Answered step by step

Verified Expert Solution

Question

1 Approved Answer

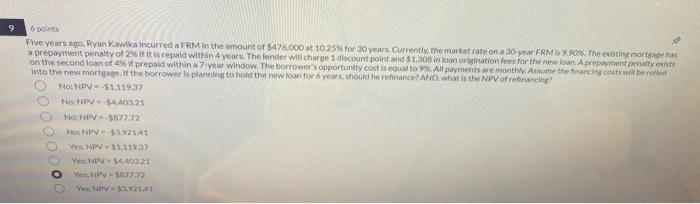

I need help. 9 6 points Five years ago, Ryan Kawika Incurred a FRM in the amount of $476,000 at 10.25% for 30 years. Currently,

I need help.

9 6 points Five years ago, Ryan Kawika Incurred a FRM in the amount of $476,000 at 10.25% for 30 years. Currently, the market rate on a 30-year FRM is 9.90%. The existing mortgage has a prepayment penalty of 2% if it is repaid within 4 years. The lender will charge 1 discount point and $1.300 in loan origination fees for the new loan. A prepayment penalty exists on the second loan of 4% if prepaid within a 7-year window. The borrower's opportunity cost is equal to 9% All payments are monthly. Assume the financing costs will be rolled into the new mortgage. If the borrower is planning to hold the new loan for 6 years, should he refinance? AND, what is the NPV of refinancing? No: NPV-$1.119.37 No: NPV-5440321 No NPV-$877.72 No: NPV-$3.92141 Yes NPV $1,119.37 Yes NFV-$4,40321 Yes NPV-$877.72 Yes NOV=$3.921.41 O O O O O O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started