Answered step by step

Verified Expert Solution

Question

1 Approved Answer

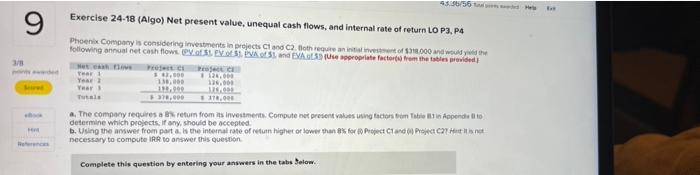

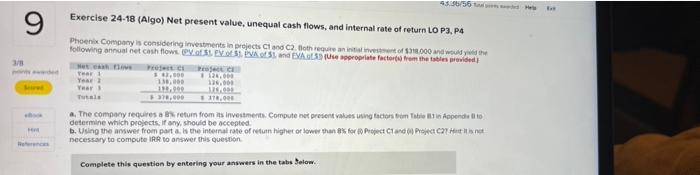

i need help 43.86756 9 Exercise 24-18 (Algo) Net present value, unequal cash flows, and internal rate of return LO P3, P4 Phoenix Company is

i need help

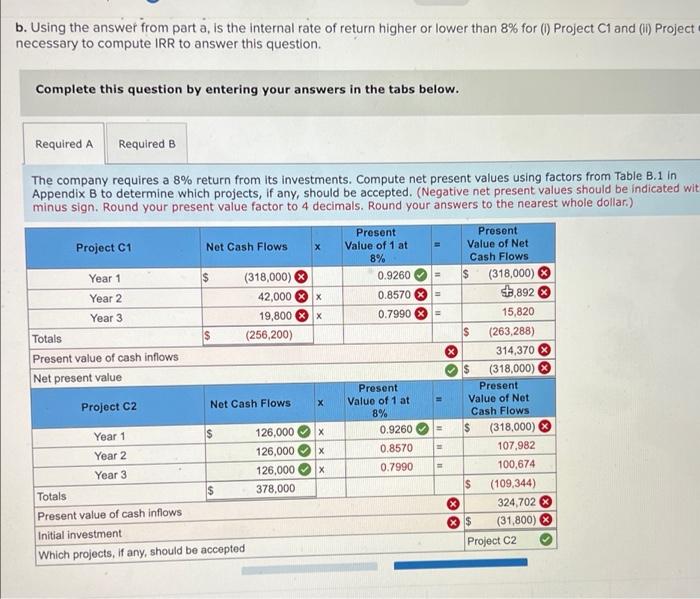

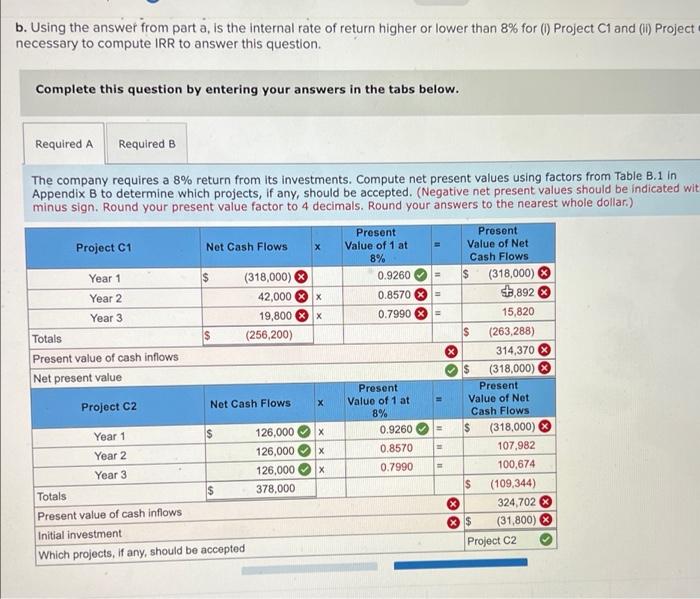

43.86756 9 Exercise 24-18 (Algo) Net present value, unequal cash flows, and internal rate of return LO P3, P4 Phoenix Company is considering investments in projects and 2 oth recreation of and would the following annual net cash flows... EVVA and A9 User propriate factor from the tables provided 3/8 Year 30.000 1 138.000 12.00 Year 112.900 Tutas 3378.000 118.000 a. The company requires a return from its investments Computere presenta un economie is opende to determine which projects. If any should be accepted 1. Using the answer from part is the internal rate of in higher or lower than for Poet and is not necessary to compute IRR to answer this question Complete this question by entering your answers in the tabs Below b. Using the answer from part a, is the internal rate of return higher or lower than 8% for (1) Project C1 and (I) Project necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Required A Required B II S The company requires a 8% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. (Negative net present values should be indicated wit minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Present Present Project C1 Net Cash Flows Value of 1 at Value of Net 8% Cash Flows Year 1 $ (318,000) 0.9260 (318,000) Year 2 42,000 0.8570 5,892 Year 3 19,800 x 0.7990 15,820 Totals $ (256,200) $ (263,288) Present value of cash inflows 314,370 Net present value (318,000) Present Present Project C2 Net Cash Flows Value of 1 at Value of Net 8% Cash Flows Year 1 126,000 0.9260 $ (318,000) Year 2 126,000 0.8570 107,982 Year 3 126.000 0.7990 100,674 $ 378,000 Totals (109,344) 324 702 3 Present value of cash inflows $ (31,800) Initial investment Project C2 Which projects, if any, should be accepted . x x X $ x x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started