I need explanation on how to got the answer please !

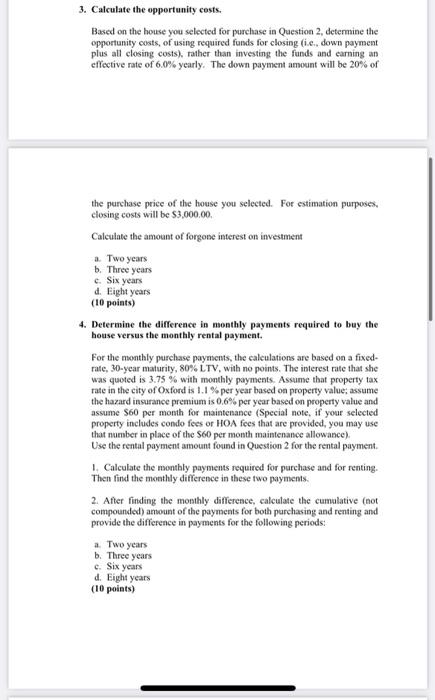

Description of the Problem: Emma Jones is planning to move to Oxford, MS to start her new job at a real estate fimm. She has not yet decided whether she wants to rent or buy a property in Oxford Emma is not from Mississippi and is asking your team to help her make this financial decision. Her monthly housing budget is $1.600. This budget must cover housing expenses including rent or owner's costs (example: mortgage, hazard insurance, property taxes, and Home Owner Association fees, if any). A good start of the analysis is to apply financial concepts such as the time value of money." Emma's contract is for three years and is renewable for three more. Her plan is to stay in the Oxford area for no more than 8 years. Even if her job continues to work out well, she will try to move from the location she selects to a different house Emma has money saved for this transaction and plans to make a 20% down payment on any house that she purchases Emma will make this decision purely based on financial motives. She is not worried about arguments such as you are throwing away your money when renting" or is better to be flexible and rent rather than buy Total points for the case: 100 points Questions: 1. Estimate the maximum house value Emma can afford to buy. Assume the mortgage that terms that Emma has is based on a fixed-rate. 30-year maturity, 8006 LTV, with no points. The mortgage interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1% per year based on property value assume the harand insurance premium is 0.86 per year based on property value and assume S60 per month for maintenance Determine the required monthly mortgage payment and the maximum house value she can afford if she buys (10 points) 2. Select the properties for comparison After determining the maximum bose value for Emma's budget in Question I select a house that Emma can afford and follow the instruction for the case Instructions for property selection Use the maximum purchase amount established in the first part of this question to select a fuse for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent Examples of these are Zillow.com. Trulia.com. Redfin.com or Realtor.com Select one property it could be a condominium, townhouse, house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house Specialem, oc, and HOA fees 2. Select the properties for comparison. After determining the maximum house value for Emma's budget in Question 1, select a house that Emma can afford and follow the instruction for the case Instructions for property selection: Use the maximum purchase amount established in the first part of this question to select a house for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent. Examples of these are Zillow.com, Trulia.com, Redfin.com or Realtor.com Select one property (it could be a condominium, townhouse, or house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house. Special Note: You may use the taxes, insurance, and HOA fees included in the information on Zillow. Trulia, etc., but you must use the mortgage information that is provided in this case study to calculate the costs associated with this decision Find a rental property near the property that is for sale that you/your team selected. This rental property must stay within the budget Where possible, select a comparable property based on square footage, lot size, type of property, number of bedrooms and number of bathrooms.) Please provide the links and images (2 pictures maximum per house) for the comparable property selected. Also state within your document the monthly rental payment of the property. (5 points) 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing fi.e., down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6,0% yearly. The down payment amount will be 20% of 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing (ie, down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6.0% yearly. The down payment amount will be 20% of the purchase price of the house you selected. For estimation purposes. closing costs will be $3,000.00 Calculate the amount of forgone interest on investment a. Two years b. Three years c. Six years d. Eight years (10 points) 4. Determine the difference in monthly payments required to buy the house versus the monthly rental payment. For the monthly purchase payments, the calculations are based on a fixed- rate, 30-year maturity, 80% LTV, with no points. The interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1 % per year based on property value assume the hazard insurance premium is 0.6% per year based on property value and assume S60 per month for maintenance (Special note, if your selected property includes condo fees or HOA fees that are provided, you may use that number in place of the S60 per month maintenance allowance) Use the rental payment amount found in Question 2 for the rental payment. Calculate the monthly payments required for purchase and for renting. Then find the monthly difference in these two payments. 