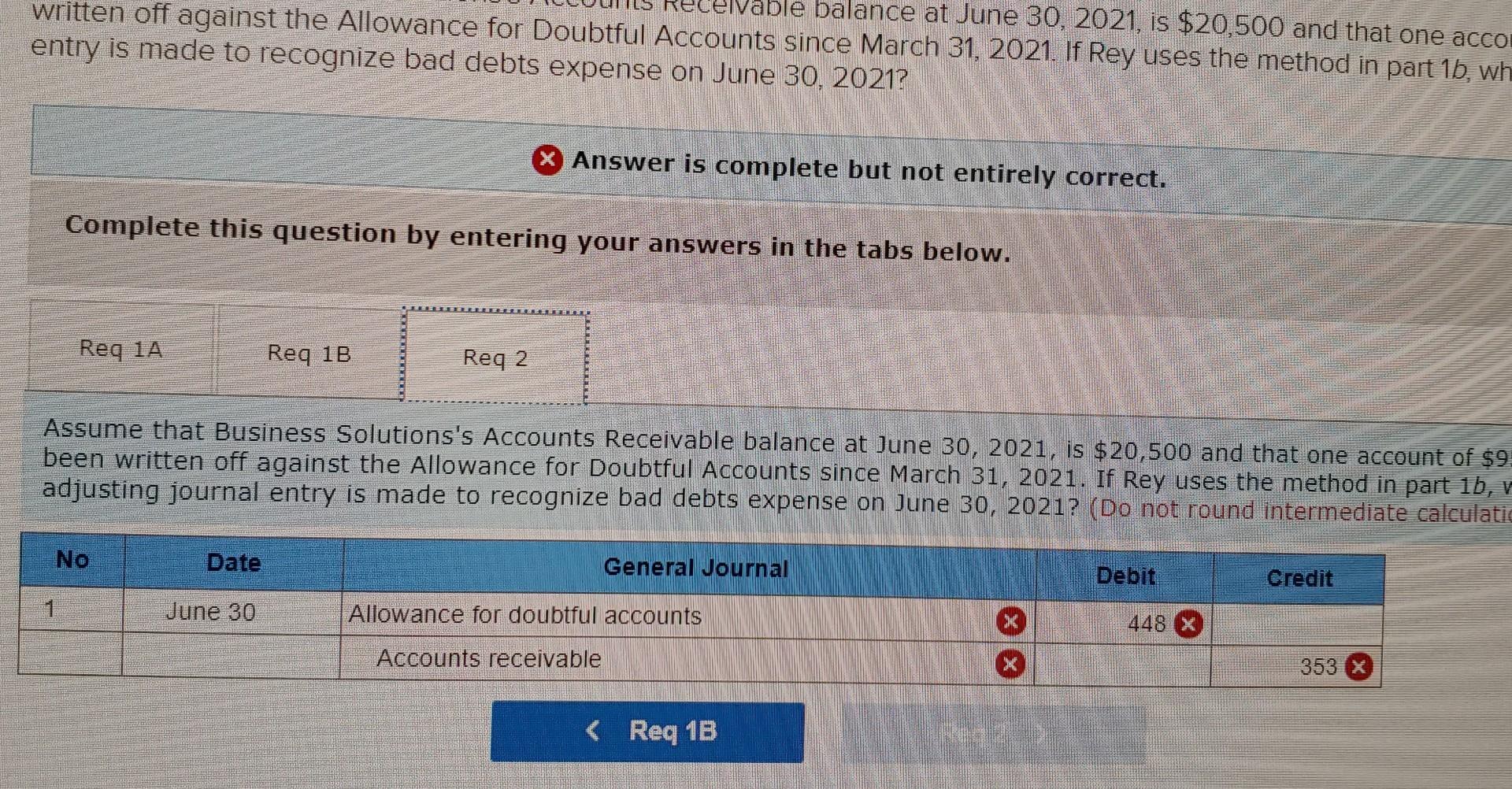

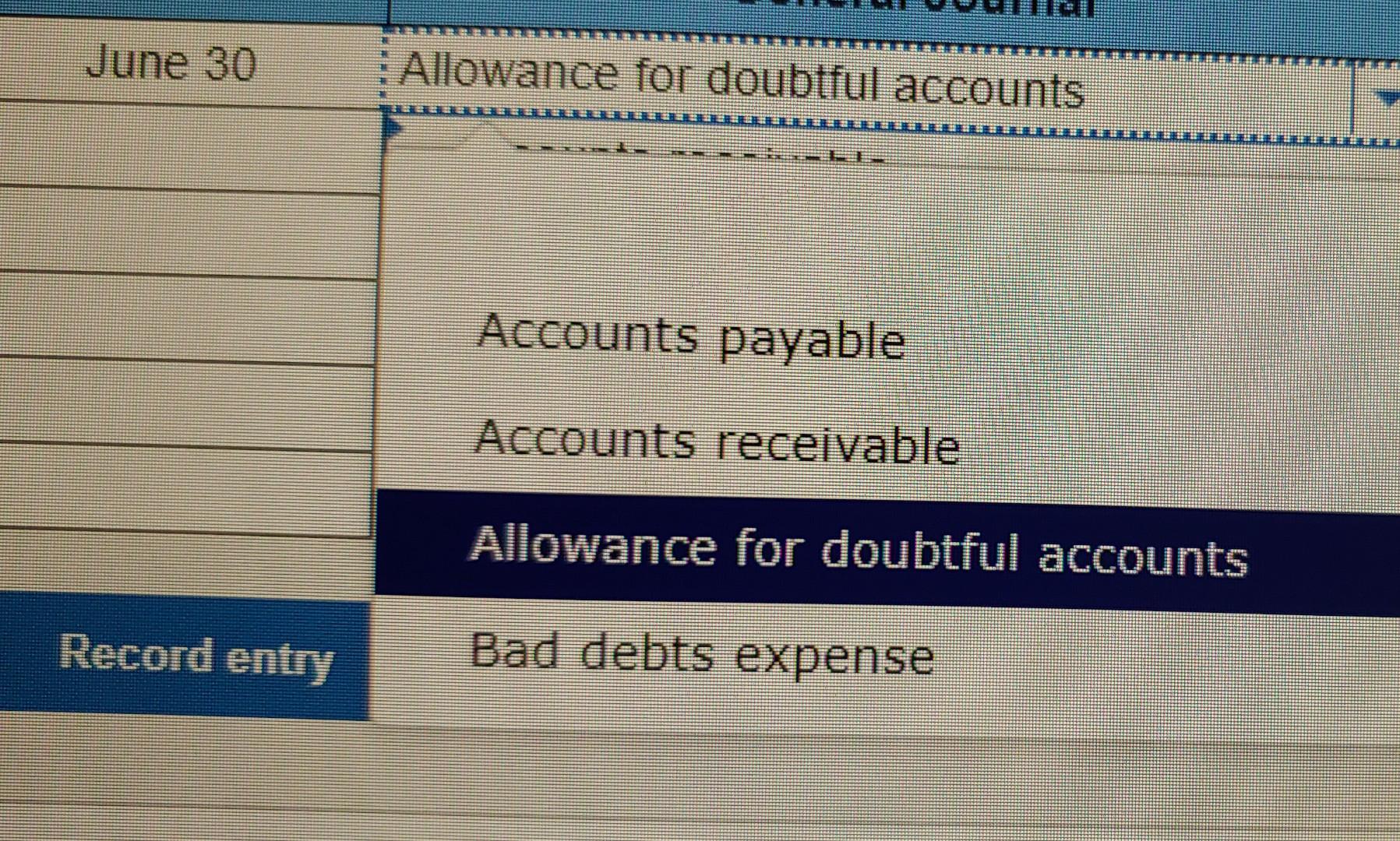

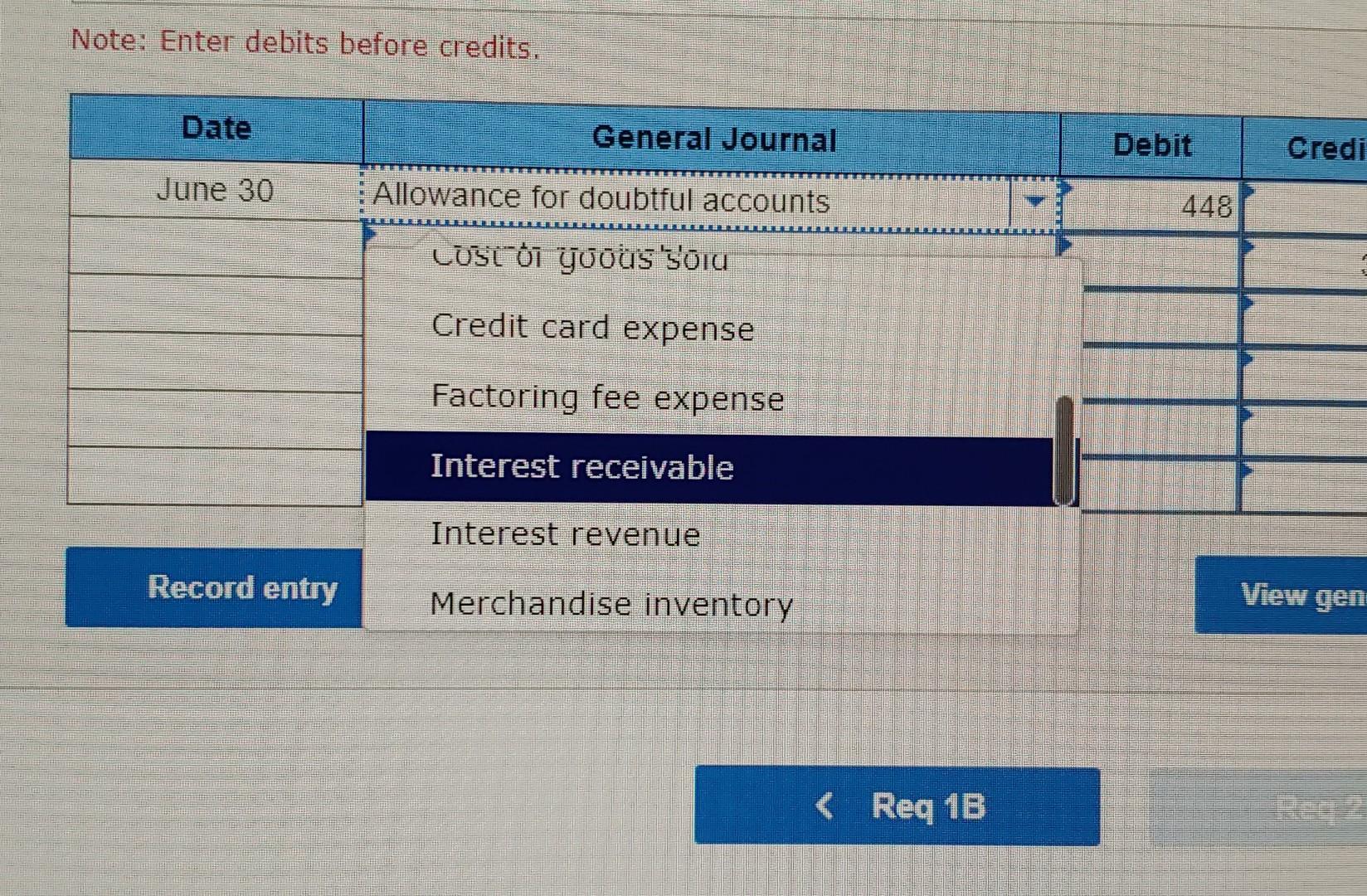

Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $56,000 during the first three months of 2021 and that the Accounts Receivable balance on March 31, 2021, is $22,417 Required: 1a. Prepare the adjusting entry to record bad debts expense, which are estimated to be 1% of total revenues on March 31, 2021. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31 1b. Prepare the adjusting entry to record bad debts expense, which are estimated to be 2% of accounts receivable on March 31, 2021. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. 2. Assume that Business Solutions's Accounts Receivable balance at June 30, 2021, is $20,500 and that one account of $95 has been written off against the