Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need full answers 1 to 5 IlI. Accountin Preparation of financial statements YOJ is preparing its annual financial statements as at 31 December 2X15.

I need full answers 1 to 5

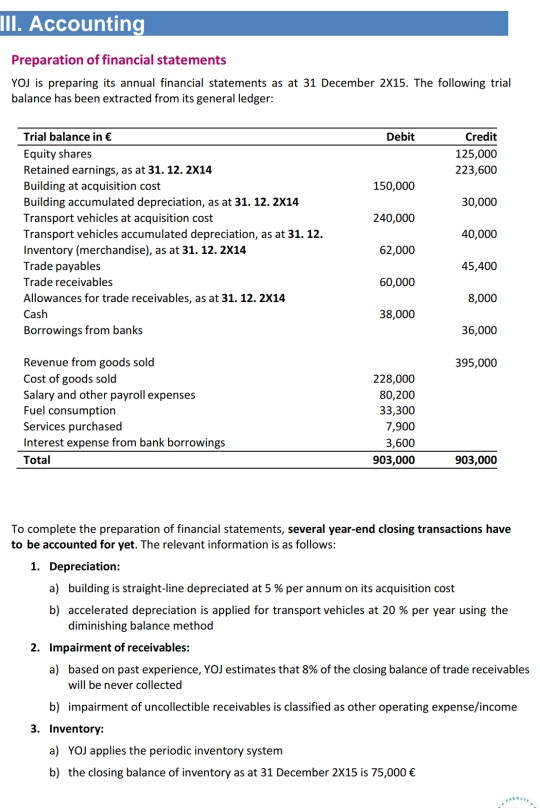

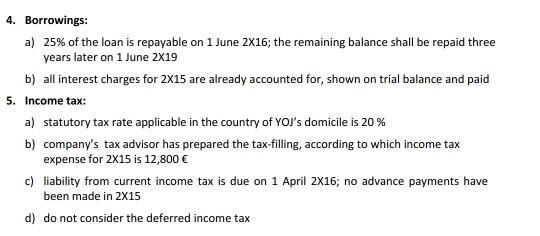

IlI. Accountin Preparation of financial statements YOJ is preparing its annual financial statements as at 31 December 2X15. The following trial balance has been extracted from its general ledger: Trial balance in Equity shares Retained earnings, as at 31. 12. 2X14 Building at acquisition cost Building accumulated depreciation, as at 31. 12. 2X14 Transport vehicles at acquisition cost Transport vehicles accumulated depreciation, as at 31. 12. Inventory (merchandise), as at 31. 12. 2X14 Trade payables Trade receivables Allowances for trade receivables, as at 31. 12. 2X14 Cash Borrowings from banks Debit Credit 125,000 223,600 150,000 240,000 62,000 60,000 38,000 30,000 40,000 45,400 8,000 36,000 395,000 Revenue from goods sold Cost of goods sold Salary and other payroll expenses Fuel consumption Services purchased Interest expense from bank borrowings Total 228,000 80,200 33,300 7,900 3,600 903,000 903,000 To complete the preparation of financial statements, several year-end closing transactions have to be accounted for yet. The relevant information is as follows: 1. Depreciation a) building is straight-line depreciated at 5 % per annum on its acquisition cost b) accelerated depreciation is applied for transport vehicles at 20 % per year using the diminishing balance method Impairment of receivables: a) 2. based on past experience, YOJ estimates that 8% of the closing balance of trade receivables will be never collected b) 3. Inventory: impairment of uncollectible receivables is classified as other operating expense/income a) YOJ applies the periodic inventory system b) the closing balance of inventory as at 31 December 2X15 is 75,000 4. Borrowings: a) 25% of the loan is repayable on 1 June 2x16, the remaining balance shall be repaid three years lateron 1 June 2X19 b) all interest charges for 2X15 are already accounted for, shown on trial balance and paid 5. Income tax: a) statutory tax rate applicable in the country of YOJ's domicile is 20 % b) company's tax advisor has prepared the tax-filling, according to which income tax expense for 2X15 is 12,800 c) liability from current income tax is due on 1 April 2X16; no advance payments have been made in 2X15 d) do not consider the deferred income taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started