Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need fast and correct answer. I will upvote you. 1. VAT is imported in poents and services ut import stage, manufacturing, wholesale and retail

I need fast and correct answer.

I need fast and correct answer.

I will upvote you.

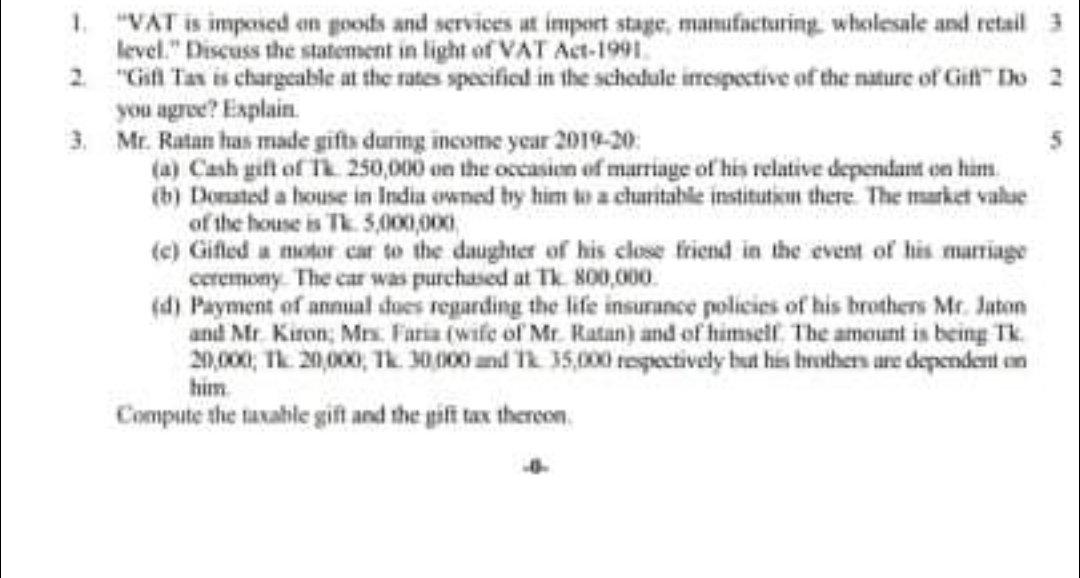

1. "VAT is imported in poents and services ut import stage, manufacturing, wholesale and retail 1 level." Discuss the statement in light of VAT Act 1991 "Gin Ton is chargeable at the rates specificil in the schedule irrespective of the nature of Gift Do 2 you agree? Explain 3. Mr. Ratan has made gifts during income year 2016-20 (a) Cushuift of TL 250,000 on the occasion of marriage of his relative dependent on him (b) Donated a house in India owned by him to a chuntabile institut there. The market vakse of the house is TL 3,000,000 (c) Gifled a motor car to the daughter of his close friend in the event of his marriage ceremuay The car was purchased at T 800.000 (d) Payment of ammual toes regarding the life insurance policies of his brothers Medutan and Ntr Keron, Mrs. Faria (wife of Mr Katan) and of himsell the amount is being Tk 20.000 TL 20,000, TL, 10000 and 12 35.000 respektively but his mothers are dependent en him Compute the taxahle soft and the giff tax thereonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started