2. After finding the monthly difference, calculate the cumulative (not compounded) amount of the payments for both purchasing and renting and provide the difference in payments for the following periods a. Two years Three years c. Six years d. Eight years (10 points) Description of the Problem: Emma Jones is planning to move to Oxford, MS to start her new job at a real estate fimm. She has not yet decided whether she wants to rent or buy a property in Oxford Emma is not from Mississippi and is asking your team to help her make this financial decision. Her monthly housing budget is $1.600. This budget must cover housing expenses including rent or owner's costs (example: mortgage, hazard insurance, property taxes, and Home Owner Association fees, if any). A good start of the analysis is to apply financial concepts such as the time value of money." Emma's contract is for three years and is renewable for three more. Her plan is to stay in the Oxford area for no more than 8 years. Even if her job continues to work out well, she will try to move from the location she selects to a different house Emma has money saved for this transaction and plans to make a 20% down payment on any house that she purchases Emma will make this decision purely based on financial motives. She is not worried about arguments such as you are throwing away your money when renting" or is better to be flexible and rent rather than buy Total points for the case: 100 points Questions: 1. Estimate the maximum house value Emma can afford to buy. Assume the mortgage that terms that Emma has is based on a fixed-rate. 30-year maturity, 8006 LTV, with no points. The mortgage interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1% per year based on property value assume the harand insurance premium is 0.86 per year based on property value and assume S60 per month for maintenance Determine the required monthly mortgage payment and the maximum house value she can afford if she buys (10 points) 2. Select the properties for comparison After determining the maximum bose value for Emma's budget in Question I select a house that Emma can afford and follow the instruction for the case Instructions for property selection Use the maximum purchase amount established in the first part of this question to select a fuse for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent Examples of these are Zillow.com. Trulia.com. Redfin.com or Realtor.com Select one property it could be a condominium, townhouse, house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house Specialem, oc, and HOA fees 2. Select the properties for comparison. After determining the maximum house value for Emma's budget in Question 1, select a house that Emma can afford and follow the instruction for the case Instructions for property selection: Use the maximum purchase amount established in the first part of this question to select a house for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent. Examples of these are Zillow.com, Trulia.com, Redfin.com or Realtor.com Select one property (it could be a condominium, townhouse, or house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house. Special Note: You may use the taxes, insurance, and HOA fees included in the information on Zillow. Trulia, etc., but you must use the mortgage information that is provided in this case study to calculate the costs associated with this decision Find a rental property near the property that is for sale that you/your team selected. This rental property must stay within the budget Where possible, select a comparable property based on square footage, lot size, type of property, number of bedrooms and number of bathrooms.) Please provide the links and images (2 pictures maximum per house) for the comparable property selected. Also state within your document the monthly rental payment of the property. (5 points) 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing fi.e., down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6,0% yearly. The down payment amount will be 20% of 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing (ie, down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6.0% yearly. The down payment amount will be 20% of the purchase price of the house you selected. For estimation purposes. closing costs will be $3,000.00 Calculate the amount of forgone interest on investment a. Two years b. Three years c. Six years d. Eight years (10 points) 4. Determine the difference in monthly payments required to buy the house versus the monthly rental payment. For the monthly purchase payments, the calculations are based on a fixed- rate, 30-year maturity, 80% LTV, with no points. The interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1 % per year based on property value assume the hazard insurance premium is 0.6% per year based on property value and assume S60 per month for maintenance (Special note, if your selected property includes condo fees or HOA fees that are provided, you may use that number in place of the S60 per month maintenance allowance) Use the rental payment amount found in Question 2 for the rental payment. Calculate the monthly payments required for purchase and for renting. Then find the monthly difference in these two payments. 