Allowance for Doubtful Accounts since March 31, 2021 If Rey uses the method in part 1b, what adjusting journal entry is made to recognize bad debts expense on June 30, 2021? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Reg 2 Prepare the adjusting entry to record bad debts expense, which are estimated to be 1% of total revenues on March 31, 2021. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. Debit Credit No Date General Journal 57 X 1 March 31 Bad debts expense 57 X Allowance for doubtful accounts Req 1B > Req 1A Req 1B Req 2 Prepare the adjusting entry to record bad debts expense, which are estimated to be 1% of total revenues on March 3 There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. No Date General Journal Debit Credit 1 March 31 57 Bad debts expense Allowance for doubtful accounts 57 X Req 13 > ble balance at June 30, 2021, is $20,500 and that one acco written off against the Allowance for Doubtful Accounts since March 31, 2021. If Rey uses the method in part 1b, wh entry is made to recognize bad debts expense on June 30, 2021? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 2 Assume that Business Solutions's Accounts Receivable balance at June 30, 2021, is $20,500 and that one account of $9. been written off against the Allowance for Doubtful Accounts since March 31, 2021. If Rey uses the method in part 1b, v adjusting journal entry is made to recognize bad debts expense on June 30, 2021? (Do not round intermediate calculatic No Date General Journal Debit Credit June 30 Allowance for doubtful accounts X 448 X Accounts receivable X 353

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started