Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED FINANCIAL STATEMENT FOR THE ANSWERE ABOVE. I am taking Amazon Incorporation Calculating ratios for the quarter ending March 31, 2020. So data pertains

I NEED FINANCIAL STATEMENT FOR THE ANSWERE ABOVE.

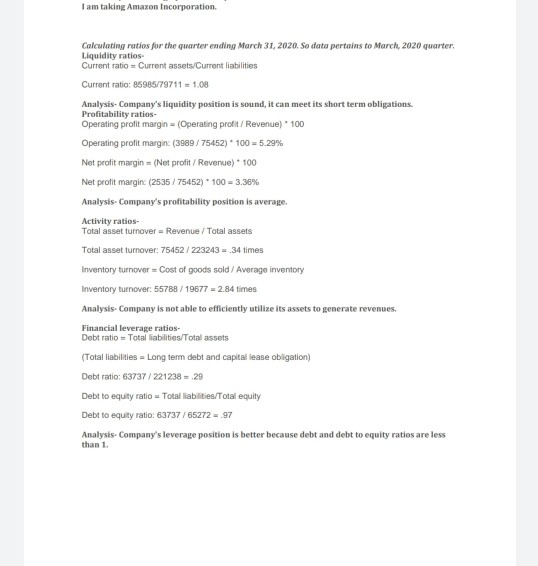

I am taking Amazon Incorporation Calculating ratios for the quarter ending March 31, 2020. So data pertains to March, 2020 quarter. Liquidity ratios. Current ratio = Current assets/Current liabilities Current ratio: 85985/79711 = 1.08 Analysis Company's liquidity position is sound, it can meet its short term obligations. Profitability ratios Operating profit margin = Operating profit / Revenue) 100 Operating profit margin: (3989/ 75452) * 100 = 5.29% Net profit margin = (Net profit / Revenue)* 100 Net profit margin: (2535 / 75452) * 100 = 3.36% Analysis Company's profitability position is average. Activity ratios- Total asset turnover = Revenue / Total assets Total asset turnover: 75452/223243 = .34 times Inventory turnover = Cost of goods sold / Average inventory Inventory turnover: 55788 / 19577 = 2.84 times Analysis Company is not able to efficiently utilize its assets to generate revenues. Financial leverage ratios- Debt ratio = Total liabilities/Total assets (Total liabilities = Long term debt and capital lease obligation) Debt ratio: 63737/221238 29 Debt to equity ratio = Total liabilities/Total equity Debt to equity ratio: 63737/65272 = -97 Analysis Company's leverage position is better because debt and debt to equity ratlos are less than 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started