2. After finding the monthly difference, calculate the cumulative (not compounded) amount of the payments for both purchasing and renting and provide the difference in payments for the following periods a. Two years Three years c. Six years d. Eight years (10 points) Description of the Problem: Emma Jones is planning to move to Oxford, MS to start her new job at a real estate fimm. She has not yet decided whether she wants to rent or buy a property in Oxford Emma is not from Mississippi and is asking your team to help her make this financial decision. Her monthly housing budget is $1.600. This budget must cover housing expenses including rent or owner's costs (example: mortgage, hazard insurance, property taxes, and Home Owner Association fees, if any). A good start of the analysis is to apply financial concepts such as the time value of money." Emma's contract is for three years and is renewable for three more. Her plan is to stay in the Oxford area for no more than 8 years. Even if her job continues to work out well, she will try to move from the location she selects to a different house Emma has money saved for this transaction and plans to make a 20% down payment on any house that she purchases Emma will make this decision purely based on financial motives. She is not worried about arguments such as you are throwing away your money when renting" or is better to be flexible and rent rather than buy Total points for the case: 100 points Questions: 1. Estimate the maximum house value Emma can afford to buy. Assume the mortgage that terms that Emma has is based on a fixed-rate. 30-year maturity, 8006 LTV, with no points. The mortgage interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1% per year based on property value assume the harand insurance premium is 0.86 per year based on property value and assume S60 per month for maintenance Determine the required monthly mortgage payment and the maximum house value she can afford if she buys (10 points) 2. Select the properties for comparison After determining the maximum bose value for Emma's budget in Question I select a house that Emma can afford and follow the instruction for the case Instructions for property selection Use the maximum purchase amount established in the first part of this question to select a fuse for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent Examples of these are Zillow.com. Trulia.com. Redfin.com or Realtor.com Select one property it could be a condominium, townhouse, house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house Specialem, oc, and HOA fees 2. Select the properties for comparison. After determining the maximum house value for Emma's budget in Question 1, select a house that Emma can afford and follow the instruction for the case Instructions for property selection: Use the maximum purchase amount established in the first part of this question to select a house for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent. Examples of these are Zillow.com, Trulia.com, Redfin.com or Realtor.com Select one property (it could be a condominium, townhouse, or house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house. Special Note: You may use the taxes, insurance, and HOA fees included in the information on Zillow. Trulia, etc., but you must use the mortgage information that is provided in this case study to calculate the costs associated with this decision Find a rental property near the property that is for sale that you/your team selected. This rental property must stay within the budget Where possible, select a comparable property based on square footage, lot size, type of property, number of bedrooms and number of bathrooms.) Please provide the links and images (2 pictures maximum per house) for the comparable property selected. Also state within your document the monthly rental payment of the property. (5 points) 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing fi.e., down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6,0% yearly. The down payment amount will be 20% of 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing (ie, down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6.0% yearly. The down payment amount will be 20% of the purchase price of the house you selected. For estimation purposes. closing costs will be $3,000.00 Calculate the amount of forgone interest on investment a. Two years b. Three years c. Six years d. Eight years (10 points) 4. Determine the difference in monthly payments required to buy the house versus the monthly rental payment. For the monthly purchase payments, the calculations are based on a fixed- rate, 30-year maturity, 80% LTV, with no points. The interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1 % per year based on property value assume the hazard insurance premium is 0.6% per year based on property value and assume S60 per month for maintenance (Special note, if your selected property includes condo fees or HOA fees that are provided, you may use that number in place of the S60 per month maintenance allowance) Use the rental payment amount found in Question 2 for the rental payment. Calculate the monthly payments required for purchase and for renting. Then find the monthly difference in these two payments. 2. After finding the monthly difference, calculate the cumulative (not compounded) amount of the payments for both purchasing and renting and provide the difference in payments for the following periods a. Two years Three years c. Six years d. Eight years (10 points) Description of the Problem: Emma Jones is planning to move to Oxford, MS to start her new job at a real estate fimm. She has not yet decided whether she wants to rent or buy a property in Oxford Emma is not from Mississippi and is asking your team to help her make this financial decision. Her monthly housing budget is $1.600. This budget must cover housing expenses including rent or owner's costs (example: mortgage, hazard insurance, property taxes, and Home Owner Association fees, if any). A good start of the analysis is to apply financial concepts such as the time value of money." Emma's contract is for three years and is renewable for three more. Her plan is to stay in the Oxford area for no more than 8 years. Even if her job continues to work out well, she will try to move from the location she selects to a different house Emma has money saved for this transaction and plans to make a 20% down payment on any house that she purchases Emma will make this decision purely based on financial motives. She is not worried about arguments such as you are throwing away your money when renting" or is better to be flexible and rent rather than buy Total points for the case: 100 points Questions: 1. Estimate the maximum house value Emma can afford to buy. Assume the mortgage that terms that Emma has is based on a fixed-rate. 30-year maturity, 8006 LTV, with no points. The mortgage interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1% per year based on property value assume the harand insurance premium is 0.86 per year based on property value and assume S60 per month for maintenance Determine the required monthly mortgage payment and the maximum house value she can afford if she buys (10 points) 2. Select the properties for comparison After determining the maximum bose value for Emma's budget in Question I select a house that Emma can afford and follow the instruction for the case Instructions for property selection Use the maximum purchase amount established in the first part of this question to select a fuse for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent Examples of these are Zillow.com. Trulia.com. Redfin.com or Realtor.com Select one property it could be a condominium, townhouse, house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house Specialem, oc, and HOA fees 2. Select the properties for comparison. After determining the maximum house value for Emma's budget in Question 1, select a house that Emma can afford and follow the instruction for the case Instructions for property selection: Use the maximum purchase amount established in the first part of this question to select a house for purchase and use the Emma's monthly budget as a maximum amount for rental payments per month . Go to an online site that offers real estate for sale and rent. Examples of these are Zillow.com, Trulia.com, Redfin.com or Realtor.com Select one property (it could be a condominium, townhouse, or house) that is for sale. Please provide the link and images (2 pictures maximum) for the property selected. Also state within your document the purchase price of the house. Special Note: You may use the taxes, insurance, and HOA fees included in the information on Zillow. Trulia, etc., but you must use the mortgage information that is provided in this case study to calculate the costs associated with this decision Find a rental property near the property that is for sale that you/your team selected. This rental property must stay within the budget Where possible, select a comparable property based on square footage, lot size, type of property, number of bedrooms and number of bathrooms.) Please provide the links and images (2 pictures maximum per house) for the comparable property selected. Also state within your document the monthly rental payment of the property. (5 points) 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing fi.e., down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6,0% yearly. The down payment amount will be 20% of 3. Calculate the opportunity costs. Based on the house you selected for purchase in Question 2, determine the opportunity costs of using required funds for closing (ie, down payment plus all closing costs), rather than investing the funds and earning an effective rate of 6.0% yearly. The down payment amount will be 20% of the purchase price of the house you selected. For estimation purposes. closing costs will be $3,000.00 Calculate the amount of forgone interest on investment a. Two years b. Three years c. Six years d. Eight years (10 points) 4. Determine the difference in monthly payments required to buy the house versus the monthly rental payment. For the monthly purchase payments, the calculations are based on a fixed- rate, 30-year maturity, 80% LTV, with no points. The interest rate that she was quoted is 3.75% with monthly payments. Assume that property tax rate in the city of Oxford is 1.1 % per year based on property value assume the hazard insurance premium is 0.6% per year based on property value and assume S60 per month for maintenance (Special note, if your selected property includes condo fees or HOA fees that are provided, you may use that number in place of the S60 per month maintenance allowance) Use the rental payment amount found in Question 2 for the rental payment. Calculate the monthly payments required for purchase and for renting. Then find the monthly difference in these two payments. 2. After finding the monthly difference, calculate the cumulative (not compounded) amount of the payments for both purchasing and renting and provide the difference in payments for the following periods a. Two years Three years c. Six years d. Eight years (10 points)